- 1. What are Payment Gateway Charges

- 2. Key Statistics & Market Trends

- 3. How Payment Gateway Charges are Calculated

- 4. Typical Charges for Payment Gateway in India (2026 Outlook)

- 5. Comparing Payment Gateway Charges Across Payment Types

- 6. How to Choose a Payment Gateway: Know Cost + Features

- 7. Strategies to Reduce Payment Gateway Charges for 2026

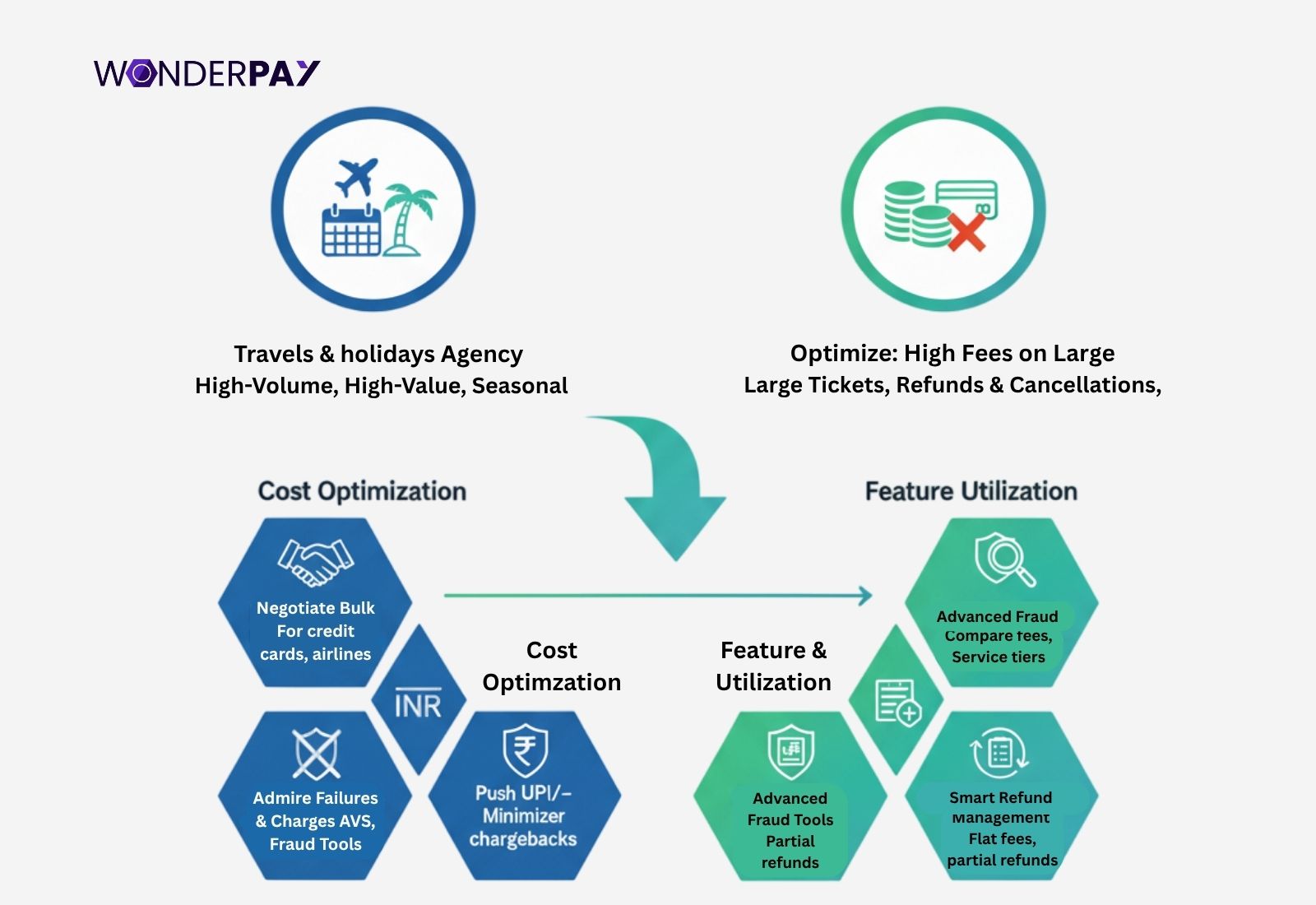

- 8. Payment Gateway Charges Useful Case Study: Travels & Holidays

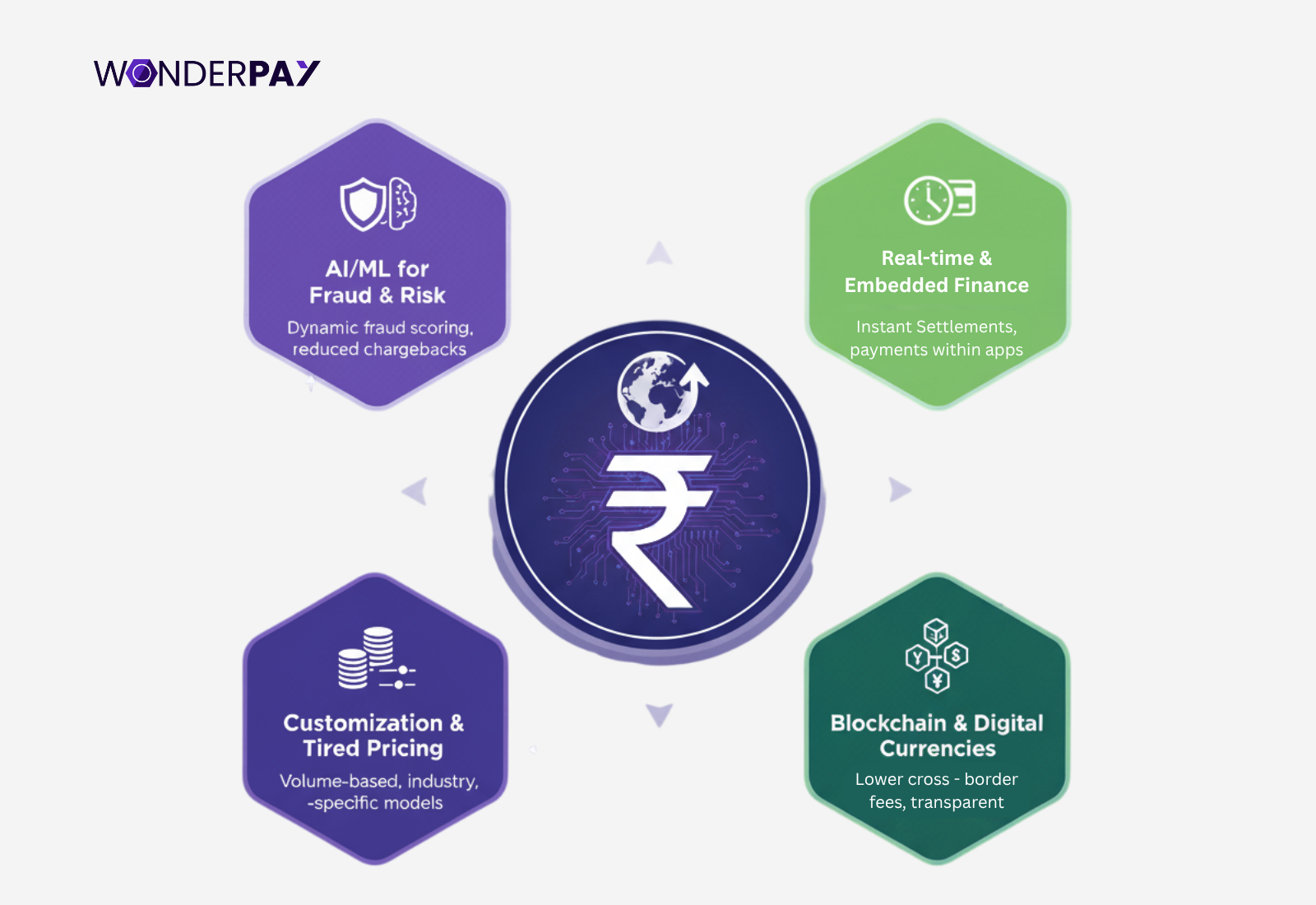

- 9. Future Outlook for Payment Gateway Charges in 2026 & Beyond

- 10. FAQs

- 11. Conclusion

Payment gateway charges can make or break your business’s profit. It is crucial to get a crystal clear idea before you get started with a gateway service. This will help you avoid difficulty in complex pricing and on-time shocking hidden fees. In order to connect with a reliable online payment services provider in today’s digital era is not just a choice but a necessity.

India moves towards being a cashless society. Paying for day to day utilities and uses like staying, buying electronic items such as a new TV, much more, using credit or debit cards, including paying for vegetables on the street via mobile phone, is growing among all age groups. Digital payments are omnipresent and result in changing consumer behavior. In the previous year, the country recorded more than 164.43 billion digital transactions.

Moreover, in India alone, the digital payment gateway market was valued at USD 16.2 billion in the previous year, 2024. It is forecast to hit USD 32.96 billion in the coming year 2030 (CAGR of 12.4%). This indicates that businesses are facing a surge of online transactions and having higher exposure to fees, hidden costs, and complexity.

This complete guide will help you learn exactly what payment gateway charges mean, how their charges are calculated, how they compare across providers, and most importantly, how your company in India and globally should budget in the year 2026. You can also find the lowest gateway charges and make an informed decision around its integration fee, and more.

Read on to get the clarity you are seeking for, take control of your payment infrastructure costs, and optimize your margins for the digital commerce age.

What are Payment Gateway Charges

Payment gateway charges in India are small fees that merchants pay to a payment gateway (PG) to securely process their digital transactions. It is typically a percentage of each transaction, but can also include one-time setup fees, yearly maintenance fees, and charges for specific services, including refunds to business customers.

Gateways play a significant role. It acts as a secure bridge between a customer, the merchant’s website, and the bank processing the payment. This enables companies to accept their various forms of electronic payments, including credit cards, debit cards, and online banking transfers, securely and without taking a long time.

