The rise of digital payments is at its peak; it has brought both advantages and disadvantages, such as Unified Payment Interface (UPI) fraud losses amounting to INR 573 crore. It increased INR 1,087 crore in 2023-24, and INR 485 crore in September 2024. If the trend continues, it could reach INR 970 crore.

Choosing the right payment gateway in India matters a lot. It does not matter what business or industry you are in. A gateway service enables you to accept or disburse payments in an advanced way while leveraging the modern solutions of Artificial Intelligence (AI) and Machine Learning (ML), which are growing rapidly.

In order to select the best online payment gateway, you should consider your payment gateway vulnerability. You can check security facts such as payment encryption, API security, certification authorities like RBI, PCI DSS, and more.

This complete guide to payment infrastructure security practices will guide you to choose the best payment gateway service provider for your organization.

Let’s get started.

What Makes Payment Gateway Security Critical for Indian Businesses

Every business is targeting a particular audience, which is divided by age group, gender, pain points, and other significant factors. The biggest challenge businesses in India are facing is educating people about basic payment security practices.

Every business is targeting a particular audience, which is divided by age group, gender, pain points, and other significant factors. The biggest challenge businesses in India are facing is educating people about basic payment security practices.

India’s digital payments adoption is skyrocketing. There are increasing cyber threats, and stringent compliance needs such as Payment Card Industry Data Security Standards (PCI DSS). In order to have strong security, build customer trust, prevent massive financial losses from fraud, reduce costly chargebacks, as well as ensure smooth operations, the next-level technologies, including AI and tokenization, are becoming essential for handling India’s high volume of digital transactions.

