- 1. What Is PCI DSS Compliance?

- 2. How Does PCI DSS Make Business Transactions Secure?

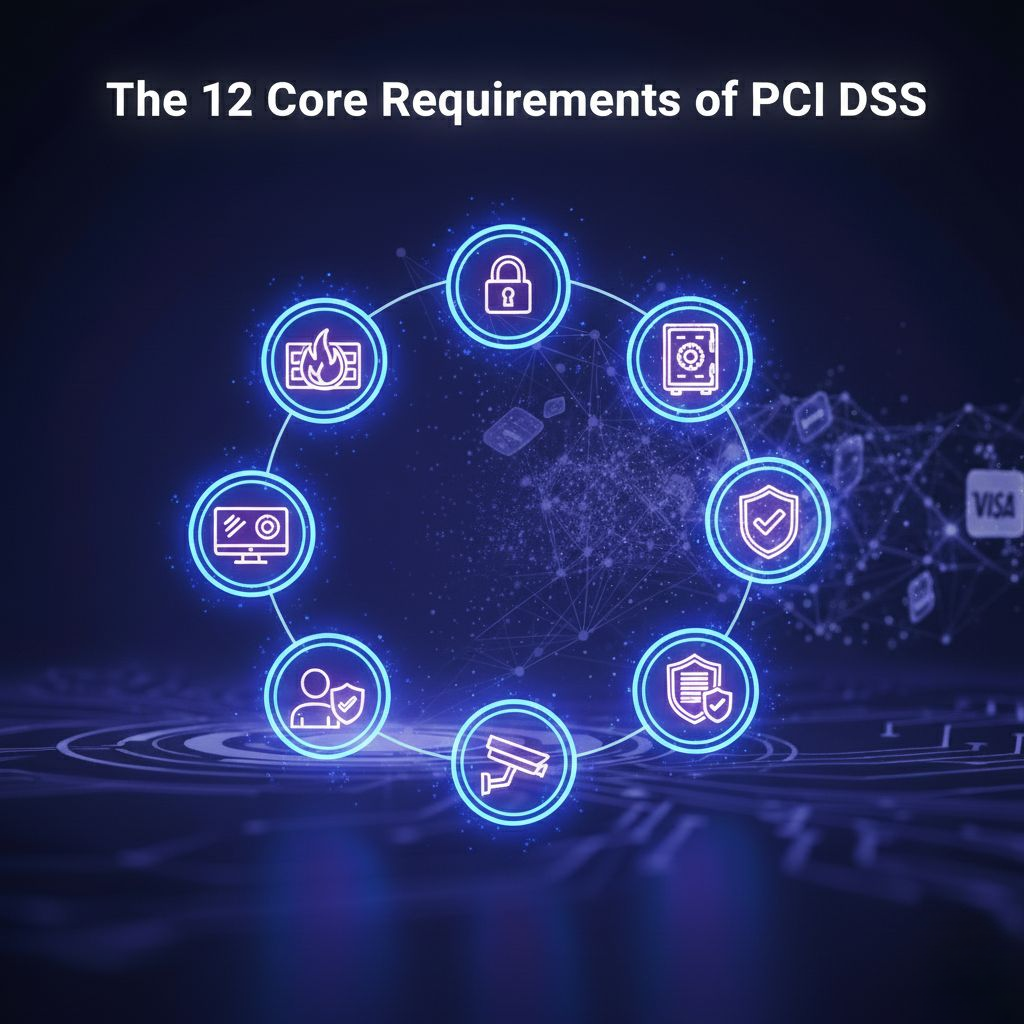

