- 1. Synopsis

- 2. What is a Payment Gateway

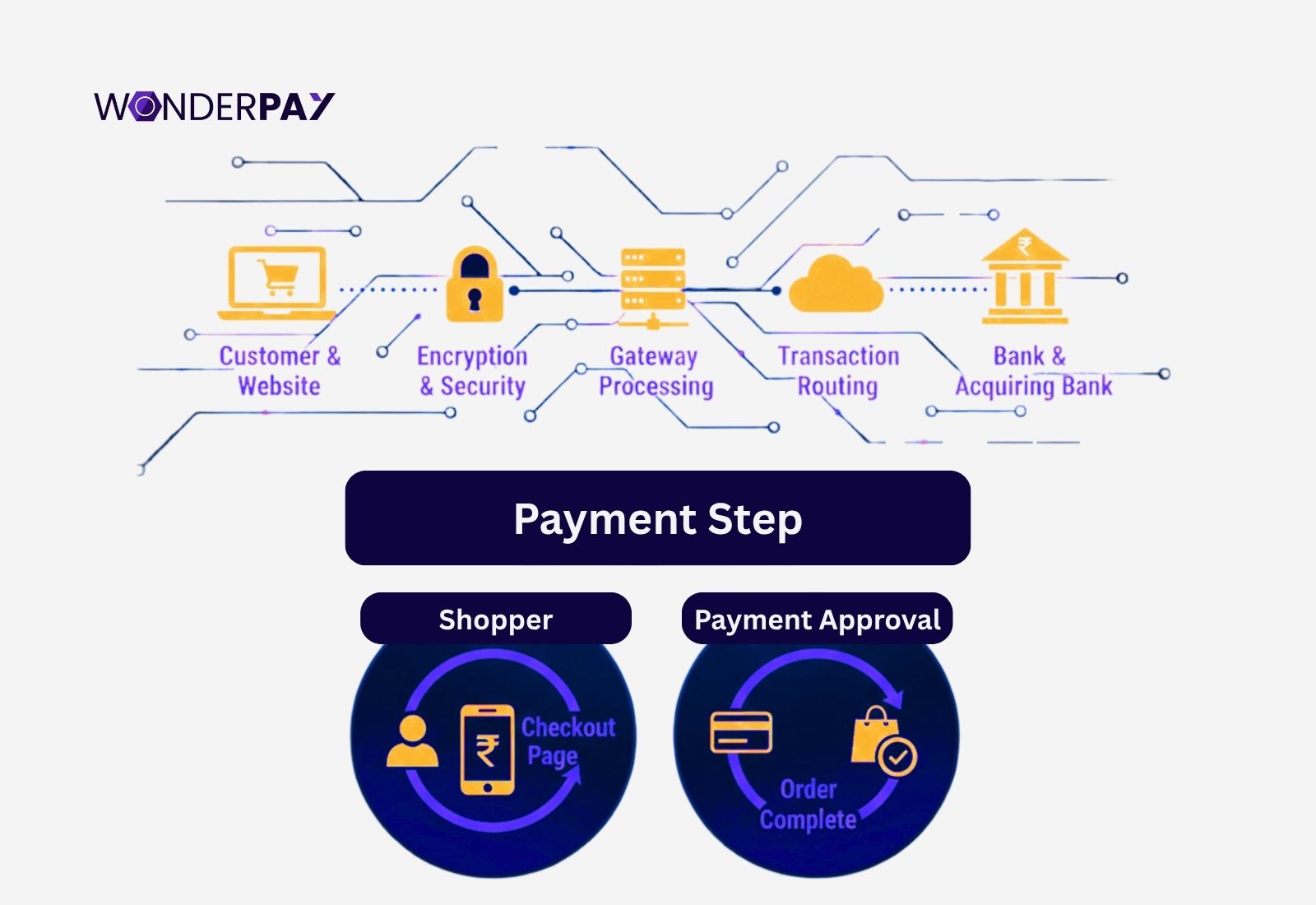

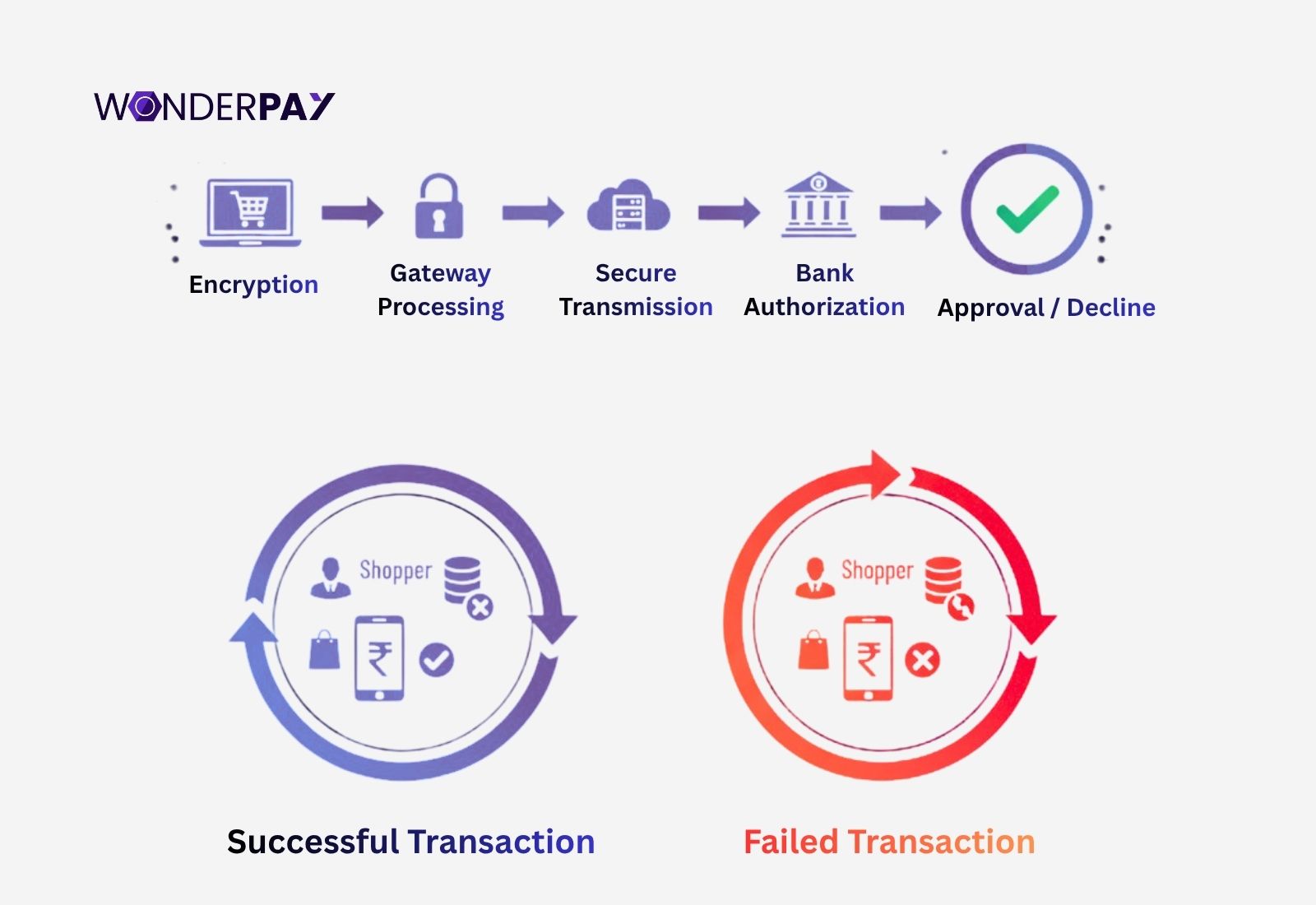

- 3. How Does a Payment Gateway Work

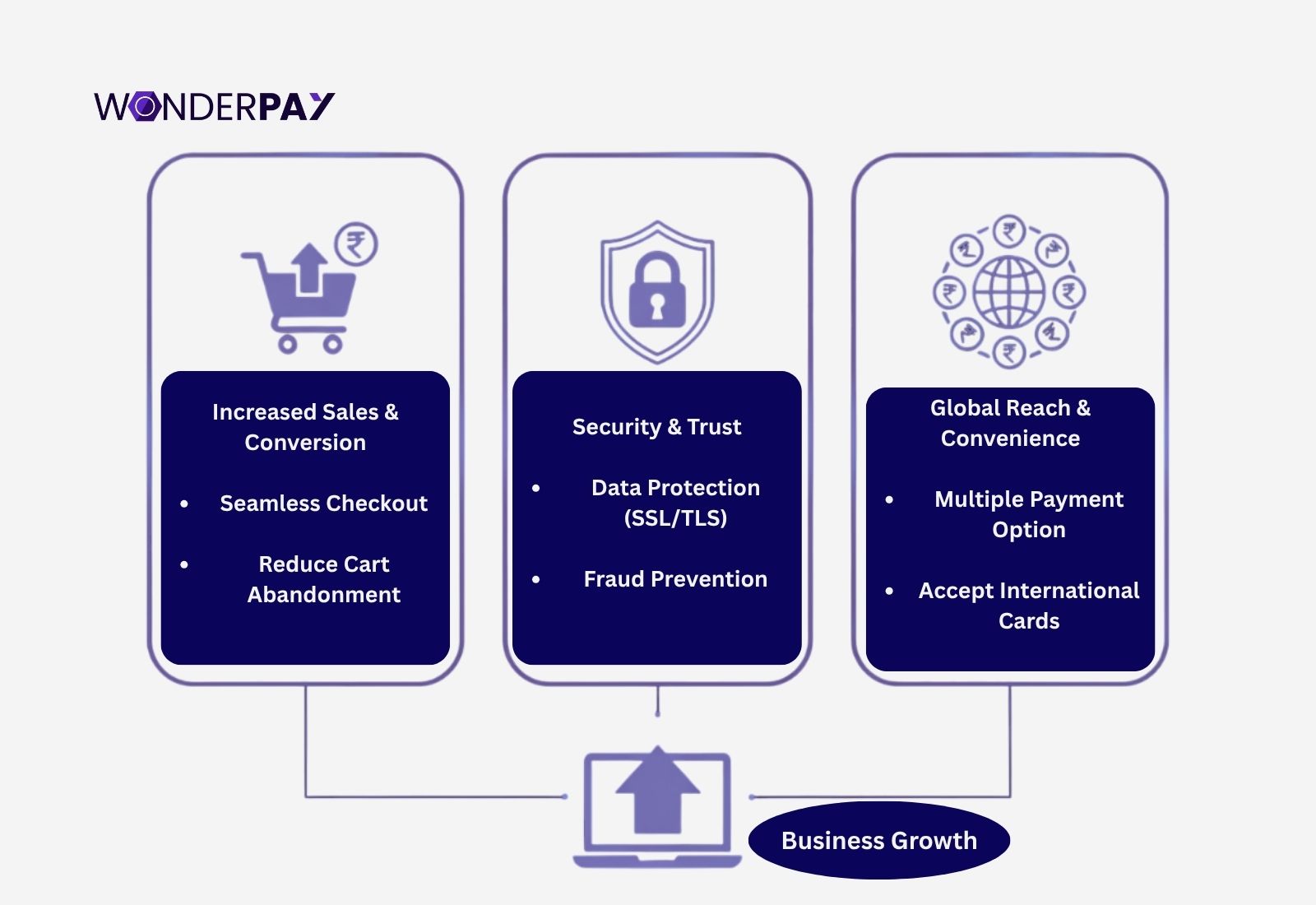

- 4. Why Payment Gateway Integration Matters

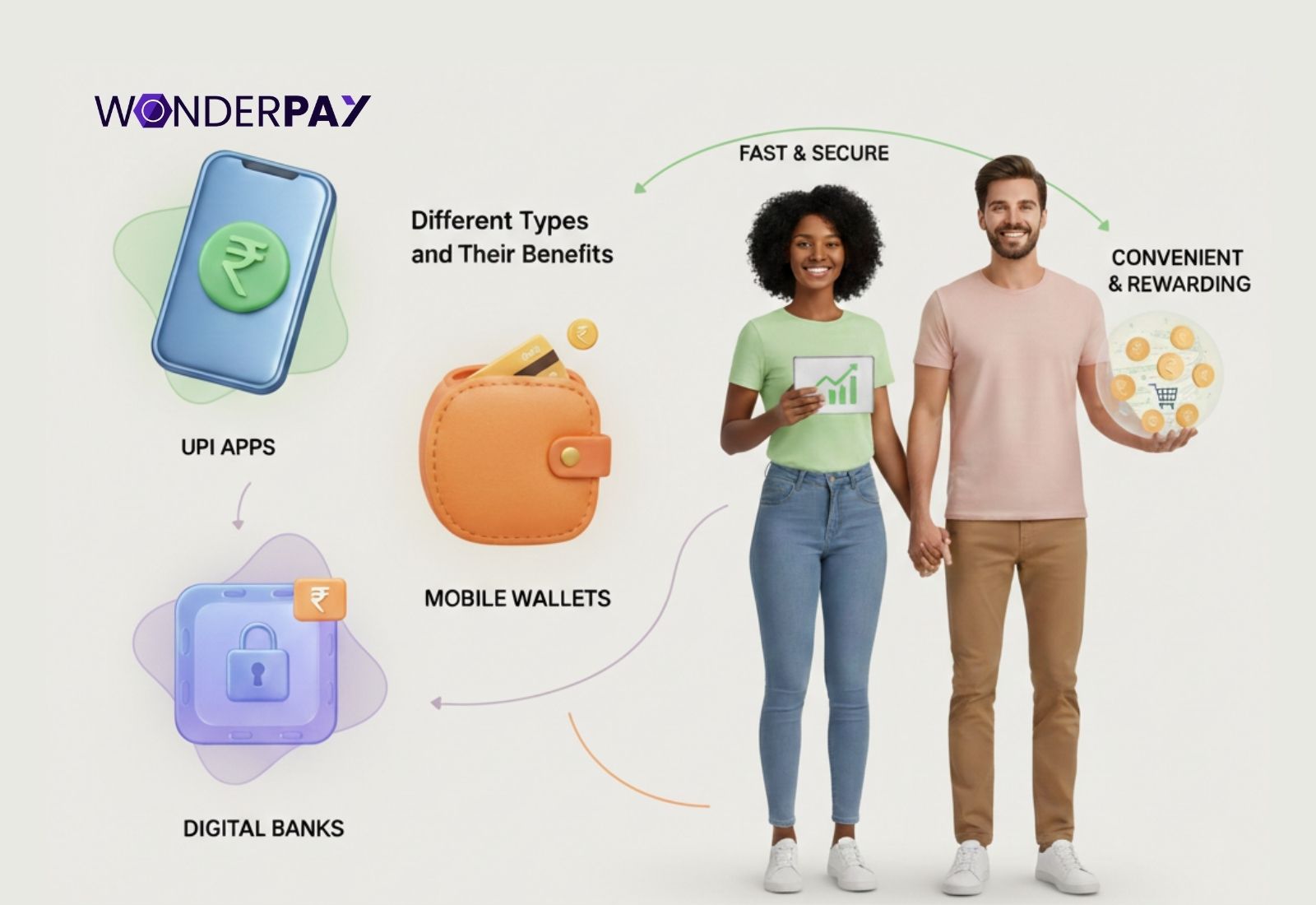

- 5. Types of Payment Gateway Integration: Explanation & Comparison