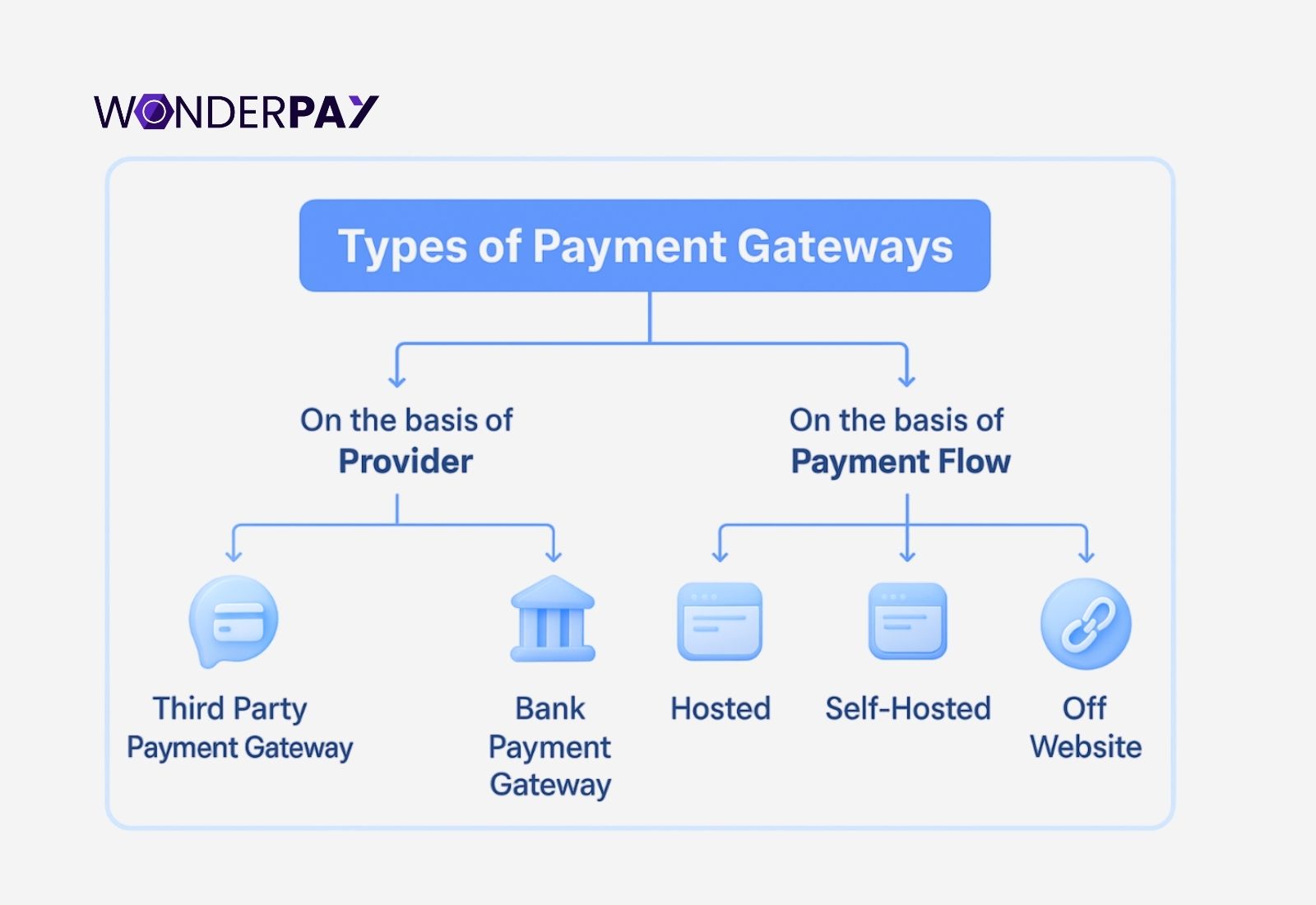

Also Read: Types Of Payment Gateways In India & How To Choose Right One

Do You Know India’s Current Threat Landscape

Here is the country’s current landscape. This will help you understand and get a better understanding.

-

Sophisticated Fraud: The rise of artificial intelligence-powered deepfakes, voice phishing (Vishing) to steal OTPs or PINs.

-

Phishing and Social Engineering: within this, users are manipulated so they can reveal sensitive details by making fake calls or messages.

-

Technical Vulnerabilities: The exploitation of weak authentication, malware, as well as data interception.

-

Credential Stuffing: When the login credentials are stolen and used (from breaches elsewhere) to access accounts.

-

Growing Attack Surface: The large number of digital payment adoption (wallets) expands opportunities for cybercriminals.

List of Top 10 Payment Gateway Security Standards for Businesses in 2026

Even though you connect with the best online payment gateway in India. The first thing you have to do is to consider all PG security standards. What are all those factors you must consider before you get started with a payment service for your organization?

In this section, we will discuss all the crucial practices you must know, even if you have already chosen the service or will be choosing to have it for your organization. This complete list with all the details will help you make an informed decision to choose the best option that can fulfill your needs for payments.

1. PCI-DSS Compliance

The abbreviation PCI DSS stands for Payment Card Industry Data Security Standard. It is a global digital payment security standard. This rule is set by major card brands such as Visa, Mastercard, Amex, and more.

Whenever a business accepts online payments or relies on a payment gateway for online payment purposes. They have to comply with Level 1, which is the strictest for high-volume processors, such as a gateway, ensuring data safety through the use of firewalls, encryption, and strict access. At the same time, the non-compliance risk includes massive fines, reputational damage, and potential loss of the ability to process payments.

Why Payment Gateways Must Be Level 1 Certified

-

Definition: PCI certified payment gateway Level 1 is one of the highest compliance tiers, for entities processing over 6 million card transactions every year or experiencing breaches, demanding rigorous annual audits also.

-

Gateways’ Role: A payment gateway for websites or even apps processes huge transaction volumes. By its very nature, within this PCI DSS Level 1, it forms part of the critical payments infrastructure. Therefore, PG’s security directly impacts all connected businesses at that time.

-

Mandatory Due to Volume: Their massive number of transactions necessitates Level 1 certification. This thing ensures they meet the strictest security measures in order to protect the entire payment ecosystem.