- 3. The 12 Core Requirements of PCI DSS

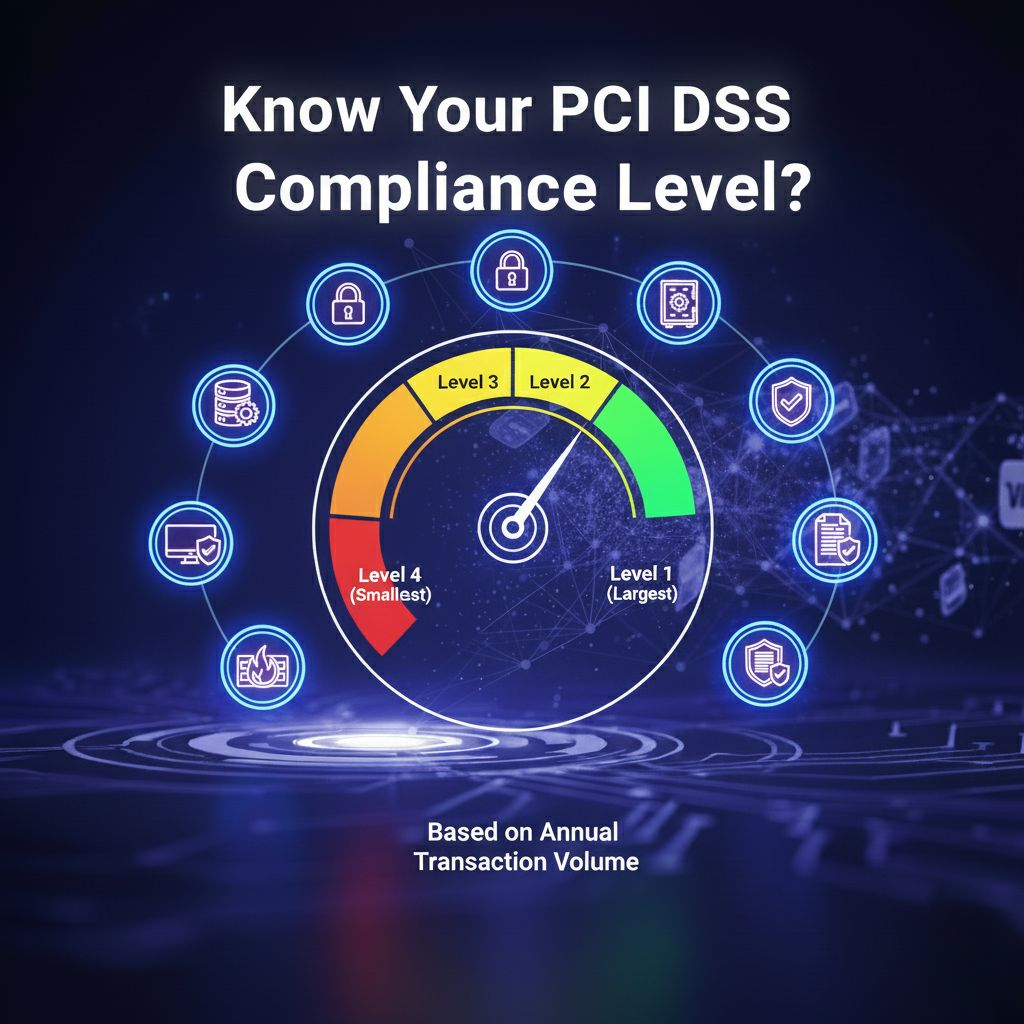

- 4. Know Your PCI DSS Compliance Level?

