- 1. What Is KYC in Payment Gateways?

- 2. What is KYB in Payment Gateways and Why Does it Matter?

- 3. Why KYC or KYB Is Mandatory to Onboard Payment Gateways in India?: Statistics

- 4. Types of KYC for Merchants

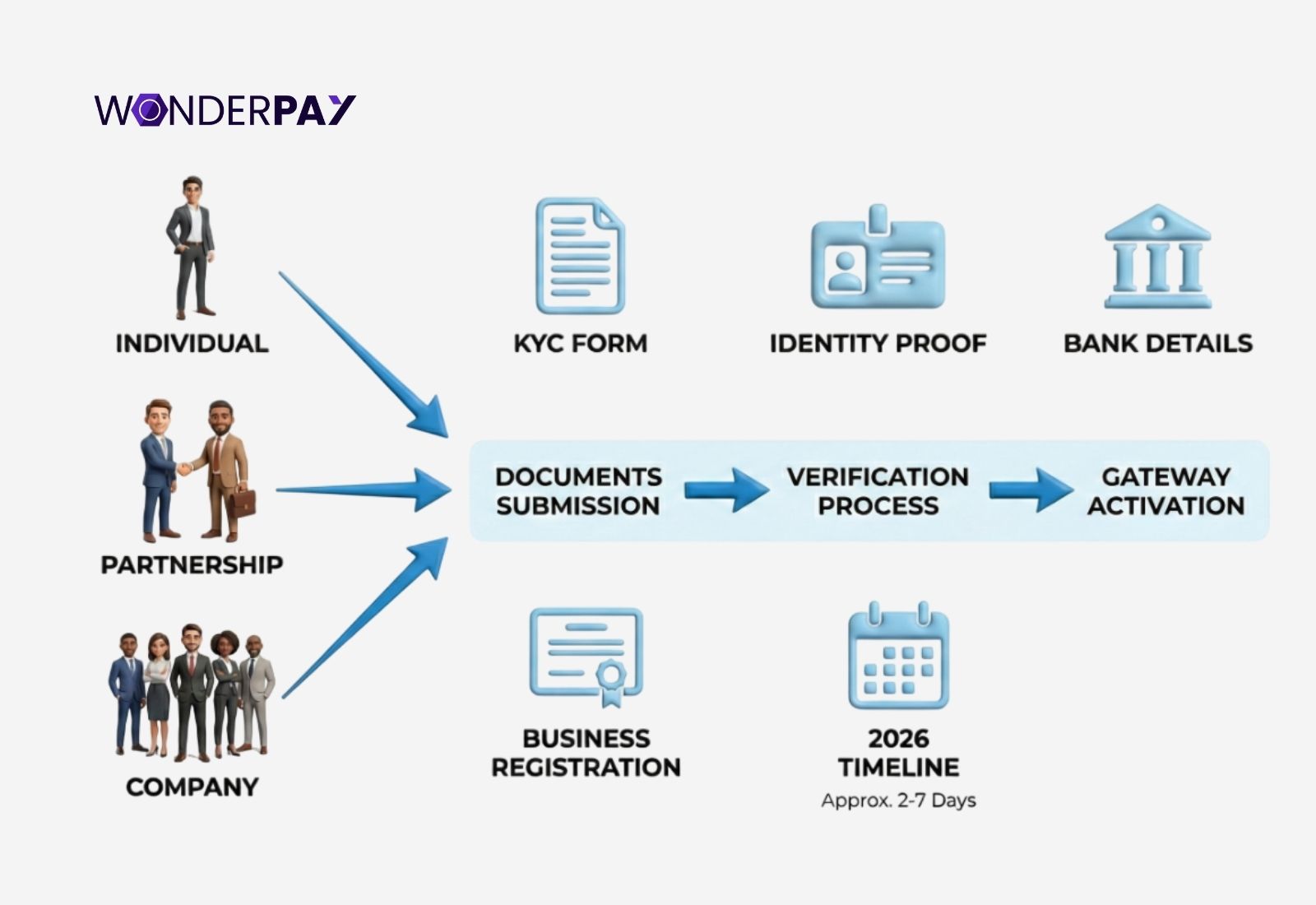

- 5. List of KYC Documents Required

- 6. Online vs Offline KYC Process

- 7. What Is Online KYC?

- 8. What Is Offline KYC?

- 9. What Options Among Online and Offline KYC to Choose?

- 10. How Long Does Payment Gateway KYC Take?

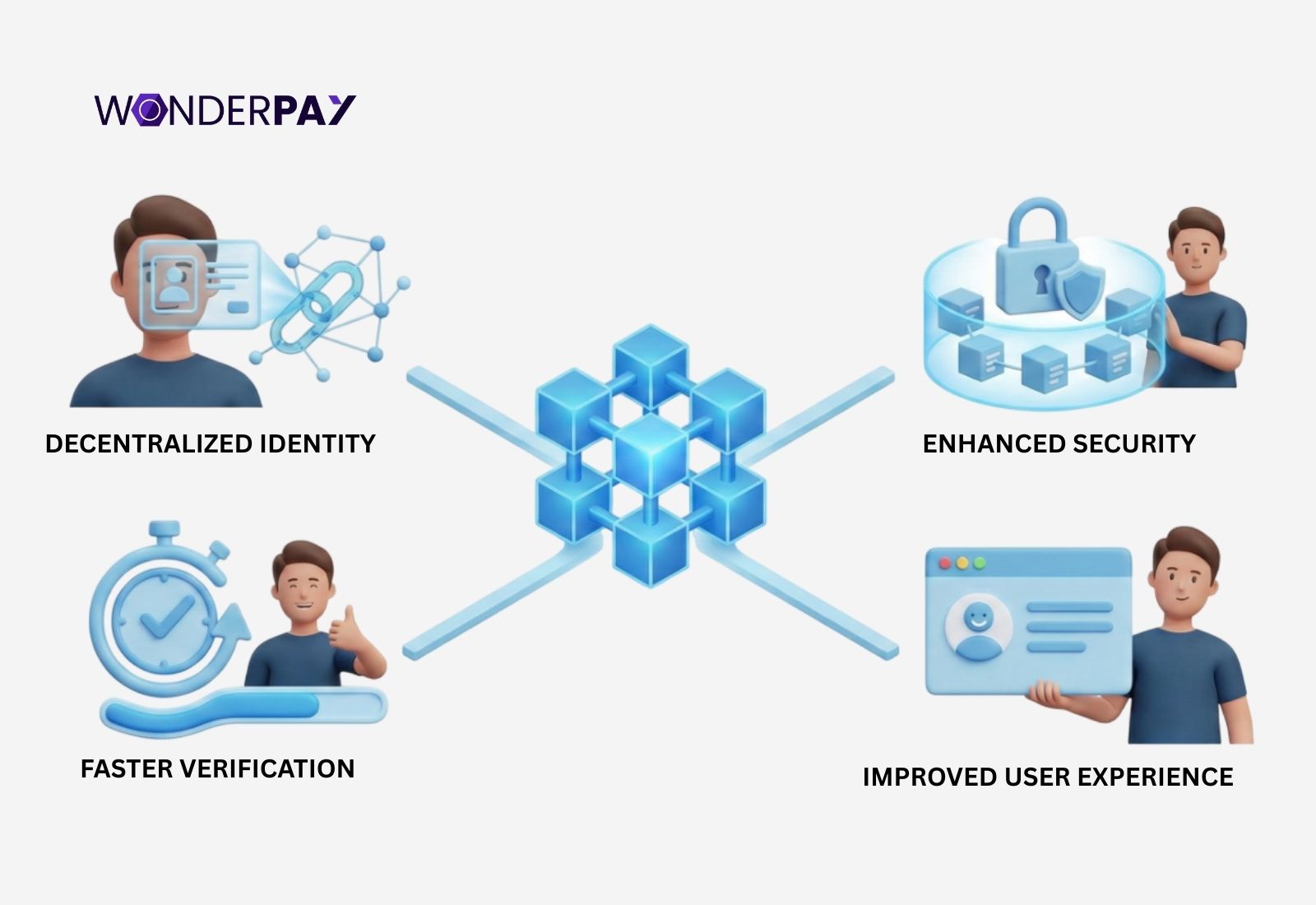

- 11. How Blockchain in KYC is Revolutionizing the Trend in 2026?

- 12. Why Choose Wonderpay Payment Gateway?

- 13. Summary

- 14. FAQs

Electronic payments in India are easier than before, but onboarding for merchants is not. Online payment gateway for Indian businesses are needed to follow strict rules and regulations set by the authorized body, the Reserve Bank of India (RBI), and the Prevention of Money Laundering Act (PMLA). This directly affects the payment gateway documents required by the businesses in the country.

Submitting incorrect or incomplete documents during gateway onboarding can lead you to KYC rejection, heavy penalties, delayed payouts, and temporary restrictions on transactions.

Businesses rely on uninterrupted cash flow; such delays can directly affect your customer trust and operations.

This guide explains the documents required for payment gateway onboarding in India. This will help individuals (freelancers) and businesses prepare correctly before they jump into the process.

