- 1. How Payment Gateways Work: A Complete Beginner’s Guide

- 2. What is a Payment Gateway?

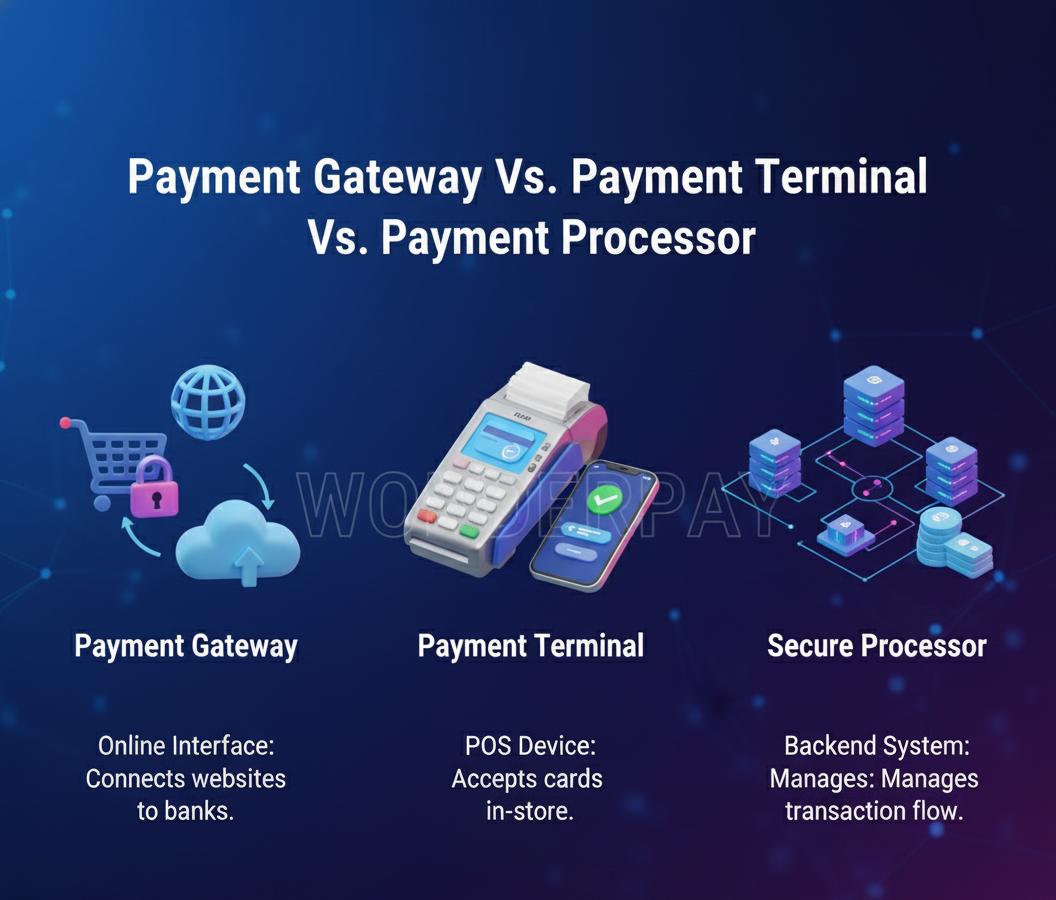

- 3. Payment Gateway Vs. Payment Terminal Vs. Payment Processor

- 4. How Does a Payment Gateway Work?

- 5. Framework of a Payment Gateway

- 6. Who Are the 5 Players in the Payment Gateway Ecosystem?

- 7. Top 4 Security Practices a Payment Gateway Implements

- 8. What Are the Benefits of a PG for Businesses?

- 9. How Much Does a Payment Gateway Cost?

- 10. What Are The Significant Payment Gateway Security Features?

- 11. How to Choose the Right Payment Gateway in India?

- 12. Types of Payment Gateway You Should Know

- 13. Why Choose Wonderpay Payment Gateway?

- 14. Summary

How Payment Gateways Work: A Complete Beginner’s Guide

Imagine having a platform that organizes all your payments with no limitations and requires no effort to accept payments from all modes, disburse funds, and reconcile transactions, while being fully compliant.

According to PwC’s latest report;

“India’s payment industry is projected to expand more than three times in volume, from 159 billion transactions in FY 2023-24 to 481 billion by FY 2028-29. On the other hand, there are payment value transactions. It is expected to double, from INR 265 trillion to INR 593 trillion.”