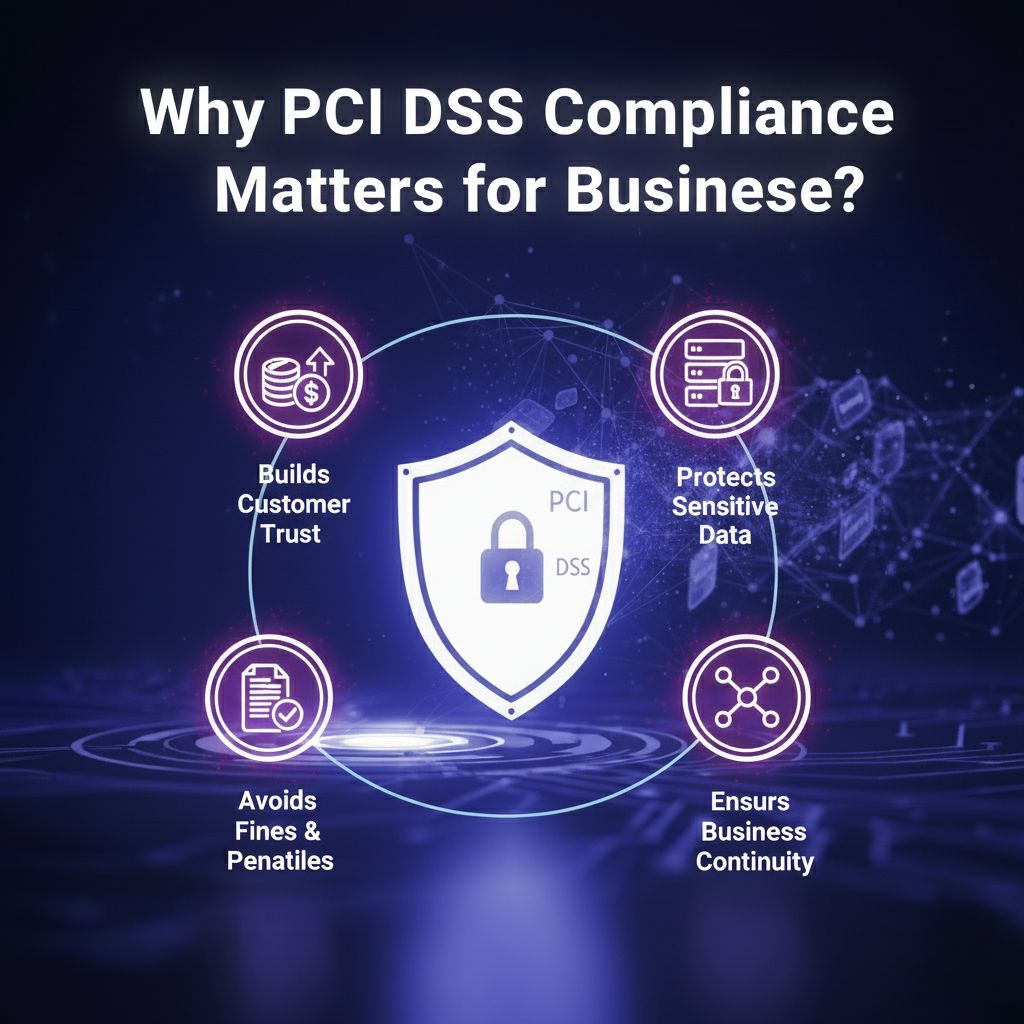

- 5. Why PCI DSS Compliance Matters for Businesses?