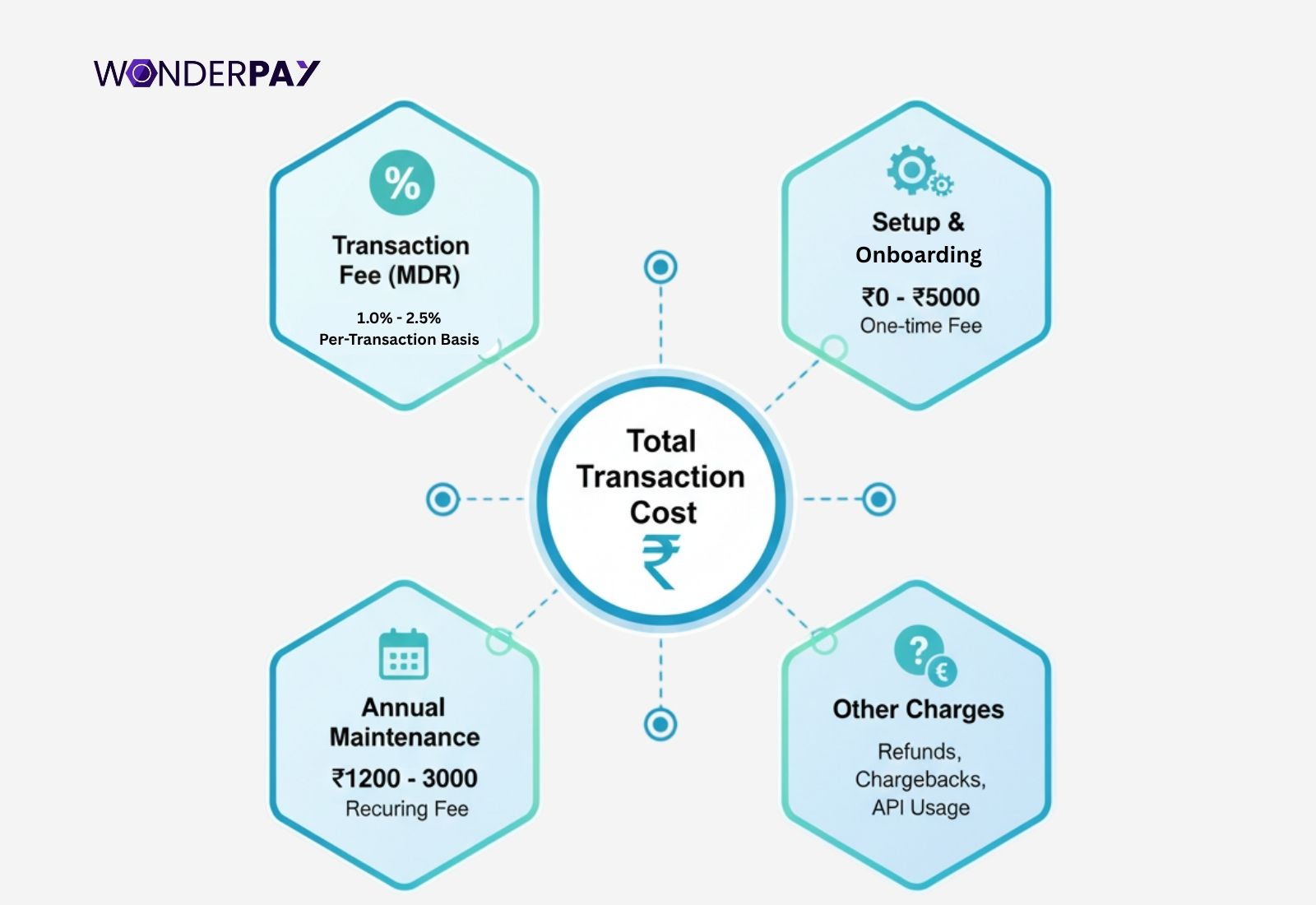

The major components you will find for merchants using a payment gateway in India include setup/integration fees, transaction fees, also known as merchant discount rate (MDR), monthly or annual maintenance fees, and refund chargeback fees.

Companies need to care about managing their costs, particularly payment processing fees. It is because all these expenses have a direct and significant effect on a company’s financial health as well as its competitive position.

Key Statistics & Market Trends

This section will help you understand and get in-depth insights into the payment gateway transaction charges. So, you can make informed decisions and get started with an online payments service for your company to get a digital money transfer solution for your organization.

-

Global Market: As we dug into the depth, WPay learned the market revenue was US $26 billion in 2022, US $31 billion in 2023, expected US $37 billion last year 2024, US $47 billion in 2025, and estimated US $57 billion in 2026.

-

Indian Market: the market for payment gateway was valued at USD 16.2 billion in India in the previous year 2024. The number will continue to grow, and it is expected to reach 32.96 billion by the year 2030.

-

Digital payments in India: In the financial year (FY) 2023 to 2024, the digital payments volume grew by 42% year on year (YoY) within the country.

-

UPI Stats: The Unified Payment Interface (UPI) transitioned volume in India was around 131 billion transactions in the financial year 2023 and 2024.