- 6. How to Choose the Best Payment Gateway for Your Website

- 7. Payment Gateway Pre-integration Checklist

- 8. How to Add a Payment Gateway to a Website and App: Step-by-Step Integration

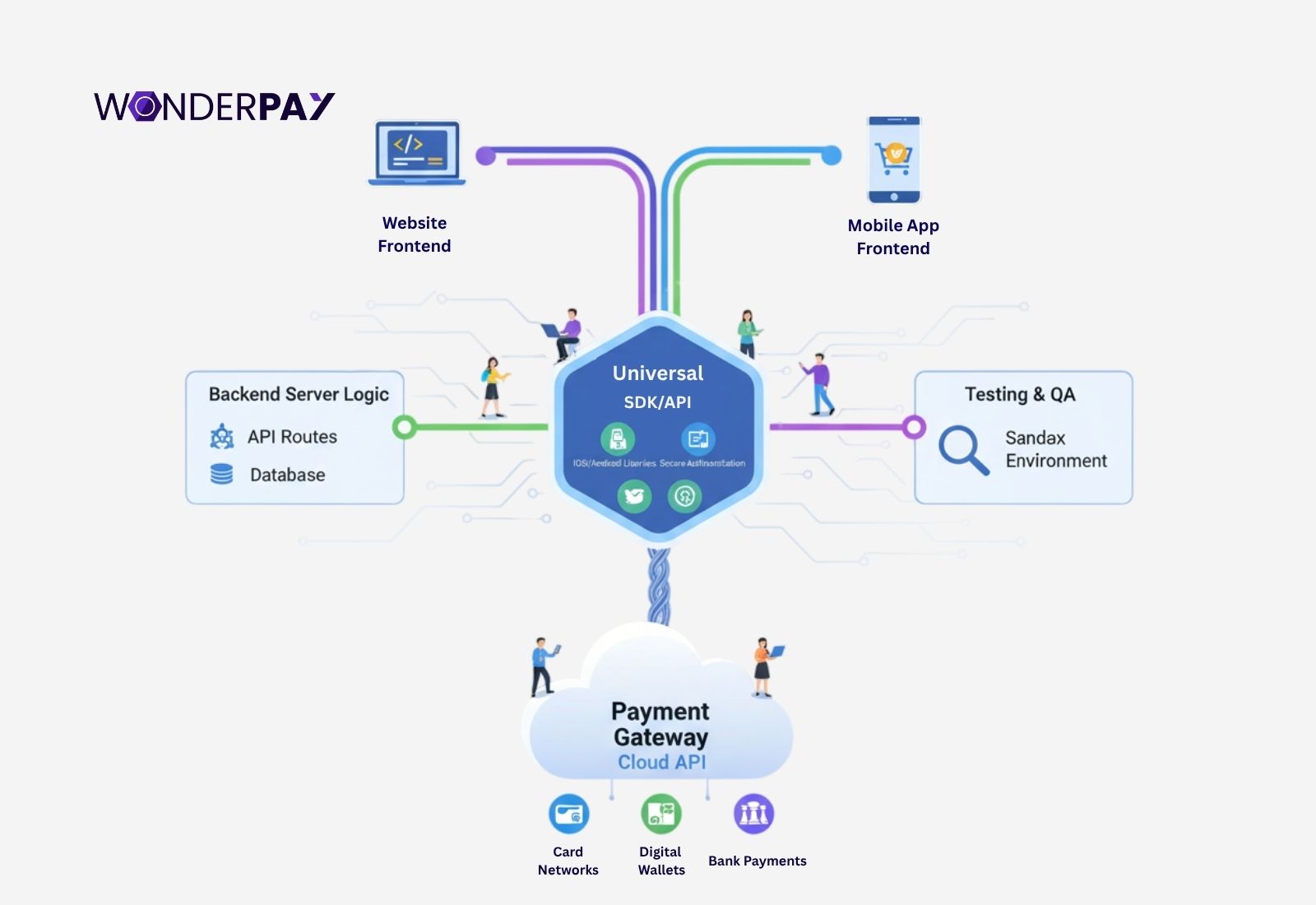

- 9. Method for Integration for Both Website and App

- 10. Example for Hosted Checkout Website Integration

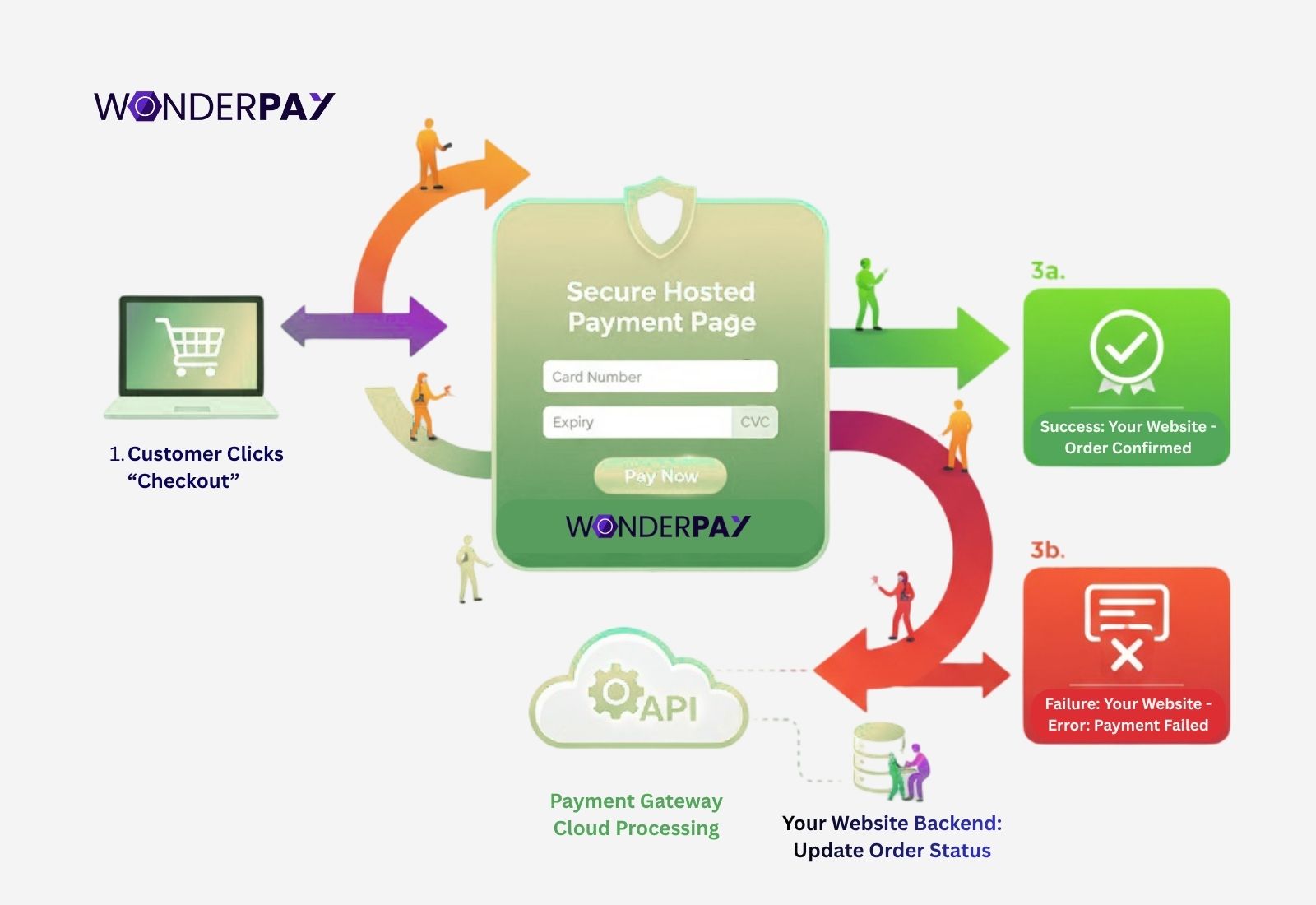

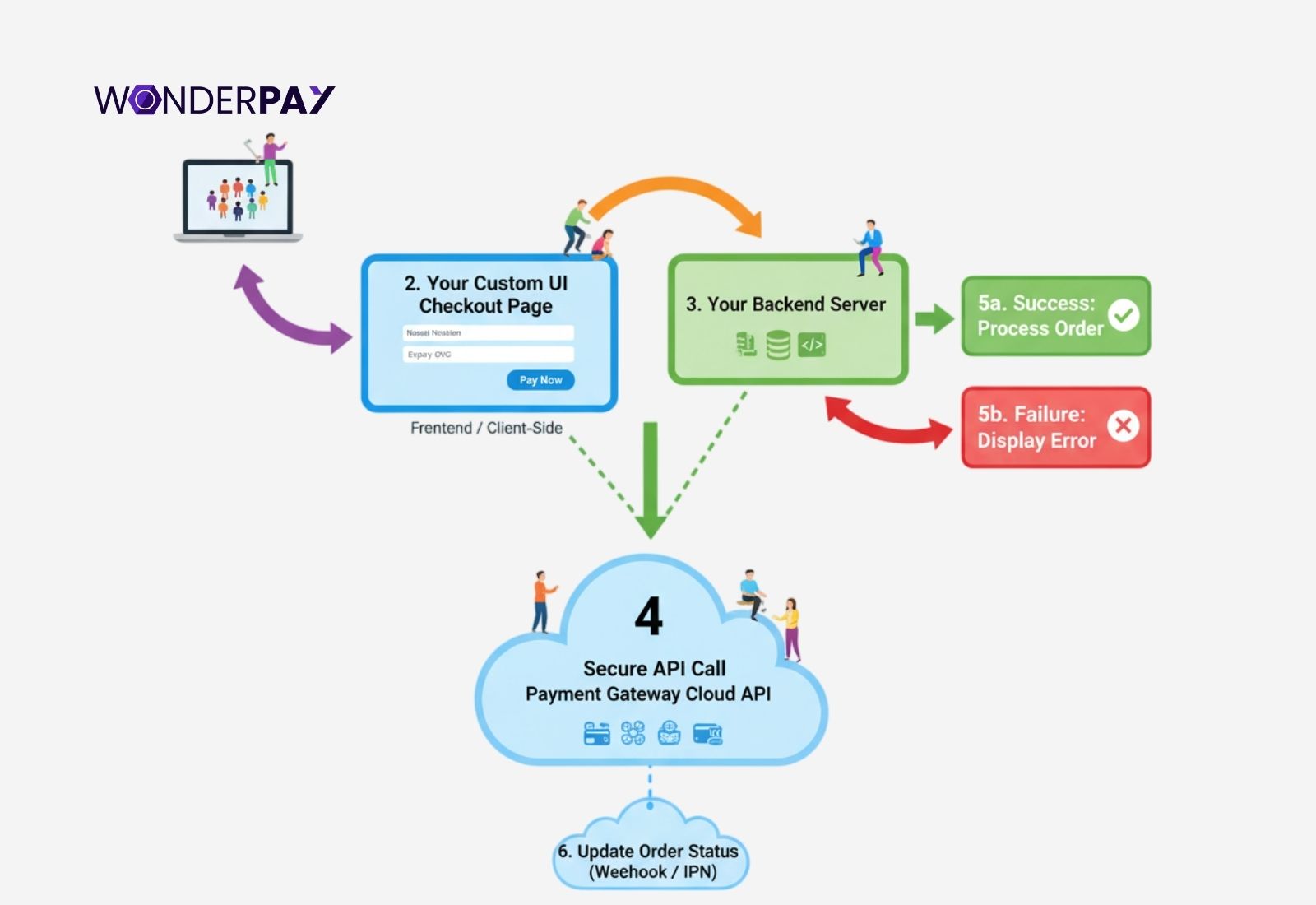

- 11. Example for API Checkout with Custom UI

- 12. How Do You Integrate a Payment Gateway In Your Mobile App

- 13. How to Test and Verify Payment Gateway Integration

- 14. What Are Payment Gateway System Security and Compliance

- 15. What is Post-integration: Monitoring, Reconciliation & Optimization

- 16. What Are Common Integration Problems & Troubleshooting a Business Should Consider

