Have you ever paid someone in bulk? If you are the one who is in search of exploring bulk payments. This blog post will help you find answers to all your questions. Continue to read and explore digital payments in detail.

The payments in bulk drive a company with the flexibility to make things simple and effective enough, as this solution comes with various benefits, including quick payments, easy to use, and secure.

If you are seeking the top solution for your organization that manages all your payouts easily. Continue to read and find out all the points you need to explore for bulk transactions.

Let’s get started!

What Is a Bulk Payment?

The bulk payments or bulk payment processing is to make payments to a group of people, like a company’s employees, cashback to an e-commerce store’s customers, etc. Bulk payment allows you to send money quickly with just a click.

It comes with a number of benefits, such as saving your time in sending payments, automating, sending confirmation for the payments, and reconciliation.

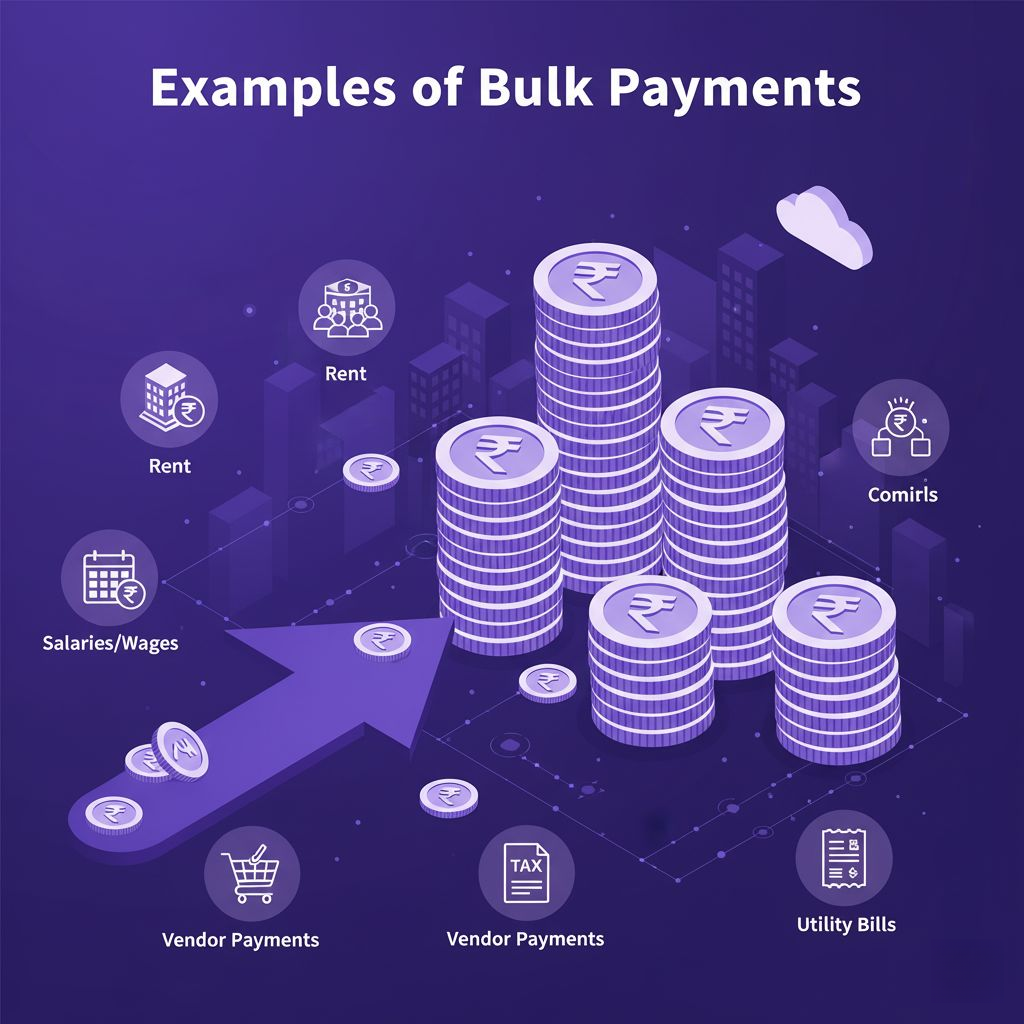

Examples of Bulk Payments

Bulk money includes a plethora of examples. In this section, we will discuss significant examples. It will help you to understand the bulk payments for your use as well.

Making Cashback Payments

The cashback payments for businesses like e-commerce (online store) are so crucial. The time users cancel a purchase, or win a cashback voucher, etc. In order to manage all the payouts on time, securely, and to the right person, bulk payout plays an important role. It can easily make payments to your users or customers.

Salary Payouts

Does your organization usually make salary payments? If so, salary payouts can fulfill your organization’s requirements. It offers companies bulk payments with its rich features like instant pay, and uses all the payment methods, including RTGS, NEFT, UPI, e-Wallet, and more.