What Is the Impact on Businesses Using Non-Compliant Gateways

Shared Responsibility: Even though in the same case, a third-party gateway processes payments, and at the same time, merchants still bear PCI compliance responsibility for their own environment.

Severe Consequences

Getting started with a non-compliance solution may lead your organization to:

-

Financial Penalties: This may cost you the heavy fines from card brands.

-

Data Breaches: It could lead your company to increase the risk of customer data theft and as well as fraud also.

-

Reputational Damage: Your business customer trust is one of the keys to retaining them for the services they require. If you lose your customer trust, this will cause you to decrease your online sales, which is important nowadays in the ever-evolving digital era.

-

Legal Issues: In case something major happens, such as the leakage of your customer payment information. The regulatory action, especially in countries like India, where the Reserve Bank of India (RBI) mandates compliance.

-

Operational Disruption: You may experience issues like being unable to process the payments or sometimes facing higher fees.

2. Tokenization for Card Security

Tokenization is to replace sensitive card details such as card number, expiry, and CVV. Instead, it generates a unique digital token for every device or each merchant. So, such types of technology must be there, and you should go for security to check if a payment gateway in India can help you with the following benefits for your organization.

-

The Reserve Bank of India mandates this practice. In order to prohibit data storage where this practice is mandated for every merchant and payment gateway, as well as the aggregator also to not from storing any actuarial card details on their servers.

-

The mandated Card on File (CoF) tokenization requires adoption of tokenization for saved card payments, which was ordered in the year of 2022.

-

It will introduce you to an extra authentication factor (AFA) for consent, which allows users more control over token usage.

What Are The Benefits of Tokenization

The top benefits for merchants who are going to use or are already using Indian Payment Gateways for their business transactions. They can have a number of advantages that are going to assist them in a number of ways.

-

Enhanced Security & Trust: It protects your business customers’ sensitive data, helps in reducing fraud risk, and builds consumer confidence in digital payments.

-

Compliance & Reduced Liability: this functionality meets the RBI guidelines, the best part a business will benefit from lowering a merchant’s responsibility for card data security.

-

Seamless Customer Experience: It enables your customers to have an easy, one-click checkout, whether it is for your recurring payments, and they can pay you when the card details are saved without re-entering them.

-

Fraud Reduction: In case a token is compromised, the card details are useless, as they are just different numbers, not the exact details. It protects both the customer and merchant from such fraud.

-

Interoperability: This system will allow the tokenized transactions across different gateways as well as seamless interoperability within and across payment networks.

Must Read: What is Instant Settlement Payment Gateway In India: Complete Guide

3. 3D Secure 2.0

It will help you enhance authentication and offer seamless, mobile-first authentication, which is mandatory via biometrics/OTP within apps. This process helps in replacing clunky 1.0 pop-ups with rich data (150+ points) for risk-based decisions. However, the feature will dramatically cut fraud and cart abandonment.

It is mandatory for all payment gateway services providers in India to ensure secure payment gateway transactions. It is done with the help of satisfying RBI’s SCA rules, shifting liability to issuers for the purpose of authenticated payments.

Explained: What is 3DS 2.0 vs. 3DS 1.0?

-

Experience: When you start with 1.0, you will see it uses disruptive redirects/static passwords. And the 2.0 will offer you a frictionless, in-app (biometrics/fingerprint) experience or will provide you with embedded flows.

-

Data: The 1.0 shares with you at least 15 data points. The 2.0 will share 150+ (device info, history, etc.) also.

-

Mobile: If you see the drawback of 1.0. It is poor on mobile, and on the other side, 2.0 is built for mobile as well as for the Internet of Things (IoT).

-

Friction: The system 1.0 has high friction (abandonment). In its place, if you check out 2.0, it will reduce friction significantly, which means fewer challenges as you would need.