Tapping into this growing trend will benefit MSMEs in approaching more customers. It enables you to diversify and secure online payments, improves your business cash flow with its support for quicker settlements, and improves operational efficiency through streamlined financial management.

Moreover, a payment gateway also boosts security against fraud, builds customer trust with smooth checkout processes, and you get valuable insights for your organization’s growth and financial opportunities.

In this guide, you will get to know everything step by step in detail. How a gateway works, its features, and its benefits.

Let’s get started!

What is a Payment Gateway?

A payment gateway (PG) is a technology. It connects both customers and merchants with their banks and payment processors for the purpose of transferring payments for an online or in-person purchase. It captures and transmits payment data securely, which is one part of the broader payment processing ecosystem. This assists in shielding sensitive information at every step.

However, an international payment gateway can handle currency conversions and its other processes for individual or your business’s cross-border payments.

What are the Main Implementation Approaches of a Payment Gateway?

It offers the two main implementation approaches, which are as follows:

-

Hosted Gateway

This usually directs a customer to the secure payment page. It is hosted by a third-party service where the customer enters the payment details. The best part of it is to reduce the merchant’s security compliance burden. Once the payment is completed successfully, the buyer returns to the merchant’s website. -

Integrated Gateway

An integrated payment gateway offers you various benefits, like:

- Let customers perform transactions while staying on your App or website.

- Improved customer experience.

The integrated payment gateway, like Wonderpay, provides you with an application programming interface (API) with advantages including:

- Customize payment experience.

- Tailor payment fields.

- Multiple payment options.

- Match to your company’s overall branding.

Also Read: Instant Settlement Payment Gateway In India: Complete Guide

Payment Gateway Vs. Payment Terminal Vs. Payment Processor

The primary distinction between a payment terminal and a payment gateway lies in their intended use. In this section, we will know what both of them are in brief and how they are used.

Payment Terminal

This is a physical device also known as a POS (Point-of-Sale) terminal. It allows retail businesses, restaurants, hotels, and other businesses to accept in-person payments via all methods, including credit/debit cards, contactless methods like NFC-enabled smartphones, QR codes, and payment links.

Payment Gateway

It is used primarily for online transactions. A payment gateway can be integrated into an organization’s existing system, such as on its business website, mobile application, or accounting tools.

Payment Processor

Its responsibility starts when a customer initiates payment to a business. A payment processor facilitates a payment by:

- Authorising.

- Processing.

- Ensures security.

Must Read: Payment Gateway vs Payment Aggregator: Know the Difference

How Does a Payment Gateway Work?

Now that you are clear about the payment gateway’s meaning. In this section, we will discuss how it works in just 7 steps.

Now that you are clear about the payment gateway’s meaning. In this section, we will discuss how it works in just 7 steps.

Step 1: Adding a Payment Gateway

Once your setup is complete, you choose a payment gateway service provider to integrate within your existing system for secure transactions.

A payment gateway like Wonderpay offers you options such as:

- PG API integration that meets your organization’s maximum needs, including branding as required, and payment methods.

- Plugin Integration for Stores Built Using Shopify, WordPress, WooCommerce, or Wix.

- SDK is the best option for a customized experience for both your application and website.

Step 2: Customer Initiates Purchase

The time your customer selects a product or a service over a provider’s mobile application or website. They processed it to a checkout page. The gateway displays multiple payment methods, including UPI, credit or debit card, or digital wallet, as users select an option. It asks them to fill in their credentials, such as a card number or UPI ID.

Step 3: Customer Data Encryption

Within the 3rd step, your entered data is encrypted via the SSL or TLS protocols. This ensures that your data is protected from unauthorized access or theft during transmission.

Step 4: Data Transmission

The data transmission to the business server takes place. It securely stores and forwards customers’ saved data to the payment gateway for the next step.

Step 5: Transaction Details to PG

Gateway receives the forwarded data from the business’s server. Now, it sends the received data to the business’s payment processor, including the acquiring bank. They are a financial institution responsible for processing the payment.

Step 6: Verification

The acquiring bank routes the transaction data to the customer’s issuing bank or the appropriate payment processor. Here, the issuing bank or payment processor verifies the transaction details. It usually includes the customer’s account balance and the validity of the payment method.