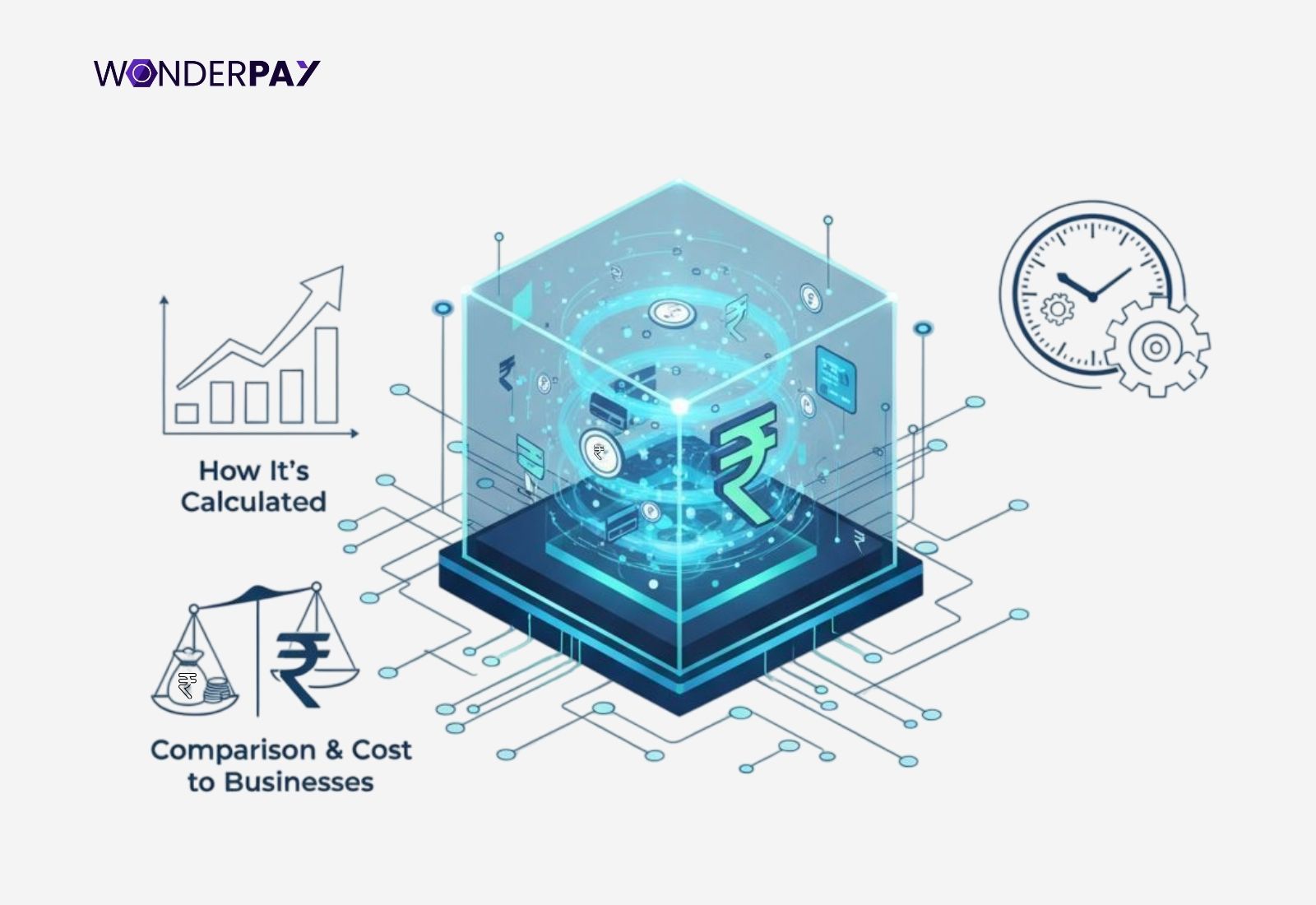

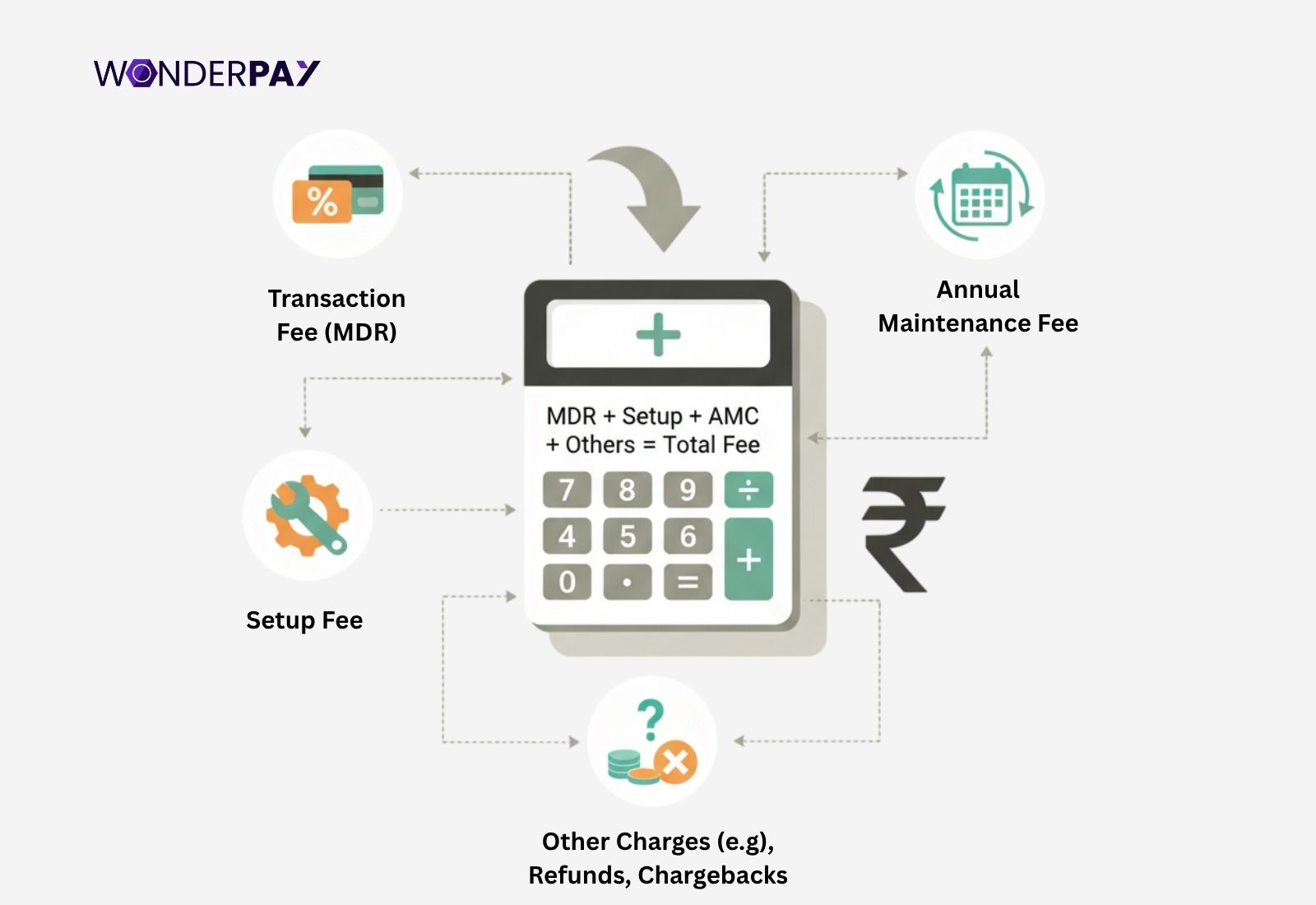

How Payment Gateway Charges are Calculated

The charges for the payment gateway are calculated based on a number of factors, which we will discuss in this section. It will clear most of your doubts and provide you with an idea of how PG will charge you.

-

Setup or integration fee: It is usually a one-time fee, where the PG provider could help you with the integration within your company website or mobile application.

-

Subscription: Some payment gateways have created a subscription-based mode for payment services. They will charge you annually or monthly, whichever plan you choose for your company.

-

Transaction fees: It is calculated using a combination of methods, especially the merchant discount rate. It is a percentage of the transaction amount. The transaction charge can also include the flat fees per transaction, interchange fee paid to card issuing banks, and other charges such as settlement charges, setup fees, and annual maintenance charges. The final calculation depends upon the payment methods, with a higher fee for credit and international cards compared to UPI. You can also connect with a provider and discuss any doubts you have about payment fees for all payment methods.

Example: Your customer paid you using a credit card for an item bought from your store. The transaction fee for that could be 3% and sometimes other taxes are also deducted, but this is not applied every time, as every service provider has their own guidelines for charges.

-

Additional fee: If you require a cross-border service for your company or as an individual, the fees will be separate. Moreover, you should ask the provider whether they support global transactions.

Example for calculation of International Payments: Suppose your company has around Rs 1,00,000 in transactions in a month with a 2% fee. The amount should be Rs 2,000 plus, and maybe Rs 50 for refunds…

In some of the cases:

- The payment gateway charges for debit cards or credit cards are usually higher than the UPI payment made by your customers.

This explanation will help you understand and connect with the right service provider you need for your company.

Must Read: Instant Settlement Payment Gateway In India: Complete Guide

Typical Charges for Payment Gateway in India (2026 Outlook)

Here are the charges for the payment gateway in India. It will help you understand the charges with an in-depth discussion. The same data will help you make an informed decision on how you should choose the right service provider for online payments for your company.

Small Businesses

There is a huge number of payment gateway service providers. They could offer their PG service by charging you around 1.50% or 2.99% for the transactions.

The other could provide you with their fees within 1.5% for many methods, 2% to 3.5% for higher risk, or for international.

-

The regional or regulatory influence: The possibility of a unified payment interface (UPI) merchant discount rate (MDR) may shift the costs.

-

Forecast: This year, the volume will grow continuously, including the competition. The fee may be compressed for large merchants, but at the same time small ones or high-risk categories, the integration charges or add-ons could be crucial.

-

Hidden cost: You should clear everything, including the settlement delays, currency conversion if you are going with the international payment gateway for your organization, as well as the chargebacks.

-

You must compare not just the percentage fees but the effective cost, which can include the integration, settlement, technical work, and more.

If you get to shop around, you will find out the providers that are advertising the lowest payment gateway charges by saying 1.5% + a small fixed fee. You should check out their hidden fee, which they will not let you know about. This thing will help you save your funds when connecting with a payment service provider for your organization.