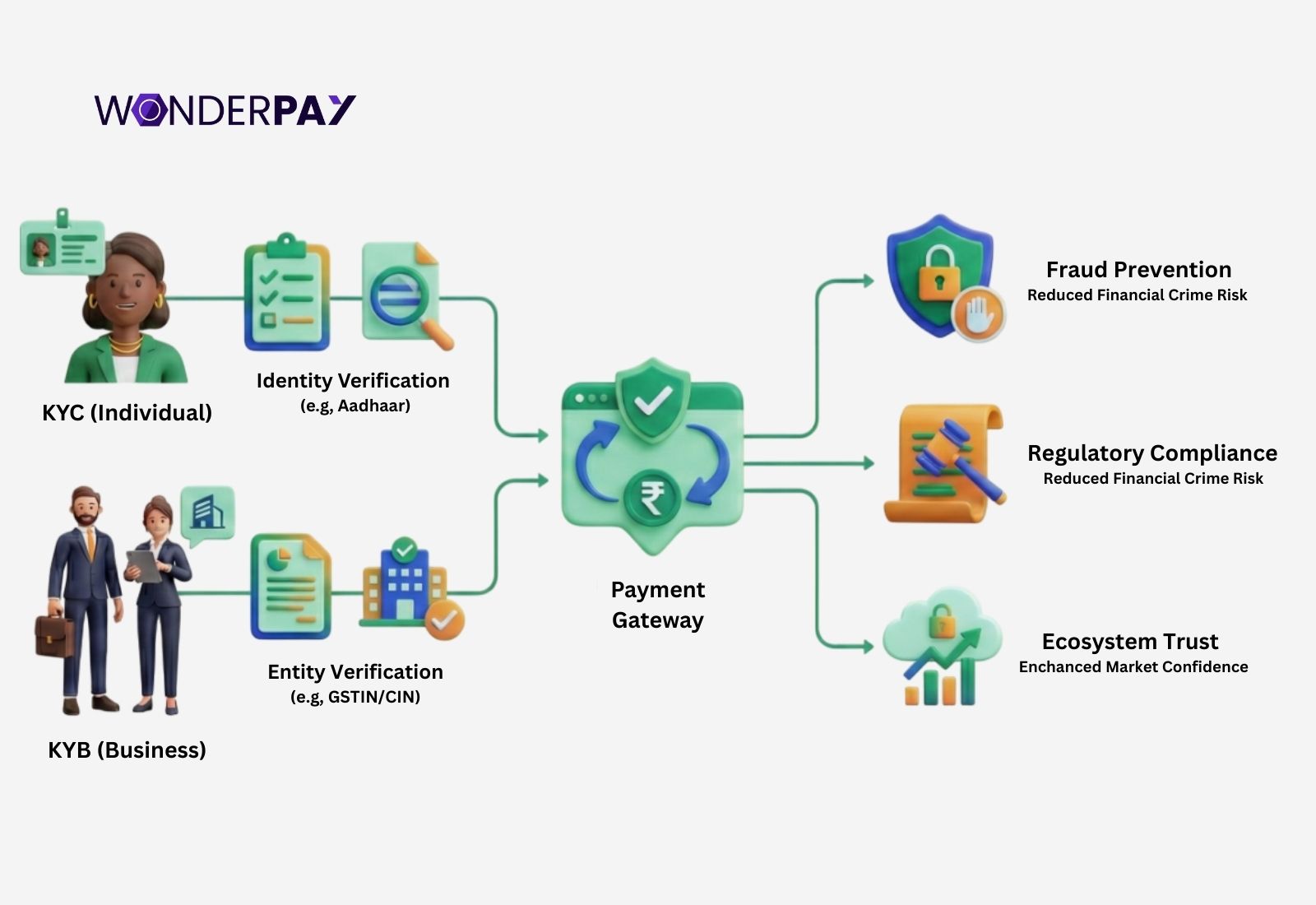

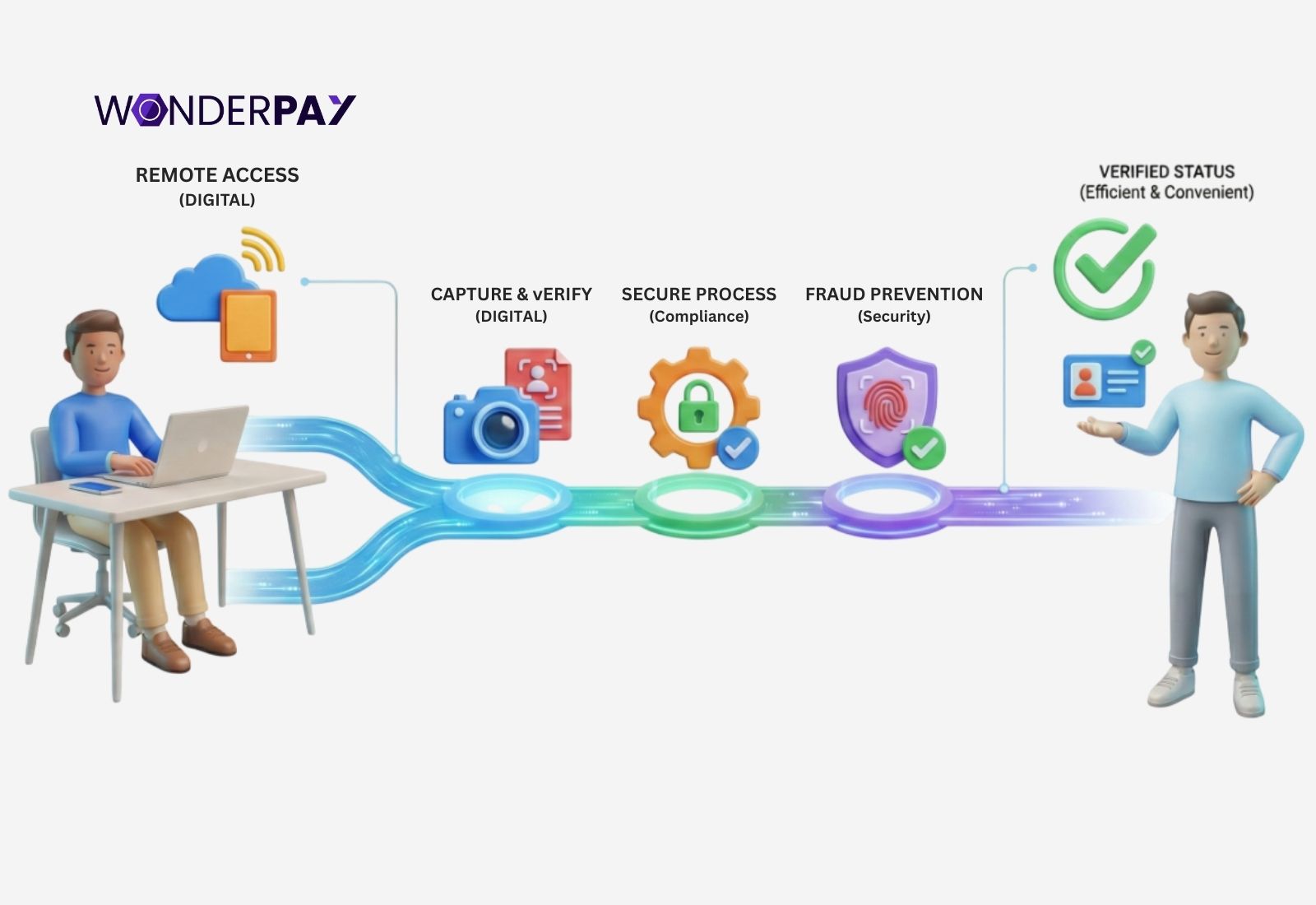

What Is KYC in Payment Gateways?

KYC stands for “Know Your Customer”. It is an RBI mandatory procedure implemented by financial institutions like payment gateways, payment processors, or aggregators. The KYC process helps avoid grave risks like fraud and money laundering.

Know your customer assists payment gateway service providers in getting into merchants’ or freelancers’ crucial information, including their identity, occupation, address, and income source. In order to maintain information accuracy by verifying it periodically, as the Reserve Bank of India recommends to financial institutions.