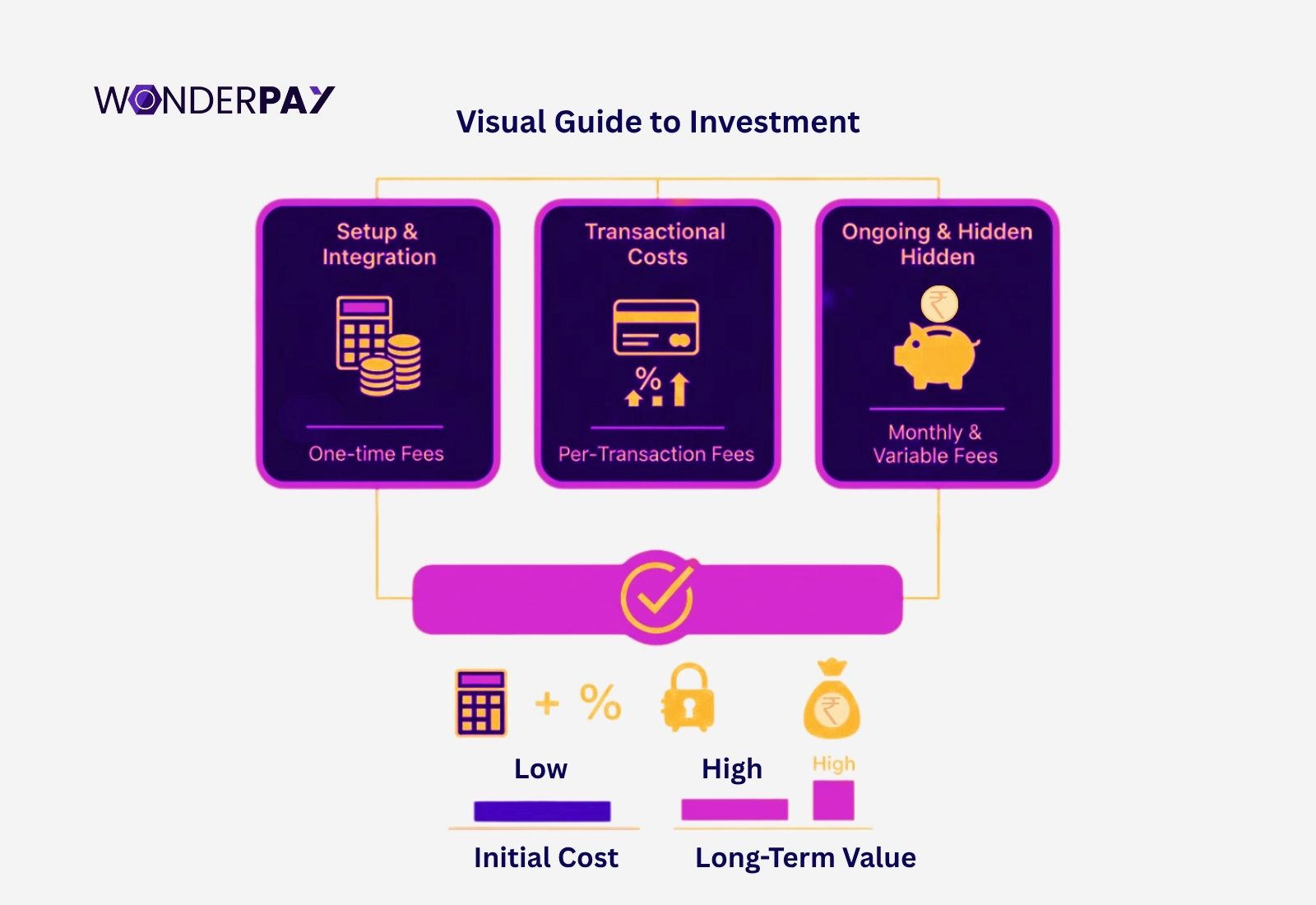

- 17. How Much Does it Cost to Integrate a Payment Gateway?

- 18. FAQs

- 19. Conclusion

Poor payment gateway integration can lead to significant financial losses, also your reputation. It is primarily because of lost sales, increased fraud, operational inefficiencies, and loss of your customer trust.

The surge in digital transactions is driven by the increasing use of Unified Payment Interface (UPI), Immediate Payment Service (IMPS), and NETC FASTag. It is a testament to India’s escalating embrace of a digital-first economy. The country made a significant milestone in becoming a cashless society. The UPI is at the forefront of the country’s digital payment revolution, with a record of 16.73 billion transactions in 2024.

Rapidly growing digital transactions are a great opportunity for business owners to tap into this growing market. In order to increase their cash flow and deliver their customers with an improved checkout experience to their customers with each transaction. To integrate a payment gateway into a website or app is a key step to getting started with the online payment journey.

Still in fog!

This comprehensive guide will assist you with a payment gateway integration step-by-step solution for your organization.

Synopsis

-

Gateway integration is critical for a business for secure and error-free transactions, while having ease of implementing the solution within a website or app.

-

Payment gateways for small businesses require a quick, affordable, and alternative solution, such as an API, plugin, webhook, and SDK.

-

If not connected with a reliable PG service provider and resolve critical issues with online payments for your business, it may lead to loss of customers due to trust issues and a complicated checkout process for their preferred payment method.

What is a Payment Gateway

It is an online payment gateway service providers, operates as a bridge between merchants and their customers to facilitate a secure payment transfer. Thanks to rich functionality like multiple payment method support, reconciliation for all business transactions, security measures like Payment Card Industry Data Security Standards (PCI DSS), encrypted transactions, escrow services, Trade Receivables Discounting System (TReDS), reconciliation, and more.

This complete solution of a payment gateway makes it stand out of the box when it comes to a connected experience of a company. It allows you to add a payment gateway to your website or mobile application to accept or disburse payments on your platform. You get the freedom to use your business branding only.

How Does a Payment Gateway Work

A payment gateway works in 5 simple steps. You can understand its working hierarchy as discussed below to get a clear picture.

-

A Customer Initiates Payment

After selecting the item(s), the customer provides payment details such as a credit or debit card, UPI details, or a business website, or within the mobile application. -

Data Encryption

Customer sensitive data for used payment methods like card details, bank account number, IFSC code, (netbanking), UPI ID, etc, is encrypted, making it unreadable. And from the approach of unauthorized access, and securely transmitted to the processor. -

Routes Transaction

Payment process now submits all encrypted details to the network, such as card networks like Visa, Mastercard, etc. -

Bank Authorization

The card network or (other chosen payment method like the UPI network) routes the request to the customer’s issuing bank. It checks for sufficient funds and fraud with security measures like One Time Password (OTP) before approving or declining the transaction. -

Confirmation and Settlement

Now the bank sends its request back via the processor and gateway to the merchant. If the payment is approved, the merchant gets notified, and the settlement process begins, moving the money to the merchant’s bank account.