Step 7: Transactions Approval or Decline

During verification, the payment processor/issuing bank approves payments. It checks if the details are correct and there is sufficient balance in the customer’s account, then the payment will be completed. In case of insufficient balance, the system declines payments. Regardless of the response, a decline or approval is sent to the business server via the payment gateway and the acquiring bank. This message is also shown on the customer’s display.

Working of a Payment Gateway with a Scenario Example

Think back, and remember how you made your recent online purchase. Here is a scenario putting you in the driver’s seat, and making payments through a payment gateway.

- You visit an online store, it could be a website or app, select a product or service.

- Now, proceed further by clicking buy now.

- Within the third step. It offers multiple payment methods, including UPI, credit/debit cards, e-wallets, and BNPL (Buy Now, Pay Later).

- Now you fill in all the details like card details, UPI, or other options information based on your preference.

- The payment gateway communicates with both the customer’s (issuing bank) and the business’s (acquiring bank). Following all 7 steps as mentioned above, from verifying to proceeding with payments.

Framework of a Payment Gateway

The PG for both online and in-store payments differs based on its uses. We will discuss both of them in brief.

The PG for both online and in-store payments differs based on its uses. We will discuss both of them in brief.

In-Store Payments

A physical store uses a payment gateway, operating it via a card reader device, also known as a POS (Point-of-Sale) terminal. It connects the payment processing network with a secure internet connection.

Online Payments

In order to have seamless online payments. A gateway like Wonderpay is integrated into a business’s website or app using an API (Application Programming Interface). This integration enables your site or mobile application to communicate with the payment processing network and receive responses from the issuing bank (customers).

Suggested Read: How To Choose Best Payment Gateway In India For SaaS

Who Are the 5 Players in the Payment Gateway Ecosystem?

The online payments journey is simple. It travels step by step as we will discuss each point comprehensively. This way, you gain a clear understanding of how it works.

-

Merchants or a Seller

It could be a business or an individual who sells a product or service. To accept online payments from all methods, including credit or debit cards, UPI, e-wallets, etc. A merchant would need a merchant account. It is a specialized bank account to facilitate the receipt of funds from online transactions.

-

Customers

Customers play a key role within the online payment gateway ecosystem. They are the ones who purchase a service or a product from a business and make payments using any of the methods they are comfortable with.

-

Acquirer and Issuer Bank

Both the issuer and acquirer bank plays a significant role in online transactions.

-

Issuer bank

It belongs to the customer. The time a customer enters card/UPI/net banking details, the gateway routes this to the issuer bank to check:

-

Card or account validity.

-

Sufficient balance.

-

Is the transaction genuine? (sends OTP, 3DS, etc.)

Within the third step, transactions are approved if all the information is correct. It declines if the transaction does not pass the security and authorization process.

-

Payment Gateway’s Role

It acts as a middleman between your business website/app, the issuing bank, and the acquiring bank. Its purpose is to transmit the customer’s payment information, handle transaction authorizations, and ensure secure settlement of funds to the merchant’s account.

-

Payment Processor’s Role

The processor plays a crucial role, while being behind the scenes. It handles the connections between the payment gateway, the merchant’s bank (acquirer), and the customer’s bank (issuer). This system operates smoothly in conjunction with a payment gateway, which securely and efficiently checks and routes each transaction.

Top 4 Security Practices a Payment Gateway Implements

A gateway such as WPay implements the advanced security measures. Therefore, a customer’s sensitive data is encrypted using the most secure techniques.

Let’s check out all the security practices that a PG implements.

-

HTTP Protocols: A gateway transition takes place through HTTPS (Hypertext Transfer Protocol Security). This makes sure that the entire data transmitted over the web is encrypted and secure.

-

Transaction Validation: It checks whether the transaction is genuine or not. The gateway and merchant use a secret key.

-

Verifies IP: One of the best practices that enhances a payment gateway process by verifying the computer’s address (IP), and if any suspicious activity is detected, it blocks the same.

-

Virtual Payment Authentication: This process includes the extra password (3D Secure). You may have received an OTP while making online purchases. This is an additional security measure to ensure that only you complete the payment.

What Are the Benefits of a PG for Businesses?

An organization from any industry can leverage a payment gateway for comprehensive payment management. It does not matter whether your business operates online or offline.

In this section, we will discuss all significant benefits in detail, providing examples and personal experiences.

Improve your business cash flow

E-commerce has become a significant part of the retail industry. Whether it is about buying or selling, both have transformed a lot with the rise of the internet. This digitization offers convenience for online shopping.