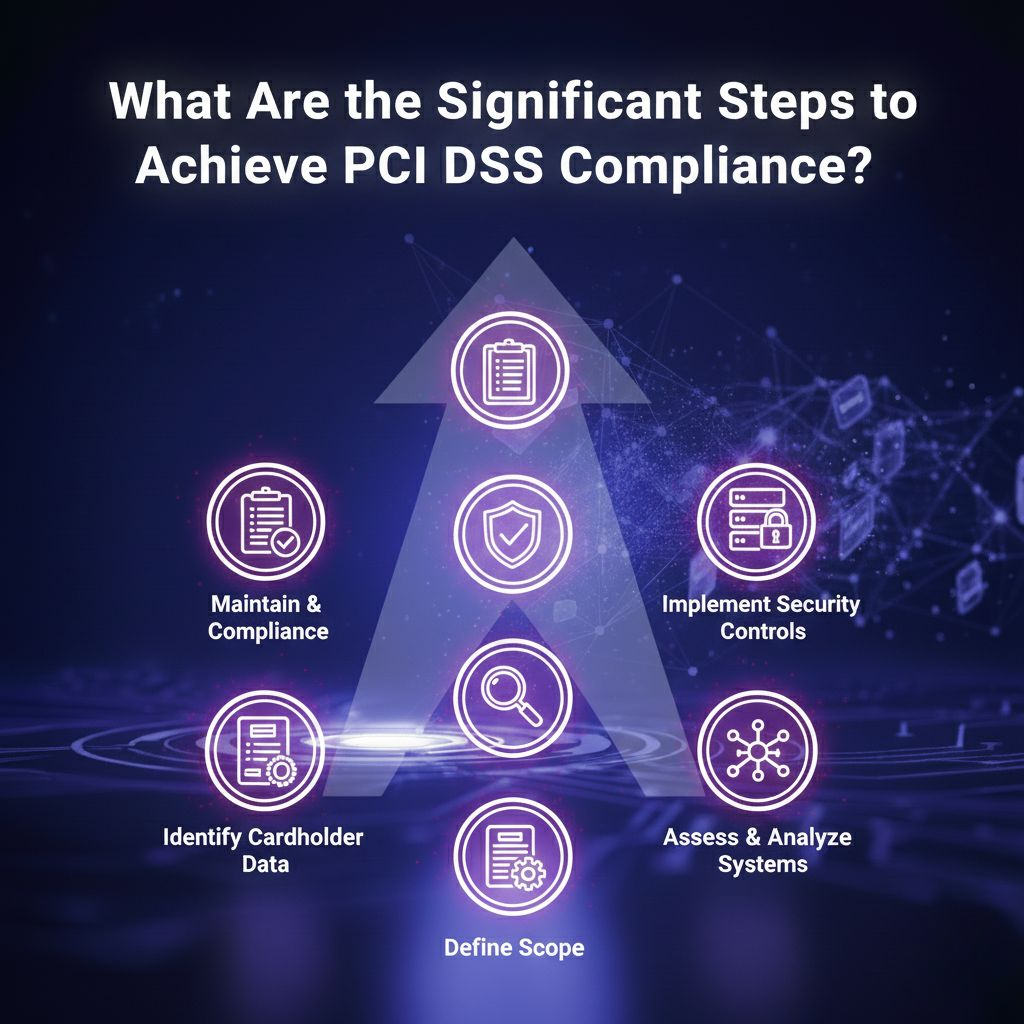

- 6. What Are the Significant Steps to Achieve PCI DSS Compliance?