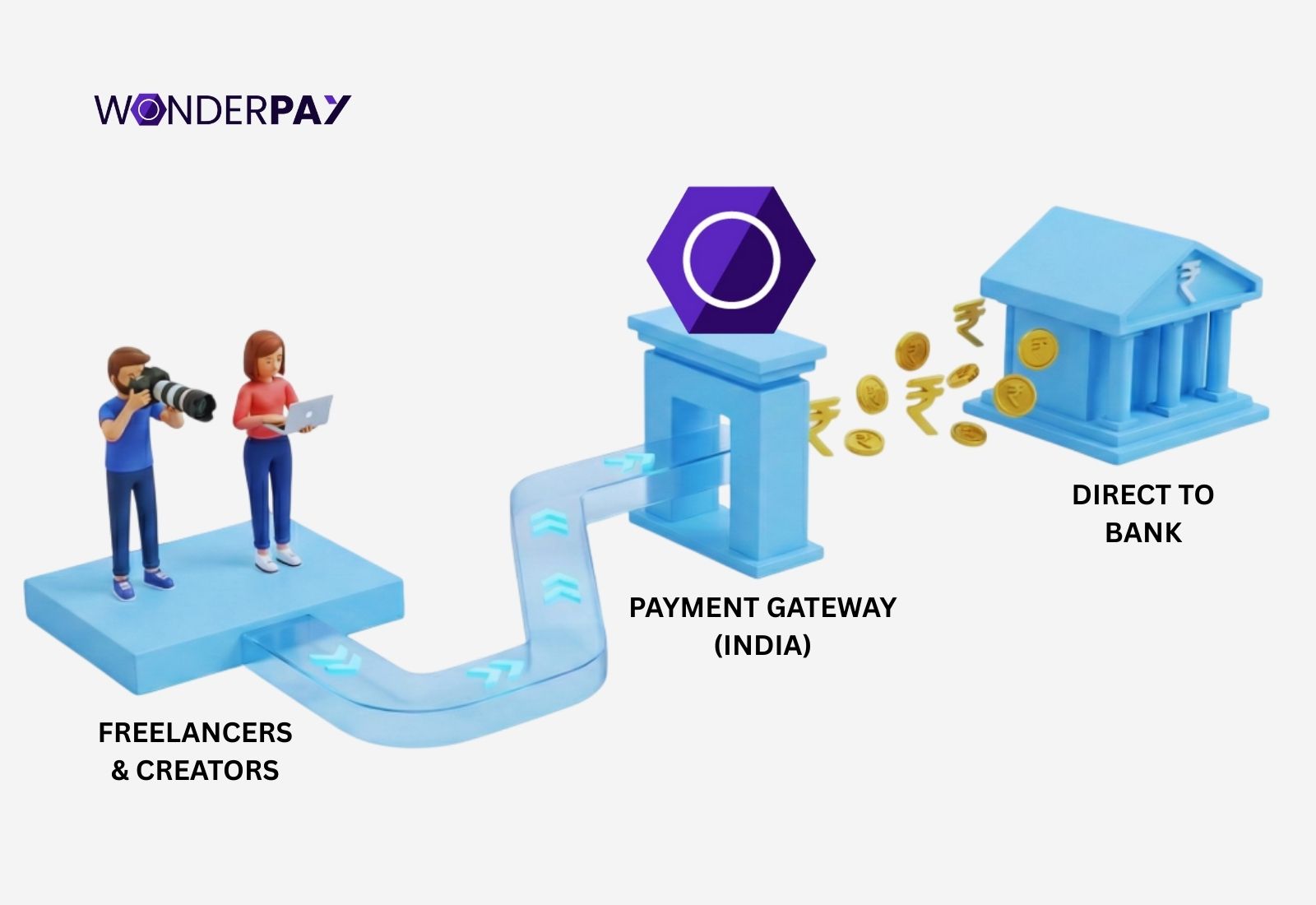

Suggested Read: Payment Gateway in India for Freelancers & Creators

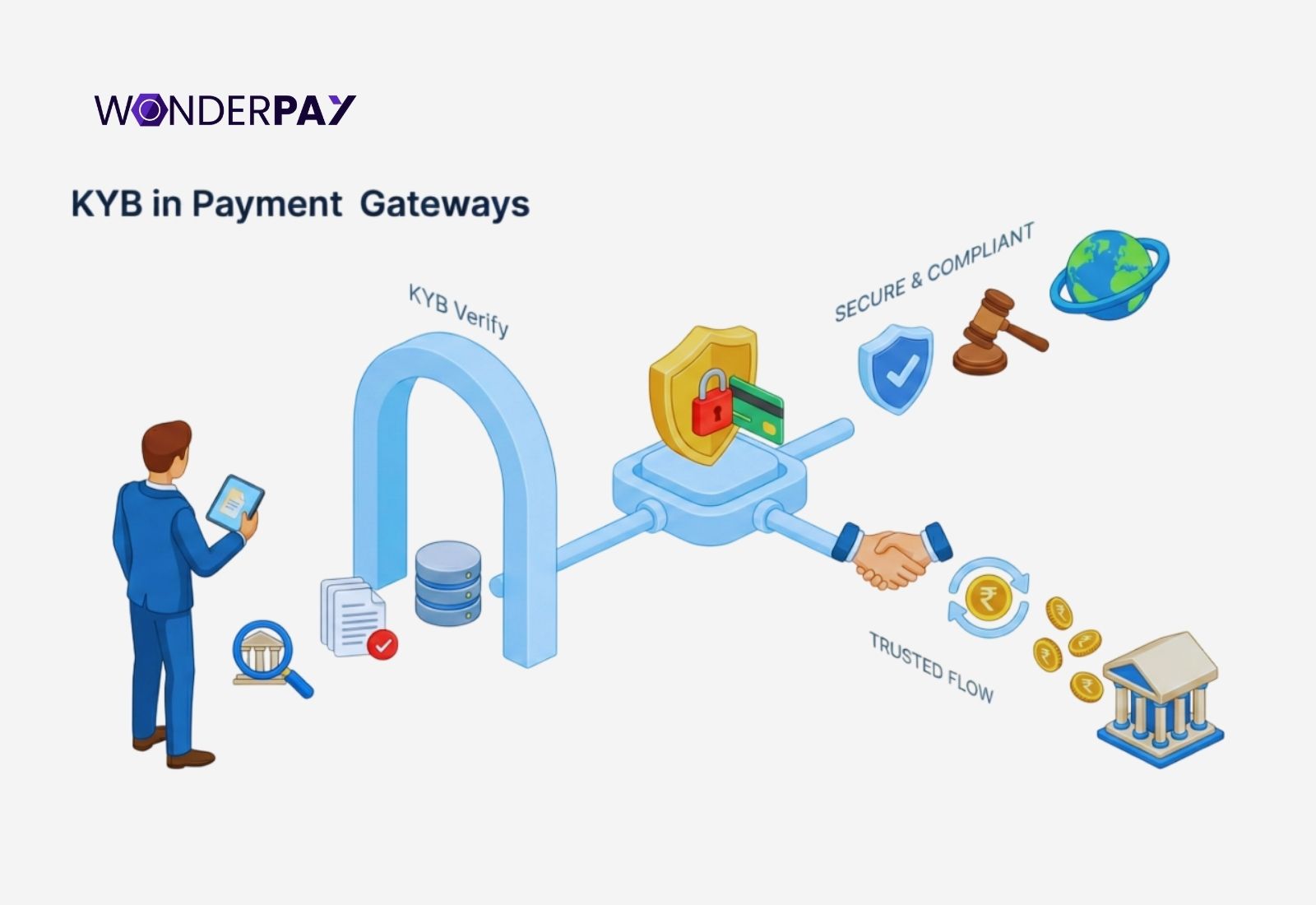

What is KYB in Payment Gateways and Why Does it Matter?

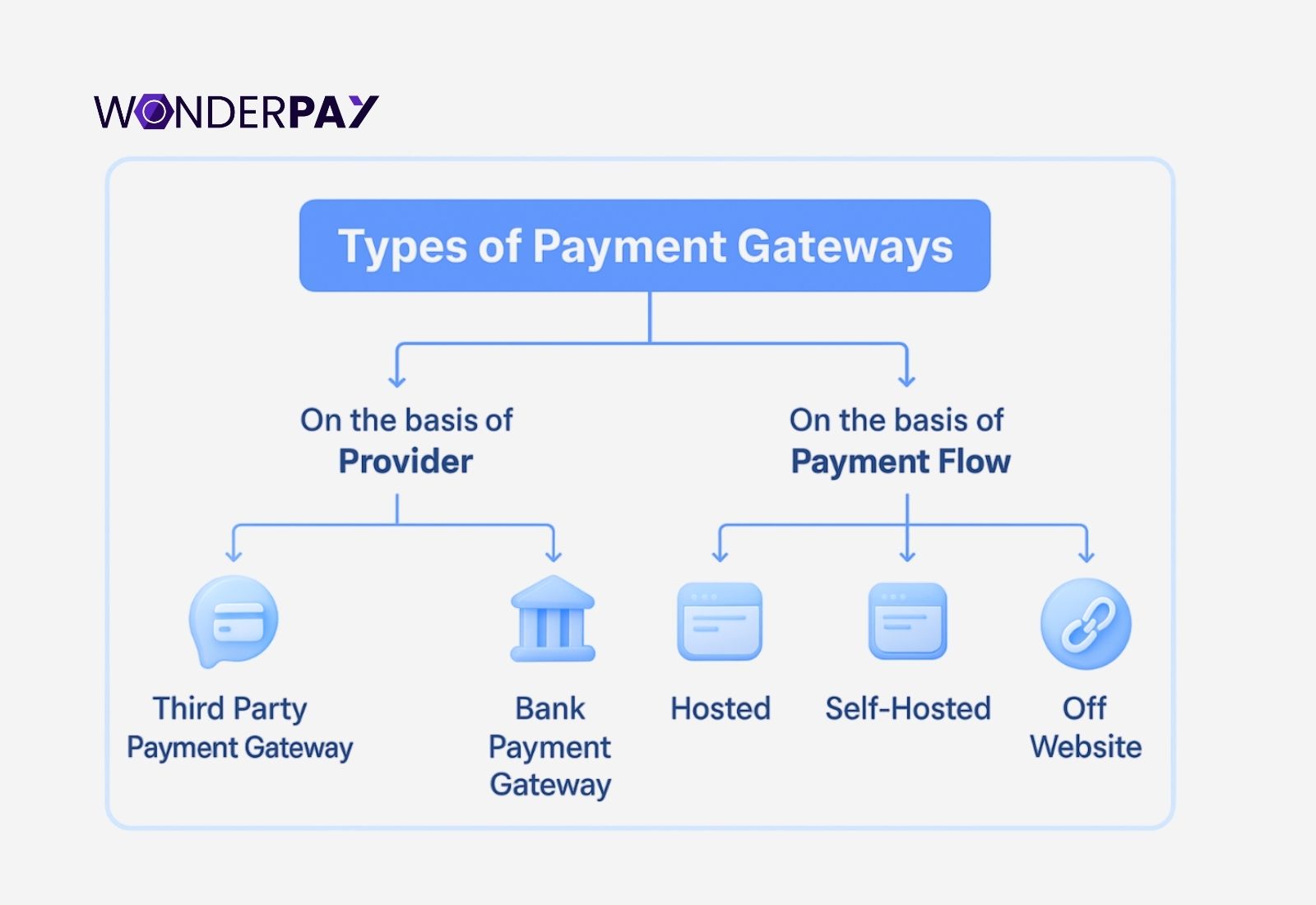

Know Your Business (KYB) is unlike KYC. This business customer identification process helps payment platforms and financial institutions verify any entity before onboarding. It supports gateways to verify various business documents, authenticate the businesses, understand their nature, the purpose of transactions, the source of income, and their financial history before a business utilizes any financial platform.

