- 1. How the Indian Payment Ecosystem Is Evolving

- 2. What is the Role of AI in the Future of Payment Gateways?

- 3. UPI, Embedded Finance, and Account-to-Account Payments

- 4. Future of Payment Gateway in India: Regulatory and Compliance Changes by 2026

- 5. Security, Tokenisation & Trust as Differentiators

- 6. What Businesses Should Expect from Payment Solutions in 2026

- 7. Final Thoughts: Future of Payment Gateways in India

- 8. FAQs

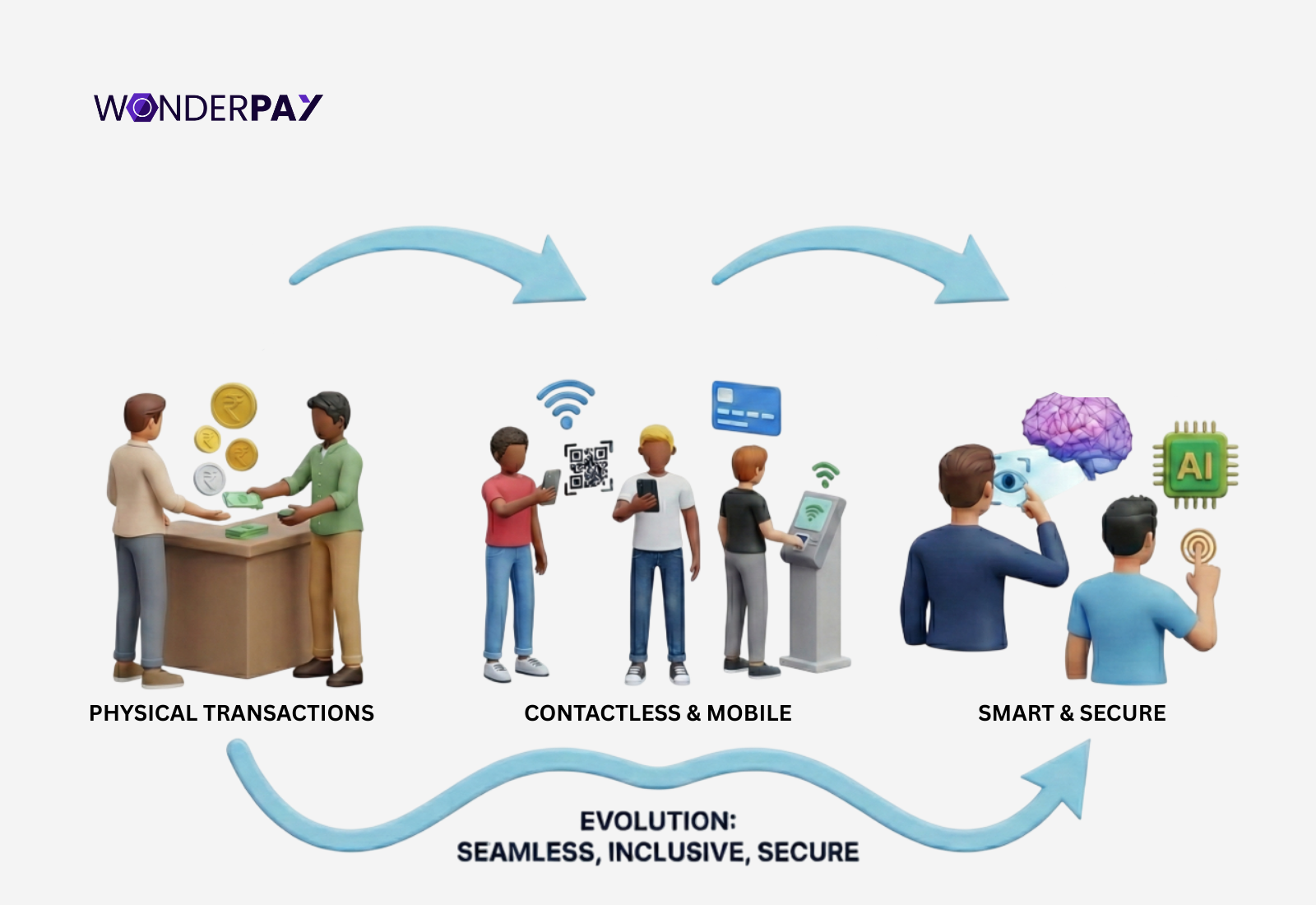

India’s evolving digital market has done well since its inception. It performed so well in the previous year as expected. The mobile computing technology, such as UPI’s evolving trends like AI-driven security, payment orchestration, and setting up credit card payments within mobile applications, and PIN-less payments, is easier than before.

Moreover, the contactless payments using cards with robust compliance, and more, are setting new benchmarks for online fund transfer for merchants and individuals. The rapidly evolving trends force a change in the future of payment gateways in India.

This raises an important question: what will be the payment gateway trends in India? This post will clear your doubts and help you make an informed decision.