Why Payment Gateway Integration Matters

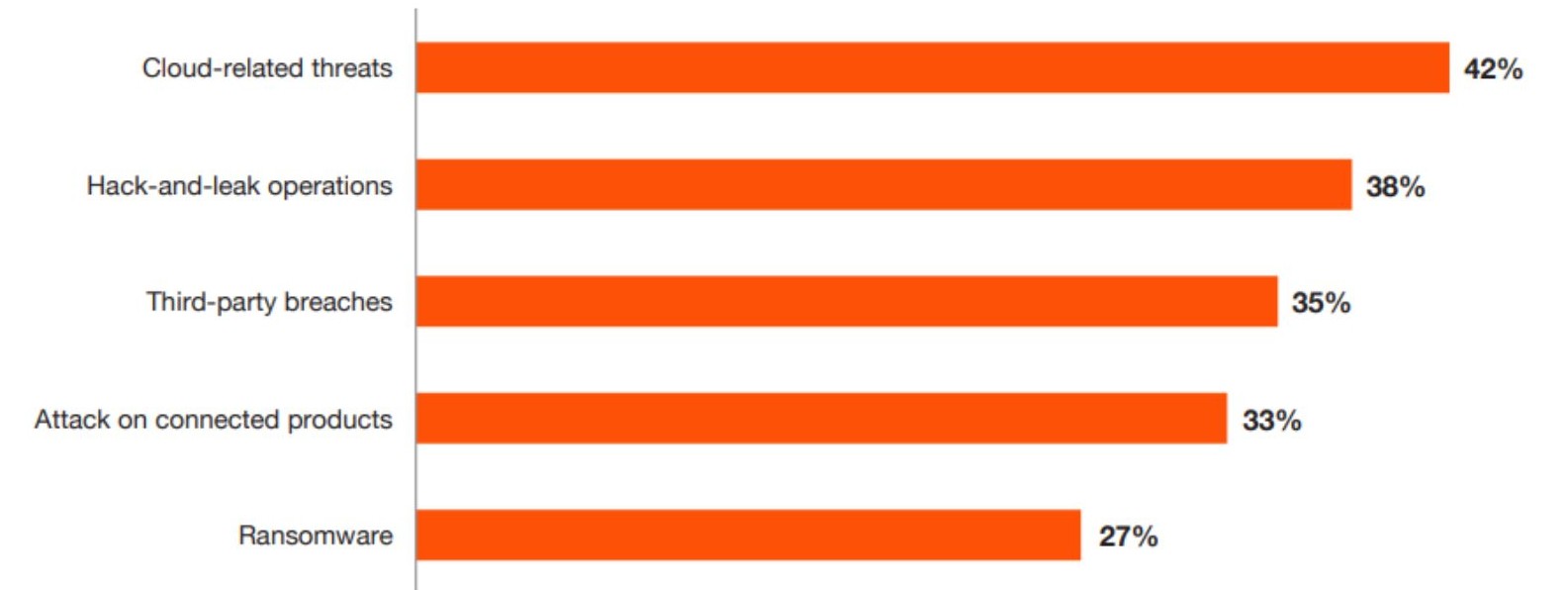

- According to PwC’s recent report for 2025 stats that the top five cyberthreats are cloud threats, 42%.

- Hack and lead operations are 38%.

- The report for connected products is 33%.

- For ransomware, it is 27%.

Source: PwC, 2025 Global Digital Trust Insights

Source: PwC, 2025 Global Digital Trust Insights

The cloud-related threads in FinTech are more prevalent. The threat actors are exploiting cloud vulnerabilities, insecure Application Programming Interfaces (APIs), which also include the misconfigured cloud settings nd insufficient access and network security controls.

Online payment gateway plays an important role in accepting and processing online payments. It helps your customers get a better experience, especially in today’s digital era. In order to deliver your business customers an improved experience to pay as they want.

This will assist you in creating a secure link between you as a merchant and banks. It protects sensitive data using its encryption, and offers a seamless, multi-channel payment experience that resolves the issues with cart abandonment and builds customer trust.

Security and Trust

- Shields Your Sensitive Data: A PG supports you in encrypting and securing customer payment information while acting as a first line of defense against fraud and data theft

. - Build Trust: Trusted services for a better checkout experience build customer trust and loyal customers while reducing the risk of reputation damage from a security breach.

Customer Experience

-

Smooth Experience: You can deliver your business target audience with a seamless experience. Let them pay using their preferred payment methods while being on your website or app for an uninterrupted experience that will help you increase conversion rates.

-

Payment Option: Collect the debt, subscription, or one-time payment using any of the payment methods from UPI, Netbanking, NEFT, credit or debit cards, and more.

-

No More Card Abandonment: By having an improved checkout experience with a well-integrated gateway, you can reduce the card abandonment rate.

Grow Your Business

-

Global Reach: Do you own an online store but do not have a better way to accept your payments from different places? If so, payment gateway integration allows you to accept all your payments from any corner of the world. It means more sales and more earnings with no limitations.

-

More Sales: Getting started with an online payment service for your organization enables you to accept online payments easily. It makes it easy for your organization to accept your payments online, as customers are comfortable.

-

Cash Flow: The payment gateway services help you improve your operational efficiency by streamlining your financial transactions, reducing manual efforts, and increasing payment processing.

-

Space for Scalability: As your business grows, a robust payment system like Wonderpay’s can handle a large volume of transactions. It prevents payment processing from becoming a bottleneck.

Types of Payment Gateway Integration: Explanation & Comparison

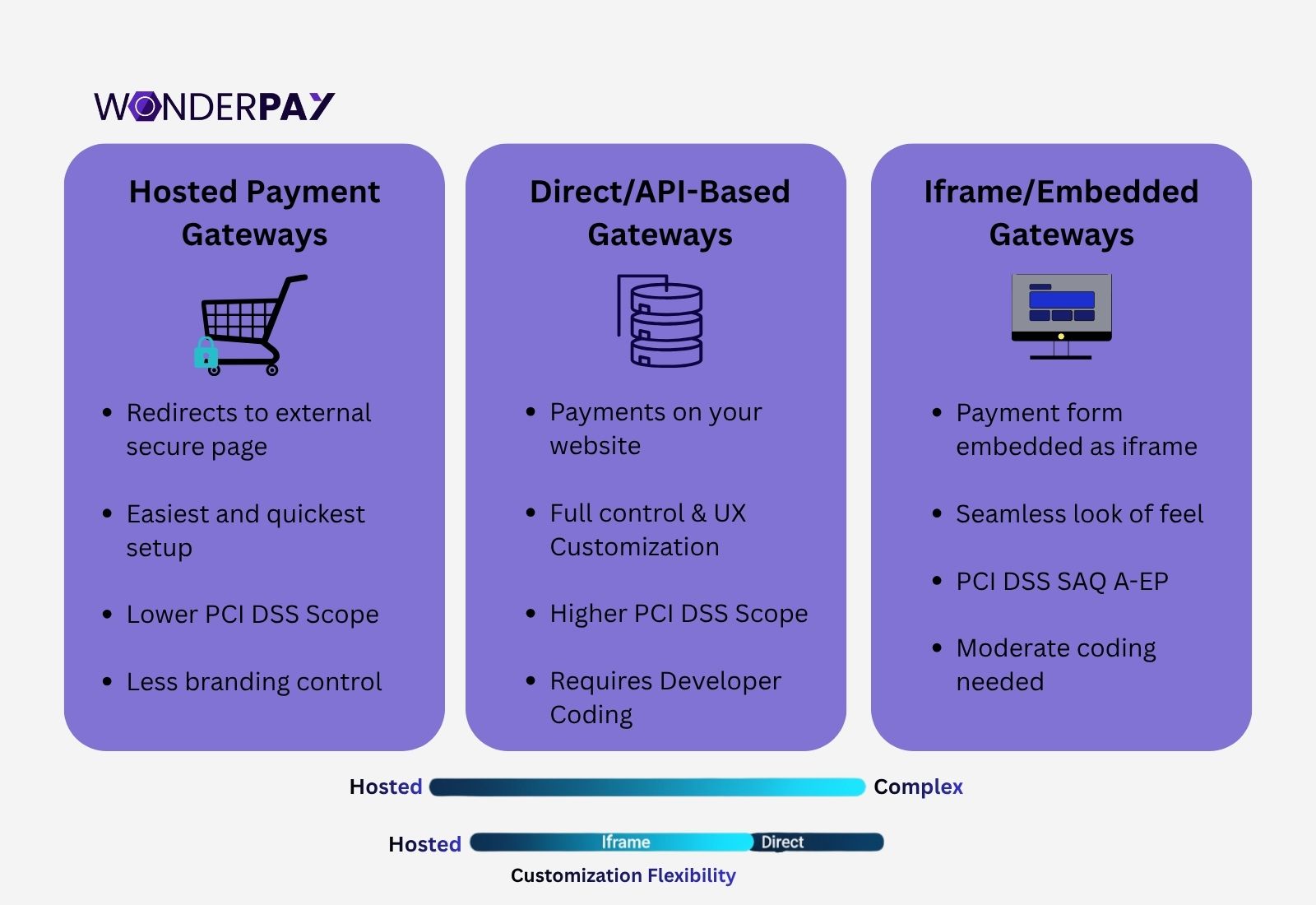

There are four types of payment gateways, but it depends on your business needs, which one you should choose. In this section, we will discuss which payment gateway in India you can choose for your organization, with all its details.

Hosted Checkout

It is also known as a redirect or a hosted page. It offers significant advantages for merchants who prioritize speed of implementation as well as their security. This PG usually redirects buyers to a third-party payment provider’s secure page for a secure payment transaction.

This minimizes the merchant payment gateway Payment Card Industry (PCI) compliance burden. Additionally, it can assist with the fastest implementation, lower development efforts.

API Based

An API integration payment gateway based payment gateway comes with complete control by a business. It is hosted on the business’s own server, and they can customize it with their branding, User Experience (UX), and maximum flexibility as the entire payment flow is managed as your organization requires it.

It is the best option for those who need a highly bespoke and branded checkout process - the time the customer pays. Within this Payment Card Industry Data Security Standards (PCI DSS) compliance, merchants’ systems directly handle the entire sensitive cardholder data, undergo regular audit, and make efforts to shield the sensitive information.