How It Is Going to Help Your Organization Reduce Fraud

-

Rich Data: It delivers you with 150+ data points and enables you to better use Machine Learning (ML) for real-time risk assessment, identifying fraud better in today’s ever-evolving digital era.

-

Frictionless Flow: The low-risk payments will go through without any of the challenges (OTP/biometric), which will assist you in improving the conversion effectively.

-

Strong Authentication: In order to manage the risky transactions, the system usually uses biometrics (face/fingerprint) or can also use OTP, making fraud harder.

-

Liability Shift: Its authenticated transactions shift chargeback liability, which is done from merchants to issuers, and will help you a lot.

How is it mandatory in India and Secure Transactions?

-

RBI Mandate: The Reserve Bank of India (RBI) has made it mandatory to have the 3DS for most online card payments, whether they are being done for domestic or international, in order to comply with Strong Customer Authentication, abbreviated as SCA.

-

Payment Gateways: A top payment gateway in India will always help your company in integrating 3DS 2.0 to deliver native Software Development Kits (SDKs) for in-app flows as well as for browser-based solutions. This ensures compliance and better success rates, also.

-

Seamless Integration: The system is embedded into checkout, which will help you in reducing redirects and improving trust for secure transactions, which is needed.

4. SSL/TLS Encryption for All Transactions

SSL/TLS stands for (Secure Sockets Layer/ Transport Layer Security). These encryptions help you in creating secure, private connections, Hypertext Transfer Protocol Secure (HTTPS). To have secure online transactions, using certificates and keys to scramble data, which includes the cards, such as credit cards, and login details. In order to enable the sender and the intended recipient to read it.

So, it can prevent interception by hackers, ISPs, or others. This technology ensures confidentiality and integrity for a customer’s sensitive data in transit, with modern TLS versions. This offers strong security by using the proper configuration, which is one of the crucial practices.

How Does the SSL or TLS System Work

In this section, we will discuss the significant facts about payment gateway security that you must consider. Below is the list of factors that are discussed in detail. It will help you make an informed decision before you finalize one.

-

Handshake: A browser and a website server perform a “handshake” where they simultaneously verify each of them simultaneously agree on encryption methods.

-

Certificates: At the time he serves presents both the SSL and TLS certificates where they are proving their identity.

-

Key Exchange: getting to have a public key that will encrypt a unique session key. It is sent to the server. Here, the server usually utilizes its private key to decrypt the same.

-

Secure Session: Within this, you will find that both parties use the shared session key, which is for fast, symmetric encryption, such as for Advanced Encryption Standard (AES), to secure all data exchanged during that session.

Why and How It Prevents Interception

-

Data Scrambling: It helps in scrambling data to turn it into unreadable code at the time of transmission.

-

Authentication: The system ensures that you are talking to the real website, but not to an imposter.

-

Confidentiality: This will support you in eavesdropping and man-in-the-middle attacks, which is also crucial.

The End-to-End Encryption of the System

-

As the technology, including SSL/TLS, secures the channel (in-transit), the end to end encryption (E2EE) will make the data secure from sender to final recipient, meaning even the service provider could not decrypt it.

-

SSL/TLS enables secure channels for E2EE services. But you will not find it well, as it does not always provide E2EE itself, which is for the application data within that channel.

What Are The Key Benefits of SSL or TLS Encryption

-

This system will help you in protecting passwords, the sensitive payment info of your customers, and personal details as well.

-

It will always help your company in building user trust as well as meet the compliance set by RBI, PCI DSS, and GDPR.

-

The technology is a must for e-commerce and any sensitive online activity as well.

5. Secure UPI Payments

The UPI payments are highly secure as they use a multi-layer approach. This delivers advantages to both parties, including the consumers as well as the merchants. A top-level or best payment gateway in India will always provide you with rich security, even if you use their ecosystem.

Here, we will discuss the significant points, such as its working, how it is secure, and what it will benefit you.

What Makes UPI Payments Secure?

