- 1. What is BBPS?

- 2. Understand BBPS in Banking with Examples

- 3. Stats: How is Bharat Connect Revolutionizing the Bill Payment Ecosystem?

- 4. Who is an agent institution on BBPS?

- 5. How Does BBPS in Banking Work?

- 6. Who are the key participants in BBPS?

- 7. Step-by-Step Process of BBPS’s Working

- 8. What Are The Benefits of BBPS in Banking?

- 9. How Was The Banking Sector Before BBPS?

- 10. Wonderpay’s BBPS Biller Solution

- 11. FAQS:

- 12. Conclusion

India’s initiative to go digital is extending rapidly, whether it is to spread a message online or pay your bills via the BBPS payment option through any platform. The technology has connected a vast number of families and businesses, allowing them to participate in activities from the comfort of their homes.

It is endorsing the country’s digitally empowered population, which is projected to achieve a transaction value of 23.6453 trillion by 2025.

Whether you are a business or an individual from urban or rural areas, BBPS (Bharat Bill Payment System) is assisting everyone by providing a unified and convenient platform for bill payments across various categories and modes of payment.

It streamlines the bill payment process for both customers and billers, offering benefits like anytime, anywhere access, multiple payment options, and instant confirmation.

In this blog post, we will discuss all aspects of BBPS services in detail.

Let’s get the ball rolling.

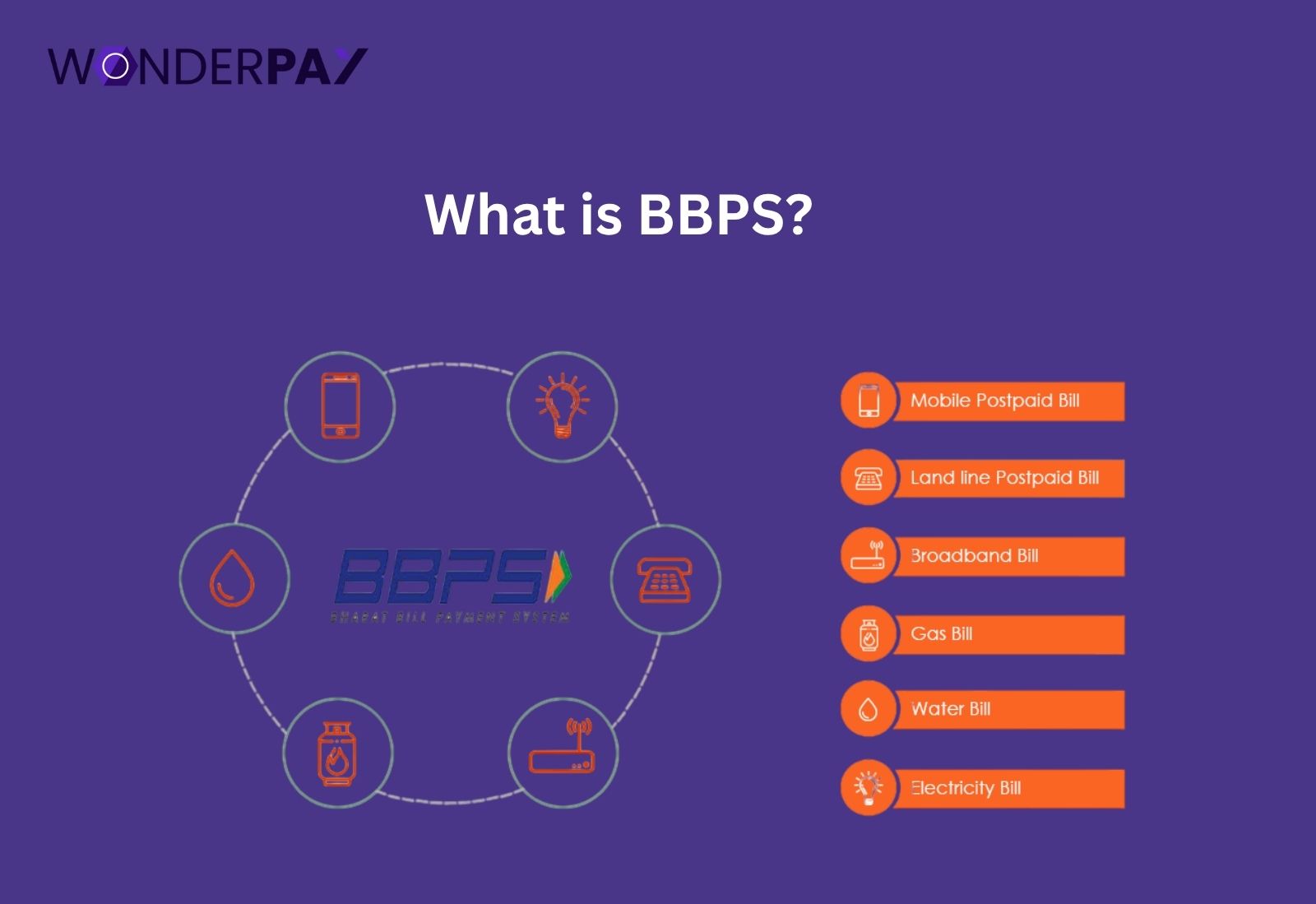

What is BBPS?

Bharat Connect, or previously known as Bharat BillPay, was conceptualized by the Reserve Bank of India (RBI). It offers a technological solution for billers to collect payments for products or services. The platform enables you to accept payments via any payment method, including UPI, credit/debit card, net banking, etc.