With over 5 million internet users worldwide, the number of online shoppers is increasing. Therefore, the number of retail e-commerce sales is estimated to exceed 4.3 trillion 4.3 trillion U.S. dollars worldwide. It will continue to exceed in the coming years.

This is an excellent opportunity for businesses everywhere to provide their customers with an improved experience to buy from their website or use a mobile application. They can select a product or service and proceed to the checkout page to pay using all available online or in-store options.

Build Customer Trust

You build your brand image by implementing a plethora of practices, from creating content to approaching targeted customers by educating them, and much more.

The time you deploy a feature-rich, secure, and trusted gateway - one that manages a sensitive task like online payments. There, you hook your customers to make an immediate payment without worrying about the data.

International Reach

Is your business outside your home country? Are you a freelancer? The international payment gateway is a great option for you. It adds value to do business across the border. This service will enable you to accept all your payments securely and efficiently without the worry of currency exchange.

Additionally, you can mitigate the risk of losing money or being defrauded with the help of escrow. It works as a middleman between both parties and holds the amount in a temporary account until certain conditions are met.

Example: you worked as a freelancer for your client. The time worked is completed at that time, and escrow will ensure both parties (you and the client) are satisfied. Then the hold amount will be released.

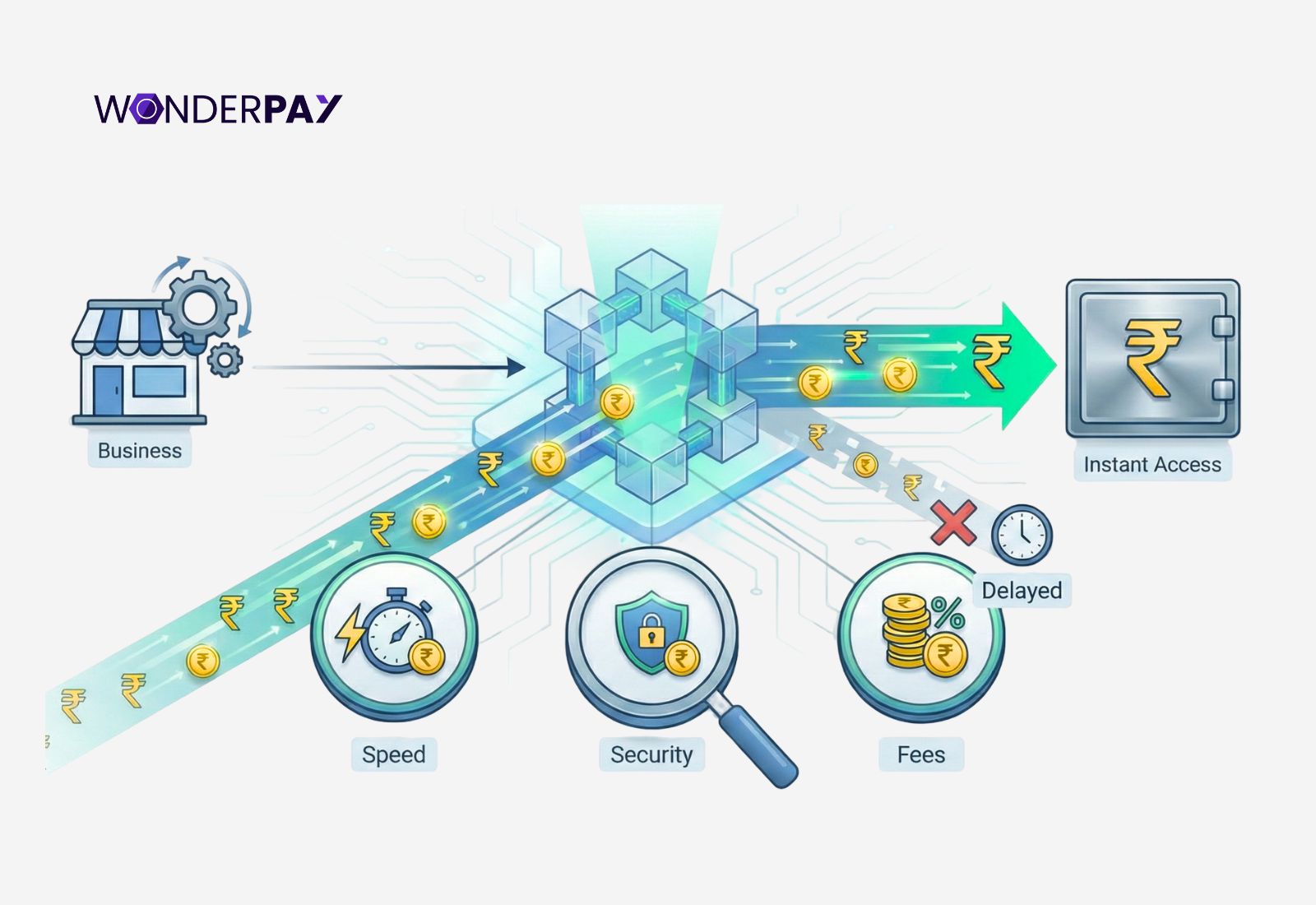

Faster Transactions

One of the best parts you will love a lot about a payment service via a gateway is to automate and optimize the entire process, from real-time authorization and security checks to secure data transmission and efficient settlements.

This entire process takes place while minimizing errors and providing high uptime without any disturbance. It is achieved with the help of encryption and fraud detection to secure data, direct connections to banks for swift approval, and features including one-click payments and smart routing to streamline the customer experience.

Ease of Accessibility

The gateway services allow individuals and businesses from any industry to accept payments as they require.

-

Do you sell on social media? If so, you can accept payments with no integration and without a website, app, or hosting it anywhere. A gateway allows you to create a payment link and accept any payment securely. You also build trust with a convenient experience for you and your customers.

-

Have a website, store, or app? You can just get the API and integrate it into any of your existing systems, including a CRM (customer relationship management) or accounting software.

-

Let your customers pay from anywhere with any method: A gateway goes beyond locations and payment methods. It allows you to get all your amounts easily without any barriers.

Reconciliation