Suggested Read: 10 Security Standards for Businesses | Payment Gateway in India

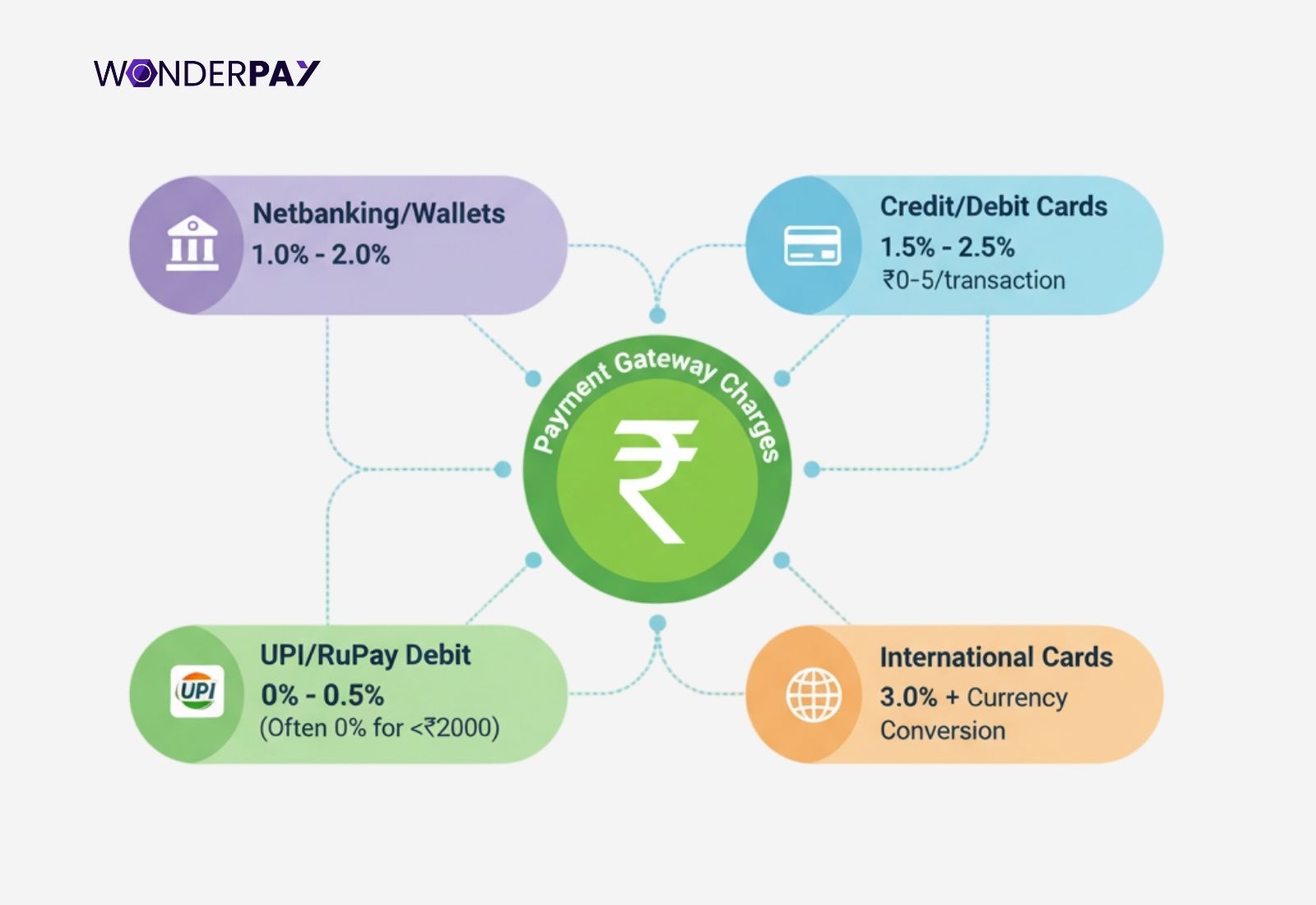

Comparing Payment Gateway Charges Across Payment Types

This comprehensive comparison of payment gateway charges around payment types will deliver you with a clear understanding in the end. You will be able to know how the significant methods for payments work.

Credit card payment gateway charges

The credit card payment gateway charges are higher. It is because of several key factors, including the increasing risk, especially with online and international transactions, the mandatory interchange fees, as well as their additional cross-border fees.

Here are some of the factors:

- Intercharge fees.

- Risk.

- Cross-border fees.

- Currency conversion.

UPI payment gateway charges

The payment gateway UPI charges are identified for their low cost, with zero consumer fee for most transactions. This makes it the most used and easiest payment method. It assists both the merchants and their customers as well. In order to endorse their cash flow system, which results in improving their revenue.

Wallets / alternative payments

Every online payment service provider has different prices for all payment methods. There, you have to consider which payment provider fits you best. It will assist you with the correct solution for your company.

Integration & maintenance charges

You need to consider that some gateways may charge one-time fees, customization, annual maintenance, plugin/module fees to your business, whether you are an e-commerce platform or another. So, payment gateway integration charges differ from provider to provider.

Payment gateway charges for e-commerce websites

The payment gateway fees for an e-commerce website vary based on the payment methods.

Example: 1.5 to 3% for cards, 2% or less could be for UPI. The other cost of payment charges for the website can include an annual maintenance charge (AMC), and additionally, fees can be for international payments.

Here is a table to help you make the correct choice for your organization. It will help you compare both solutions and make an informed decision.

| Payment type | Typical fee structure | Notes |

|---|---|---|

| UPI Merchant | 0.5 to 2% (India) pending change | Low cost, fast settlement |

| Credit Card Domestic | 1.5 - 3% + fixed | Higher risk or processing cost |

| Cards International | 2.5 - 4% + currency conversion | Additional cross-border cost |

| Integration/setup | One-time, & hourly rates, fixed prices, or a hybrid of the two | Hidden cost for small businesses |

| Refund/Chargeback | Can expect a fee from $20 to over $100 per dispute. | Adds up for high-return industries |

Now, you can compare the prices for PG with your current provider. This way, you will be able to make the right decision on which option for gateway payment option you should choose for your organization.