Bharat Connect, or previously known as Bharat BillPay, was conceptualized by the Reserve Bank of India (RBI). It offers a technological solution for billers to collect payments for products or services. The platform enables you to accept payments via any payment method, including UPI, credit/debit card, net banking, etc.

On the other hand, customers can pay as easily as they want, 24/7, via physical payment collection outlets, at their nearby bank branches, agent collection stores, digital channels such as websites and mobile applications, across India.

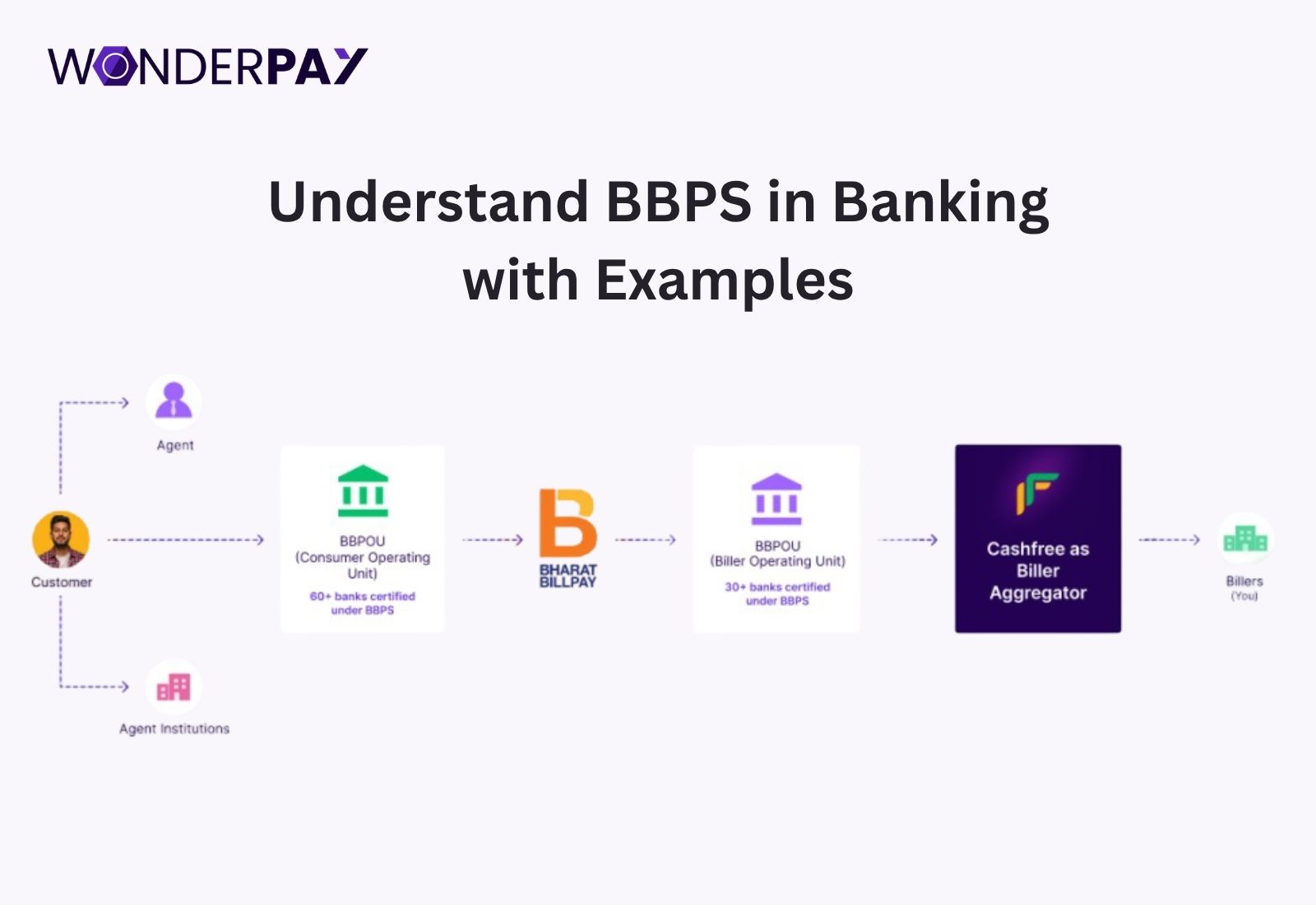

Understand BBPS in Banking with Examples

The working of BBPS in banking is simple. It starts with a user making monthly bill payments as follows.

-

The user opens their service provider’s mobile app or website, or other payment processing channels, such as a UPI or a payment gateway like Wonderpay, which provides the Bharat Bill Payment System within its platform.

-

The payer (an agent on behalf of the consumer) selects a biller, such as a water, gas, DTH, electricity, or any other service provider. They enter the bill details and make payments. At the same time, the biller (DTH, Water, Electricity, etc.) receives payments, and customers receive confirmation SMS and receipts over their registered email ID.

What are the Objectives of BBPS in Banking?