Client Side SDK

A client-side payment gateway integration method for an e-payment gateway, within this, the collection and encryption of sensitive payment data, such as credit card information, takes place directly within the customer’s browser (client side) by utilizing a Software Development Kit, abbreviated “SDK” or pre-built User Interface (UI) components delivered by the payment provider.

E-commerce Plugin Integration

E-commerce payment gateway integration typically includes pre-built plugins for popular platforms such as WooCommerce, Shopify, and Magento in order to connect to a payment gateway’s API.

The plugin simplifies the process, allowing you to accept your online payments. The best part is that you do not have to write code from scratch. It supports all payment methods, including debit, credit cards, digital wallets, and Unified Payment Interface (UPI).

Comparison of Types of Payment Gateway Integration

| Integration Type | Development Effort | PCI DSS Scope | Checkout UX Control | Conversion Impact | Best For |

|---|---|---|---|---|---|

| Hosted Checkout | Very Low | Minimal (handled by PG) | Low | Moderate (trust-driven) | Small businesses, startups, low-tech teams |

| API-Based | High | High (full PCI requirements) | Maximum | High (fully optimized UX) | Enterprises, scaling D2C brands, custom platforms |

| Client-Side SDK | Medium | Low to Medium | Medium | High | Apps, digital platforms want a balance between control & compliance |

| E-commerce Plugin | Very Low | Minimal | Medium (limited by plugin features) | High | E-commerce stores using Shopify/WooCommerce/Magento |

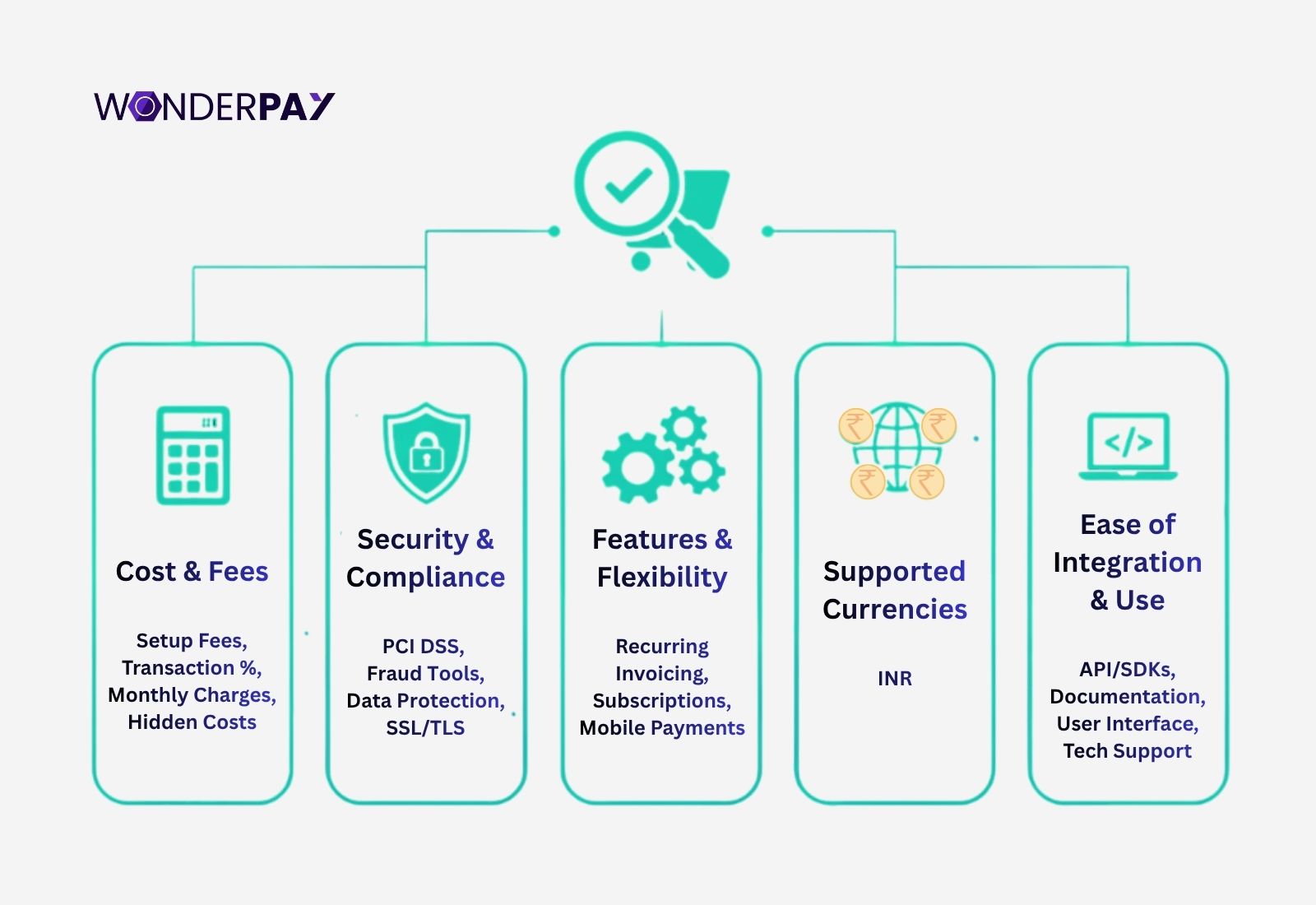

How to Choose the Best Payment Gateway for Your Website

Getting started with the best payment gateway, evaluate your business needs. Here, we will discuss some factors that you must consider when connecting with a payment gateway service provider. It will help you make an informed decision that you are seeking.

Key Factors to Choose the Best Payment Gateway

Support all payment methods: It should support all payment methods like UPI, cards, wallets, netbanking, and others. This gives your users the freedom to pay using the option customers are familiar with.

Success Rate: Check the success rate of all online payments made through the platform. If there were any problems with the transactions previously. You would be able to make a better decision on which provider to opt for.

Their Settlement Frequency: This will help you understand the option you should be choosing, such as a quick settlement for your business. If it did not perform well last time, you may think of another option you choose.

Fees: How much do they charge for their services, including settlement fees, transaction charges, annual fees, and more? You can compare the fees and decide on the one that fits your business needs.

Developer Documents

Are they providing a payment integration option like SDK, API, and plugins? If you get the right option for your organization. It will help you meet your company’s exact requirements and provide you with the option you need exactly.

Customer Support

Does the payment gateway have a dedicated support team? The support team is the one that will assist you with all the issues, in case you get stuck somewhere. Therefore, you should get connected with the service provider that can help you in need.

PCI DSS: The Payment Card Industry Data Security Standards (PCI DSS) compliance ensures customer payment data security. Does your provider implement them? If so, you can get started with the one.

Read More: Payment Gateway vs Payment Aggregator: Know the Difference

Payment Gateway Pre-integration Checklist

You need to have the crucial practices for the payment gateway that are discussed in this section clearly. This section will help you make your online business transactions secure by following all the practices.

Your Business Needs

- Transaction volume

- Average ticket

- Domestic payment or international payment gateway.

Look for Website Tacks

- Check for PHP

- Note

- Python

- Ruby

- Support for Shopify or WordPress

- SSL

- HTTPS

- Server Requirements

Legal or Compliance

- Know Your Customer (KYC) Docs for merchant accounts.

- PCI DSS compliance readiness

Developer Keys

- API Key, secret, and webhook secret.