Must Read: Types Of Payment Gateways In India & How To Choose Right One

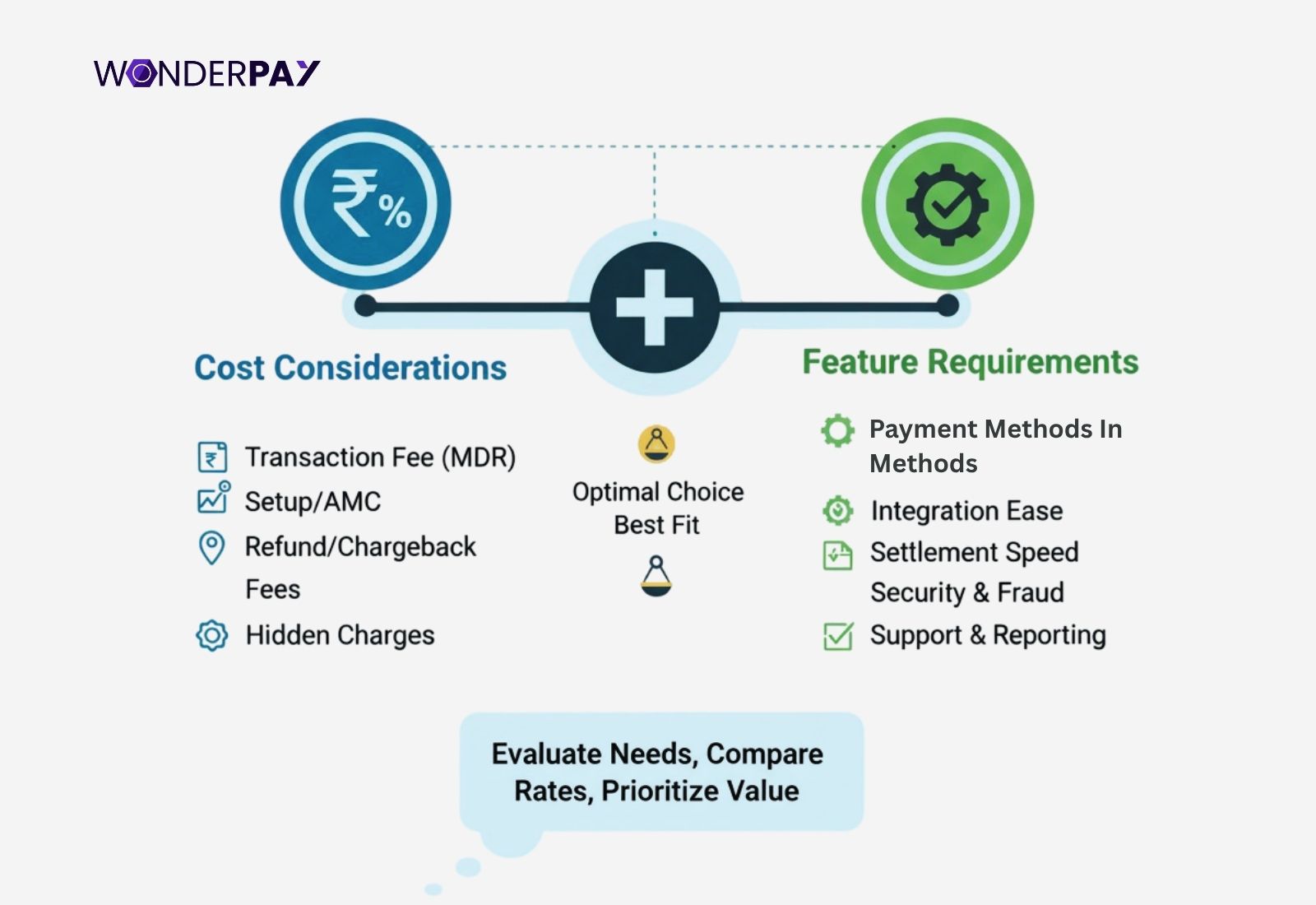

How to Choose a Payment Gateway: Know Cost + Features

Getting started with the right payment gateway service for your organization is crucial. It is not about the lowest payment gateway charges, but the risk. Instead, you need to go with the features you will use, support, settlement speed, risk or fraud management, reliability, and the easiest integration solution.

This section will help you understand and make the correct choice for the payment service you need for your organization.

Checklist for businesses to choose a PG service

Here is a comprehensive list, section-wise, to help you understand the charges for the payment gateway. This will assist you in picking a payment gateway for your organization.

Let’s check and find out how this supports you.

Fees and Pricing

-

Transaction Fees: You should compare the transaction fees with the other providers.

-

Set up and other fees: First things first, what you should do is to understand the upfront prices or the recurring costs if they charge.

-

Hidden charges: Never ignore or be shy to ask if there are any potential extra costs like chargeback fees or service charges; they will tell you in the end.

-

Pricing structure: You can choose a plan that aligns with your business needs and the transaction volume.

Payment Options: Including the Features

-

Payment Methods: Check if the system supports all payment methods, including credit or debit cards, UPI, netbanking, and more. This will open doors for the payments to flow into your business account.

-

International Payments: Do you usually accept or disburse payments outside your home country? If so, you can connect with the gateway service provider that supports the same for your company.

-

Advance Features: Buy Now Pay Later (BNPL), Equated Monthly Instalment (EMI), recurring payments, or subscription options are available. This will enable you to collect smart revenue and give the option to let your customers pay.

Integration and Compatibility

-

Check Platform Compatibility: Make sure the gateway works with your current website or mobile application.

-

API and Plugins: You should look into whether the payment gateway, India, can help you get a user-friendly Application Programming Interface (API), and Software Development Kits (SDKs), or can provide you with the pre-built plugins for easy integration you need.

-

Optimized for Mobile: Check if the checkout page is compatible with mobile phones, as there will be more and more users who rely on their phones.

-

Space for customization: Customization gives you the freedom to model the payment solution to meet your business requirements, such as the branding.

Performance and Support:

-

Settlement speed: Since the payment gateway in India relies upon the authority guidelines are regulations governing the process, primarily established by the Reserve Bank of India (RBI). Their guidelines are clear to perform a merchant background check, ensure Payment Card Industry Data Security Standards (PCI DSS) compliance. Moreover, the settlement must happen within the timeline line such as T+1.

-

Reliability: You should consider your provider’s uptime as well as tracking their records to ensure reliability.

-

Customer Support: Get to know how quality and responsive their customer support is. You can ask them for help with integration or during an outage. It assists you in understanding them well.

-

Reviews and their reputation in the market: It will help you understand how they are doing in the market and decide whether you should connect with them or not.

Security and Compliance

-

PCI DSS Compliance: It is a mandatory practice to secure customer-sensitive payment information like card details. So, make sure the provider of the gateway implements them all.