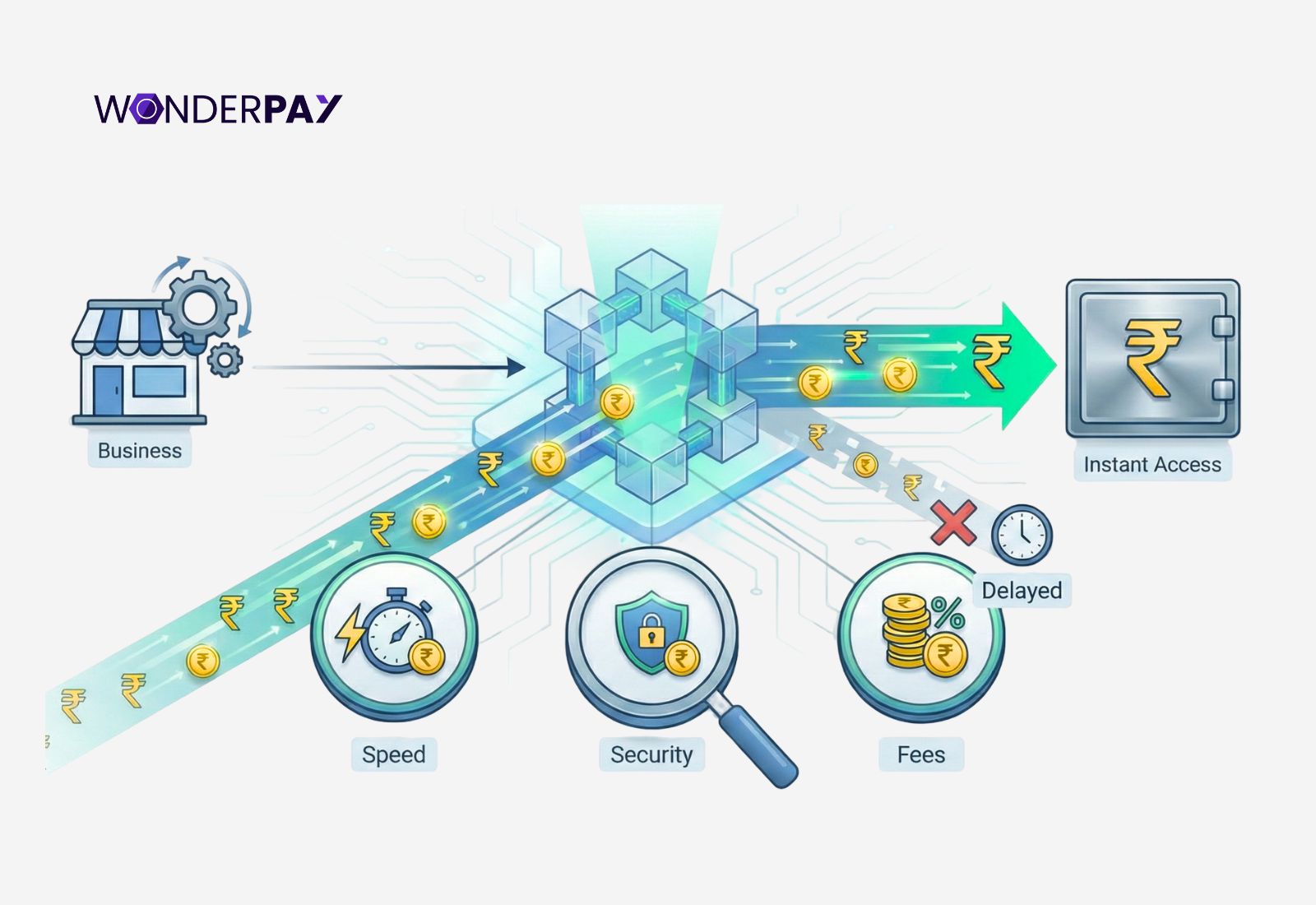

How the Indian Payment Ecosystem Is Evolving

The digital payment trends in India are growing Month on Month (MoM). The reports by the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) revealed that digital payments grew by 1,767 crore to 251 lakh crore in volume.

The digital payment trends in India are growing Month on Month (MoM). The reports by the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) revealed that digital payments grew by 1,767 crore to 251 lakh crore in volume.

The role of Unified Payment Interface (UPI) in real-time payments was outstanding, with Month on Month (MoM) transactions; it grew from 1,504.17 crore to 20.64 lakh crore.