The aim of introducing BBPS is to simplify all bill payments for both consumers and businesses. In this section, we will discuss its objectives, which are as follows:

- Anytime, anywhere payments

- Multiple payment modes

- Standardized process

- Secure transactions

- Real-time confirmation

- Terroperability

- Reaching unbanked and underbanked customers

- Reduce transaction costs

- Improved efficacy

- Promoting digital adoption

- Reduce paper transactions

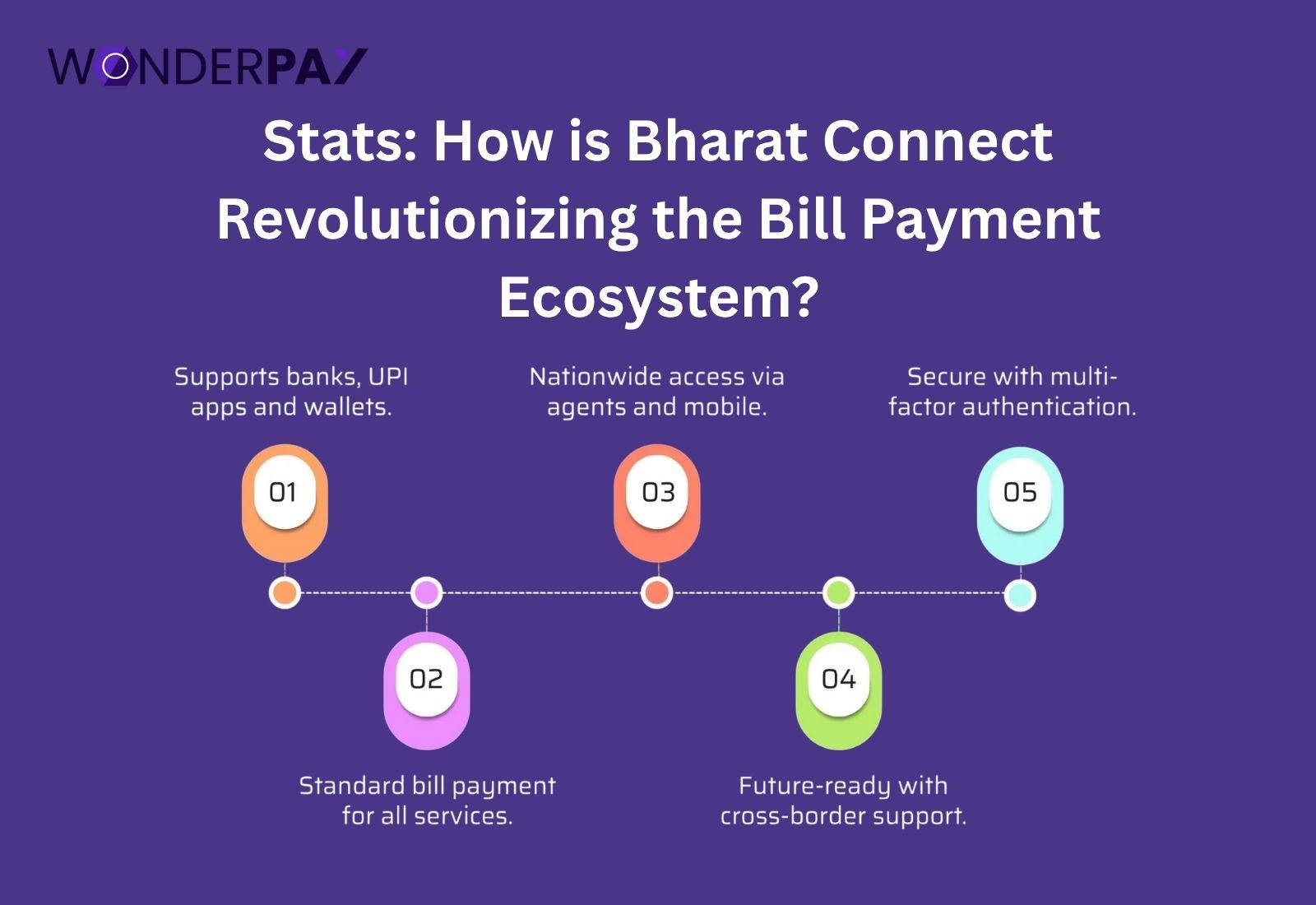

Stats: How is Bharat Connect Revolutionizing the Bill Payment Ecosystem?

The digitization is at its peak, creating opportunities for many businesses and individuals. Here, we will discuss how Bharat Connect is revolutionizing online bill payments, highlighting some significant statistics.

Quarterly Performance

- The quarterly performance for the financial year 2025-26 was 750.36 million volume, and Rs 3,57,294 transaction value.

Transaction for June 2025

- India recorded 8.14 million transactions on June 1, 2025, with a value of ₹4954.97 crore, and the number increased by 10.80 million transactions with a value of ₹7703.66 by the end of June 30.

Top Biller Categories by Volume – June 2025

In this section, we will discuss the major biller categories, their share of the total transaction volume, and the transactions they generated.

| Category | Share (%) |

|---|---|

| Electricity | 30% |

| Credit Card | 19% |

| Fastag | 15% |

| Loan Repayment | 11% |

| DTH | 7% |

| Mobile Prepaid | 5% |

| LPG Gas | 4% |

| Mobile Postpaid | 3% |

| Insurance | 3% |

| Gas | 1% |

| Water | 1% |

According to the data, the total transaction volume it generated was 249.72 million for June 2025. However, the total volume is increasing as compared to the previous year, 2023-24, which was just 140.03 Mn.

Suggested read: What Is PCI DSS Compliance? Meaning, Rules & Key Benefits

Who is an agent institution on BBPS?

An entity that is separate from the Bharat Bill Pay Operating Unit (BBPOU) and offers bill payment services to its customers through its physical or digital channels is an agent institution.

In this section, we will discuss the top 10 agent institutions, including the value and volume of bill payments through their platform. This will help you visualize their performance.