Know Your Business (KYB) is unlike KYC. This business customer identification process helps payment platforms and financial institutions verify any entity before onboarding. It supports gateways to verify various business documents, authenticate the businesses, understand their nature, the purpose of transactions, the source of income, and their financial history before a business utilizes any financial platform.

KYB plays a vital role by identifying and detecting any fraudulent activities on the gateway platform, while ensuring business customers comply with the regulatory laws - including their activation of GSTIN, business decision makers’ documents, and more.

Further, these careful considerations with the payment gateway business verification create transparency between payment infrastructure providers and their customers. Within the process, one mistake of onboarding a suspicious business or individual with the intention of illegal activities may spoil the gateway’s reputation as more and more liens are spotted, leading to regulatory fines, legal liabilities, and damage to the brand.

Know: Key Benefits to Implement KYB for E-Payment Compliance

- Enhanced Security and Fraud Prevention

- Improved Regulatory Compliance

- Streamlined Onboarding Process

- Increased Trust and Transparency

Suggested Read: What is a Payment Gateway & How Does it Work?

Why KYC or KYB Is Mandatory to Onboard Payment Gateways in India?: Statistics

India is a global leader in the digital payments economy driven by Unified Payment Interface (UPI). It fosters financial inclusion, transparency, and economic growth, as it enables instant, stable, and secure transactions, but this growth comes with drawbacks also.

India is a global leader in the digital payments economy driven by Unified Payment Interface (UPI). It fosters financial inclusion, transparency, and economic growth, as it enables instant, stable, and secure transactions, but this growth comes with drawbacks also.

It experiences sharp rises in both registration of cases under the Prevention of Money Laundering Act and total monetary value involved in financial institutions, such as banking frauds.

Here is a report from the Enforcement Directorate (ED) for its “Key Performance Indicators” under the law PMLA for the years 2024 and 2025.

-

Enforcement Directorate (ED) India recorded a total number of attachments was 44% (461).

-

The value of assets attached amounted to 30,0336.41 crore (141%).

-

In the previous year, the Enforcement Directorate made 21.32% (214) arrests.

-

The number of convictions was 113% (34), and the amount of confiscation was 18.37 Crore.

-

The total number of Enforcement Case Information Reports (ECIRs) was 11% (775).

-

It records 19% (333) of prosecution complaints also.

-

The value of restitutions made is 15,261.15 crore as reported by the body.

In order to protect the financial system, India is aggressively cracking down on money laundering and foreign exchange by enforcing compliance and deterring financial crime.

The Foreign Exchange Management Act (FEMA)

The law regulates foreign money movement, including foreign exchange, overseas transfers, exports, and imports.

-

The number of investigations made was 2631.

-

The 624 show cause notices issued, which include the people and entities, have been asked to explain suspected violations.

-

276 adjudication orders were passed.

-

The body imposes a Rs 5238 crore penalty.

-

As of now, the body has covered the Rs 105 crore penalty actually recovered in the previous year.

Types of KYC for Merchants

There are 7 main KYC types. One thing you must keep in mind is that not all of them are one size fits all when initiating the know your customer process for any financial platform. In this section, we will discuss all the types with their brief descriptions.

There are 7 main KYC types. One thing you must keep in mind is that not all of them are one size fits all when initiating the know your customer process for any financial platform. In this section, we will discuss all the types with their brief descriptions.

- Paper-Based KYC.

- Digital KYC.

- Video KYC.

- Electronic KYC or eKYC.

- In-Person KYC.

- Central KYC.

- Aadhaar Offline KYC.

1. Paper-Based Know Your Customer

It is a traditional process, which includes hard copies (xeroxed of your original proof of address and identity ID). This process is still valid in the legacy system, but is slow and completed manually.

2. Video KYC

The video KYC/KYB outlined in one of the notifications by the Reserve Bank of India on January 9, 2020. It is a real-time video call where a financial institution’s authorized representative verifies customer documents by displaying them and at the same time answers identification questions also.

Video enabled KYC verification offers better user convenience, as well as allows companies to comply remotely. Kotak Mahindra Bank is one of the best examples of implementing video document verification as a pioneer in India.

3. In Person KYC

The high-risk categories, such as large transactions, including high-value loans, and more, within these regulated sectors mandate customers to present physically for verification purposes before one of the representatives responsible for validating identity and documents.

4. Digital KYC

Once you may have experienced uploading your documents manually on a portal. It could be creating your trading account on one of the platforms. It may have asked you to upload your documents manually or by scanning. It is a digital KYC mandate before you start using a platform, which requires careful consideration to identify you as a person.

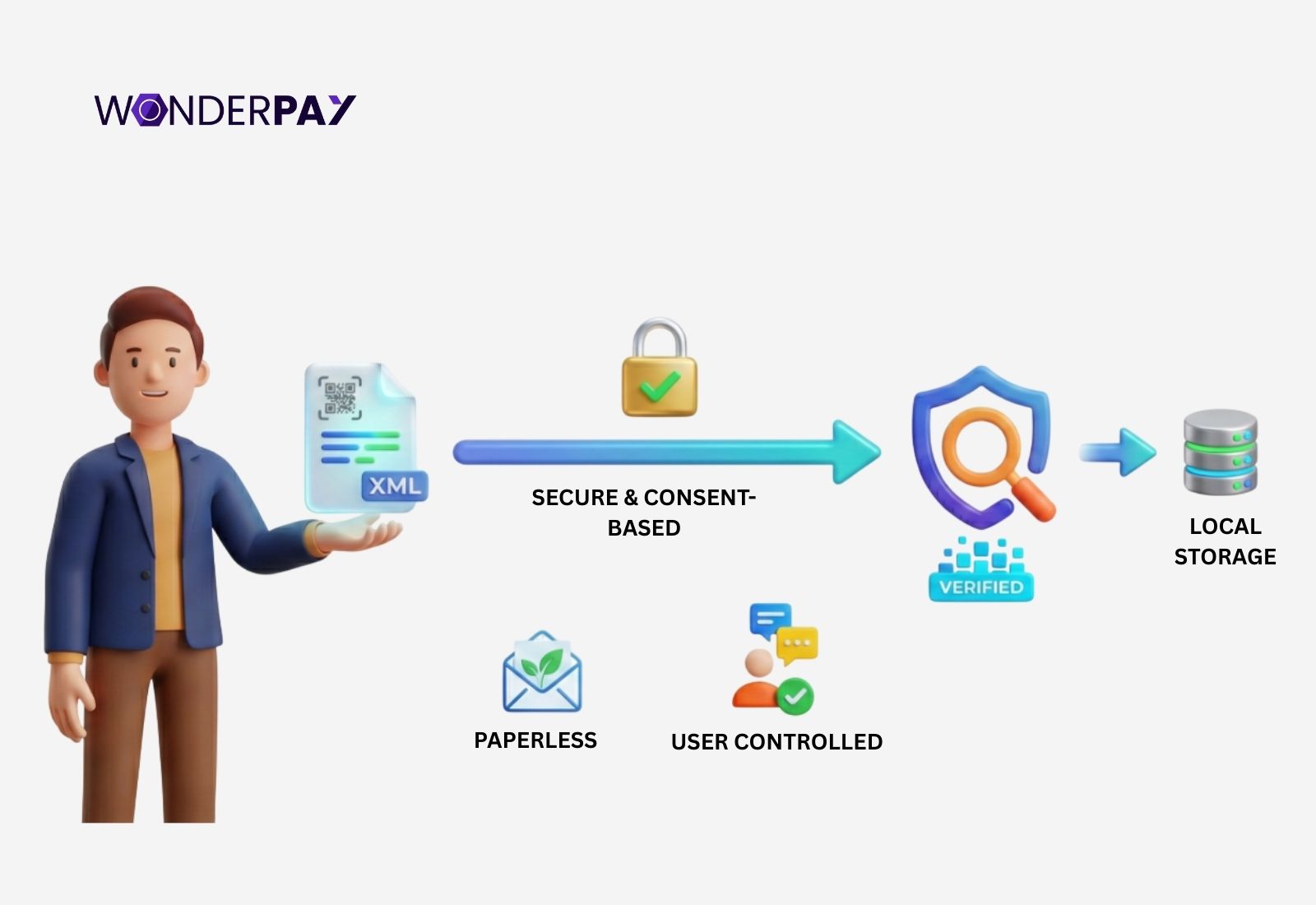

5. Aadhaar KYC

This system does not require access to the live database. It allows a customer to download their Aadhaar card in XML file format and share it securely with a financial entity or business.