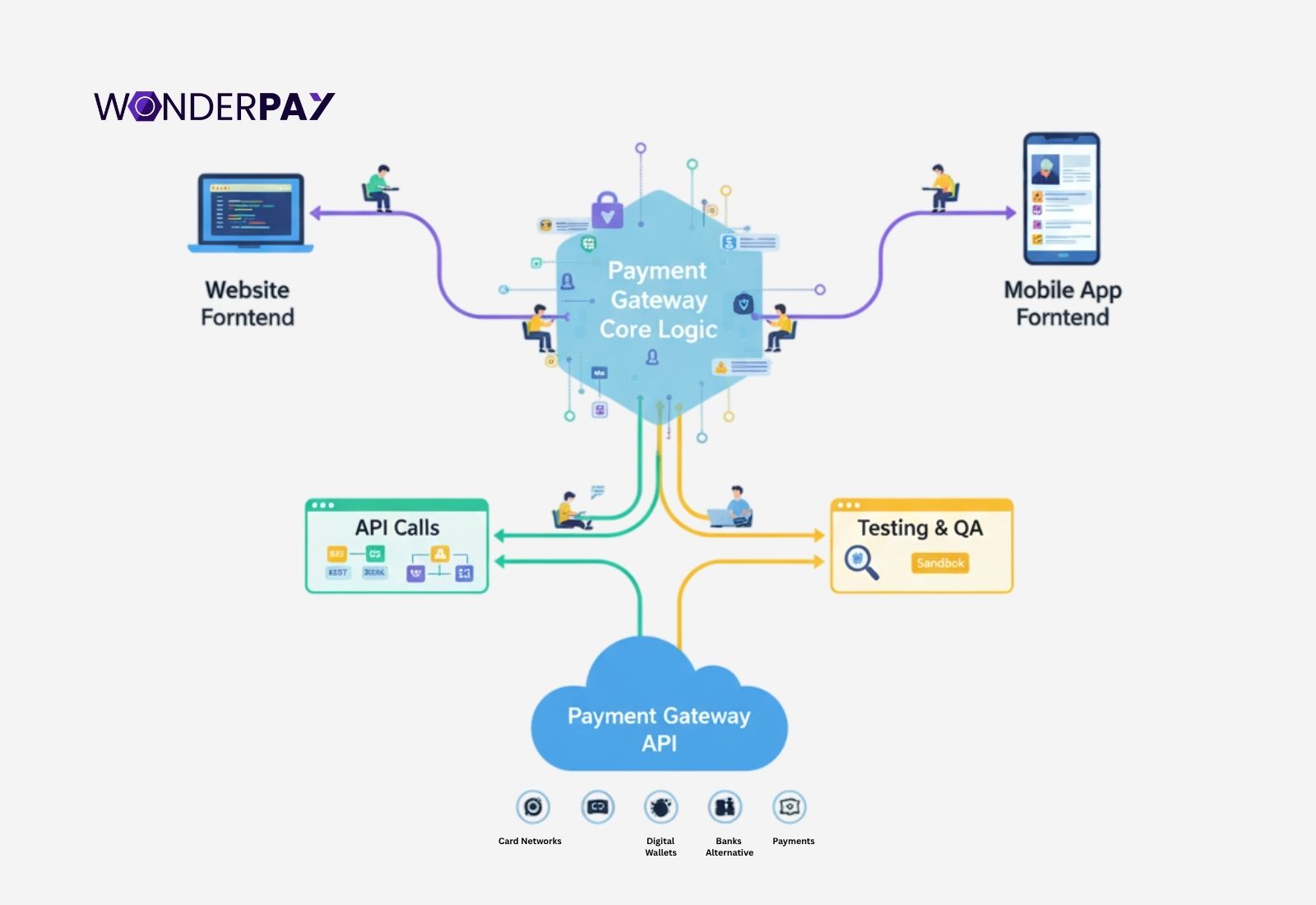

How to Add a Payment Gateway to a Website and App: Step-by-Step Integration

A payment gateway can be installed easily within a website or app. Here, we will discuss some of the significant steps you must follow properly. It will help you understand everything in detail and come up with the solution you are seeking.

-

You can sign up with a payment gateway in India, like Wonderpay PG services, for your organization.

-

Complete KYC

Submit your business details such as:

- Business Details

- PAN, GST (if applicable)

- Bank Account.

- Your Website or app information

- Get Test and Live API Credentials

You will get the following credentials, including:

- Public Key / Secret Key

- Merchant ID

- Webhook Secret

- Sandbox credentials

Method for Integration for Both Website and App

Payment gateways usually offer these integration types:

For Websites

| Method | Use Case | Setup Difficulty |

|---|---|---|

| Hosted Checkout (Redirect Page) | Fastest way to accept payments | Low |

| API Checkout (Custom UI) | Full UI control; custom forms | Medium |

| Payment Button / Drop-in Widget | No coding; instant setup | Very Low |

For Mobile Apps

| Method | Platform | Purpose |

|---|---|---|

| Mobile SDK | Android / iOS | Native in-app experience |

| UPI Intent | Android | Pay via UPI apps on the device |

| WebView Hosted Checkout | Both | Fastest, works like a website redirect |

Example for Hosted Checkout Website Integration

Hosted Checkout is the simplest and most secure way to integrate payments without handling sensitive data.

Flow

User → Create Order (Backend) → Redirect to Payment Page/ → User Completes Payment → Gateway Redirects Back (Success/Failure) → Backend Verifies Signature → Updates Order Status

Example Redirect Form (HTML)

<form action="https://payment-gateway.com/checkout" method="POST">

<input type="hidden" name="order_id" value="{{ORDER_ID}}">

<button type="submit">Pay Securely</button>

</form>

Backend Verification (Pseudo Code)

const crypto = require("crypto");

const expectedSignature = crypto

.createHmac("sha256", SECRET)

.update(orderId + "|" + paymentId)

.digest("hex");

if (expectedSignature === receivedSignature) {

// Payment is valid

}

Example for API Checkout with Custom UI

Useful when you want complete control over the payment UI (cards, UPI, netbanking, wallets, etc.).

Flow

- Backend: Create an order

- Frontend: Collect user inputs

- Gateway: Process payment token

- Backend: Verify payment signature

- Backend: Mark order success or failure

Basic Frontend Snippet

const options = {

key: "PUBLIC_KEY",

amount: 50000, // 500.00 INR

currency: "INR",

order_id: ORDER_ID,

callback: function(response) {

fetch("/verify-payment", {

method: "POST",

body: JSON.stringify(response)

});

}

};

How Do You Integrate a Payment Gateway In Your Mobile App

Payment gateway integration for cross-platform mobile apps, including Android and iOS, is easy. Here you can find the source code and the instructions to add PG to your platform.

- First, install the SDK

- Use the given keys

- Now launch the payment sheet

- Receive callbacks

- Check the server’s signature

Example for UPI Intent (Android)

Intent intent = new Intent(Intent.ACTION_VIEW);

intent.setData(Uri.parse("upi://pay?pa=merchant@upi&am=500&cu=INR"));

startActivityForResult(intent, 101);

Webhook Setup

It makes sure that you get reliable notifications for payments even though a user did the following:

- After closing the browser

- If the app crashes

- In case the network fails

You May Use The Following Webhook Events Below:

payment_authorizedpayment_failedpayment_capturedrefund_processedsettlement_done

The webhook should have the endpoints such as:

- Signature validations

- Database update status

- It should return HTTPS 200

Test in Sandbox Now

Before you go live, here is a complete checklist you must consider to avoid any issues.

- Successful payments

- Declines

- Timeouts

- Webhook retries

- Refunds

- Multi-mode testing (pay using cards, UPI, netbanking, wallets)

- Cross-browser testing (Chrome, Safari, Firefox)

- App testing (Android + iOS)

How to Test and Verify Payment Gateway Integration

You can test and verify your PG integration easily with just a few practices. Let’s find all the significant facts discussed in this section with in-depth detail.

Sandbox and UPI Test Behaviour

An online payment gateway sandbox provides you with a testing environment in order to simulate the behavior of a live production environment without real money and even a fictitious financial account.

Test Cards

The Sendbox environment uses test cards. It simulates a credit card number that is delivered by a payment gateway for testing purposes only.

-

Purpose: Its purpose is to decline or fail transactions based on specific card numbers as well as details also.

-

Without Real Money: It ensures safe testing while making transactions, as it does not involve actual funds.

-

Behaviour Detection: Payment Gateway integration developers use different card numbers to detect responses like successful transactions, authorizations, Card Verification Value (CVV) mismatches, or insufficient funds errors.

Test Behaviour Detection for UPI

UPI testing in the sandbox includes a number of simulated transactions. It can include testing such as:

-

Simulated Transactions: Within this, the sandbox simulates the flow of a Unified Payment Interface transaction. It includes payment initiation requests, user approval, rejection, as well as the final confirmation or a failed transaction.

-

Scenario Testing: A developer can test different outcomes, such as successful payments, a payment failed due to an incorrect Virtual Payment Address (VPA), a payment time out, or a request for payment declined by the user.

-

Integration Testing: It helps you with the verification of how an application will handle various transactions, ensuring the user interface will provide you with appropriate feedback for all scenarios.

Know the Automated Test of A Payment Scenario

The time you go with payment gateway integration for your website or mobile application. It requires a comprehensive approach, which also includes automated tests and a thorough Quality Analysis (QA) checklist.

A checklist you must consider for integration:

-

Payment success: You can simulate successful online transactions by using valid test card details or payment methods provided by your gateway’s sandbox environment. You should also verify that the order status updates correctly at the same time the payment is recorded accurately within your system, and the gateway’s dashboard also.

-

Failure of the payments: You may check all the payment failure scenarios, including:

- Invalid card details.

- Insufficient funds.

- Card expiry.

- Payment gateway’s errors.

You must make sure that all the failure options discussed above are handled by your system. The time your customer makes a payment that is unauthorized and does not process the order.

- Partial Refunds.

- Chargebacks.

Webhook

The webhook’s signature validation and retry handling play a crucial role, which we will discuss in this section.

Signature Validation: The webhook signature validation assists you in ensuring the authenticity and integrity of incoming webhook notifications from the payment gateway. It will help your organization in preventing malicious or tampered data from being processed.