Transaction Value for Year 2025

According to the latest data reported by Bharat Connect. Here are the transaction values for June 2025.

| Rank | Volume (Lakh) | Value (₹ Cr) |

|---|---|---|

| 1 | 648.77 | 14,163.09 |

| 2 | 193.48 | 7,256.40 |

| 3 | 105.26 | 2,870.39 |

| 4 | 11.56 | 2,092.73 |

| 5 | 2.54 | 1,179.34 |

| 6 | 22.83 | 1,036.47 |

| 7 | 16.06 | 815.69 |

| 8 | 2.19 | 323.33 |

| 9 | 2.05 | 282.99 |

| 10 | 3.45 | 231.27 |

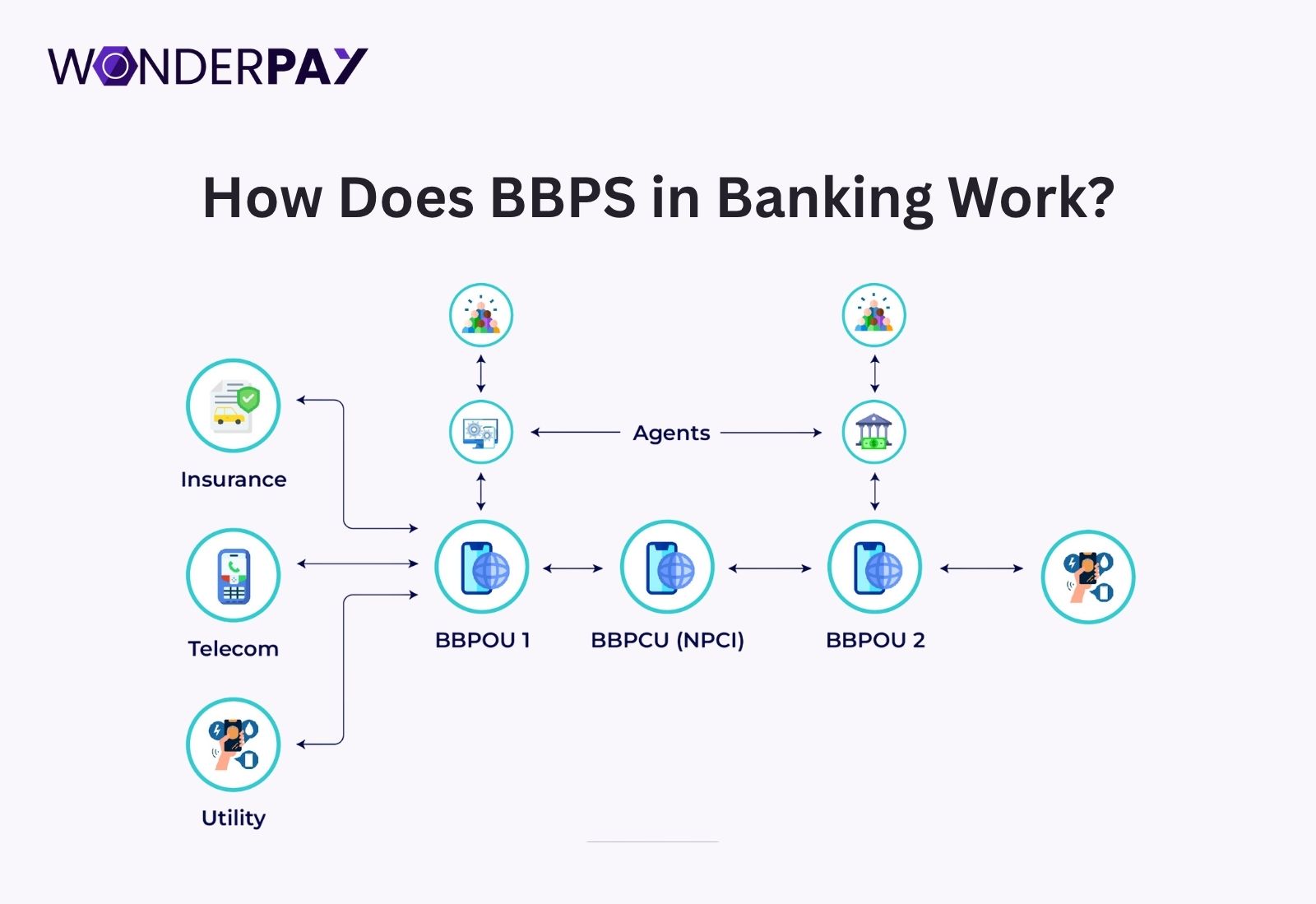

How Does BBPS in Banking Work?

There are 7 key processes of BBPS in banking. Here, we will discuss each process step by step.

There are 7 key processes of BBPS in banking. Here, we will discuss each process step by step.

- Banks Become BBPOU (Customer Operating Units)

- A bank registers as a BBPOU on Bharat Bill Pay to offer bill payment services to its bank customers.

- The bank’s mobile app, ATM, and netbanking are integrated with the BBPS network.

- BC or a Customer Initiates a Bill Payment

- A user can accept the BBPS service using the bank’s app, a third-party payment app, or by visiting an authorized agent.

- Select a type of bill to pay, like water, electricity, gas, broadband, prepaid mobile recharge, or other.

- Enter the required details such as consumer number, account ID, K-number for bill payments, etc.

- Bank Routes Request to BBPS

- The Customer Operating Unit (COU) (banks) sends a request to the Bharat Bill Payment system in real-time.

- BBPS Connects to the Biller

- The BBPS bill payment routes the request to the correct Biller Operating Unit (BOU), which maintains the bill data.