Reconciliation enables you to automatically track transactions. It offers you various benefits and avoids manual reconciliation prone to errors, especially when you have to handle large transaction volumes, multiple payment methods, and settlements from different banks.

It helps your organization with:

- Automated tracking of transactions.

- Unified view across payment methods.

- Faster settlement verifications.

- Reduces financial leakage.

- Improves cash flow accuracy.

- Compliance and audit readiness

Easy to Use

Businesses face various challenges while being on a busy schedule. Therefore, an online payment management software offers you an easy-to-use solution. It manages all your online and in-person payments without the need for any special skills to use the payment gateway.

Anyone can operate this software to accept and disburse your payments for any purpose as you need.

Anytime Anywhere Access

Whether you are in a Tier 1 or 2 city, the software is designed for all types of individuals or businesses. It enables you to manage all your payins or payouts to anyone at any time and anywhere.

For All Industries

What business and industry are you in? It does not matter! You can start using a payment gateway immediately. This comprehensive platform is designed to align your business with the rapidly growing digital economy.

The best part you will like is its customization to meet your business’s exact requirements. It allows you to align it with your brand guidelines and payment requirements.

Gain Valuable Insights

Who wouldn’t need insights from huge payment data? You can make an informed decision for your business. To know what payment methods are frequently used, who your customers are, and what their behaviour is, and more.

Also Read: Why Choose Wonderpay Payment Gateway In India for Businesses

How Much Does a Payment Gateway Cost?

The cost to the payment gateway varies by providers and their fee structure. However, it may include charges on a percentage-based transaction fee (Merchant Discount Rate or MDR).

You can also get an idea with the breakdown as follows:

Consider payment gateway charges

- Setup Fee

- Maintenance or Annual Fee

- Transaction Charges

- Additional Charges

What Are The Significant Payment Gateway Security Features?

Security starts with a strong system. Therefore, a payment gateway in India, such as Wonderpay, comes with the best practices a business needs. Here, we will discuss the significant security features you must consider.

Tokenisation

The time a customer makes a payment using a card on a merchant website or app. It replaces the card’s sensitive details, such as the number, CVV, and expiry date, with an encrypted code known as a token.

Fraud Prevention

Gateways come with an advanced fraud detection tool. It helps everyone to prevent suspicious activities by analysing transaction patterns and behaviors in real time. This makes it the best option to use an online payment management system without any worries.

PCI DSS Compliant

PCI DSS (Payment Card Industry Data Security Standard) is a set of mandatory security standards designed to protect credit and debit cardholder data from any unauthorized activities. It includes the organizations that usually process, store, or transmit their customers’ card data.