6. Electronic KYC

eKYC or electronic KYC is one of the best types. This system is powered by the Unique Identification Authority of India (UIDAI). It utilizes Aadhaar based OTP authentication or biometric data in order to verify identity quickly and accurately.

Electronic KYC is considered to be the fastest, easiest, most secure, and accurate method. Additionally, the eKYC solution is asked to actively choose options by regulators for a better experience.

7. Central KYC or CKYC

The central KYC option is totally different from all verification methods. It is a centralized repository managed by the government. Within this system, customer details are stored after their KYC is completed with any financial institution. Its purpose is to store the document data to avoid the repeated process of KYC.

The time a customer goes for any other service, such as mutual funds, banks, or organizations like insurance providers. The central process system for KYC can be completed with Central KYC.

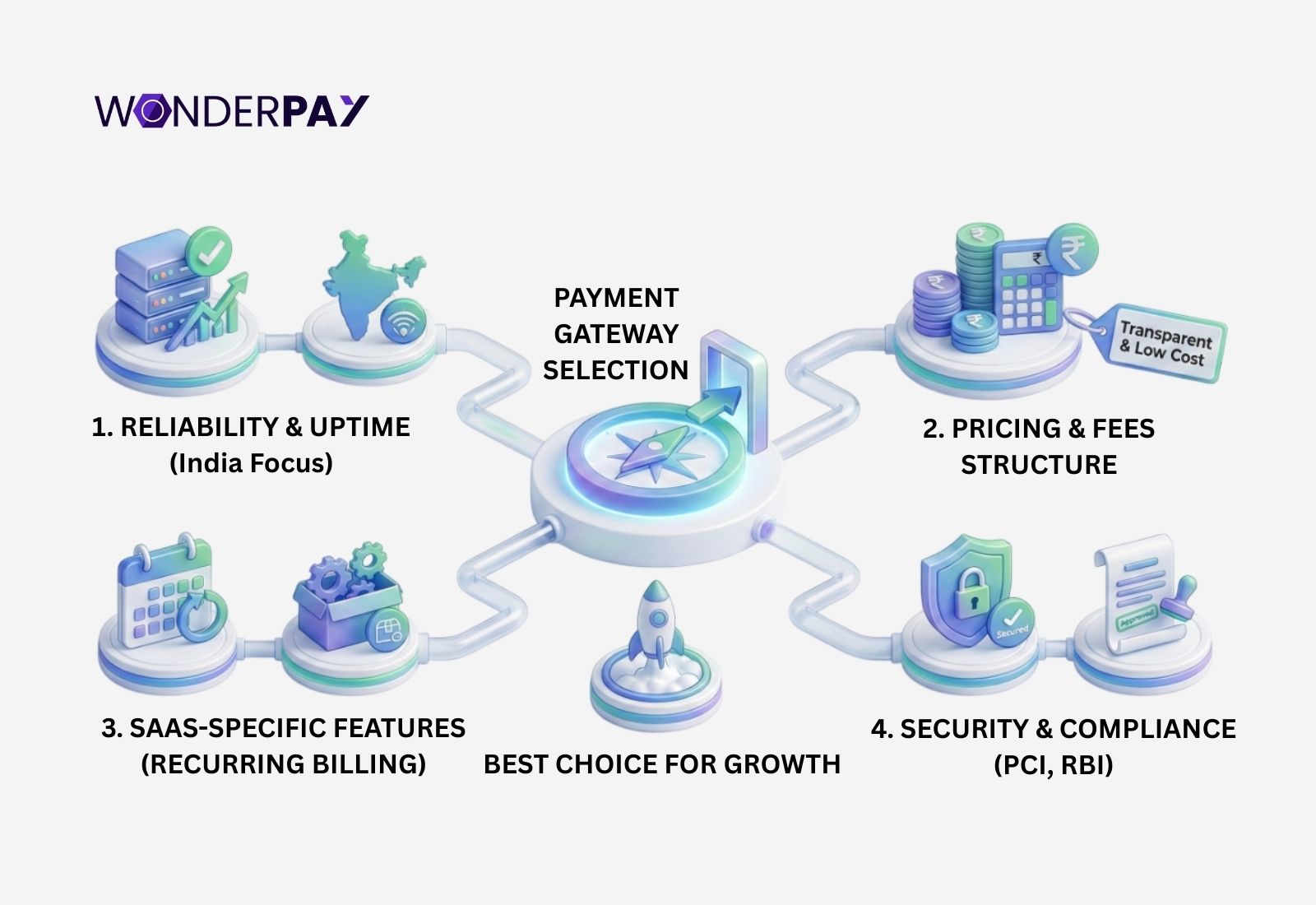

Must Read: How To Choose Best Payment Gateway In India For SaaS

List of KYC Documents Required

The documents required for payment gateway in India are all listed in this section. It will help you choose the correct proofs you would need.

Guided the merchant onboarding (standard KYC) using real, trustworthy sources from current payment gateway policies.

In India’s digital payments scene, businesses and individuals have to go through a pretty rigorous verification process before they can start taking payments through a payment gateway. This is all thanks to RBI’s KYC and AML guidelines for Payment Aggregators and service providers; essentially, to make sure everyone’s legitimate, safe, and not breaking any rules.

Most payment gateways follow a tiered document process based on your business type (Proprietorship, Partnership, Company, NGO, and so on).

1. Core Documents to Prove Your Identity and Legitimacy

These are the basics that show you are a real business.

PAN Card / Form 60

This one helps verify the tax identity of your business or yourself.

Proof of Business Registration

Choose the one that applies to your business:

- Certificate of Incorporation (for Pvt Ltd / LLP)

- Udyam/MSME Registration

- Shop & Establishment Certificate

- Trust Deed / Society Registration

- Partnership Deed (if applicable)

GST Certificate or GST Declaration

You will need this one if your turnover has exceeded the GST threshold - otherwise, many gateways are happy to accept a declaration that you haven’t enrolled.

Memorandum and Articles of Association (for Companies)

These are the company documents you will need if your business is a company.

These are the minimum documents you’ll need to get past before you can go live with a payment gateway.

2. Documents to Verify the People Behind the Business

These just help the payment gateways make sure they know who they’re dealing with.

Any government-issued ID:

- Aadhaar

- Passport

- Voter ID

- Driving License

Photograph and signature of the person authorising documents (this one gets asked a lot)

Board Resolution or authorisation Letter (for companies)

This one proves that the person submitting documents has the authority to act on behalf of the business.

3. Bank and Settlement Verification

You need to show a bank account where your customers can send payments.

Cancelled Cheque or Current Account Statement

This one gets requested a fair bit to confirm the account that the funds will be paid into.

Cashigo

Bank account details with the business name and PAN numbers matching

Getting this one wrong is a common reason for delayed onboarding.

Some gateways may also ask you to deposit and withdraw a small amount to prove that the account is yours.

4. Business Address and Operational Proof

This just helps the payment gateways understand where and how your business operates.

Proof of your business address

- Utility bills (electricity/telephone)

- Rent agreement

- Corporate office lease

Information about your website or online presence (if you have one).

5. Optional or Category-Specific Documents

Depending on what you do and the level of risk associated with your business:

- FSSAI Licence: If you are in the food/delivery industry.

- Import-Export Code (IEC): If you are in the export business.

- Trust 80G / 12A Certification: In case you come from an NGO or not-for-profit.

Financial Statements or Bank Statements: You might need these if you are a high-risk merchant or on an enterprise plan.

6. Check List of Payment Gateway Documents Required

This comprehensive list will assist you in making an informed decision at the time of onboarding. So, you can select the exact documents required for payment gateway.

A. Mandatory for All Merchants

- PAN / Form 60

- Business registration proof

- ID for the person authorising documents

- Bank account details + cancelled cheque

- Proof of business address

B. Company / LLP

- Certificate of Incorporation

- Memorandum & Articles of Association

- Board Resolution / Authorization Letter

- GST Certificate

C. Proprietorship / Individual

- PAN of proprietor

- Aadhaar / other ID

- Business registration (Shop Act / Udyam)