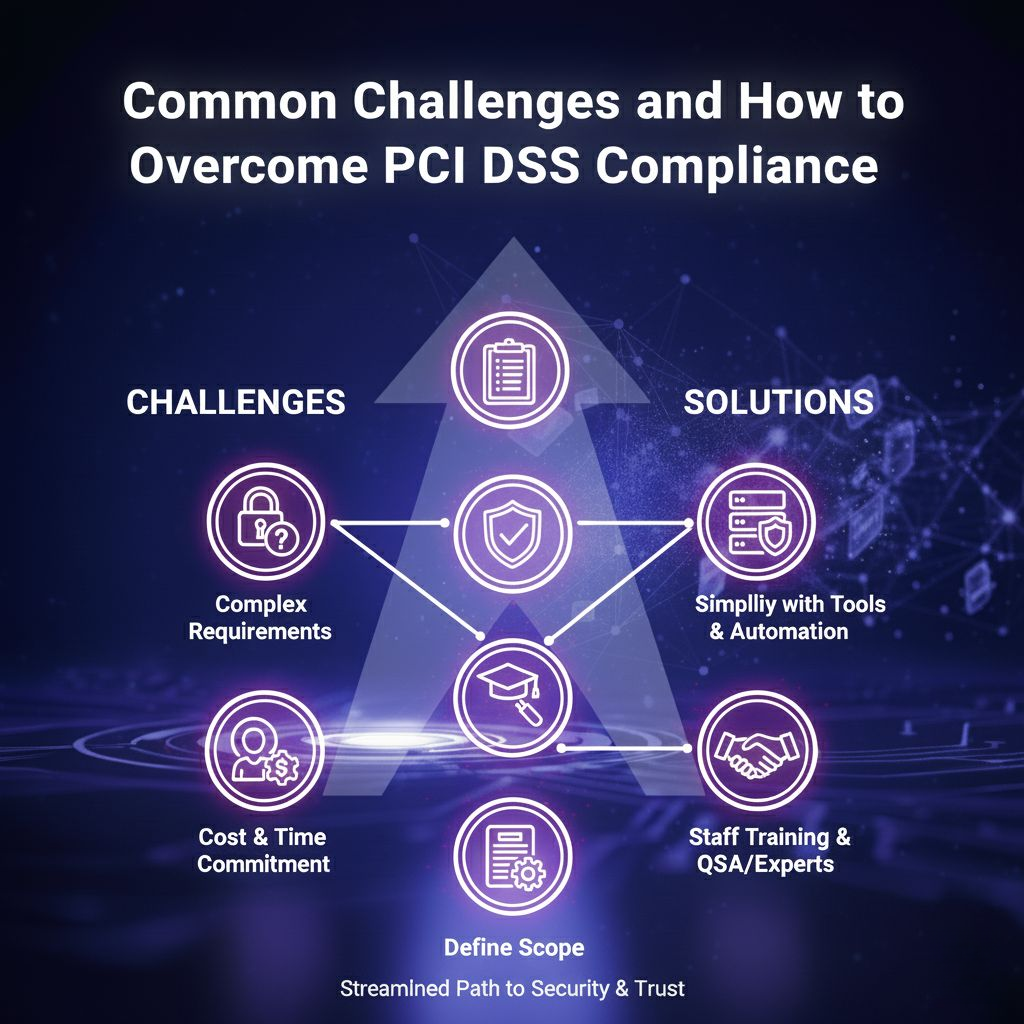

- 7. Common Challenges and How to Overcome PCI DSS Compliance

- 8. The Role of Payment Platforms in Facilitating Compliance

- 9. FAQs:

- 10. Conclusion

Imagine processing hundreds of customer payments daily, only to discover a data breach compromising sensitive card information.

According to the PCI Security Standards Council. The data types compromised in breaches are 22% card track data, 18% card-not-present (e-commerce transactions), and 16% financial and user credentials.

The increasing number of cyber threat attacks has made it crucial for merchants and service providers. In order to seek a PCI DSS compliance gateway to strengthen their security, build customer trust and protect against data breaches as well as financial penalties.

PCI DSS, is an internationally accepted security standard. It ensures businesses handle sensitive cardholder data securely. This framework for enterprises implements robust security measures to prevent data violations and fraud, and establish customer trust.

The payment security standards are compulsory for all organizations that store process or transmit cardholder data.

This comprehensive guide, will discuss PCI DSS compliance and its role in securing customer transactions.

Let’s get the ball rolling.

What Is PCI DSS Compliance?

PCI DSS full form is “Payment Card Industry Data Security Standard”. It is a set of security standards designed to protect cardholder data and sensitive authentication data by ensuring that all businesses processing, storing, or transmitting credit card information maintain a secure environment.

PCI DSS full form is “Payment Card Industry Data Security Standard”. It is a set of security standards designed to protect cardholder data and sensitive authentication data by ensuring that all businesses processing, storing, or transmitting credit card information maintain a secure environment.

The major card brands, including Visa, Mastercard, Discover, JCB (Japan Credit Bureau), and American Express, enforce payment security standards.

How Does PCI DSS Make Business Transactions Secure?

Payment Card Industry Data Security Standards work in 5 easy ways. It ensures that business users make transactions securely. This step-by-step process will help clear your doubts about integrating a PCI-compliant payment gateway for your business’s digital payments.

Payment Card Industry Data Security Standards work in 5 easy ways. It ensures that business users make transactions securely. This step-by-step process will help clear your doubts about integrating a PCI-compliant payment gateway for your business’s digital payments.

#Step: 1. Secure Network and System Protection

-

Firewall and secure network configuration: The PCI DSS mandates the use of a firewall and a secure network configuration that ensures the restriction of unauthorized access to your business users’ data.

-

Malware Protection: Ensure your company implements and regularly updates anti-virus software and other malware prevention measures to protect systems and networks.

-

Secure system and application: PCI DSS requires organizations to develop and maintain secure systems and applications to eliminate vulnerabilities and avoid data breaches.

#Step: 2. Protects Cardholder Data

-

Encryption: The PCI DSS, Payment Card Industry Council mandates the encryption of cardholder data during transmission and storage to avoid unauthorized access and breaches.

-

Access to Data: Businesses must restrict access to cardholder data based on a need-to-know principle. However, Wonderpay provides a virtual account number to your business. This will help you mitigate the risk of accessing your customers’ sensitive data.