- The biller fetches the bill details and sends them back to the BBPS, which forwards them to the bank.

- Customer Reviews and Confirmations

- The customer sees the bill and its due payment date.

- Confirms the bill payment using net banking, UPI, debit card, or wallet.

- Payment Confirmation and Receipt

- The bank processes the payment, and BBPS sends it to the biller.

- The real-time confirmation, message, and receipt (with instant BBPS transaction ID) are generated for the customer.

- Settlement

- In this last step. The payment amount is settled through RBI/NPCI clearing, and the funds are transferred to the biller’s account.

Know the BBPS Structure in Brief

Its structure is divided into two separate parts, and it is as follows:

-

Bharat Bill Payment Central Unit (BBPCU)

NPCI manages BBPCU, serving as the central hub for the system. It establishes operational standards, including overseeing settlements and ensuring consistency in coordination across the system. -

Bharat Bill Payment Operating Unit (BBPOU)

BBPOUs are authorized by the RBI. It includes banks and non-bank entities, enabling them to manage direct interactions with customers, billers, or both to handle bill payments and aggregations under BBPS. However, the operating units adhere to all guidelines and standards set by BBPCU.

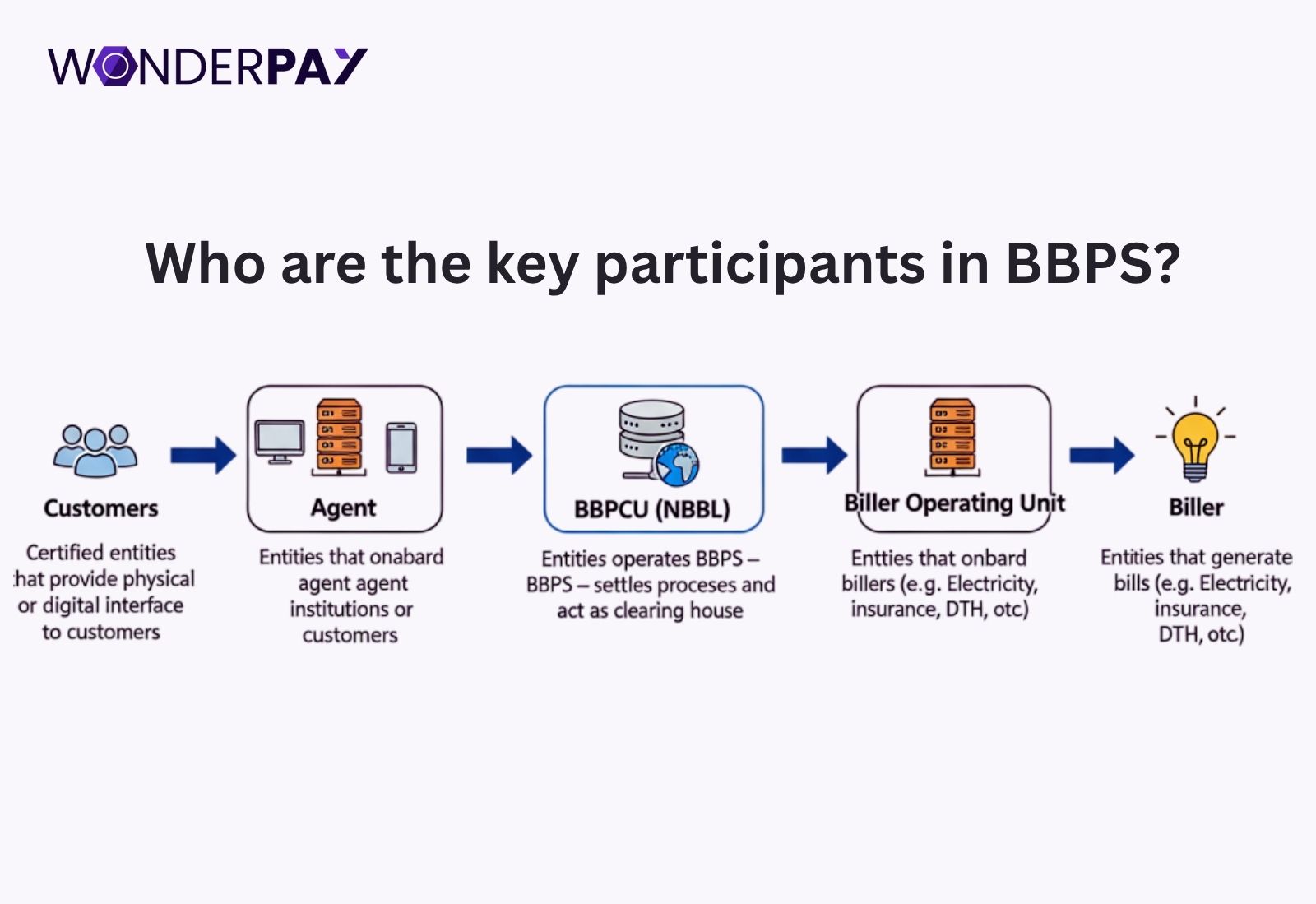

Who are the key participants in BBPS?

There are 4 participants within the BBPS ecosystem. We have organized them in a list.

There are 4 participants within the BBPS ecosystem. We have organized them in a list.

Agents or Agent Institutions

A merchant/shopkeeper who facilitates bill payment for its customers through digital channels.

Biller

A service provider, such as a mobile internet service, cable TV, electricity, or other utilities, generates bills for its consumers.

Bank

This operates as a BBPOU, and at the same time, banks interact with both consumers and bill generators.