-

Fraud Prevention: You need to make sure that the PG has features like 3D secure authentication, tokenization, and chargeback protection.

-

Supports Data Encryption: Confirm in the first that it can encrypt the user data during transmission and storage.

-

Implements Local Regulations: Check if the gateway implements all local financial regulations, such as RBI approval in India.

Also Read: How To Choose Best Payment Gateway In India For SaaS

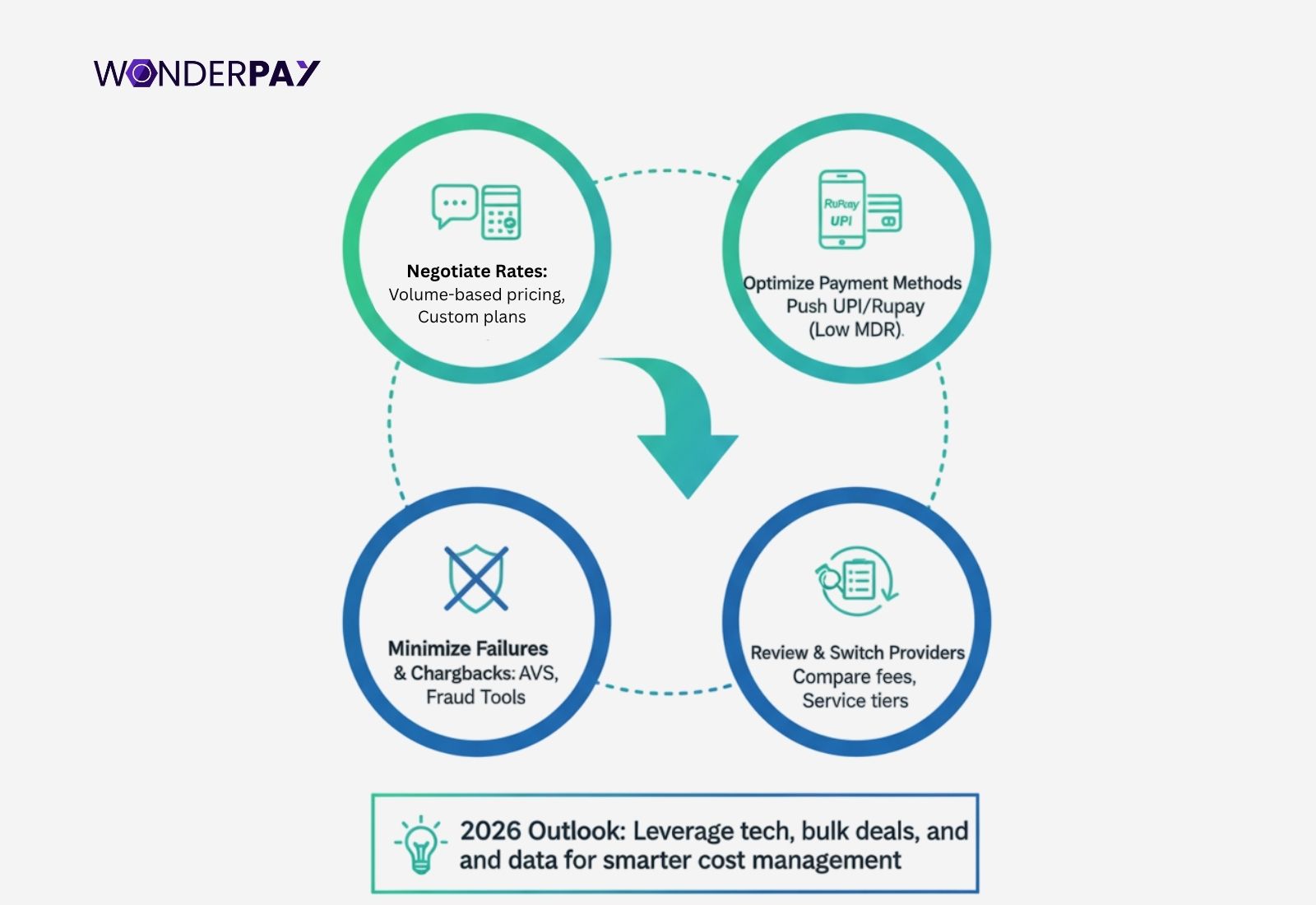

Strategies to Reduce Payment Gateway Charges for 2026

How to avoid payment gateway charges? It all just needs a strategy. This section will reveal all the factors you should consider to reduce payment gateway charges in India for your company.

-

Negotiate with Your Providers: If it is possible, you should negotiate with the provider based on the volume discounts and bundling. It could help you reduce the charges and let you get the service you need.

-

Optimize Transaction Route: It is to select the best payment path, such as UPI, Wallet, etc., dynamically. In order to maximize the success rate (conversion) while minimizing processing cost, the MDR/charges.

-

Reduce Cashbacks and Refunds: You can reduce the PG charges indirectly by reducing chargebacks, refunds, and failed transactions by having a better checkout User Experience (UX) and fraud prevention.

The charges are influenced by:- Success rate of your transactions.

- Ratio of your dispute or chargeback.

- Volume of refund.

- Knowing your risk score or merchant profile with the payment aggregator or acquirer.

It means that if your company has lower chargebacks, refunds, and higher successful transactions, then you are considered a low-risk merchant. You can also go with the custom pricing as a low-risk merchant.

-

Integrated Solutions: The time you get to connect with an option like an integrated solution for your company. It may help you with fewer payment gateway integration charges.

-

Frequently Review: You may check if the fee has changed, which may help you with the updated option that the provider may have reduced or given offers.

-

Alternative Models: You can consider alternative models, as some gateways may offer a pipeline model (flat fee) instead of just giving you options that are based on a percentage for high volume.

Payment Gateway Charges Useful Case Study: Travels & Holidays

The Travels & Holidays company delivered outstanding results to its customers by improving their digital payment issues. It increases their cash flow by 89% by delivering an easy and simple way to reserve their journey with a quick solution to make payments on time while aligning with the company’s budget.

Challenge

Travels & Holidays was facing a problem with their digital payments. And get a comprehensive payment solution, in order to accept payments, reconciliation, and at the same time deliver a better checkout experience to customers for easy fund transfer.

Solution

Delivered a flexible and customizable solution for payment gateway transaction charges.

-

Optimized for charges payment gateway debit card for easy payments as customers need.

-

Customize the pricing to meet the exact requirement.

-

Delivered a customized multi-payment method payin services.

Results

-

Resulted in increasing 89% cash flow for the company.