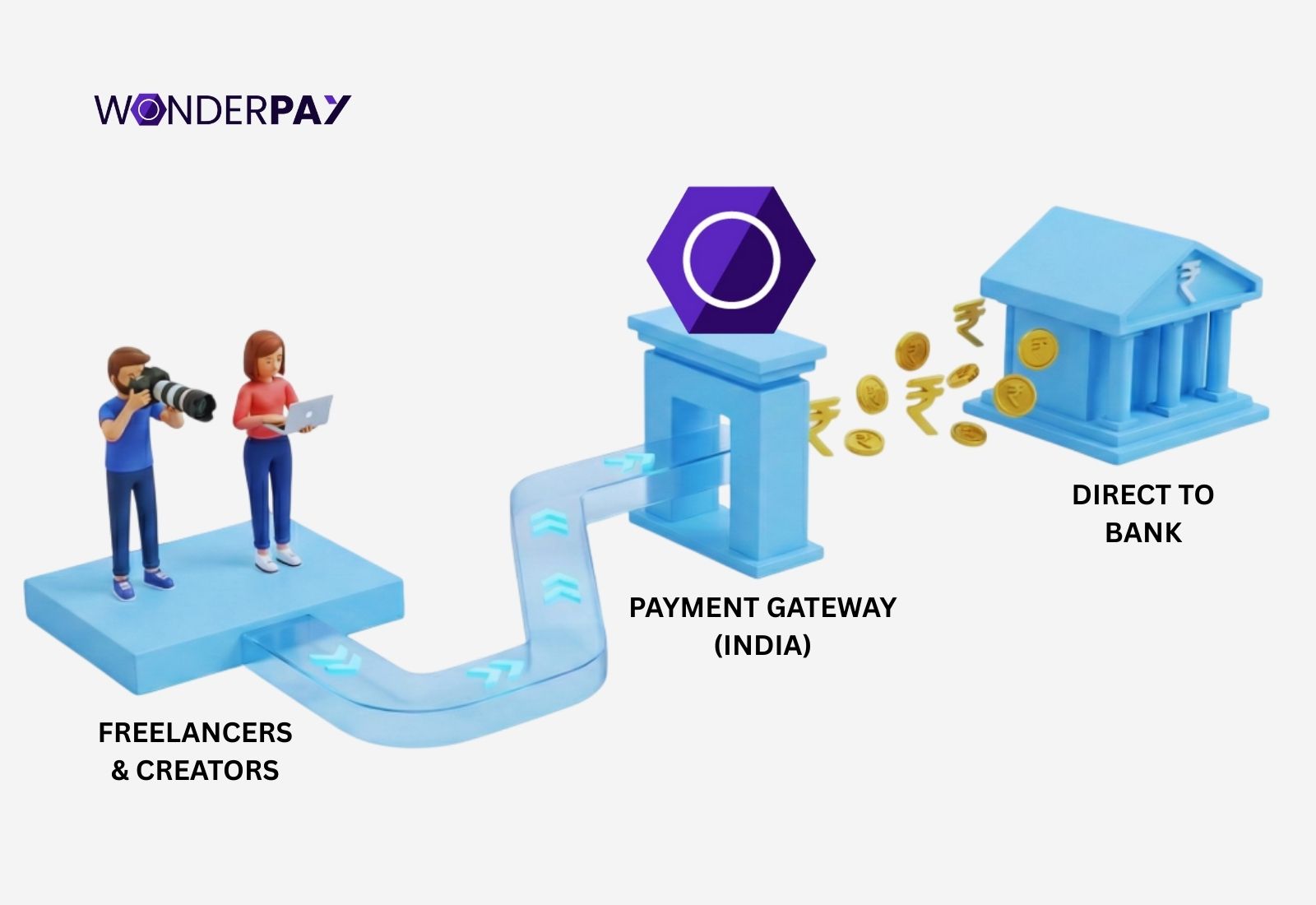

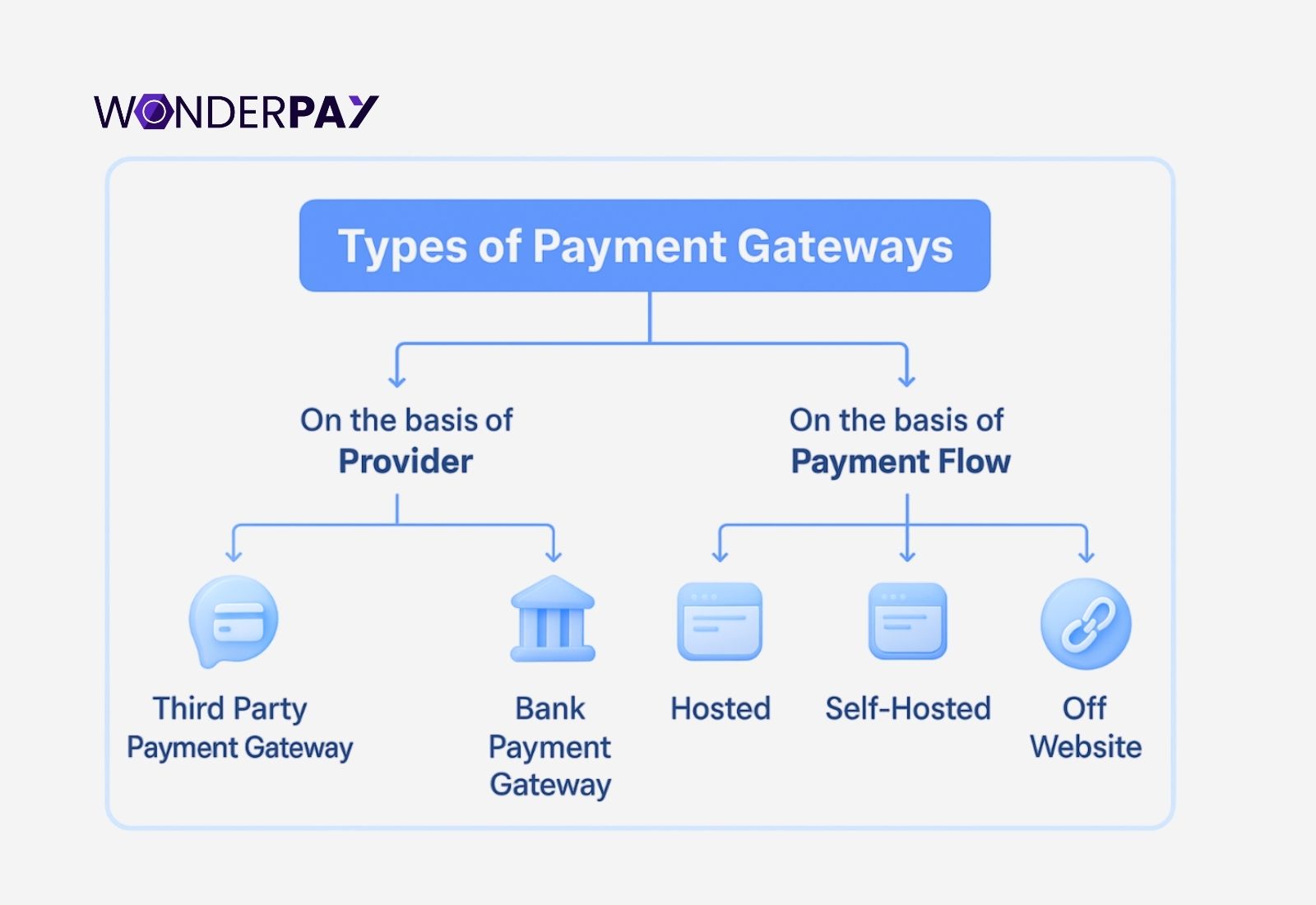

Coming to the payment gateways from the infrastructure. It is a move from proprietary, siloed systems like early card networks or closed-loop wallets to the unified, open public infrastructure. They used to allow transitions with their own network, but the new infrastructure, epitomized by UPI, which is open and interoperable, connects hundreds of banks and diverse fintech apps on a single platform.

The aggregator evolves into a full-stack payment aggregator that manages a wide range of services, including merchant onboarding, fraud protection, and compliance, making it easier for small businesses to adopt digital payments without the technical burden.

The underlying infrastructure, like the NPCI’s developed UPI, IMPS, NETC, and BBPS. All acts as the backbone of modern commerce. This enables a wide array of services to be built on top, such as embedded finance as well as Artificial Intelligence (AI) driven solutions.

What is the Role of AI in the Future of Payment Gateways?

AI in payment gateways contributes to fraud detection with the help of Machine Learning (ML). It analyzes a vast amount of data in real time, identifies complex patterns, and anomalies invisible to humans. At the same time, AI and ML enable instant flagging of suspicious transactions, reducing false positives. The best part of ML is its continuous learning from new data to adapt to evolving fraud tactics. It prevents losses and improves efficiency, also.

This modern technology also supports enhancing smart payment routing using ML to dynamically select the most efficient and cost-effective path for each transaction in real time. It moves beyond the traditional, static rule-based systems to optimize several factors for improved outcomes.

The overall impact of AI on payment gateways in India will help in predictive failure prevention using machine learning and data analytics. In order to anticipate and mitigate various issues such as fraud, technical errors, and system overload. This takes place before they cause an actual disruption to the translation process.

Read More: What is a Payment Gateway? Meaning, Features, Benefits, & Working?