- Bank statement / cancelled cheque

D. NGOs / Trusts / Societies

- Trust / Society Deed

- 80G / 12A certificates

- PAN & bank statements

Also Read: Why Choose Wonderpay Payment Gateway In India for Businesses

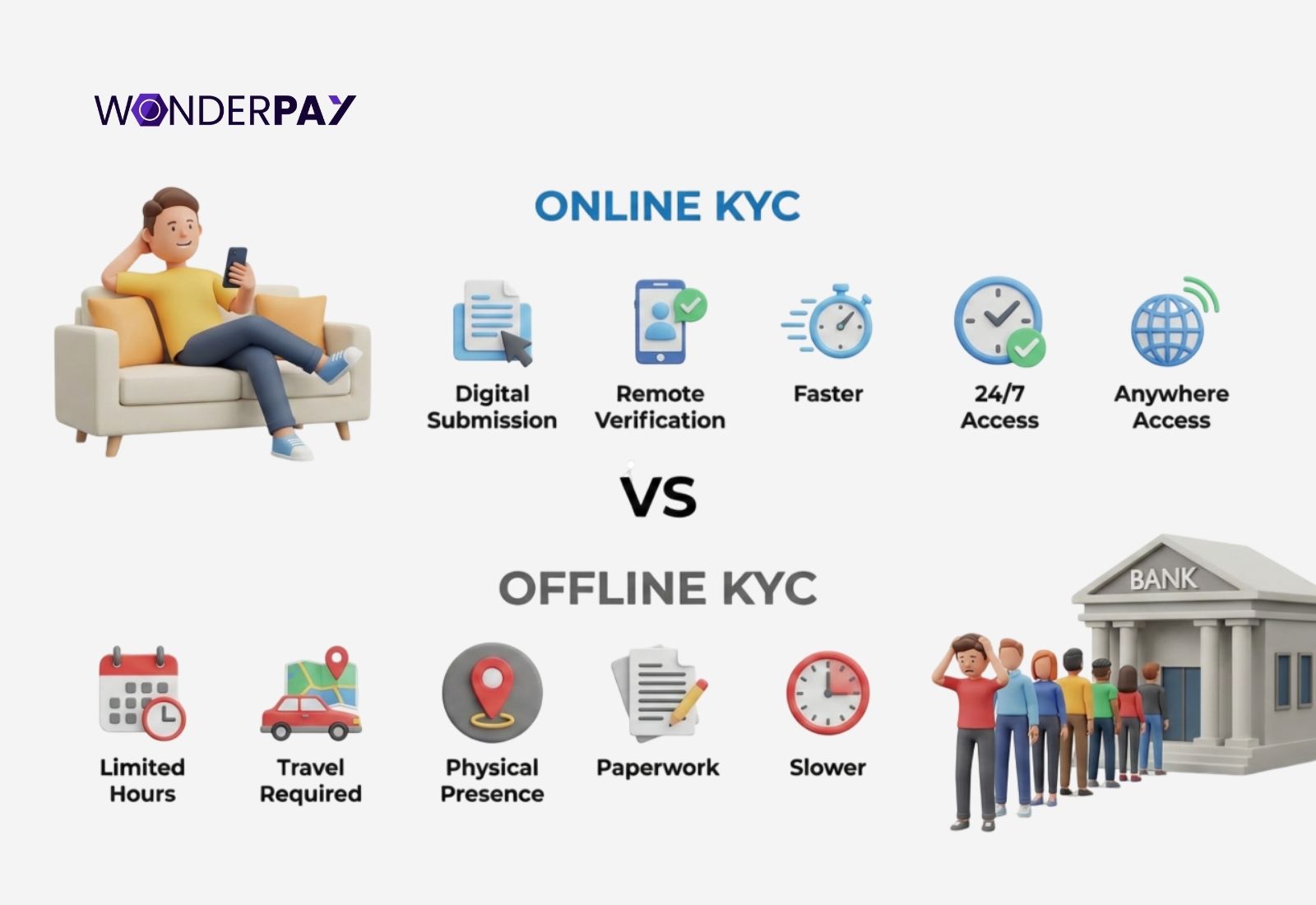

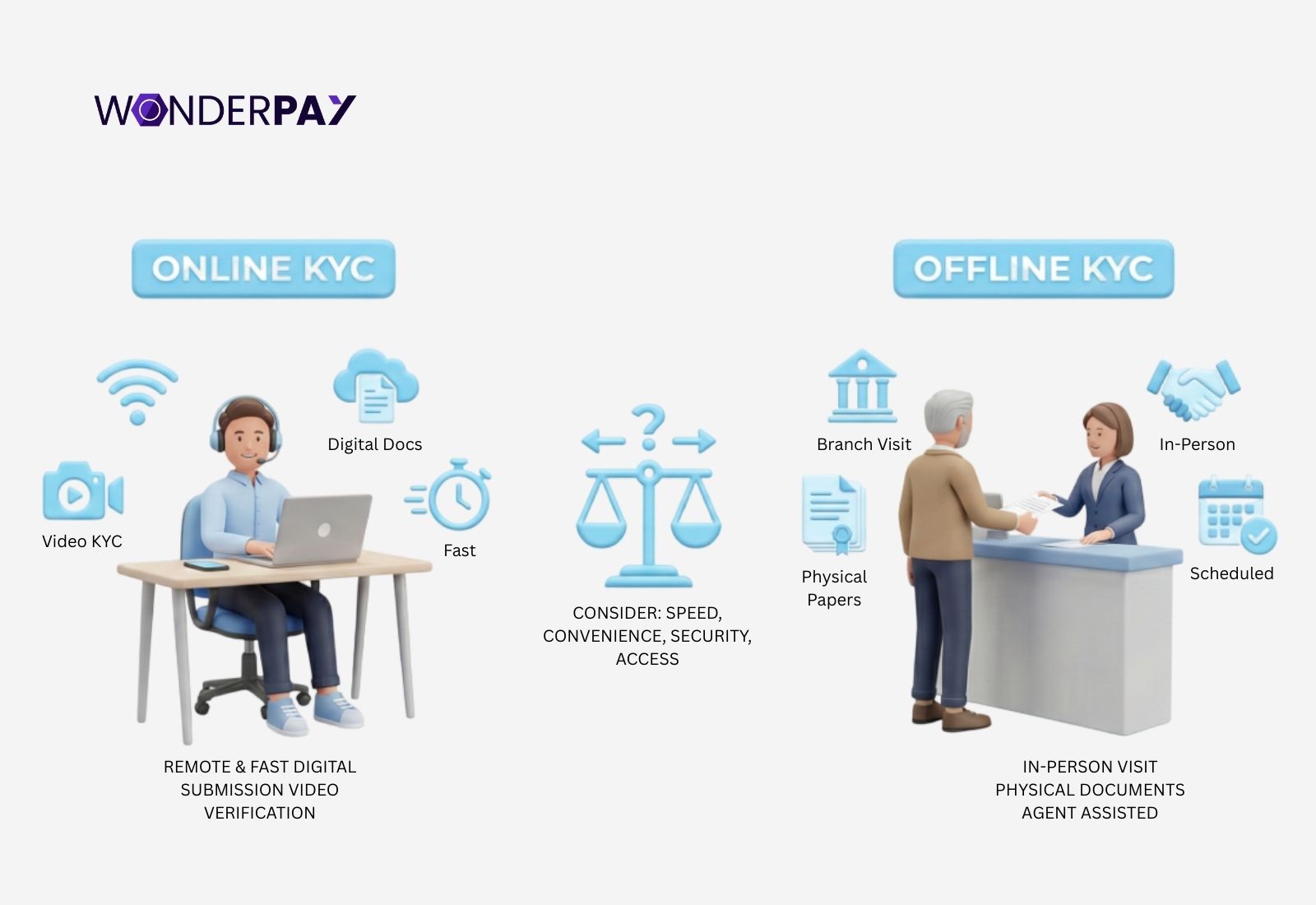

Online vs Offline KYC Process

KYC is completed through two main approaches in India. It includes the digital KYC, or eKYC, and offline, using a paperless offline eKYC. Both methods are legally recognized and serve the same goal in order to provide identity and reduce fraud, but they differ in speed, user experience, connectivity needs, as well as the privacy model also.

KYC is completed through two main approaches in India. It includes the digital KYC, or eKYC, and offline, using a paperless offline eKYC. Both methods are legally recognized and serve the same goal in order to provide identity and reduce fraud, but they differ in speed, user experience, connectivity needs, as well as the privacy model also.

Know More: Instant Settlement Payment Gateway In India: Complete Guide

What Is Online KYC?

Online KYC or e-KYC is a fully digital verification process. Within this identity, data is validated in real time by using government or institutional databases.

How Does e-KYC Work?

-

A user will enter identity details like Aadhaar + OTP or biometric via an app or portal.

-

The system communicates with UIDAI or other authorised APIs to instantly validate the person’s identity.

-

Once it is authenticated, the user is verified within seconds or minutes.

What Are Online KYC’s Key Benefits?

-

Fast and Convenient: Most onboarding completes instantly, where you will not need to visit a centre. It is ideal for digital wallets, fintech apps, and online loan approvals.

-

Fewer Manual Errors: Its automated checks reduce mistakes that are common in paper-based systems.

-

Lower Costs for Businesses: No printing, scanning, or storage costs help scale to millions of users.

-

Better Customer Experience: It allows users to complete the process anytime, anywhere. It is especially useful for remote onboarding, too.

What Are The Considerations and Challenges?

-

Requires Real-Time Connectivity: The authentication usually requires internet access as well as stable connectivity.

-

Privacy Perceptions: The real-time database checks involve data transmission. Within this, some users often worry about it, though it is secure and encrypted.

Also Read: Know about Payment Gateway Charges for Businesses

What Is Offline KYC?

One of the options of offline KYC refers to paperless but non-live verification mechanisms. Within this system, the identity data is pre-fetched as well as recorded without continuous online checks also.

Its Two Major Forms are as follows:

-

Offline Aadhaar e-KYC: Using this option, a user will download an encrypted XML file (or share a QR) from UIDAI and then share it with the institution.

-

Physical KYC: It is a traditional system to verify a person’s identity. This process allows users to submit paper copies of identity proofs, as this process is completed for verification at a nearby centre.

The offline Aadhaar e-KYC will allow identity verification without real-time connectivity. Additionally helps you with the limited data exposed, whereas traditional offline know your customer will require physical documents as well.