Unified Payment Interface (UPI) security involves around three core components, which are as follows:

-

UPI PIN: It is mandatory to enter a 4 to 6-digit code for the authorization of every transaction, even if he steps are done as “payment testing” before making them live, so they can act as a personal digital signature of a person making a transaction, but the code is not required to receive money.

-

Two Factor Authentication: Within this, the system verifies both the user’s securely linked devices as well as the unique UPI PIN.

-

Risk Management: The strict guidelines from the authorities, RBI, and NPCI mandate that banks need to use advanced fraud detection algorithms to monitor unusual activity; at the same time, they have limited the daily transaction limits to mitigate potential losses.

Your payment gateway security testing checklist must include every aspect to provide you with the best digital payment service. One that eliminates all your headaches about the security your organization needs to have.

What Are the UPI Payment System Benefits for Merchants

Organizations starting with a payment system like UPI can get advantages as listed below:

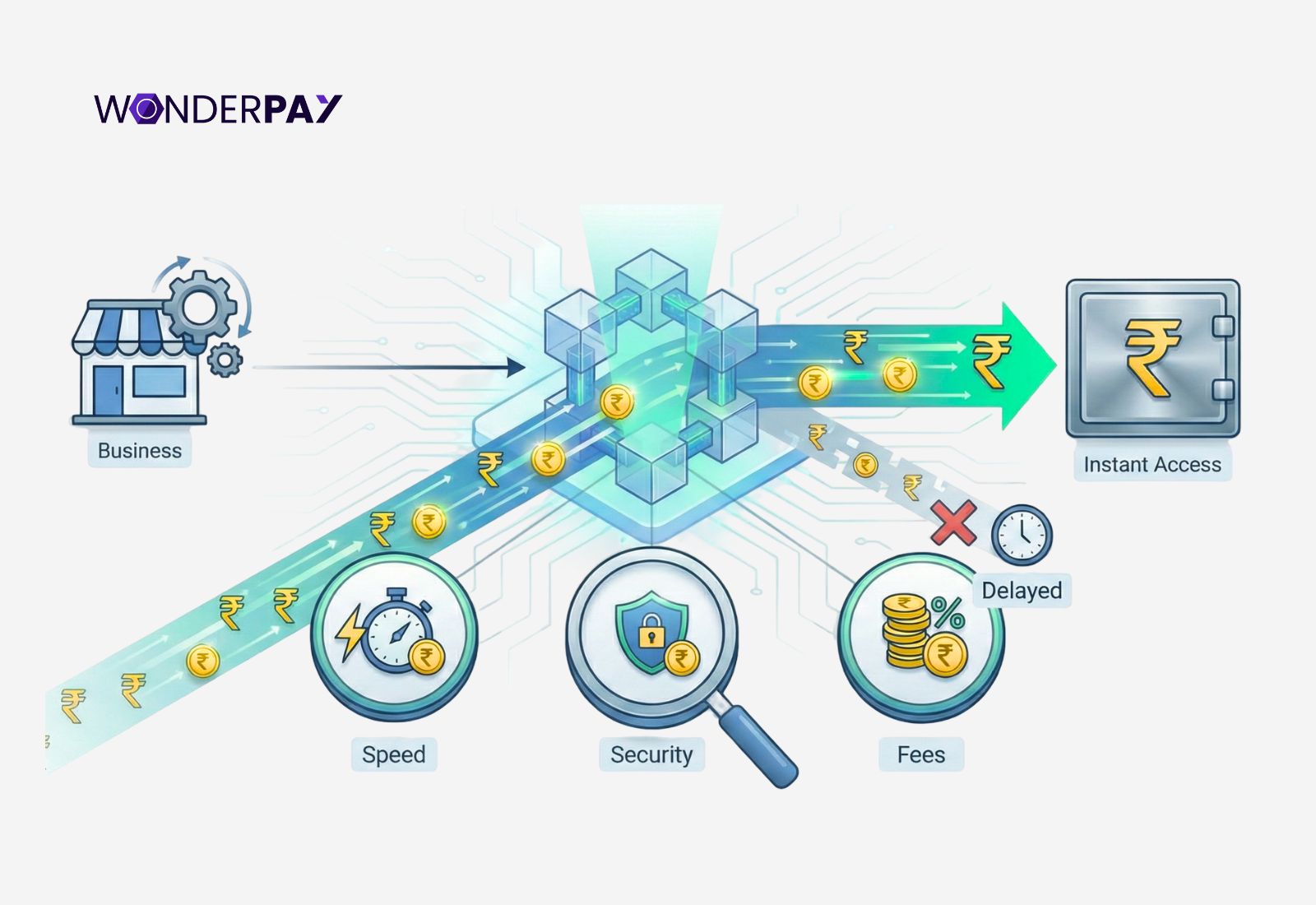

- You can have instant payments (does not apply to all PGs in India)

- Make a wider approach to your business customers.

- It will provide you security at the same time enhance your system with just a low cost.

- You get a simple and easy reconciliation system for your organization.

Suggested Read: Payment Gateway Charges Guide for Businesses

6. Fraud Detection With AI & Machine Learning

The modern solutions like Artificial Intelligence (AI) and Machine Learning (ML) are transforming fraud detection by providing real-time, adaptive solutions that move beyond the traditional, static rules.

It is a crucial practice, especially for the Indian merchants, due to its rapid growth of the digital economy. This has also led to a significant surge in sophisticated cyber fraud.

Get Help With The Real-Time Anomaly Detection