Vendor Payout

You may be making various payouts to your supplier. Therefore, the vendor payout option enables your organization to streamline all your payouts. You can automate the payouts to different suppliers. It helps your organization with encrypted transactions for security purposes, on time, and more.

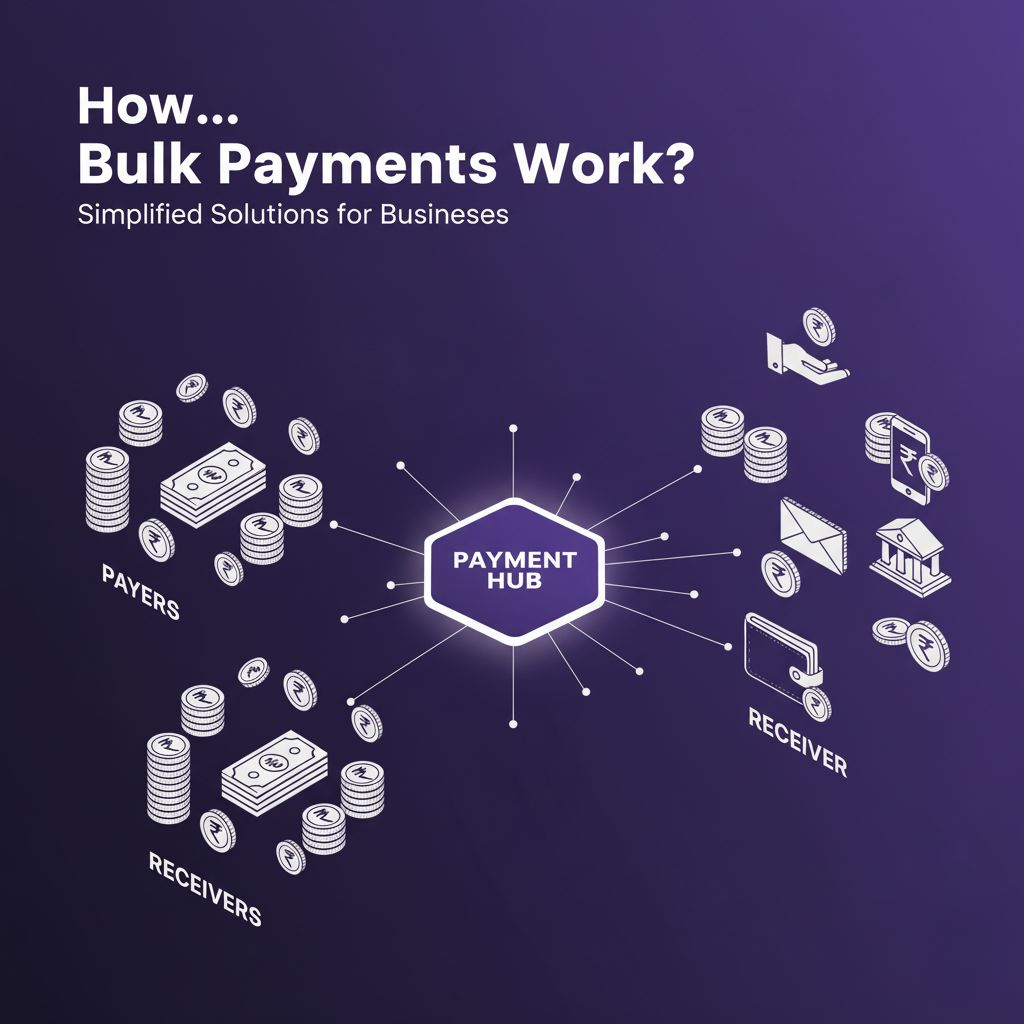

How Bulk Payments Work?

The bulk payment works in four easy steps, which we will discuss in this section step by step. It will assist you in understanding the process of a payment system. You can go through the process; we will discuss it in this section.

-

Make a Bulk List

Whom are you going to pay? Prepare a list of all payment receivers. The list should include the beneficiary’s account details and the amount you need to pay to the person. Make sure the details you enter are accurate; either payment will fail for the specific person whose information is incorrect.

-

Upload the Bulk List

The list you prepared of beneficiaries. Now you need to upload it to payment systems, which could be a payment gateway, a bank portal, or a third-party software solution you are using.

-

Verifications

The bulk payment system verifies all the details, including the receiver’s account details and the amount that needs to be paid. Here, the payor reviews and approves the transactions.

-

Completes the Payments

The time payor approves payments. The payment system processes the payments by debiting the payor account and crediting the beneficiary account. And for the confirmation, both the beneficiary and the payors are updated over the registered mobile number via SMS or email.

Bulk List vs. Bulk Payment – What’s the Difference

Both the bulk list and bulk payment are different from each other. Below, we will discuss the main differences in brief for both terms.