-

Supported to a customer’s satisfaction and increased it to 90%.

-

The company got a comprehensive solution to improve its productivity by 99%.

This progressive solution assists the organization in improving its work and drives the connected experience they were expecting. In the ever-evolving digital and best solutions for customers to have the most used UPI payment gateway charges method.

Future Outlook for Payment Gateway Charges in 2026 & Beyond

Do you know what the future of digital payment charges will be and how this is going to affect businesses? In this section, we will go into depth and find the facts for both decreases and increases in price for 2026 and beyond.

-

According to the states discussed in section 3 (key statistics). The payment ecosystem will continue to grow. Economies of scale could push fees down, but regulatory charges may push some costs up, ex, the Unified Payment Interface (UPI), Merchant Discount Rate (MDR).

-

The digital payment option is at its peak and experiences increasing adoption in India. The rapid digitization, low-cost acceptance infrastructure, like payment with QR code and soundboxes, is driving adoption across Tier 2 to Tier 4 cities.

-

Popular platforms like Bharat Connect, FASTag are expanding their use cases. Bharat Connect is now in categories such as healthcare, education, and society maintenance, with transaction value expected to increase at a 30% CAGR. On the other hand, FASTag is expanding into parking, fuel, and smart city applications via the Global Navigation Satellite System (GNSS).

-

Moreover, the online payments are projected to grow from 206 billion transactions in the financial year (FY) 2025 to 617 billion in FY 2030, with the value rising from INR 299 trillion to INR 907 trillion, which is about 3 times in the 5-year period.

-

The UPI is on top in this evolution. It continues to lead retail payments and accounts for 90% of transaction volumes. While having innovations including biometric authentication, Internet of Things (IoT) powered payments, and cross-border remittances, the unified payment interface is on track to clock 1 billion transactions per day by the financial year 2028. So, jumping on the embargo, new players, and the greater competition may reduce fees.

-

RBI mandates two-factor authentication for all online payments from April 2026. This may increase the infrastructure cost, and it may feed into the fee structure costs also. As in the first 9 months of 2025, Indians lost INR 107.21 Cr to cyber fraud.

FAQs

-

Is there any TDS on payment gateway charges?

No, the transaction you initiate between the merchant and the acquiring bank (customer). It does not have as such TDS (Tax Deducted at Source) applicable to standard payment gateway charges.

-

Which payment gateway charges less in India?

Wonderpay payment gateway may help you with an affordable online transfer dashboard for your company. You can choose a payment plan and easily select one that fits your needs.

-

Do international payment gateway charges differ from payment gateway charges in India?

Yes, the international transaction charges are higher compared to the domestic charges in India. It is because of foreign currency conversion, cross-border transactions, and the risk.

-

Is there any GST on payment gateway charges?

Yes, the Goods and Services Tax (GST) is applicable to payment gateway service charges in India. It is levied on the transaction processing fee, which is charged by a payment aggregator or gateway, not on the total transaction amount itself.

-

What are payment gateway charges, and how much do payment gateways charge?

Payment gateway charges are a fee to process a business’s one payment. It is a percentage fee of a transaction amount known as Merchant Discount Rate (MDR), which could be from 1.5% to 3% or higher, or often less.

-

Are there any payment gateways with zero charges present in the market?

No, there is no payment gateway with zero charges. Every PG service provider invests in their technology and manages several expenses. However, a gateway service provider may provide you with a discount offer, no setup fee, or maintenance fee.

-

Do payment gateways cost money?

Yes, it is for the transaction initiation as well as for the online money transfer software integration, and its yearly maintenance also. It could differ from the service provider you choose for your organization.

-

What are payment gateway charges, and how are they calculated?

The payment gateway charges meaning is a fee for processing a business’s online payment. It is calculated using a combination of a percentage-based fee, such as the Merchant Discount Rate (MDR). It is sometimes fixed per transaction fee.

PG charges can also include one-time setup fees, annual maintenance fees, and extra costs for international transactions. This is determined using factors like payment method and transaction volume.

-

How much do payment gateway charges cost in India for small businesses?

Payment gateway charges in India typically consist of a percentage of each transaction. It includes a small fee, ranging from 1.5% to 3.5% or it may cost you other charges like transaction charges, Rs 3 to Rs 6.

Note, every PG has a different fee, and they charge you for one time setup and annual maintenance charges also.

-

What is the difference between UPI payment gateway charges and card charges?

The main difference between the UPI payment gateway charges and the credit card payment gateway charges is the cost. UPI payments come with lower fees for merchants, while credit or debit card payments involve a merchant discount rate (MDR).

-

Are there any payment gateway integration charges I should be aware of?

Yes, there are payment gateway integration charges**,** which are known as one-time setup fees. But before that, know what option you choose among the hosted payment gateway, API hosted, self-hosted, or mobile SDK integration.

It may help you reduce the implementation charges or do the rest process yourself.

-

How can I find the lowest payment gateway charges for my business?

You can find the lowest payment gateway charges option by researching the market and comparing the fee structure for multiple providers. Who is charging the lowest fee for setup, annual, and refund charges?

Moreover, you can consider your use case and choose a provider and PG solution according to your needs and requirements.

-

What are the typical payment gateway transaction charges for e-commerce?

The payment gateway transaction charges for e-commerce include the Merchant Discount Rate (MDR). It is a percentage of the transaction value, which could be 1.5 to 3% as well as the flat fee per transaction, like Rs 2 to Rs 5. Moreover, the additional charges could be setup fees, refund fees, annual maintenance fees, and higher rates for your international cards, and premium cards, including the cross-border transactions as well.

-

Do all gateways charge the same fees, or can I negotiate charges for a payment gateway?

No, charges for the payment gateway can be distinguished based on your company’s transaction volume, industry, and you can also negotiate.

Fees vary provider to provider because of different pricing structures, which include per-transaction costs, monthly fees, and charges for chosen payment methods.

Conclusion

Understanding a payment gateway charges clearly before you start is critical for a business’s profitability. Since it is a technology, you will need several practices, from the installation of a payment gateway within your website/application to maintenance.

Moreover, you should negotiate, know their fee structure, benchmark, and optimize payment mix, etc. It may help you reduce the costs to your company, and let it align with all your needs to get a fine solution, a PG technology for you.

Review your current payment gateway service provider right now, map the cost per transaction to your company, and identify opportunities to switch or for the year 2026.

Are you in search of analyzing your current payment gateway charges? Do you want to select a gateway service that fits your volume and business model? Contact us right now.