Consumers

Consumers can pay their bills through various channels, including bank websites, mobile applications, or by visiting a physical outlet in their vicinity.

Payment Modes and Channels

BBPS allows you to pay via any payment mode, including cash, credit cards, or digital wallets. It also enables you to choose from various payment channels, including Automated Teller Machines (ATMs), kiosks, mobile applications, bank branches, or agent outlets. This provides an improved experience for both customers and businesses.

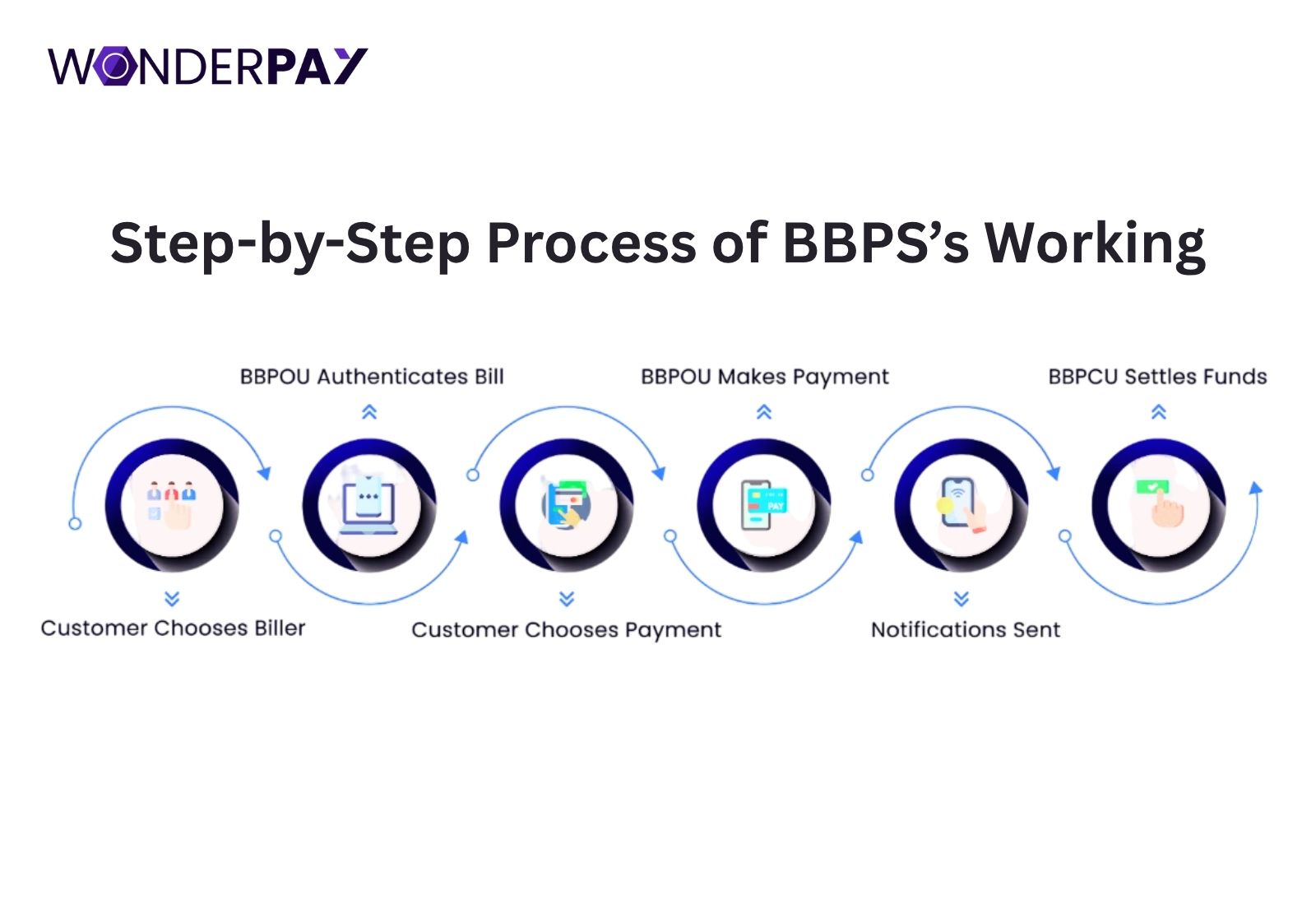

Step-by-Step Process of BBPS’s Working

The working of BBPS is straightforward. It completes its process in four steps, as discussed in this section.

The working of BBPS is straightforward. It completes its process in four steps, as discussed in this section.

-

Bill fetching

A customer selects their choice platform, then the biller, and fetches the bill using a reference number on the bill. -

Payment processing

- The customer reviews the payment details and confirms the payment method.

- The BBPOU processes the payment by debiting the customer’s account.

- BBCU receives the payment details instantly.

-

Settlement

BBPCU manages all settlement processes between BBPOUs and billers to ensure timely payments. -

Confirmation

Customers receive instant payment confirmations via SMS and email, and can also obtain a printed receipt for their transactions.

Also Read: What is Bulk Payment? Process, Benefits & Its Working?