What Are the Key Advantages of Offline Know Your Customer Verification?

-

Works Without Constant Internet: This is especially the best and most useful system for rural or low-connectivity contexts.

-

Greater User Data Control: Users decide when and with whom to share their offline identity file.

-

Improved Privacy: Only essential fields are shared; sensitive data stays with the user.

Know The Considerations and Challenges

-

Slightly Slower than Online: No real time match relies on pre-packed verification files.

-

Manual Handling Required: Especially for traditional paper KYC (banks, NBFCs).

Explore the Easy Side-by-Side Comparison of Online KYC vs Offline KYC

| Feature / Criteria | Online KYC (e-KYC) | Offline KYC |

|---|---|---|

| Speed | Near-instant online verification | Takes longer than online but faster than traditional paper KYC |

| Connectivity | Requires real-time internet | Offline is possible with pre-downloaded files |

| User Convenience | Best for remote/on-the-go verification | Easy for non-tech users offline |

| Privacy Control | Moderate (real-time data exchange) | High (user controls data sharing) |

| Infrastructure | Digital systems & APIs | Document/QR/XML-based |

| Fraud Risk | Lower (automated checks) | Moderate (needs careful handling) |

| Cost | Lower for businesses in the long term | Higher manually (paper & handling) |

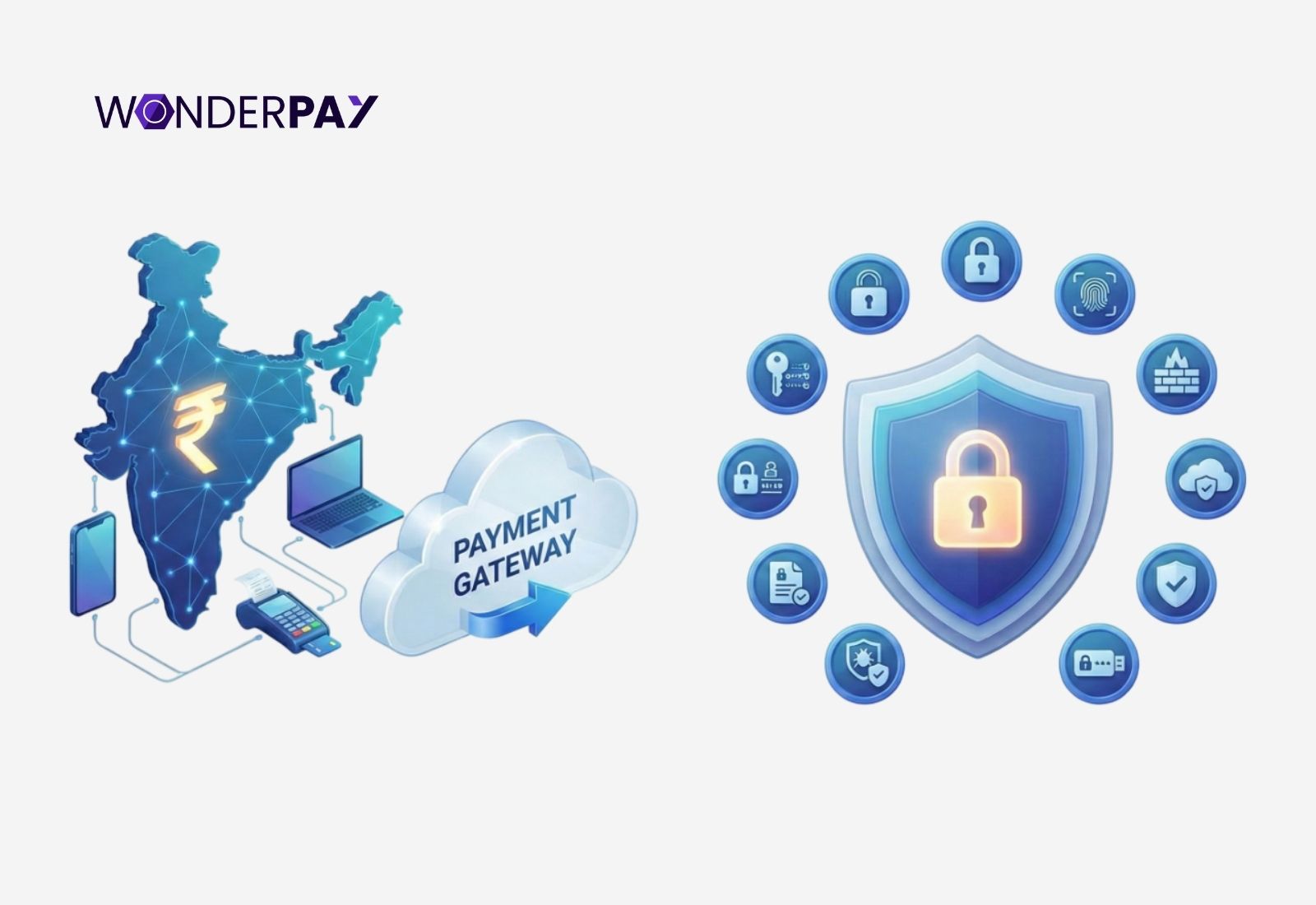

Suggested Read: What Is PCI DSS Compliance?

What Options Among Online and Offline KYC to Choose?

For your better experience, in this post, we will discuss both the options that you must consider. It will include who should use what and why.

Online KYC is ideal for:

- Fintech platforms and wallets

- Instant onboarding for payment services

- Remote customers or mass adoption scenarios

- Businesses prioritising speed and growth

Offline KYC is ideal for:

- Users with intermittent connectivity

- Users with high privacy preferences

- Government schemes where field verification occurs

- Situations where government portals support paperless verification (XML/QR) without online checks

Also Read: Payment Gateway vs Payment Aggregator: Know the Difference

What Is The Reason Both Still Matter?

The recent regulatory changes in India nowadays encourage flexible onboarding. It includes the video based remote verifications, the OTP based electronic KYC, as well as the traditional face to face checks. So that the financial inclusion and compliance both go hand in hand.

This mix assists users everywhere, urban or rural, both of them are digitally native or less connected.

The Security and Compliance Takeaways

-

Both online and offline KYC methods; whatever you use, they must adhere to RBI or UIDAI standards to prevent fraud.

-

You should always ensure platforms protect data in transit as well as storage with industry-standard encryption.

-

Users should never share sensitive OTPs or biometric data via unsecured channels to avoid scams.

How Long Does Payment Gateway KYC Take?

The time to complete the payment gateway KYC depends on a merchant’s profile and the quality of documents (how accurate they are). Additionally, it also depends upon the process, whether the PG service provider opted for eKYC, offline, or in-person.

The time to complete the payment gateway KYC depends on a merchant’s profile and the quality of documents (how accurate they are). Additionally, it also depends upon the process, whether the PG service provider opted for eKYC, offline, or in-person.

In this section, we will discuss a comprehensive list of how long it takes to complete the KYC process with clear reasons.

Common KYC Rejection Reasons

-

Document accuracy: It is about the documents’ match with your business profile, freelancer, or any individuals. If there is any document mismatch, it may cause you delay or require reverification from scratch.

-

Registered business entity: The companies with a registered entity, like LLP, generally include multiple members. Therefore, you need to double-check the payment gateway documents required because you will need to share your business partner’s docs like Aadhaar, for verifications as a PG requirement. In case it mismatch you may face rejection.

Here is a complete and concise list of pay reasons that may cause payment gateway onboarding rejection if not meet

1. Invalid ID Proof

Issues:

- Name/DOB missing, incorrect, or unreadable

- Face photo unclear or missing

- Passport without a signature

Fix:

- Ensure the full name, DOB, and validity date are clear

- Upload a clear face photo

- The passport must include a signature

Accepted IDs:

- Passport, National ID, Residence Permit, Driving License

Not Accepted:

- Student, Work, or Travel Visa

2. Invalid Document Photo

Issues:

- Blurred, cropped, masked, or irrelevant images

Fix:

- Upload clear, uncropped images with all corners visible

- Use valid IDs only (Passport, National ID, Driving License)

3. Invalid Proof of Address

Issues:

- Document not in your name

- Unacceptable document type

- Issued from a restricted country

Fix:

- Name & full address must match your profile

- Document must be issued within the last 3 months

Accepted Address Proof:

- Utility bills, Bank statements, Government-issued residence proof

- Internet/Cable TV/House phone bills

- Tax/Council tax bills

Not Accepted:

- ID cards, Mobile bills, Tenancy agreements

- Insurance/Medical bills, Bank slips

- Screenshots, handwritten receipts

4. Screenshot / Not Original Document

Issues:

- Screenshot, scan, printed copy, or black & white image

Fix:

- Upload original PDF or color photo

- No edits or image processing

5. Missing Document Pages

Issue:

- Incomplete document upload

Fix:

- Upload all pages (front & back) with all corners visible

6. Damaged Document

Issue:

- Poor quality, glare, or unreadable text

Fix:

- Upload a clear, undamaged document

7. Expired Document

Issue:

- Document validity expired

Fix:

- Upload a valid, non-expired ID

8. Unrecognized Language

Issue:

- Document in an unsupported language that is not officially in knowledge of the PG service provider.