-

Secure Storage: PCI DSS compliance for small businesses needs businesses to store cardholder data securely, using encryption or other data protection methods, and preventing unauthorized access to, and modification of, the data.

#Step: 3. Data Transmission Security

- Secure Data Transmission:

The Payment Card Industry requires companies to encrypt cardholder data during transmission across open, public networks to prevent interception and ensure data integrity.

#Step: 4. Regular Testing and Monitoring

-

Regular security testing: The PCI DSS requires businesses to test their security systems and processes regularly, including vulnerability scans and penetration testing, to identify and address potential weaknesses.

-

Ongoing monitoring: Organizations are advised to continuously monitor access to network resources and their users’ card data to detect and respond to security threats promptly.

#Step: 5. Information Security Policy

- Maintain an information security policy:

Businesses must have an information security policy that outlines security practices and procedures for managing cardholders’ information.

The 12 Core Requirements of PCI DSS

The 12 core requirements of PCI DSS are like goals that you have to consider. In order to secure cardholder data.

The 12 core requirements of PCI DSS are like goals that you have to consider. In order to secure cardholder data.

| Why implement PCI DSS? | PCI DSS Requirements |

|---|---|

| The goal is to build and maintain a secure network and systems. | Install and regularly maintain a firewall configuration to protect cardholder data. Avoid using vendor-supplied defaults, whether for system passwords or other security parameters. |

| Shield cardholders’ information. | Shield the stored data of the cardholder. Businesses need to encrypt the transmission of cardholder data across public networks. |

| Maintain a vulnerability management program. | Use and regularly update anti-virus software or programs. Develop and maintain secure systems and applications to ensure optimal security and reliability. |

| Implement strong access control measures. | Access to cardholder data should be restricted to individuals who require it for business purposes. Ensure all access to system components is identified and authenticated. |

| Monitor and test networks regularly. | Limit physical access to cardholder data to authorized personnel only. Implement a tracking and monitoring mechanism for all access to network resources and cardholder data to ensure compliance with regulations. |

| Maintain an information security policy. | Conduct regular testing of security systems and processes to ensure effectiveness. Establish and maintain an information security policy that applies to all personnel. |

Know Your PCI DSS Compliance Level?

A merchant’s PCI DSS compliance is determined by the number of card transactions processed annually. Below is a detailed discussion to provide a better understanding of your Payment Industry Data Security Standard level.

A merchant’s PCI DSS compliance is determined by the number of card transactions processed annually. Below is a detailed discussion to provide a better understanding of your Payment Industry Data Security Standard level.

Level: 1

Merchants processing over 6 million card transactions annually come under Level 1.

Level: 2

If you make annual card transactions between 1 and 6 million, you are classified as level 2.

Level: 3

20,000 and 1 million card transactions annually are classified as level 3.

Level: 4

Merchants processing 20,000 card transactions annually are identified as level 4 within PCI DSS compliance.

Must Read: What is Payout? Process & Benefits.

Why PCI DSS Compliance Matters for Businesses?

Payment card industry data security standards compliance is essential for each and every businesses that process, store, or maintain cardholder data. So the it can help in minimize financial and reputational risks. This section will discuss all the PCI compliance benefits of implementing the Payment Card Industry Data Security Standard.

Payment card industry data security standards compliance is essential for each and every businesses that process, store, or maintain cardholder data. So the it can help in minimize financial and reputational risks. This section will discuss all the PCI compliance benefits of implementing the Payment Card Industry Data Security Standard.

-

Data Breach Prevention: Aims to avoid data breaches by setting security requirements for organizations that handle cardholder data. All these requirements encompass areas such as network security, system and application development data protection, access control, and security testing.

-

Customer Trust: PCI DSS compliance India significantly impacts customer trust by ensuring their payment card data is handled securely. Companies that demonstrate compliance build a trusted relationship with their customers enabling them to make payments using their cards with confidence. Thereby allows concerns about data breaches and fraud. The best part of this compliance is to gain customer loyalty and repeat business.

-

Avoid Penalties: Why should your business face liabilities and spoil its brand reputation? Your organization can avoid being liable in the future by:

- Prioritizing strong security measures.