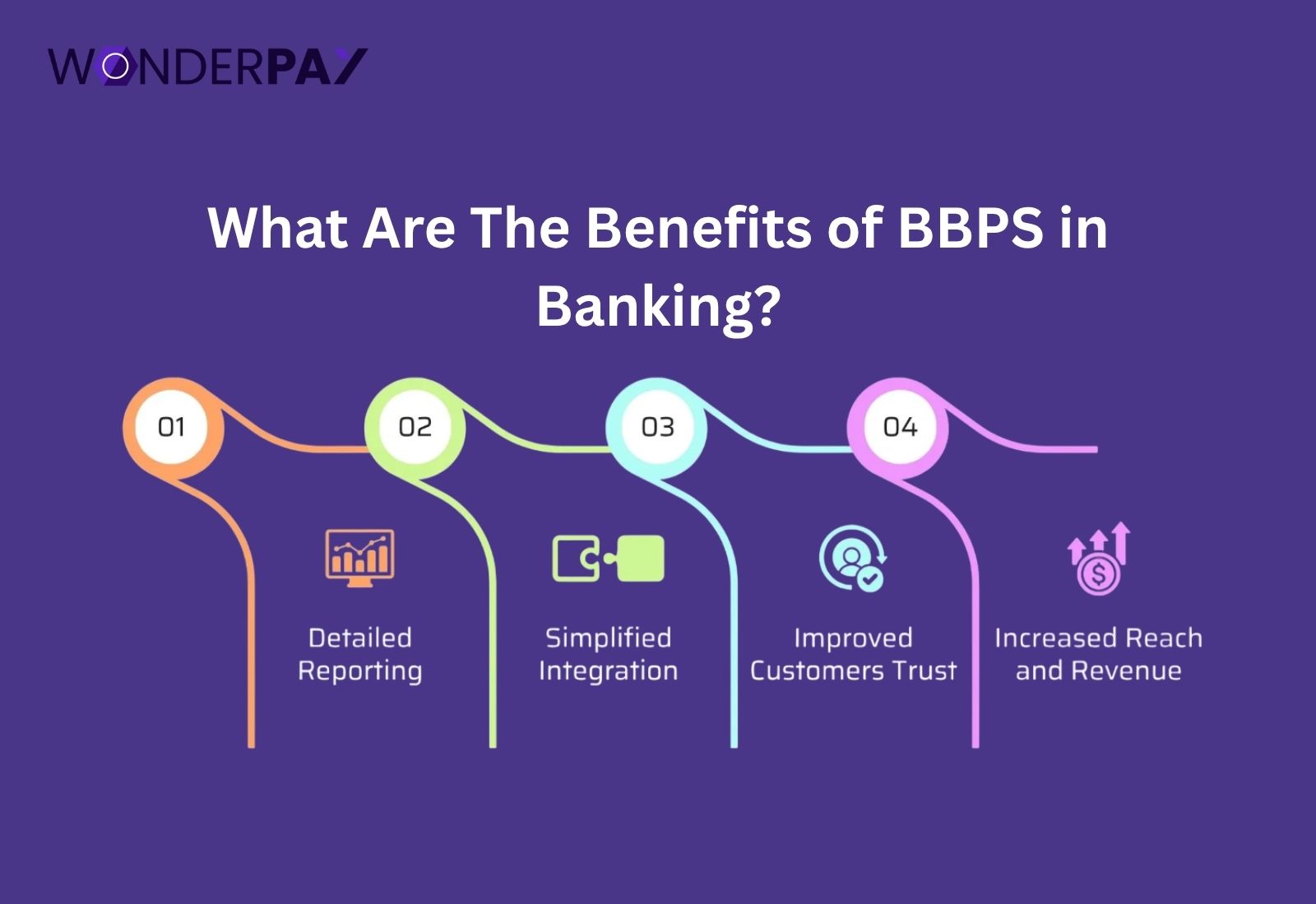

What Are The Benefits of BBPS in Banking?

It offers various benefits to the businesses, customers, and consumers with all billing solutions in one place, with its simple solution.

It offers various benefits to the businesses, customers, and consumers with all billing solutions in one place, with its simple solution.

Aggregate

BBPS enables an organization to manage all its payments from a single platform, regardless of the channel and payment modes. The best part businesses like is saving the time and effort they put into reconciling multiple channel payments, which include payment gateway, service providers’ mobile application, net banking, etc.

24/7 Availability

The Bharat Bill Payment System enables customers to make bill payments from the comfort of their respective places at any time and from anywhere. It results in an improved experience for business correspondent (BC) customers.

Trusted and Quick Settlements

The RBI regulates BBPS, while NPCI operates it. This makes the platform trusted, robust, and secure, and prioritizes the needs and requirements of everyone. At the same time, it provides you with convenience, accessibility to a single platform, multi-channel payment acceptance, real-time payment confirmation, cost efficiency, and more.

Flexible with Payment Modes

The BBPS platform enables businesses to enhance their customers’ experience. It allows billers to accept payments easily via any payment mode, including internet banking, mobile banking, UPI, as well as cash, with the assistance of agents in the vicinity, primarily in rural areas.

Improve Payment Collection

Organizations can collect payments seamlessly, which helps enhance revenue collection and management. It ensures timely payment settlements, accelerates business cash flow, and improves customer service. Moreover, it enhances engagement with its key features, including due date reminders and recurring payment scheduling, and the organization benefits from increased customer satisfaction and loyalty.

How Was The Banking Sector Before BBPS?

Banks faced numerous problems, which include issues such as:

-

A complex bill payment ecosystem: Consumers used to visit different platforms or biller offices for each bill payment. For example, if a user had to pay an electricity bill, they would visit the office or nearby agents who charge a small fee; the same applies to water, DTH, and mobile services.

-

Lack of standardization and reach: A centralized, interoperable system was not in place. Each bank and utility had its channel.

-

Limited access for rural/semi-urban customers: There were only three options for consumers to rely upon, either cash-based, offline agents, or visiting a long distance.