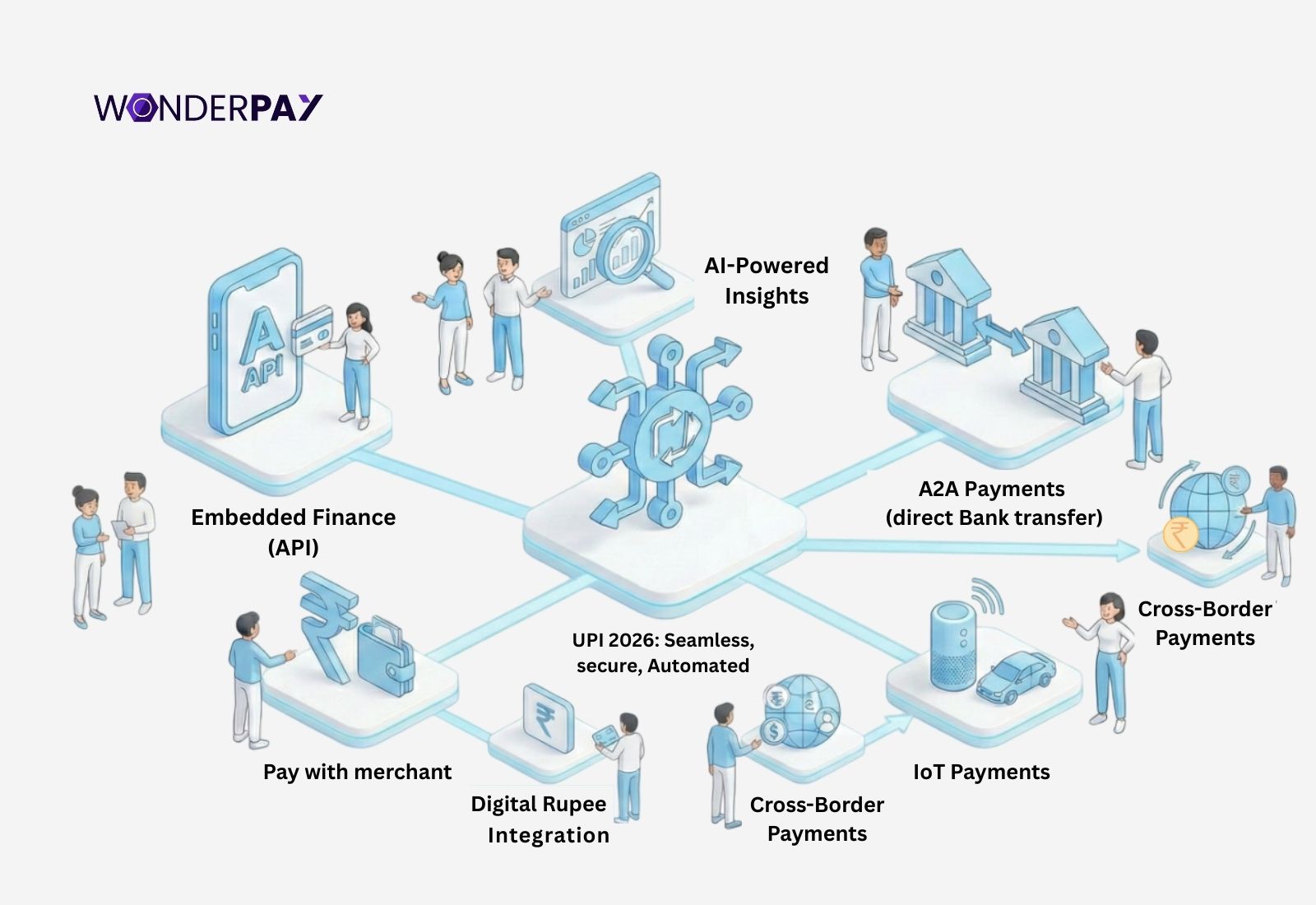

UPI, Embedded Finance, and Account-to-Account Payments

The UPI Innovation 2026, such as Unified Payment Interface embedded finance, and account-to-account (A2A) payments via UPIAuto pay, is revolutionizing the payment system. It will enable both customers and businesses to create seamless, secure, and automated financial experiences.

The auto-pay systems of India’s most used payment method, UPI, primarily integrate financial services directly into non-financial platforms. It will result in reducing friction, improving efficiency, and driving financial inclusion.

On the other hand, embedded finance India or UPI embedded payments within the apps use Application Programming Interface (API) to integrate bank functions directly. This will enable users to pay utilizing the unified payment interface within a mobile application, such as a food delivery or e-commerce application, while being on the platform. This seamless experience with account to account (A2A) payments uses tech for direct bank transfers.

The ease of paying online via UPI for regular expenses and large spending, like purchasing items for amounts of Rs 50,000 or above with credit cards, is now a habit for Indians. This is replacing the traditional way, such as buying using a debit card.