- Firewalls.

- Strong password policies.

- Data encryption.

- Regular security assessments.

- You can also train your employees on security best practices.

- Ensure that third-party vendors comply with the PCI DSS.

- Competitive Advantage: If you want to stand out in a competitive market. PCI DSS compliance services will be a competitive advantage for businesses like yours. This will make you stand out of the box by fostering customer trust, mitigating risks, and enhancing cooperative efficiency.

Additionally, PCI DSS helps build strong client relationships, reduce the risk of costly breaches, and even attract new business opportunities.

What Are the Significant Steps to Achieve PCI DSS Compliance?

Businesses can achieve compliance by implementing the 12 core PCI DSS requirements assessing their scope of compliance, implementing necessary security controls, and, regularly testing and monitoring systems and processes.

Businesses can achieve compliance by implementing the 12 core PCI DSS requirements assessing their scope of compliance, implementing necessary security controls, and, regularly testing and monitoring systems and processes.

- Assessment:

- Identify cardholder data: You can identify cardholder data, and make it easy for you to take inventory of IT assets, and business processes for payment card processing.

- Inventory IT Assets: Create an inventory of all IT systems like applications and business processes that, handle payment card information.

- Vulnerability Analysis: Analyze identified IT assets, including business processes for potential vulnerabilities one that could expose cardholder data.

- PCI Readiness Assessment: Conduct a PCI readiness assessment. In order, to understand the current risks in the environment and how closely the organization aligns with PCI DSS requirements.

- Remediation:

- Vulnerability Readiness: Fix vulnerabilities and eliminate storage of cardholder data unless necessary.

- Get Rid of Unnecessary Data Storage: You can delete the cardholder data storage unless it is essential.

- Implement Secure Business Processes: It is advisable to follow secure business processes to minimize the risk of future data breaches.

- Reporting:

- Self-Assessment Questionnaire: If you are eligible for PCI DSS certification you can complete the self-assessment questionnaire (SAQ). In order, to document your compliance.

- Report on Compliance: If your organization has a higher volume of transactions or complex environments. Therefore, you may need to engage a Qualified Security Assessor (QSA) for a Report on Compliance (ROC).

- Continuous Monitoring: Regularly test security systems,, and processes you should also maintain an information security policy.

The above PCI DSS compliance checklist makes it easy for your organization to align with the rules and regulations.

Common Challenges and How to Overcome PCI DSS Compliance

You may implement the PCI DSS compliance, which will benefit your business in various ways to build trust, make good relations with your business’s targeted customers, have loyal customers, and more. But what about the challenges to deploy PCI DSS compliance?

You may implement the PCI DSS compliance, which will benefit your business in various ways to build trust, make good relations with your business’s targeted customers, have loyal customers, and more. But what about the challenges to deploy PCI DSS compliance?

Do not worry! This section will discuss the challenges you may experience, and how to overcome them.

-

Resource Constraints: Many businesses lack dedicated IT teams which should be responsible for managing security operations, and mitigating potential liabilities.

- Solution**:** You may consider outsourcing to qualified security assessors (QSAs) or using managed security services as well.

-

Complexity of Standards: Understanding, and implementing all 12 requirements can be daunting so what should you be doing then?

- Solution**:** You can break down the requirements into manageable steps and prioritize based on risk assessment.

-

Maintaining Compliance: One thing to consider is that compliance is not a one-time event, but rather a continuous effort.

- Solution: If you want to overcome or maintain compliance, you can implement continuous monitoring tools and regular staff training.

The Role of Payment Platforms in Facilitating Compliance

Wonderpay, facilitates compliance to ensure secure transactions prevent fraud, and, adhere to regulations like PCI DSS. Our team at WPay implement it through features such as encryption, fraud detection, and secure data handling, all while managing the risks associated with online transactions.

Wonderpay, facilitates compliance to ensure secure transactions prevent fraud, and, adhere to regulations like PCI DSS. Our team at WPay implement it through features such as encryption, fraud detection, and secure data handling, all while managing the risks associated with online transactions.