White Label Wallet

It is a reliable, efficient, and cost-effective solution for companies. It allows your customers to add money to their wallet while on your platform and make secure and effortless payments for whatever they purchase. Additionally, you can rebrand it to meet your organization’s brand guidelines.

3DS Authentication

3DS is one of the best security measures. It is an extra layer of security for the online transactions via debit or credit card after a customer enters the payment details.

Also Read: 10 Security Standards for Businesses | Payment Gateway in India

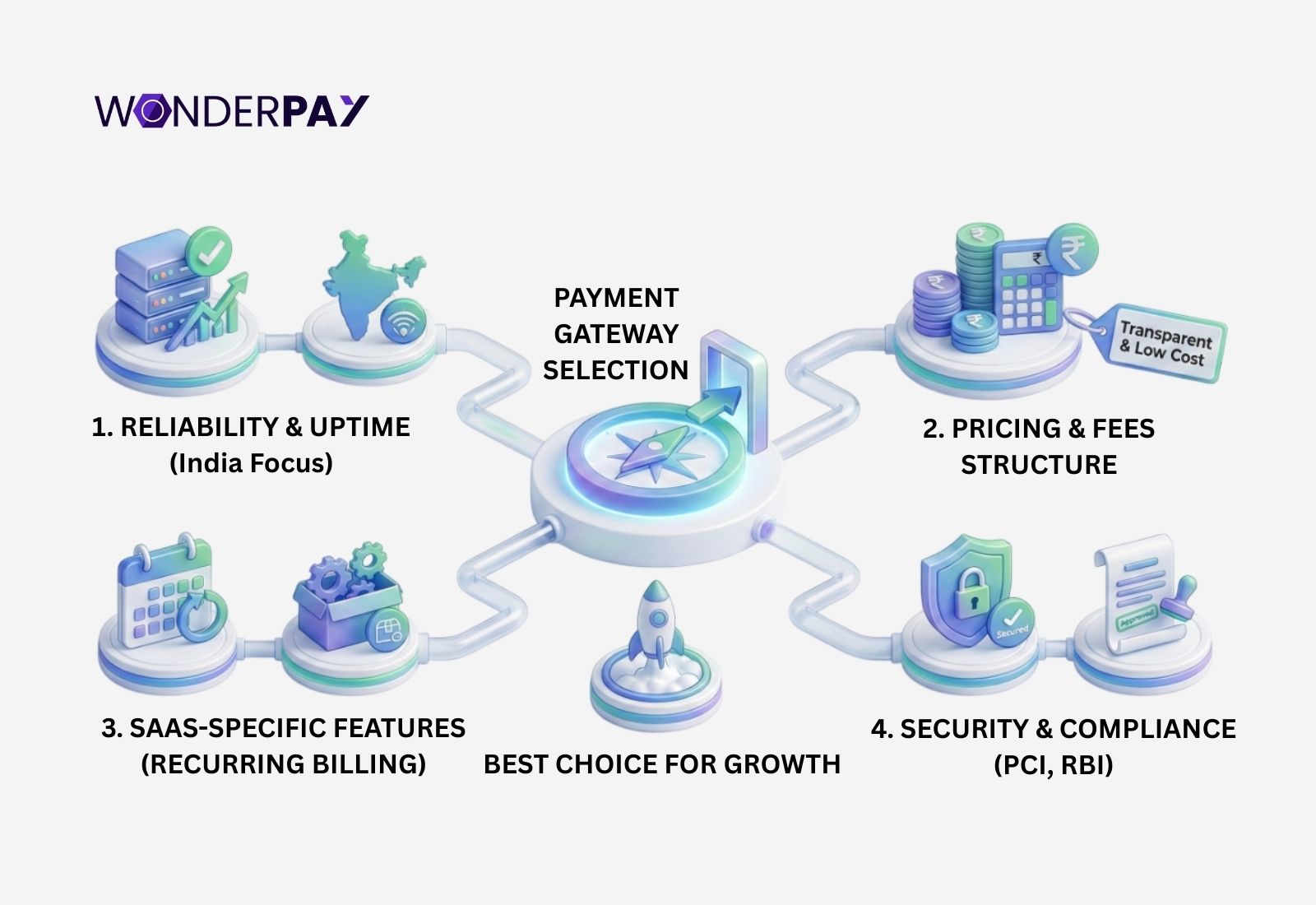

How to Choose the Right Payment Gateway in India?