Python

import hmac

import hashlib

def validate_webhook_signature(payload, signature, secret):

expected_signature = hmac.new(secret.encode(‘utf-8’), payload.encode(‘utf-8’), hashlib.sha256).hexdigest()

return hmac.compare_digest(expected_signature, signature)

Retry: You need to make sure your system handles the webhook retries from the gateway. Moreover, you can simulate scenarios where your endpoint might be unavailable or return an error temporarily, as well as verify that the gateway retries the notification and your system processes it upon availability. You can also use idempotent operations in order to avoid duplicate processing if retries occur.

Quality Analysis Checklist

The QA checklist for reconciliation, digital payment settlement, as well as currency conversion includes the following. This comprehensive checklist will help you understand the QA for the company’s app or website payment gateway integration.

-

Reconciliation: You need to check that it matches all the records provided by the payment gateway, whether it is for failed, successful, or refunded transactions.

-

Settlement amounts: Verify that the settlement amount received from the payment gateway matches the expected amount, which is deducted after any fees or charges on it.

-

Currency conversion: You need to check out and confirm if the payment gateway system can convert the different currencies.

What Are Payment Gateway System Security and Compliance

This complete checklist for the payment gateway ecosystem security and compliance includes the significant options you must consider when going for an online payment gateway in India for your organization.

Here is a multi-faceted approach that covers functional, security, performance, and compliance, like PCI DSS testing. It also includes specific technical and fraud prevention measures.

Common SAQ types are:

- Self-Assessment Questionnaire (SAQ) A

- SAQ A-EP

- SAQ B or B-IP, C, C-VT, and P2PE.

- SAQ D

Technical Implementation

- Tokenization

- SSL or TLS

- Content Security Policy (CSP)

- Secure storage patterns

Webhook Security

The role of a webhook is to provide you with real-time updates on your transactions, and it also needs security measures, which are as follows:

- Signature validation

- IP allowlist

Mitigating Fraud with the Help of:

- 3D secure

- Device fingerprinting

- Velocity checks

What is Post-integration: Monitoring, Reconciliation & Optimization

All three practices, including monitoring, reconciliation, and optimization for post-integration of the online payment management tool, are continuous processes. It is essential for maintaining a healthy and efficient payment infrastructure. This will assist your organization in ensuring accurate, improved success rates and managing the operational costs also.

Let’s discuss them step by step for a clear understanding.

Monitoring

The continuous monitoring includes the Key Performance Indicators (KPIs) in real time by using the comprehensive dashboard.

-

Know its success rate, which is the primary metric of its approved transaction rates.

-

What was the reason? You should consider analyzing its reasons for failed transactions, such as network issues, bank declines, and invalid credentials.

-

The tracking of its fund settlement time from the customer’s account to the merchant account may be T+1 or more.

Reconciliation

Its role is to verify the transactions, including all its refunds, settlements, cashbacks, and other payin or payouts. To match your business’s internal records with those of the payment gateway and banks as well.

Automated system: The top payment gateway in India, Wonderpay, delivers you with the modern payment gateway solution of auto reconciliation. It supports you in streamlining the complex task and reducing human error, as it is important for various settlement cycles while using different payment methods.

Match Data: It endorses match transaction IDs, amounts, and dates among several systems. For the purpose of driving accuracy and quickly identifying any discrepancies or missing funds.

Optimization Explained

It focuses on utilizing the data that is gathered while monitoring to implement strategies. It will help businesses in improving their performance and profitability, also.

The payment orchestration: This helps in smart routing automatically by redirecting failed transactions to an alternative gateway or payment method.

Payment gateway pricing optimization: Encourages the use of payment methods that have lower payment gateway transaction costs.

What Are Common Integration Problems & Troubleshooting a Business Should Consider

Businesses can avoid many payment gateway integration problems. This will help in avoiding grave issues as discussed in this section.

-

Avoid the callback signature mismatch: It is calculated by the business system from a webhook payload. The time does not match the signature provided in the request header. It took place often due to body mutation or incorrect secrets.

-

The Cross-Origin Resource Sharing (CORS): It is a web browser security feature that blocks requests to a different domain and does not allow unblocks since the destination server allows it.

-

Transaction failure: From the end of the issuing bank or gateway due to reasons like insufficient funds, incorrect payment details, or identifying any fraudulent activity.

-

Double charges: This issue usually charges a customer twice for a single transaction. It could be due to network issues, duplicate requests, or a lack of idempotency in the integration logic as well.

How Much Does it Cost to Integrate a Payment Gateway?

The cost to integrate a payment gateway varies based on factors like integration type, your company’s transaction volume, and the provider you select. However, you can choose a PG integration solution based on your requirements, whether you need API hosted, hosted, self-hosted, or local bank integration.

Once you are clear, it will be easy for you to ask your provider for the payment gateway setup price to pay. Here is the gateway installation type breakdown for your website or app.

-

API and Self Hosted: Application Programming Interface (API) hosted integration allows you to customize it. To meet your company branding, payments are processed on the merchant’s platform as it is integrated on the merchant’s own website or app.

-

Hosted Gateway: It redirects customers to a secure payment page, which is hosted by a payment gateway. It is simple to integrate and handles security compliance like PCI DSS.

-

Self Hosted: within this merchant collects and securely transfers customers’ payment data to PG for processing, while keeping your customer on your page.

-

Local Bank Integration: It connects you with the local banking system for direct payment processing - a banking payment gateway in India can also help you with the regional payment methods like UPI.

FAQs

-

What are the payment gateway charges?

There is a fee to process online transactions using a payment gateway platform. It includes payment gateway charges such as Merchant Discount Rate (MDR), which is a percentage of the transaction, potential one-time setup fees, monthly or annual maintenance fees, or charges for services.

-

How is the international payment gateway different from the payment gateway in India?

An international payment gateway distinguishes itself from a domestic gateway mainly by its ability to handle cross-border transactions and support for multiple currencies. Its global payment gateway should also support international payment methods and global compliance requirements. On the other hand, payment gateways in India (domestic) focus on local currency and banking systems such as UPI.

-

What is a UPI payment gateway?

It is a service that facilitates online transactions as it connects you (merchant account) and the customer’s bank account via Unified Payment Interface (UPI) infrastructure. This helps businesses and customers to connect in real time for quick money transfer.

-

What is a payment gateway?

A payment gateway is a technology that connects businesses and their customers’ banks to accept or disburse payments. It can also be used to payout for cashbacks, paying taxes, and more. This payment technology comes with various benefits for businesses, such as using it for subscription payments for SaaS businesses, accepting payments for customers for individual customers.

-

Do I need PCI DSS compliance to accept cards on my website?

Yes, if you accept credit or debit card payments, you have to implement PCI DSS compliance to shield customers’ sensitive payment information from unauthorized access. Even though you are using a third-party payment processor, you are still responsible for the security of the data transmitted via your company website.

-

How to add a payment gateway to a website?

You can add a payment gateway to a website easily, just by following a few steps. The first is to select a gateway service provider, create a merchant account, and then obtain your API keys. Now you can integrate PG using a platform-specific plugin or by using the API for a customized code site. Test the integration properly using a sandbox environment that includes a temporary account and payment methods with no real money, and after testing, go live.

-

What is the best payment gateway in India for small businesses?

The best payment gateway in India for small businesses is Wonderpay. It can help you with its intech infrastructure. If you need multiple functionalities to improve your customer experience. In order to have auto reconciliation, auto payin or payout, PCI DSS compliant, easy to use UI/UX, and more, then you can go with Wonderpay. It will help you with the top benefits to your organization, including other advantages you are seeking.

-

Is it better to use hosted checkout or API integration?

The choice between a hosted checkout and an API integration purely depends on your specific needs, resources, and desired levels of control you seek.

Hosted checkout provides you with a quick setup, requires minimal development resources, and complies with PCI DSS, reducing merchants’ responsibility. Additionally, it has less exposure to sensitive payment information on the merchant’s servers.

If you go with API integration. It can provide you with complete control over the checkout page design, user experience, and payment flow. It comes with seamless integration to provide you with direct payments within the merchant’s website or mobile application for a consistent brand experience. It also has lower long-term costs and may offer you more favorable transaction fees at scale, which depends on the gateway provider you choose.

-

How long does payment gateway integration take?

If it is complex and has an API solution, it may take a few days (4 to 5), but with Wonderpay, you can get it done within 24 hours. In case you just need an extension solution for WooCommerce, and others. It may take a few hours to get started. However, it depends upon the approval of your account on the gateway to be approved which you must consider.

-

Which payment gateway is best in India?

The best payment gateway in India should provide you with the functionality, it should be easy to use with (UI/UX) with no learning curves, must follow PCI DSS, and RBI’s payment gateway guidelines, and should have an affordable price for integration, transactions, and more.

Conclusion

Payment gateway integration is a significant practice. It enables secure online transactions, enhances customer experience, streamlines business operations, and builds trust. It means no space for compromise. Therefore, implementing everything properly will enhance your payment infrastructure and avoid liabilities of data breach, which is a huge issue for businesses.

If you are seeking a reliable payment gateway in India with expertise in integration, as well. We at Wonderpay will help you. Connect with one of our experts right now and book a free integration review.