-

Integrated Solutions: Wonderpay’s integrated solution streamlines compliance for businesses by taking responsibility for security-sensitive payment data and adhering to significant regulations, including PCI DSS, GDPR, and PSD2.

You can achieve a complete solution by eliminating the need for businesses to handle payment information directly, thereby reducing the risk of data breaches and the burden of compliance requirements. -

Automation: Our PCI DSS payment gateway helps you automate and manage payment processes, monitor transactions, generate reports, and enforce security protocols. As you begin using this platform, it will help you streamline operations, reduce manual efforts, and enhance security by identifying and mitigating risks in real-time.

-

Support, and Resources: You get expert guidance, and up-to-date compliance information, particularly regarding payment card industry data security standards such as PCI DSS compliance, and other regulatory requirements.

- You will get built-in security features.

- Risk mitigation strategies.

- You get resources to help you stay informed and compliant.

Also Read: What is a Payment Gateway? Features, Benefits & How Does It Work?

FAQs:

What are the 4 levels of PCI compliance?

The PCI DSS council determines a merchant’s PCI level based on the volume of card transactions a merchant processes annually. All four levels dictate the specific requirements and procedures a merchant must follow to maintain PCI DSS compliance.

What are the 12 requirements of PCI DSS compliance?

The 12 requirements of PCI DSS aim to shield cardholder data. It includes:

- Install and regularly maintain a firewall configuration to protect corporate data.

- Avoid using vendor-supplied defaults, whether for system passwords or other security measures.

- Protect the cardholder data.

- Encrypt the transmission of cardholder data across the open public network.

- Use and regulate an updated antivirus software program.

- Develop and maintain secure systems and applications to ensure optimal security and reliability.

- Access to cardholder data should be restricted to individuals who require it for business purposes.

- Ensure all access to system components is identified and authenticated.

- Ensure to have limited access to cardholder data to authorized personnel only.

- Implement a tracking and monitoring mechanism for all access to network resources and cardholder data to ensure compliance with regulations.

- Conduct regular testing of security systems and processes to ensure effectiveness.

- Establish and maintain an information security policy that applies to all personnel.

What is the PCI DSS compliance program?

The PCI DSS is a global security standard designed to protect cardholder data during transactions. It contains a set of requirements for organizations to ensure a secure environment. The Payment Card Industry Security Standard Council (PCI SSC) is responsible for managing and developing the standards.

Who needs PCI DSS compliance?

PCI and DSS compliance is required for any organization that stores, processes, or transmits cardholder data. It includes credit and debit card numbers, expiration dates, and security codes. Additionally, this includes merchants, payment processors, acquirers, issuers, and service providers, based on their size and the transaction volume they handle.

What does PCI stand for?

The separate meaning, along with PCI DSS, full form PCI stands for Payment Card Industry, with another abbreviation, “DSS”, Data Security Standards. If we see the complete information. It will be “Payment Card Industry Data Security Standard” with a payment gateway solution.

Is PCI DSS compliance mandatory?

Yes, all businesses that are involved in online transactions between them and their customers. They all need to implement the compliance set by the PCI Security Standards Council. If not, the organization can face the PCI DSS non-compliance fee. A financial penalty charged by payment processors to businesses that failed to comply with the practices (PCI DSS requirements).

What are the key requirements in PCI DSS compliance documentation?

The key requirements it includes are as follows:

- Installing and maintaining firewalls

- Protecting cardholder data by encrypting it during transmission.

- Using anti-virus software

- Unique IDs and restrictive passwords

- Mentioning PCI DSS certification

Conclusion

By now, you understand the PCI DSS compliance meaning and how crucial it is to your business. Whether you are a business owner or a key stakeholder, maintaining secure transactions is essential for earning customer trust and building long-term loyalty.

Introduce secure card payments to your customers, prevent fraud, and protect your business from data breaches that could damage your brand’s reputation.

Wonderpay is your one-stop solution. Our PCI DSS-compliant payment gateway supports pay-ins, pay-outs, instant settlements, free UPI collections, and more—all designed to keep your transactions safe and seamless.

Get in touch with our team today to safeguard your business and ensure uninterrupted operations with a payment gateway you can trust.