The rich solution of today’s digital solution of AI and ML comes with the ability to analyze a vast amount of Data streaming. It takes a few seconds to identify suspicious activities as they occur. It shields and minimizes the financial losses.

- Continuous monitoring.

- Flagging deviations.

- Quick response.

Analyze User Behaviour

Artificial Intelligence and Machine Learning analyze user behaviour to indicate a security breach or any fraudulent intent. Moreover, the ML learns each time while working to identify users’ activities (behaviour). This advanced feature applies its learning in the future as the transactions happen, which means an advanced technology that makes your entire ecosystem stronger day by day.

How will it help

- User profiling.

- Bot and account takeover detection.

- Reduced false positives.

Why India Needs the Advanced Technology of AI and ML

India, Asia’s most identified digital transactions maker in volume, hit the top. At the same time, the country is facing a huge number of fraudulent transactions. This increasing number of frauds forces Indian companies to adopt the technology immediately.

How it will help:

- Soaring digital transactions.

- Rapidly evolving threats.

- Significant financial losses.

- Operational efficiency and trust.

7. Robust KYC & Onboarding Verification

The Reserve Bank of India mandates stringent Know Your Customer (KYC) norms for all merchants. This ensures financial integrity and prevents fraud and money laundering. Getting started with a trusted payment gateway in India shields your company by implementing the norms via robust onboarding verifications and advanced fraud prevention technologies.

Here is a security testing list you must consider for your organization. It will help you connect with the right payment service provider for your organization.

List of RBI KYC Norms

As discussed, the RBI’s guidelines, which are specifically the Master Direction on Regulation of Payment Aggregators, as well as the KYC Master Direction. This requires a comprehensive and ongoing due diligence process, which will include all entities accepting each of their online payments.

The Know Your Customer (KYC) norms include the following.