-

Role of traditional banks and offline agents: Banks and physical agents in nearby areas of consumers acted as collection points. It made the process slow, inconvenient, and prone to errors.

How BBPS Transformed the Landscape?

When BBPS arrived, it brought about several changes for both businesses and their customers. In this section, we will discuss the key points that led to a positive change.

-

Seamless platform: The bill payment system enables consumers to pay multiple types of bills, regardless of their categories, on a single platform.

-

Real-time confirmation and secure transactions: The real-time confirmation of bill payment improved the experience and reduced disputes.

-

Boost to customer trust and convenience: You can think of a system that gives you all the information quickly about your transactions and is easily accessible, so that you get such benefits. It is definite that you will choose such an improved platform.

-

Multiple access channels: The integration with all the service providers’ systems made it more effective to pay bills from a customer’s comfort zone.

What Key Benefits Banks Get with BBPS?

-

Customer Retention: Banks become one-stop digital utility hubs that help you reduce customer attrition.

-

Revenue Opportunities: Transactional fees, commissions, and cross-selling services offer various opportunities for agents in rural areas to earn a living.

-

Operational Efficiency: Automated reconciliation saves time and helps mitigate issues such as errors.

-

Financial Inclusion: This revolutionized the bill payments for the customers in rural areas. Now, they can pay via BC (business correspondents) and micro-merchants.

BBPS and Rural Banking Revolution

-

Micro-merchants as agents: This helps local shopkeepers, who act as BBPS touchpoints, and ensures last-mile delivery.

-

Cash-dominant areas: This allows consumers to pay in cash at BBPS-enabled outlets and receive a printed receipt for the paid bill.

-

Support Jan Dhan and SHGs: BBPS has helped expand the utility of basic bank accounts and empowered underbanked communities as well.

BBPS for the Future of Digital India

-

Onboarding of new categories: BBPS expanded its reach to include insurance premiums, credit card bills, education, and municipal tax payments on its platform.

-

Government Alignments: It supports the Digital India and Smart Cities mission by digitizing citizen payments.

-

Integration with DPIs: It can seamlessly connect with UPI, AePS (Aadhaar-enabled Payment System), and other digital payment rails.

What Are Challenges and the Road Ahead for BBPS in Banking

Here are some challenges that can be understood briefly.

- Onboarding more billers and banks.

- Ensuring a uniform service experience across urban and rural areas.

- Promoting digital literacy and awareness.

- Strengthening grievance redressal and agent-level transparency.

Wonderpay’s BBPS Biller Solution

Wonderpay, a leading payment gateway, is your trusted partner to help you manage all your digital payments.

Our comprehensive payment gateway solution is designed to cater to all businesses, regardless of their industry or sector. Here is how we can help you:

Pay bills: You get a user-friendly UI/UX to make all bill payments from anywhere at any time, with no barriers, thanks to secure and efficient BBPS integration.

Accept Payments: Accept all your payments via various payment modes, including payment links, virtual account numbers, invoice financing, recurring payments, and more, while improving your cash flow.

Payout: Disburse salaries, bulk payout, schedule auto payouts seamlessly with no downtime issues.

Tax payments: Making tax payments is extremely easy while adhering to compliance and best security practices.

Smart Billing: Collect payments for your services or products, whether one-time payments or recurring, with eNACH.

Teller: Focus on growing your business and selling more. Let Wonderpay Teller accept payments easily or invoice financing via TReDS.

You get a complete payment solution for your business. It helps you increase cash flow, makes your team more productive, and securely automates payments or payouts with minimal complexity.

FAQS:

What is BBPS in Banking?

The Bharat Bill Payment System (BBPS) is an RBI-mandated system. It offers integrated and interoperable bill payment services to customers, which include serving across geographies with certainty and have end-to-end encrypted transactions.

What role does BBPS play in the digital payments ecosystem of India?

It serves as a trusted and reliable payment system that connects various stakeholders within the ecosystem. Its secure platform intends to fill the gap for the diverse billers and consumers. In order to provide a unified and interoperable digital payment solution.

What is the settlement cycle for BBPS?

The BBPS settlement cycle operates on a T+1 basis. All settlements are fast and guaranteed to be settled within 24 hours as a biller’s customer makes their payments.

How does BBPS support financial inclusion in rural areas?

Bharat Bill Payment System (BBPS) supports financial inclusion in rural areas in various ways. It provides convenient digital bill payment services in customers’ vicinity, with the help of local agents, to facilitate bill payments on behalf of customers.

It reduces reliance on cash, supports digital literacy, and empowers small businesses. BBSP’s one-stop solution for all the bills, from electricity to mobile recharge, even to those without smartphones.

What does BBPOU stand for?

The abbreviation “BBPOU” stands for Bharat Bill Payment Operating Unit. It is an authorized entity by BBPS that facilitates bill payments for electricity, water, and telephone. Moreover, the BBPOU operates under the guidelines set by Bharat Bill Payment Central Unit (BBPCU).

It is the apex body for the BBPS. In simple terms, BBPOU is an operational arm that enables customers to pay any of their bills through various channels, including physical agents and online portals.

Conclusion

Now it is clear to you what BBPS is in banking. What it stands for, how BBPOUs are authorized, who regulates, and more. All the significant points discussed above provide you with detailed information and in-depth research.

If you are looking to be a BBPOU or a payment services provider. Wonderpay is a trusted and India’s top payment service provider. Connect with our team right now, and discuss your business’s exact payment management requirements.