There are several key factors you must consider to get started with the right payment gateway in India. Check all the facts in brief discussed below:

What are your business needs?

You need to be clear first to know what exactly you want a PG to solve. It will help you determine what you should be looking for before you finalize the gateway for your retail or any other business.

You can check out points like:

- What does it cost you, including its fees?

- Does it support payment methods such as credit/debit cards, RuPay, MasterCard, UPI, and net banking?

- Check whether it provides options like EMI for high-value purchases.

- Easy integration while having multiple options that meet your requirements as you need, like API, SDK, or plugin option to integrate into your website or app.

- Implements security and fraud protection practices, including PCI DSS.

- It should provide your business customers with a seamless user experience to have a smooth checkout and be responsive to use on both PC and mobile.

- Meets your business needs, like being scalable, and has an analytics option to provide you with insights.

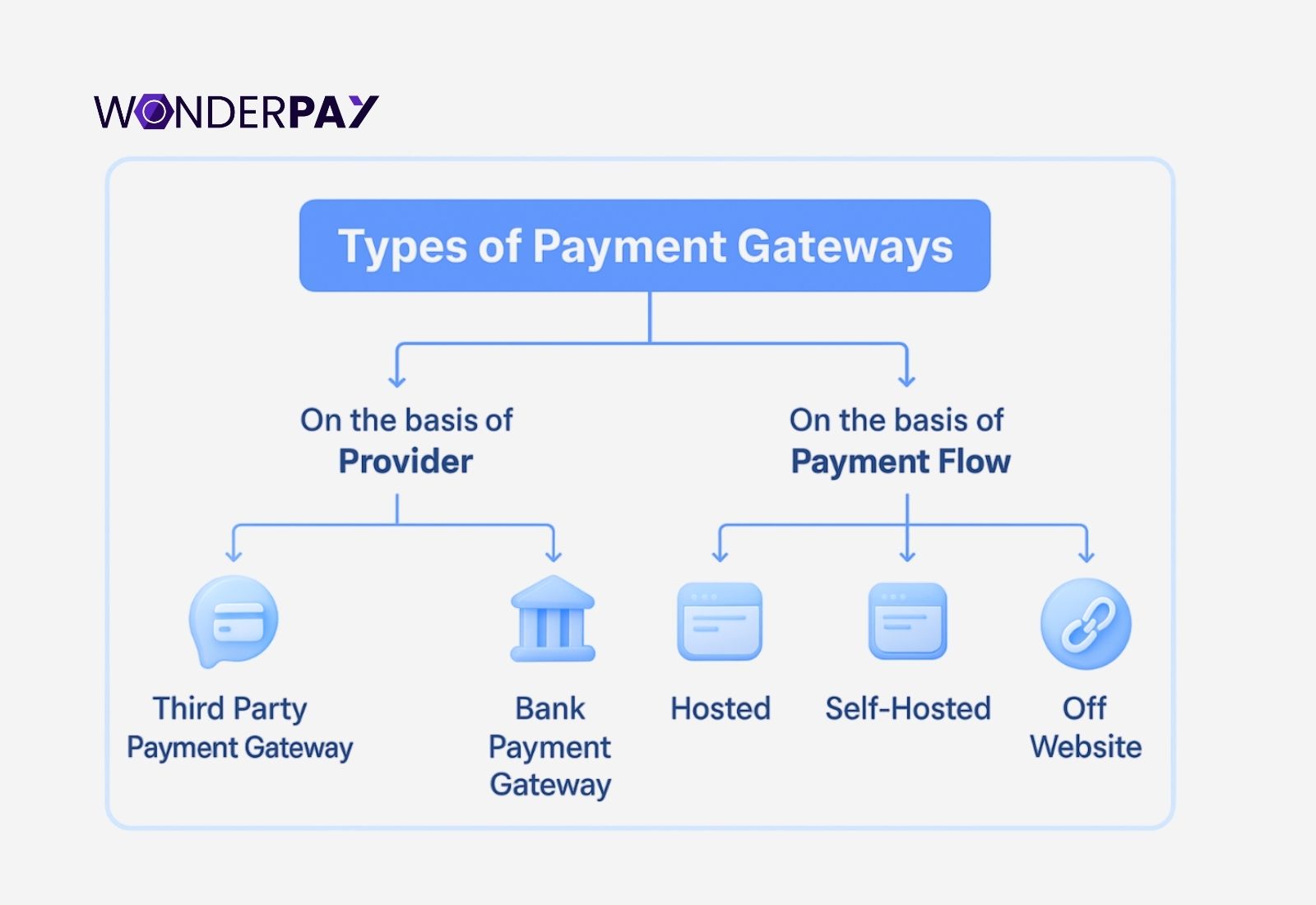

Types of Payment Gateway You Should Know

Typically, there are 4 types of payment gateways. They can be used based on a business’s requirements. The table includes the types and their working brief.