- Mandatory full KYC

- Payment aggregator’s responsibility

- User of CKYCR and video KYC

- Ongoing monitoring

The Prevention of Fraudulent Storing from Onboarding

- Pre-screening as well as the background checks

- Website and content analysis

- Physical verifications (CPV

- Automated verifications

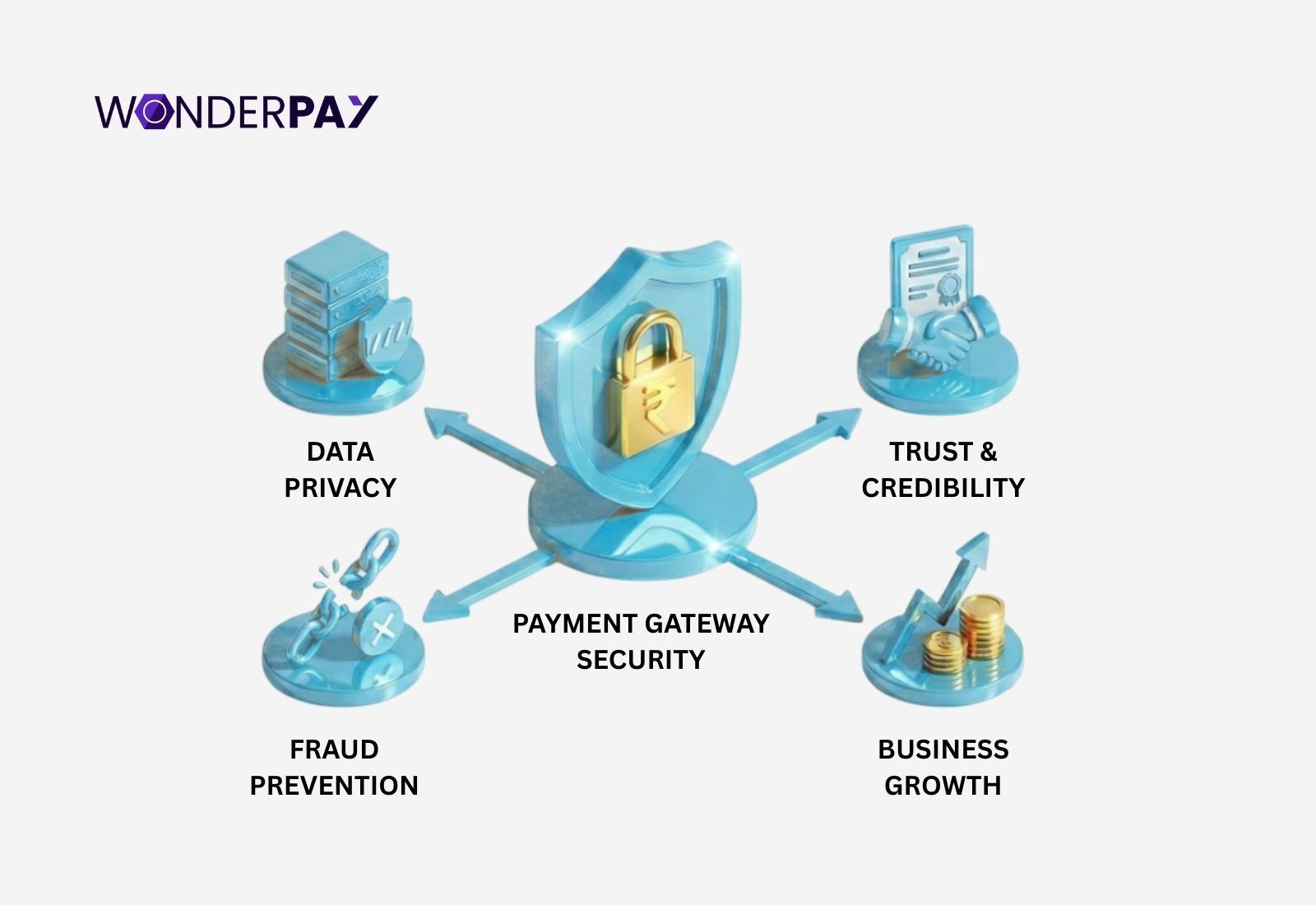

How Can the Best Online Payment Gateway in India Protect Your Business

The top payment gateway in India will always support your business with the following practices. Here is a complete list that you must match with your list to connect with the right solution provider for your organization.

Data Security and Compliance

- Payment Card Industry Compliance.