Fix:

- Upload a document with Latin characters or an international passport

9. Face Recognition Issues

Issues:

- Face does not match the ID photo

- Multiple people in frame

Fix:

- Ensure a clear face match with ID

- Only one person is in the selfie

10. Invalid Selfie

Issues:

- Blurry, dark, or improper face scan

Fix:

- Retake a selfie in good lighting

- Follow the on-screen face scan instructions carefully

11. Multiple Accounts Detected

Issue:

- Same ID used on more than one account

Fix:

- Only one verified account per person is allowed

12. Excessive Invalid Submissions

Issue:

- More than 5 failed attempts within 24 hours

Fix:

- Wait 24 hours before reapplying

13. Service Restricted Countries

Issue:

- The specific countries that are not supported by the gateway service provider or a payment gateway in India.

Outcome:

- Trading and services are not permitted

14. Under 18 Years of Age

Issue:

- Does not meet the age requirement

Outcome:

- The users who do not meet the age requirements as set by the authority regulations, such as the Reserve Bank of India (RBI).

Fresh Reads: Future of Payment Gateways in India

How Blockchain in KYC is Revolutionizing the Trend in 2026?

The current trend of blockchain in KYC redefines trust, speed, and compliance. It’s a repetitive, document-heavy process, secure, reusable, and real-time identity layer transforming the know your customer process.

The current trend of blockchain in KYC redefines trust, speed, and compliance. It’s a repetitive, document-heavy process, secure, reusable, and real-time identity layer transforming the know your customer process.

-

One-time KYC will be Reusable Everywhere

The verified identities are stored on permissioned blockchains using their Distributed Ledger Technology (DLT) and shared with consent across institutions, which eliminates repetitive KYC. -

Faster Onboarding

The DLT technology of blockchain enables smart contracts for instant verification and approval. This assists in cutting onboarding time from days to minutes. -

Tamper-Proof Compliance

The immutable audit trails ensure data integrity, simplify regulatory audits, and reduce fraud. -

Privacy First Identity Control

A customer shares only the required data via cryptographic proofs, not the entire documents. -

Lower Cost, Higher Accuracy

It reduces manual checks that are prone to error, fewer intermediaries, and menial duplication lower operational costs.

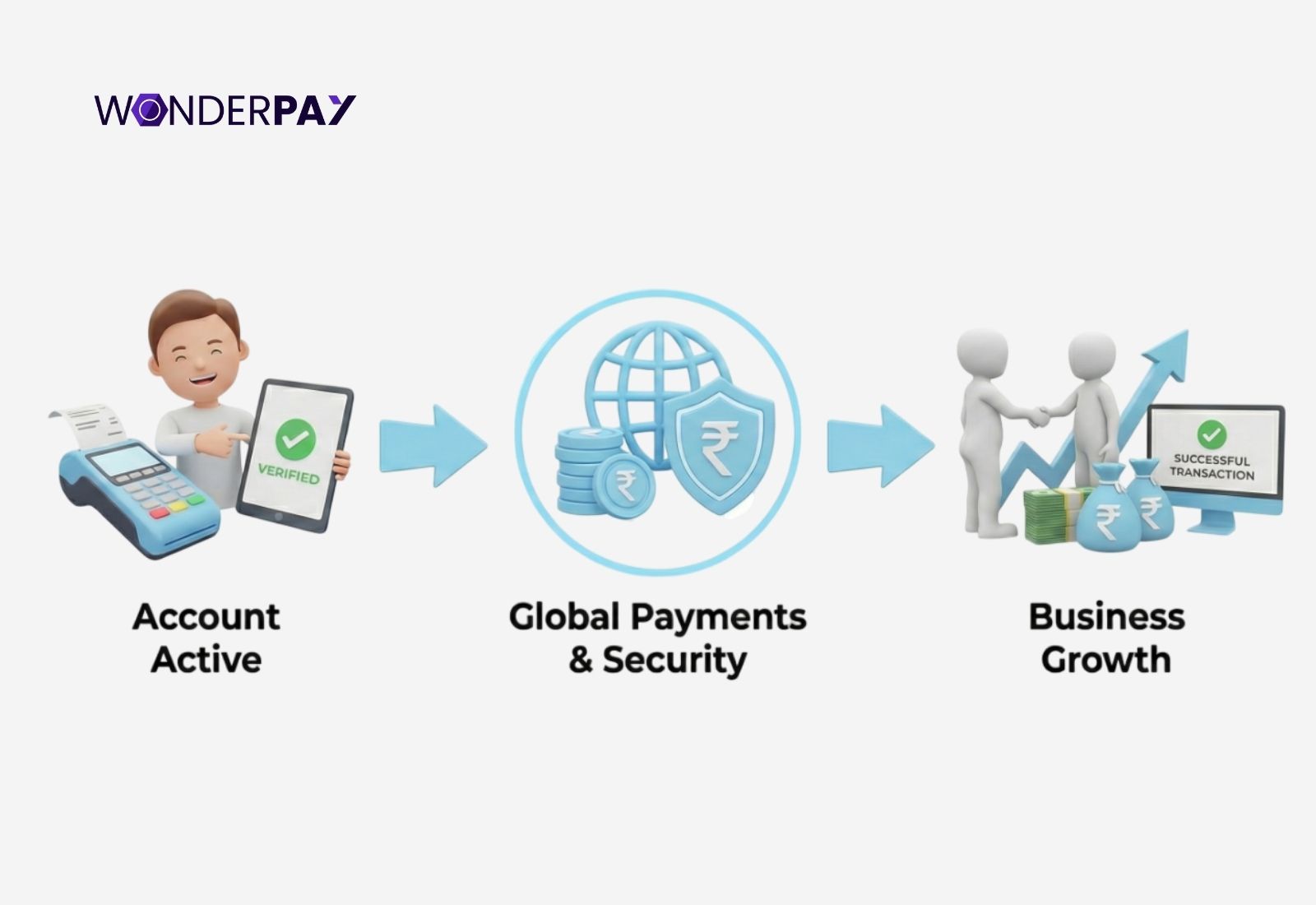

Why Choose Wonderpay Payment Gateway?

The online transitions in India are so simple; why not the onboarding? It is every individual and business problem seeking an online payment gateway solution. The complex PG onboarding causes businesses to experience delayed payments, lose a business deal, and have no approach to a compliant and trusted online translation solution. In the last they opt for expensive and insecure methods for business transitions, etc.

Wonderpay ends this loop with its simplified merchant KYC in India. Businesses seeking a reliable PG solution. WPay’s easy onboarding solution, with just a few steps, eliminates the complex KYC.

- Merchant enquiry form.

- A few documents for KYC.

- Physical verification.

- Agreement.

- Digital verified signature.

This easy five-way solution assists several brands in the country to onboard and use PG for all their digital transactions from payin to payout with top features.

Summary

I hope this guide is clear to you about the payment gateway documents required for a seamless and rejection-free onboarding. With the KYC being the backbone of every financial institution, security becomes a priority for merchants seeking online payment solutions backed by compliance.

Thanks to the evolving technology of blockchain, which strengthens and speeds up the KYC with its quick, secure, and shared consent within financial institutions for easy onboarding.

Do you want to start using a payment gateway for your business, but are stuck in the onboarding KYC verification loop? Do not worry, connect with one of our experts and get started with the gateway for your company, right now, with only the documents required for payment gateway and fast processing.

FAQs

1. Is GST mandatory for payment gateway KYC?

No, the Goods and Services Tax (GST) is not universally mandatory during a payment gateway KYC. But it will be necessary once your company crosses the annual turnover threshold, which is about 20 to 40 lakhs. In case you are selling your products in the marketplace, such as Amazon. Therefore, you would need GST as most of them declare for small businesses or individuals.

2. Can individuals get a payment gateway?

Yes, any individual running a small business, including freelancers, can start with a payment gateway with just the minimum payment gateway documents required, and many platforms now cater to non-registered individuals to utilize documents like PAN and Aadhaar for the simple payment link service.

3. Can I get the Wonderpay payment gateway without KYC?

No, since KYC is mandatory by the Reserve Bank of India (RBI), including Payment Card Industry Data Security Standard (PCI DSS). Wonderpay strictly implements every rule & regulation. However, WPay simplified the KYC process for everyone with just a few KYC/KYB steps. The easiest process will help you get started in less time without needing you to wait endlessly.

4. What if my KYC is rejected?

It happens due to missing information, unclear docs, or mismatched details. Once the documents required for payment gateway are clear, you can start using a PG for your company without any restrictions. The best part is, you get a clear reason notification for KYC rejection, and you just have to fill that document gap to get approved.

5. Is Aadhaar compulsory?

Yes, in India, Aadhaar is one of the commonly used KYC documents. Its biometric based authentication makes it a strong and reliable option for identity verification.

However, Aadhaar is not the only document that is accepted for payment gateway onboarding. As per the RBI compliant merchant onboarding guidelines, businesses must submit additional mandatory documents, which include PAN, business registration proofs, and bank account details, and depend on the merchant type also.

6. Do startups need full KYC?

Yes, it is a compulsory practice mandate under the Reserve Bank of India (RBI), Prevention of Money Laundering Act (PMLA), and Anti Money Laundering (AML) guidelines. It applies to all businesses seeking a payment gateway service, but often the documents and depth depend on the business structure and regulatory use case.

7. What is the KYC due diligence process?

It is to collect an individual or business information such as name, address, date of birth, and documents inclidng gement issued IDs. This helps gateway service providers get accurate customer identification that assesses risk levels and meets compliance requirements.