Suggested Read: Payment Gateway Charges Guide for Businesses

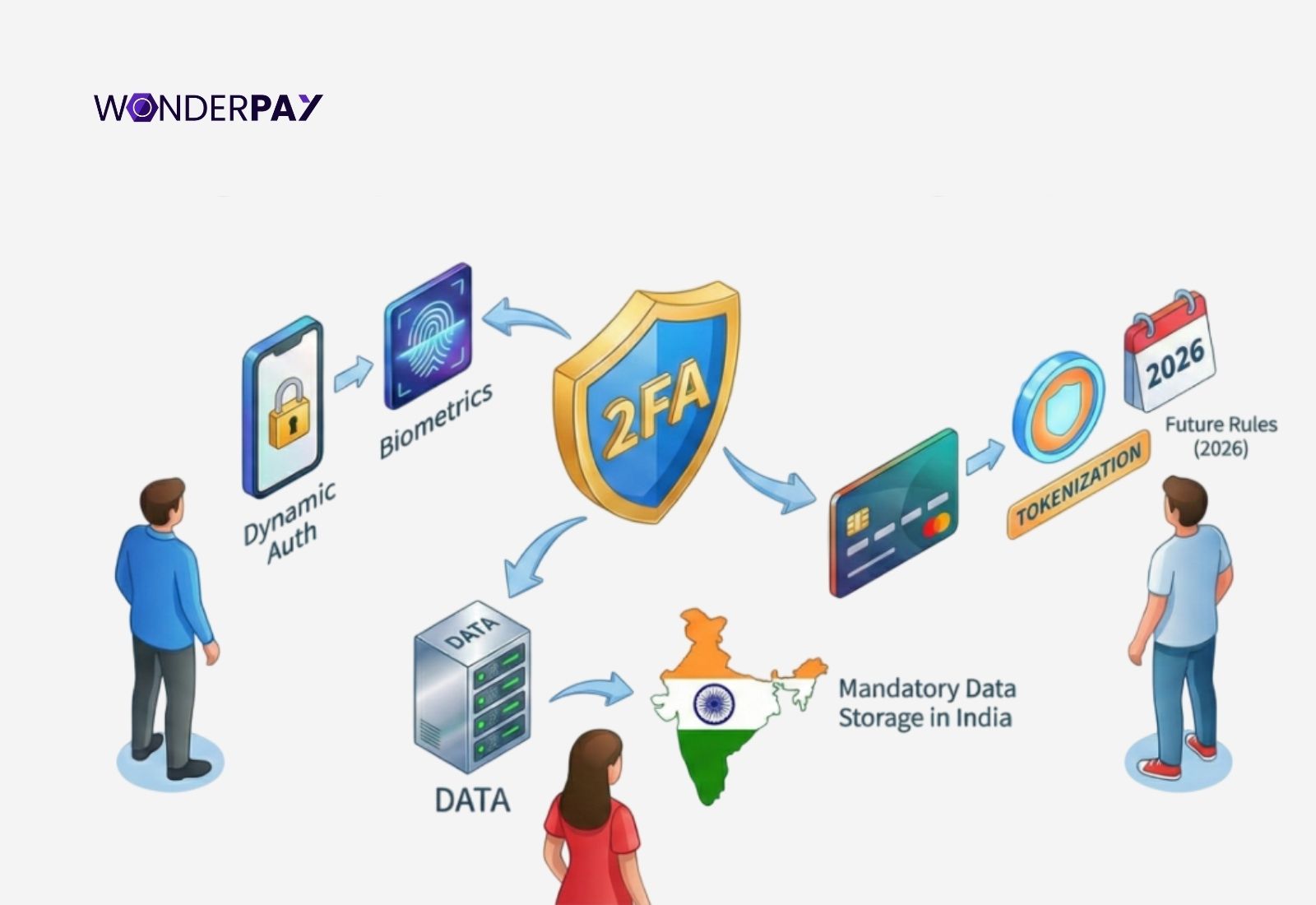

Future of Payment Gateway in India: Regulatory and Compliance Changes by 2026

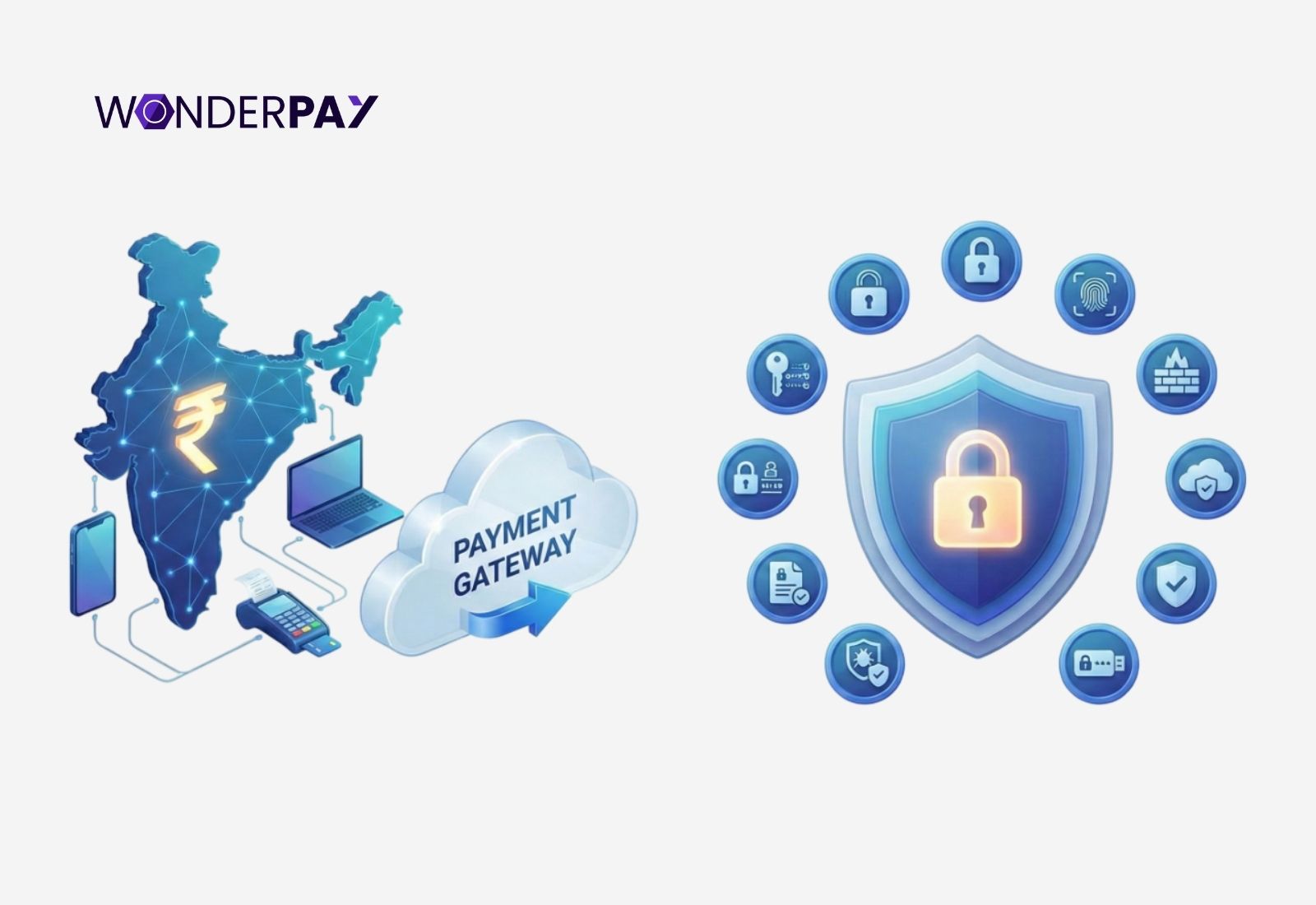

According to the latest reports, RBI payment regulations mandate two-factor authentication for most domestic digital payment transactions. With at least one factor dynamically generated for online payments. All these rules introduce risk-based security checks and a wide range of authentication options, which also include biometrics, at the same time exempting some low-value transactions and making issuers responsible for non-compliant transaction losses.

Data is a strategic national resource for any country, not just an operational asset. Whether it is full transactional data, payment instructions, messages, payer or payee information, or any additional data captured through payment systems during the transaction processing, such as timestamps, IP addresses, or device metadata. It is mandatory to be stored solely on servers located in India.

The payment compliance in India is governed by the Reserve Bank of India’s tokenization norms. It substitutes actual card details with unique tokens for domestic digital payment transactions. The framework is projected to incorporate newer risk-based authentication regulations by 2026.