- Encryption and Tokenization.

Advanced Fraud Detection Tools

- Machine Learning (ML) and Artificial Intelligence (AI)

- 3D Secure and 2FA

- Risk scoring

Operational Control

- Real-time monitoring and alerts

- Chargeback prevention

- Transparent reporting

Also Read : Why Choose Wonderpay Payment Gateway In India for Businesses

8. Secure API Architecture

Payment gateway API testing, or say secure Application Programming Interface, architecture relies on a defense-in-depth strategy. This should combine strong authentication, encryption, access controls, and monitoring.

The specific methods will include OAuth, API keys, and webhook security measures. All these methods must be chosen based on the use case and implemented with best practices.

The Principles of a Secure API Architecture

- Authentication and authorization

- Encryption

- The principle of least privilege

- API gateway

- Continuous monitoring and auditing

What to Do to Secure API Keys

- You should never hardcode or commit keys

- Apply restrictions.

- Rotate keys regularly

- You can use a separate key for environments

What is IP Whitelisting

Internet Protocol (IP) whitelisting will restrict API access to a predefined list of approved IP addresses.

It will help you in the following way:

- Reduces attack surface

- Requires static IPs

- Combine with other measures

The Solution for Payload Signature Verification

- You can use a shared secret: within this, a webhook provider uses a unique secret key in order to create a cryptographic signature (HMAC) of the payload data, and then they include it in the request header.

- Verify the signature.

- Implement replay protection.

- Star is using HTTPS.

Conclusion

It becomes crucial for every business in order to know how to choose the best payment gateway. It is a significant practice to connect with a reliable service provider, one that aligns with your business. This will require you to conduct in-depth research on a service provider to know how they meet all regular compliance, whether they are in developing countries like India or any of the developed countries, to provide a secure payment ecosystem.

If you are in search of a reliable and compliant Payment gateway in India with RBI, PCI DSS. You can consider Wonderpay, which eliminates all your headaches to connect and drive you with a secure payment system. Contact one of our executives right now and get a free consultation.

FAQs

What is a payment gateway security standard?

It is a set of robust measures, primarily centred around the PCI DSS (Payment Card Industry Data Security Standard). Its role is to protect customers’ payment-sensitive data, such as card numbers, CVV, expiry dates, etc.

During online transactions using encryption like SSL/TLS, tokenization, strong authentication (like 3D Secure), including advanced fraud detection, ensures compliance and builds customer trust.

Which payment method has payment protection?

When using a payment gateway, all payment methods come with rich security features, from two-factor authentication to protecting each payment information of a customer as well as protecting the merchant.

It means there is no gap that could put you to facing any liability until it is done by the authorized person who is responsible for the payment approval.

How do I ensure my payment provider’s security?

The common payment gateway security testing checklist includes: SSL certificate integration and TLS data encryption, PCI DSS compliance to avoid saving card information for security purposes, tokenization, digital wallet, and bank transfer acceptance.

What is the payment security of Wonderpay?

Wonderpay offers all sizes of businesses strong payment security through PCI DSS Level 1 compliance, advanced encryption (TLS/SSL).

It ensures customers’ sensitive card data is never stored on the merchant server but tokenized, protecting both customers and business from breaches with real-time monitoring, OTB verification, and adherence to global security standards.

What type of security is there in an e-payment system?

It is a secure payment system abbreviated as SPS. This is a specialized infrastructure that ensures the safe processing as well as transmission of financial transactions, which is done particularly in digital spaces. This practice is crucial for avoiding risks such as fraud and unauthorized access as well.

What are the four types of security in finance?

The four types of security in finance are debt, equity, derivatives, and hybrids. All these are categories with financial instruments for the purpose of investments. It helps with bonds or notes where you lend money (debt securities), stocks represent ownership in a company (equity securities), contracts whose value comes from an underlying asset (derivative securities), and the last one is a mix of fear of debt and equity, such as convertible bonds (hybrid securities).