| Types of PG | How do they work? |

|---|---|

| Hosted gateways | A third party usually provides it. Redirects to the payment service provider’s platform. Easy to integrate. Less control over the customer’s experience. |

| Self-hosted gateways | Transaction data is collected on your organization’s website. Get access to the checkout process and customer experience. Comply with PCI DSS. Get a full, customized payment experience. |

| API hosted gateways | It offers you a simple checkout process on your app or website. This gateway collects the payment details through the API. To ensure a smooth customer experience. However, you will need a secure cardholder data environment to meet data protection standards. |

| Local bank integration | It connects with a bank’s own payment platform. These types of gateways are worth it for a company that is targeting customers in a specific region or country for the purpose of building trust in the targeted audience’s region. |

Suggested Read: Types Of Payment Gateways In India & How To Choose Right One

Why Choose Wonderpay Payment Gateway?

Wonderpay, one of the trusted payment gateway companies in India, provides you with a high degree of customization. It meets your specific business requirements and drives you with a fully compliant, easy-to-use, scalable, and cost-effective solution.

We have been in the fintech industry for a long time, and deliver a user-centric solution that your company needs to grow, and manage all online payments like a pro in your industry.

Key highlights of WPay

- Compliant platform as we follow all RBI and PCI DSS guidelines.

- Easy-to-use platform.

- Cost-effective (competitive pricing).

- 100% customizable.

- Support all payment methods.

Summary

Hope you have a crystal clear understanding of “what is a payment gateway”, its working, and how it benefits a business in the growing digital era. In order to organize all their online and in-store payments in an efficient and smarter way.

This growing solution of a gateway is a lucrative opportunity for businesses. To improve their cash flow, manage payments effectively, gain valuable insights, build trust, and foster a loyal customer base.

Connect with one of the trusted payment gateway companies in India, Wonderpay, and level up in the rapidly growing digital era now.

FAQS:

1. What is the difference between a Payment Gateway and a Payment Processor?

A payment gateway is a technology. It securely connects the front end that collects, encrypts, and sends a customer’s payment details to the processor. Understand it as a bridge between all parties involved in the transaction. It enables the exchange of information to proceed with payments.

On the other side, a processor, an entity, or a service. Its work is to facilitate electronic transactions between the customer and the business. Its name suggests its job is to process. It authorizes credit/debit cards and other digital payment methods.

2. How long does it take to set up the Wonderpay payment gateway?

There are two phases: the first is onboarding, and the second is integration. Onboarding involves submitting documents and verifying your account. It may take 24 hours to onboard a business for their payment management.

3. What’s the difference between a payment gateway and a payment terminal?

Both the payment gateway and terminal are different. A terminal is a physical device also known as a POS (Point of Sale). It enables merchants to accept in-person payments. On the other hand, a payment gateway is a virtual technology. It facilitates online transactions on a business’s own website or app using all digital payment methods online.

4. How Does a Payment Gateway Benefit My Business?

It comes with various benefits, including.

- Improving your business cash flow.

- Accept payments from all methods.

- Build brand trust.

- Get customer insights to make informed decisions.

- Reconcile.

- Multi-currency support.

- Accept international payments.

- High-level security.

-

What is a UPI payment gateway?

It is a digital service. It acts as a middleman to let businesses accept payments from their customers using the Unified Payment Interface (UPI). The best part of it is to facilitate real-time money transfer from the customer account to the merchant.

-

How does a Payment gateway keep information secure?

There are multiple data protection practices a PG deploys. It includes encryption, replacing sensitive data with an unreadable token through tokenization. Moreover, it verifies transactions with tools such as CVV/CVC checks and 3D secure protocols - including real-time fraud monitoring and IP address verification to detect suspicious activity and have strict compliance like PCI DSS.