Must Read: 10 Security Standards for Businesses | Payment Gateway in India

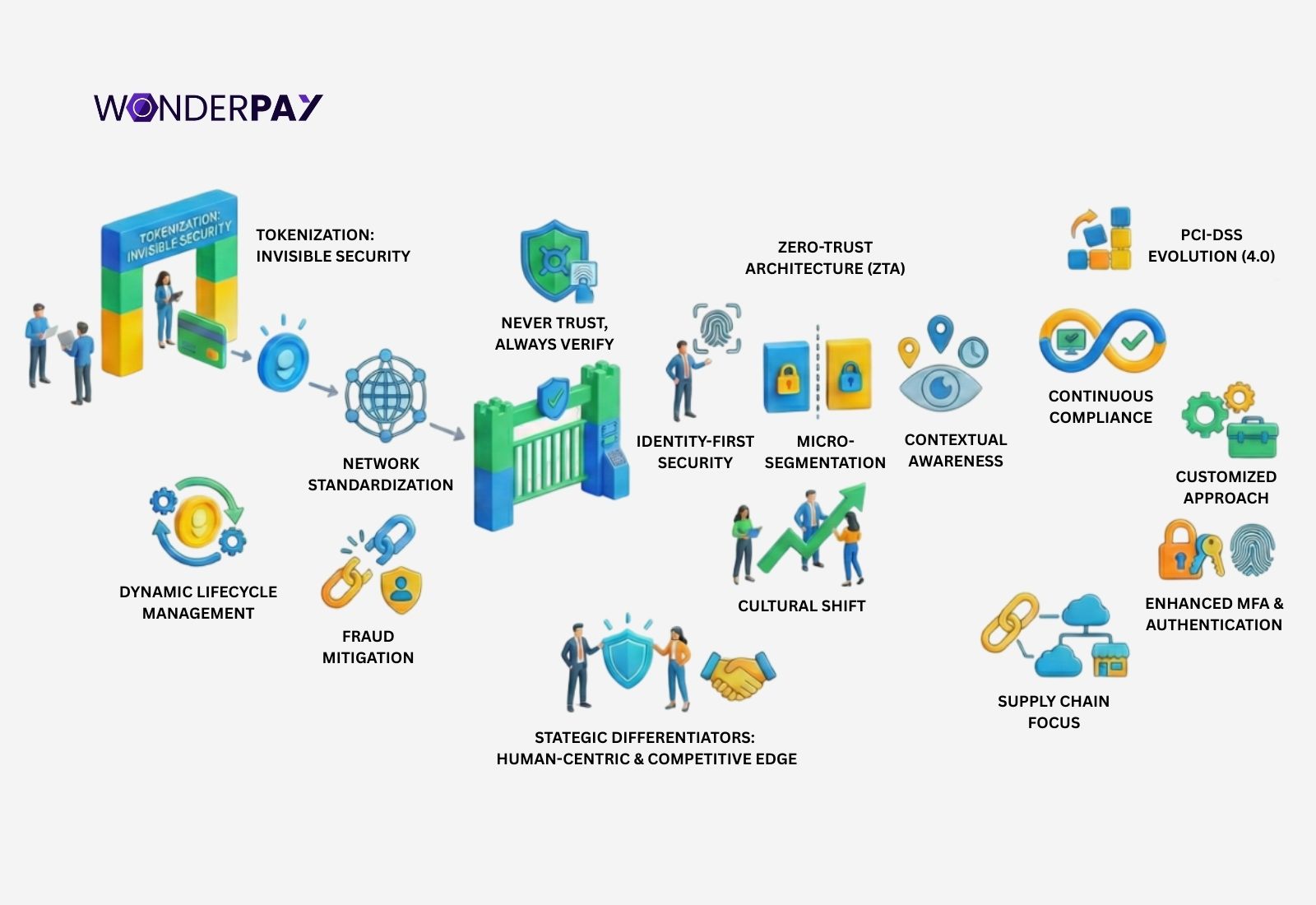

Security, Tokenisation & Trust as Differentiators

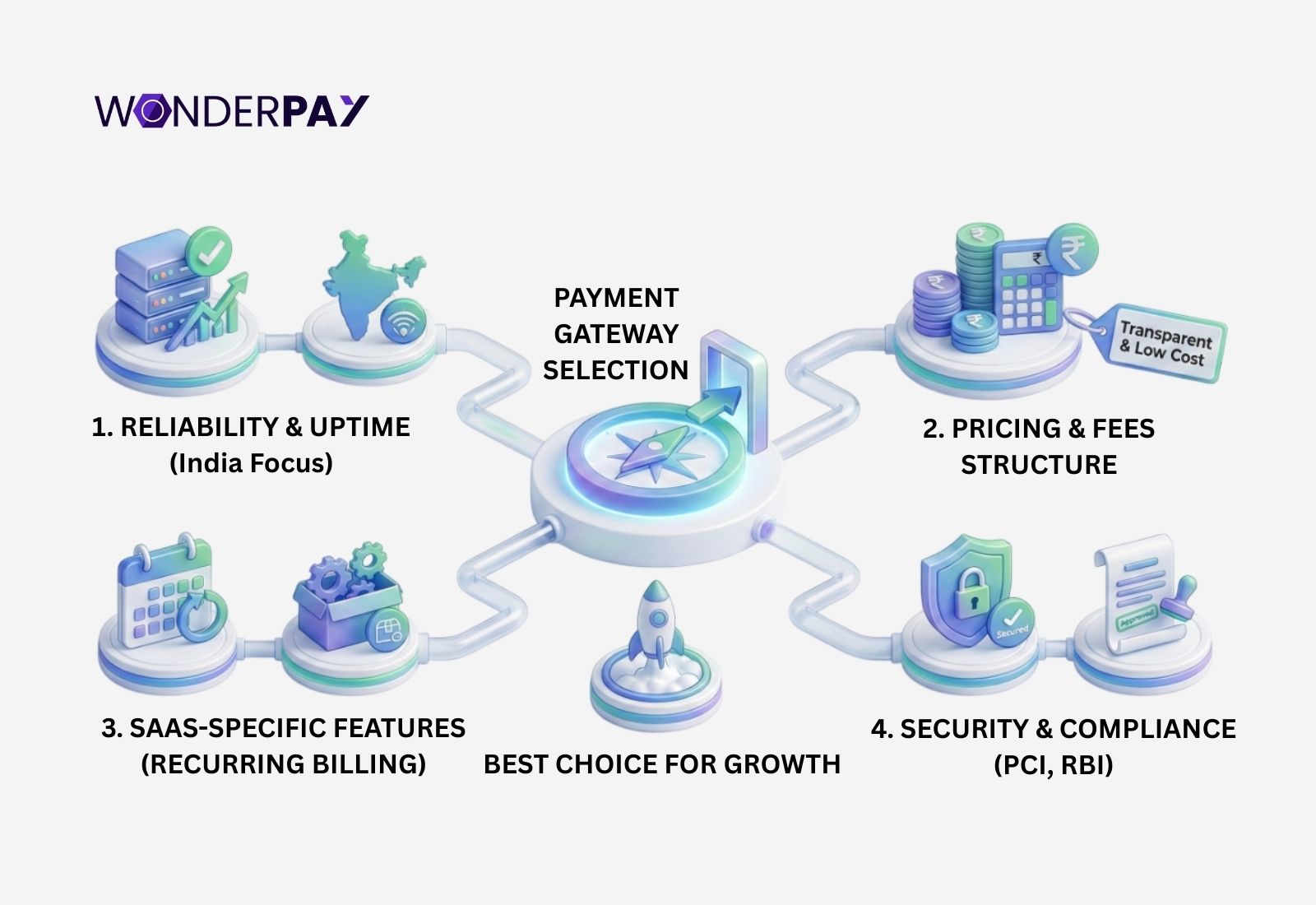

2026 payment security trends in India, and trust have shifted from back-end compliance tasks to core business differentiators. This includes all payment service providers. With the integration of advanced technical standards; as they allow institutions to offer high-security environments at the same time maintaining a frictionless user experience.

1. Tokenization: Invisible Security

It evolves into a “differentiating technology” that is going to reinforce consumer trust by making sensitive data invisible.

-

Network Standardization: By 2026, network tokenization will have reached critical mass, where Primary Account Numbers, also known as PANs. It rarely travels across the internet.