Bulk List: It is to create a complete list of all the beneficiaries with their account details, and other information, including the payable amount. It will then be uploaded to a payment system that we are using, which could be the Wonderpay gateway.

Bulk Payment: This is a process to make payments to multiple accounts by uploading a bulk list you created. Once everything is complete, the payment will be processed by the payment system.

What Are The Benefits of Bulk Payment?

The payout gateway India for bulk payments offers several benefits for an organization. Here, we will talk about its significant advantages. You can go through all the points discussed below.

Pay Instant

It does not matter whether you are making a one-hundred payout or a one-thousand. The payout system allows you to pay instant to all beneficiaries. This quick payment makes you productive, working on other valuable tasks instead of paying manually one by one.

Error Free

Manual payments are prone to errors, which may require you to repeat the transactions by adding all the information again. You can eliminate making errors by just using the payment gateway’s payout service. This service assists you in making all types of payouts easy and quick.

Build a Loyal Customer Base

The e-commerce and other related businesses usually provide cashback to their customers. So, when a customer refuses a purchase and demands cash back, you can return the payments in the proper way - as you can send an SMS or email, saying the payments will be processed within 3 to 4 business days.

In order to fulfill the promise to your business customers. You have to transfer the payment on time. Therefore, the payment system, the payouts allows you to return money to the customers. This way, you can build strong relations with your customers.

The solution will assist you in building a loyal customer base also, which is more important for long-term retention.

Reconciliation

The bulk transaction will also help you with easy reconciliation. You will have a complete report, who you have paid, what the amount was, and when. This is a simple and great option you will like a lot to have payouts seamless payout solution for all payments with the clarification you need.

Easy to Use

The bulk payout services have easy UI (user interface) and UX (user experience). This eliminates the learning curve and allows anyone to use the software easily. You can easily navigate and use any of the features.

Risks and Challenges with Some Bulk Payment Systems

There could be several challenges and risks in bulk payments. This may be because of poor payment solutions.

In this section, we will discuss some of the crucial points that you should consider. It will help you a lot to be prepared for them, in case you face any of them while choosing payout services.

This section will help you spot the challenges and risks in advance before you face them. Continue to read and find all the points discussed here.

You May Face Operational and Data Challenges

Payment Failures and Errors: In case of incorrect recipient data, such as account number or sometimes insufficient balance in your account may cause financial losses and damage to your business reputation.

Manual Errors: The manual data input may lead to errors like wrong account number, name, or other such information.

Difficult to reconcile: You may be paying a large number of people. It means huge data, right? Would you like to put more manpower into reconciling each transaction? If so, this will require more time and does not give you assurance of having accurate entries.

What Could be Security and Fraud Risks?

Fraudulent Activities: The leakage of sensitive data, and malicious actors can exploit vulnerabilities within the bulk payment system to have fraudulent transactions.

Data validation: Without the proper user’s bank account verification and data validation checks. It increases the chances of a higher risk of sending payments to incorrect or invalid accounts.

Financial and Management Challenges

Higher costs: The payment system may cost you a higher transaction fee, such as for high-volume operations.

Managing multiple currencies: It can be a huge challenge if a payment system does not support international payments. This will make it difficult for you to convert the payments in your regional currency because of no international payment support.

Scalability issues: A payment solution should not just meet your current requirements but also have the ability to scale in the future as your business grows.

Read more: What is a Payment Gateway? Meaning, Features, Benefits, & Working.

FAQs:

1. What is bulk payment?

Bulk payment is to transfer funds to multiple accounts at a time. The best example of bulk payment is salary payouts. It assists in saving time by eliminating manual work or entries of various accounts one by one, then sending payment, which is prone to errors and requires more time and manpower.

This becomes challenging for various companies or individuals when they have to pay out to a large number of recipients.

2. What is payout meaning in simple terms?

The meaning of payout is to give money to another person (in simple terms, transferring payments from one account to another). It could be for any purpose, from purchasing a product or service. The fund is debited from the payer account to the payee, and this process is called payout.

3. What is the purpose of bulk payments for businesses?

The purpose of bulk payments is to speed up the process for payout, eliminate manual work, as it is one of the highest reasons for errors in payments, it helps your team to be productive and focus on other priority tasks, and you can pay a large number of groups without any barriers like translation limits and payment options.

4. What’s the difference between NEFT, RTGS, and IMPS in bulk payments?

The NEFT, RTGS, and IMPS are payment options you can choose while transferring funds to anyone. However, each payment option has different priorities, which we will discuss in brief below.

- NEFT stands for National Electronic Funds Transfer. It is the best option for regular bulk payments like salaries, when urgency is not critical.

- RTGS’s full form is real-time gross settlement. This is used for high-value transitions that need immediate settlement.

- IMPS, its full form is Immediate Payment Service. This payment option is best for small-value bulk payments, as speed is the highest priority.