-

Dynamic Lifecycle Management: The specialized hubs now manage token lifecycles. All these automatically update digital tokens when physical cards are replaced in order to prevent payment failures.

-

Fraud Mitigation: As tokenization is unique to specific merchants as well as devices, a breach at one merchant does not expose data that is usable elsewhere. This practice drastically reduces the impact of system compromises.

2. Zero-Trust Architecture (ZTA)

RBI’s transition from the previous perimeter based security to the “Never Trust, Always Verify” model.

-

Identity-First Security: The new boundary is identity, by using the biometrics, adaptive multi-factor authentication (MFA), as well as behavioral analytics for continuous verification.

-

Micro-Segmentation: The Network is broken into smaller, isolated zones to limit the “blast radius” of any potential breach.

-

Contextual Awareness: The access is granted based on real time risk signals, which also include device health, IP geolocation, and transaction history.

-

Cultural Shift: Leading institutions view ZTA being as a facilitator of growth and resilience rather than a regulatory hurdle.

3. PCI-DSS Evolution

The transition to Payment Card Industry Data Security Standard abbreviated (PCI-DSS). It is 4.0 marks a fundamental shift within the security philosophy.

-

Continuous Compliance: The standard has moved away from “point-in-time” annual audits, which is toward a model of continuous monitoring, at the same time proactive security governance.

-

Customized Approach: The organization will have more flexibility to implement alternative security controls. This will help meet the “intent” of a requirement, and will also allow for innovation in how they protect data.

-

Enhanced MFA & Authentication: The latest version of PCI DSS 4.0 will mandate multi-factor authentication which is for all access to cardholder data environments (CDE). It will not be just for remote access, and will enforce stricter password policies, and this should have at least 12 characters.

-

Supply Chain Focus: The scope of compliance will explicitly include the third-party service providers, at the same time, cloud environments, requiring rigorous vendor risk management.

5. What will Strategic Differentiators for 2026

-

Human-Centric Security: The most successful providers within the country will deliver both security and convenience. They can help you by knowing when to be “invisible” (using background risk checks). And knowing when to be present (clear, user-friendly authentication prompts).

-

Compliance as a Competitive Edge: High-trust environments will attract more partnerships as well as help you in reducing operational risks, turning regulatory adherence into a market advantage.

Also Read: Instant Settlement Payment Gateway In India: Complete Guide

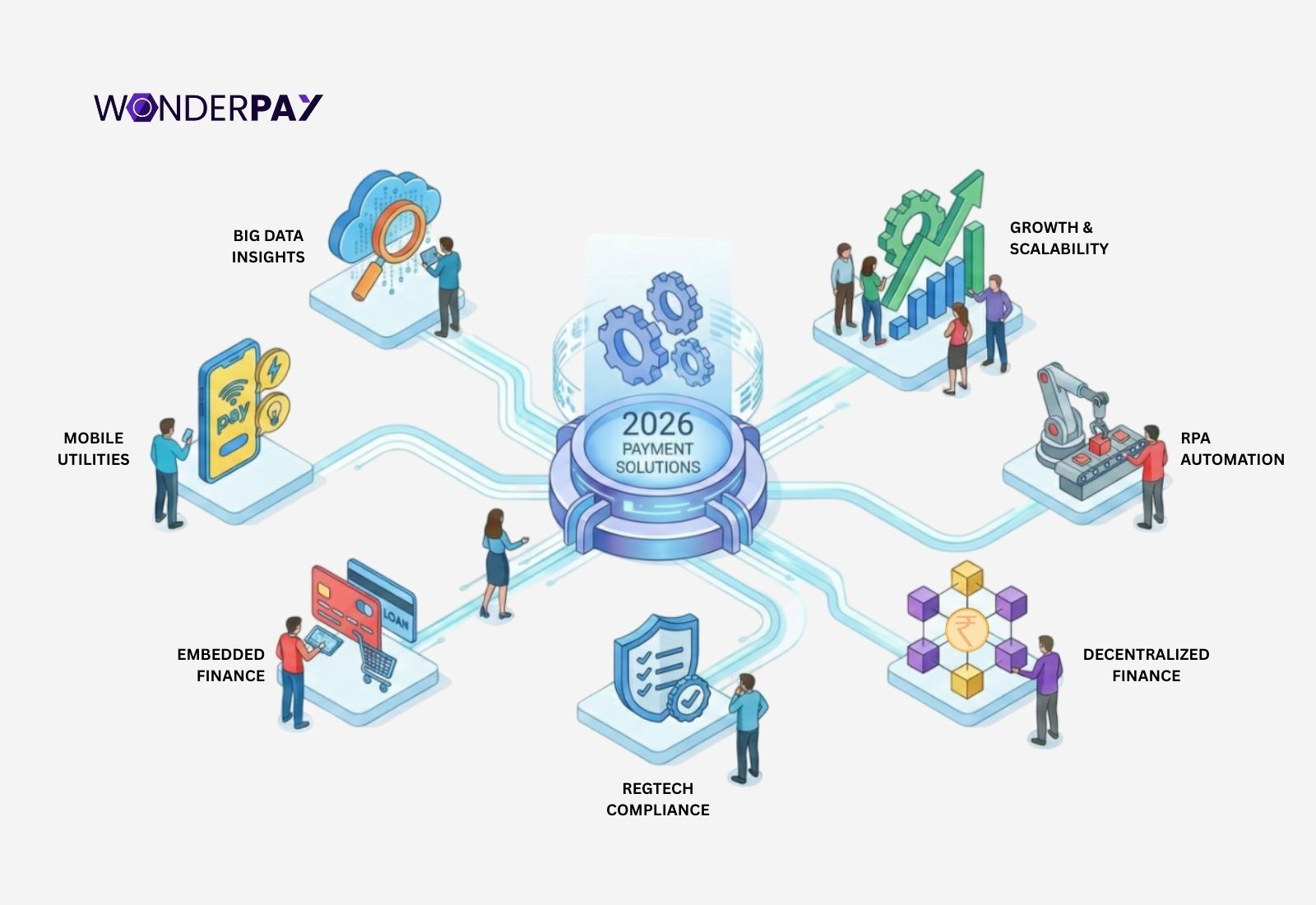

What Businesses Should Expect from Payment Solutions in 2026

The future of online payments in India is faster, insight-driven, and expects simple payments anywhere, anytime without friction. As AI makes its place in every industry, from e-commerce to improve its users’ experience with technologies like Augmented Reality (AR) and Virtual Reality (VR), online streaming platforms to deliver tailored results to their customers primarily through the extensive use of AI and Machine Learning (ML) algorithms that analyze a vast amount of data to create a highly persornalized experience.

Fintech is not exceptional; here are the top significant trends in payment gateway (fintech) in 2026.

1. Big Data Analytics

The future of payment gateways in India brings outstanding technologies of big data analytics. This will help merchants enable enhanced fraud detection, deeper customer intelligence, and optimized business operations. It will benefit merchants to make more informed, data-driven decisions, at the same time gaining a competitive advantage, including:

-

Advanced fraud detection and prevention.

-

Enhanced customer experience and personalization.

- Personalized offers.

- Optimized checkout.

- Improved services.

-

Optimized operations and efficiency.

-

Payment routing.

-

Inventory and demand forecasting.

-

Automated reporting.

-

Risk management and compliance.

-

Revenue optimization.

2. Mobile Pay Utilities

The mobile payment gateways assist utility merchants by offering benefits like enhanced security, improved cash flow, increased operational efficiency, and a better customer experience.

The Trend Will Help with Following:

-

It will enhance customer experience and retention.

- Provide convenient services to pay anytime, anywhere using their preferred methods.

- Faster and frictionless payments.

- AutoPay and reminders.

-

Help businesses improve operational efficiency and cash flow

-

Automation with the help of a gateway automates the entire payment lifecycle, from authorization to settlement. This will help eliminate the manual data entry and reduce the administrative workload on your team.

-

The faster settlement: translations are processed in real time. This will lead to quicker fund settlements in the merchant’s bank account while ensuring you a steady and predictable cash flow.

-

Its centralized system enables you to manage all payments from a single dashboard across multiple locations, including service types such as electricity, water, telecom, etc., with simplified tracking and reconciliation.

-

It helps you reduce the cost by shifting you from manual processing to digital solutions can lower operational costs, which are associated with physical infrastructure and manual handling.

-

-

Heightened security and fraud prevention

-

Data protection with the help of existing systems, like end-to-end encryption, tokenization, and adherence to standards such as PCI DSS, to protect sensitive customer financial information.

-

The evolving technology of AI and ML assists in identifying and blocking suspicious activities in real time, protecting both the business and the customer from financial loss.

-

The extra layer of security with the help of multi-factor authentication, like OTP (One Time Password) or biometrics, provides you with an improved solution.

-

-

Business Growth and Scalability

-

Wider reach; by offering diverse as well as popular mobile payment methods, such as UPI in India. This will allow merchants with a wider customer base, including tech-savvy individuals and in semi-urban areas.

-

Scalability of the modern payment platform is designed to handle high transaction volumes and can scale easily as a business expands its customer base or introduces new services.

-

Get data insights to gain access to valuable data and analytics on customer payment trends and customer behaviour. It will also help organizations’ marketing strategies and business decisions.

-

3. RPA to Enhance Business Operations

RPA stands for “Robotic Process Automation”. It uses software bots, or bots in payment gateways. In order to automate repetitive, rule-based tasks, which are mostly handled manually by humans. It will improve efficiency, reduce costs, and enhance security in payment processing operations.

RPA Will Help Merchants with the following advantages:

- Increase speed and efficiency.

- Enhance accuracy and error reduction.

- Cost savings.

- Improved fraud detection.

- Streamlined reconciliation.

- Better customer experience.

- Scalability.

- Improved compliance and auditing.

4. Embedded Finance

This will help companies get seamless access to crucial financial services such as credit and insurance at the point of need. Thus, helping you in improving cash flow, operational efficiency, and overall financial inclusion.

You will get benefits including:

- Help improve access to credit.

- Enhance cash flow management.

- Operational efficiency and time savings.

- Seamless customer experience.

- New revenue streams and business growth.

- Financial inclusion.

5. Decentralized Finance Growth

Next-generation payment systems in India will help businesses by offering lower transaction costs, faster settlement time, enhanced security, and global accessibility.

Decentralized Finance (DeFi) will help companies with:

- Reduce costs.

- Faster transactions and improved cash flow.

- Global market access and financial inclusion.

- Increase security and transparency.

- Automation via smart contracts.

- Protection against currency volatility.

- New financial opportunities.

6. RegTech For Compliance Automation

It helps businesses by providing increased efficiency, reduced costs and risks, and the ability to scale operations more effectively. Further, this system will assist you in transforming manual, time-consuming compliance tasks into streamlined and proactive processes using technologies such as AI and ML.

Businesses will get benefits:

- Increase efficiency and speed.

- Cost reduction.

- Enhanced risk management and fraud detection.

- Improved accuracy and audit readiness.

- Scalability and agility.

- Enhance data security.

Suggested Read: Why Choose Wonderpay Payment Gateway In India for Businesses

Final Thoughts: Future of Payment Gateways in India

The future of payment gateways in India improves at a rapid pace year on year. The evolving technology enriches digital payments this year, too. With the advanced solution of AI, ML, regtech, which includes big data and blockchain, to automate and streamline regulatory compliance and risk management for businesses’ finances.

These payment gateway trends in India are a revolution for businesses. It will support organizations in driving their business growth, improve productivity with PG’s automation for manual or rule based tasks, and improve security. It means you can reduce costs on hiring more manpower, and you can work more effectively and promptly.

Get connected with us and receive updates for the latest insights that improve your business experience. Sign up for the newsletter, right into your main with our thought leadership.

Also read about: Types Of Payment Gateways In India & How To Choose Right One

FAQs

What is the future of payment gateways in India?

The future of online payments in India is wider, productive, and AI-driven. Its advanced solution of artificial intelligence with machine learning improves security by identifying customer behavior and avoiding unauthorized access. It also supports businesses in recommending solutions or content that the customers are seeking. The regtech (Regulatory Technology) streamlines regulatory compliance and risk management processes to be cost effective, fast, and accurate.

How will AI change payment gateways?

Artificial intelligence is dominating every industry, from e-commerce, fintech, manufacturing, logistics, and more. As the technology is evolving, and business operations are getting faster, at the same every industry requires quick payment settlement, accepting payments easily with enough security, and fast onboarding. Therefore, AI and Machine Learning are changing PGs in many ways:

- Improves onboarding to be quick, accurate, and cheap.

- Secured payment solution.

- Detect fraudulent activities before they take place.

- Recommend the solution.

Will UPI replace traditional payment gateways?

No, next generation payment systems in India will not replace payment gateways. Instead, it transforms gateways to be more effective by delivering quick solutions for onboarding, making them more secure, and generating automated reports for reconciliation, and more.

What challenges will payment gateways face by 2026?

The core challenges a payment gateway could face in 2026 include:

-

AI vs. AI: The artificial intelligence-powered frauds, such as deepfakes, voice cloning, and advanced defences like behavioral biometrics and contextual analysis.

-

Rising costs: It may let you face the increased transaction fees and operational expenses.

-

Educating both the customers and businesses from scratch to adopt the modern solutions by replacing the old ones.