Electronic payments are the new key to improved and successful cash flow. It is no longer a choice for businesses. India’s most successful payment method, Unified Payment Interface (UPI), accounts for over 75% of retail digital payments alone in the country.

The growing number of online business transactions includes more effective, easy-to-use, and beneficial technology, such as different types of e-wallets.

e-Wallet payment innovation comes with a number of advantages, like contactless payments with Near Field Communication (NFC). It is secure, simple, and lets users pay with their added and preferred payment modes (card payment).

This blog post discusses the types of digital wallets, their benefits, and their meanings in a concise, comprehensive way.

Also, Explore a detailed guide on choosing the right payment gateway for your business.

What Is a Digital Wallet?

A digital wallet meaning an online service via a mobile application or software. It carries payment information of added credit/debit cards and bank accounts. Additionally, it records other credentials such as IDs, loyalty cards, etc.

This digital solution eliminates the need to enter the payment details manually each time, carrying the physical cards, and remembering the credentials (passwords, IDs) while making in-store purchases, for money transfer, and bill payments.

An online wallet payment system works as you link it to your financial accounts. It also encrypts the data while making the transactions easy with just a tap or click, with security features like biometrics, face lock, PIN, and encryption.

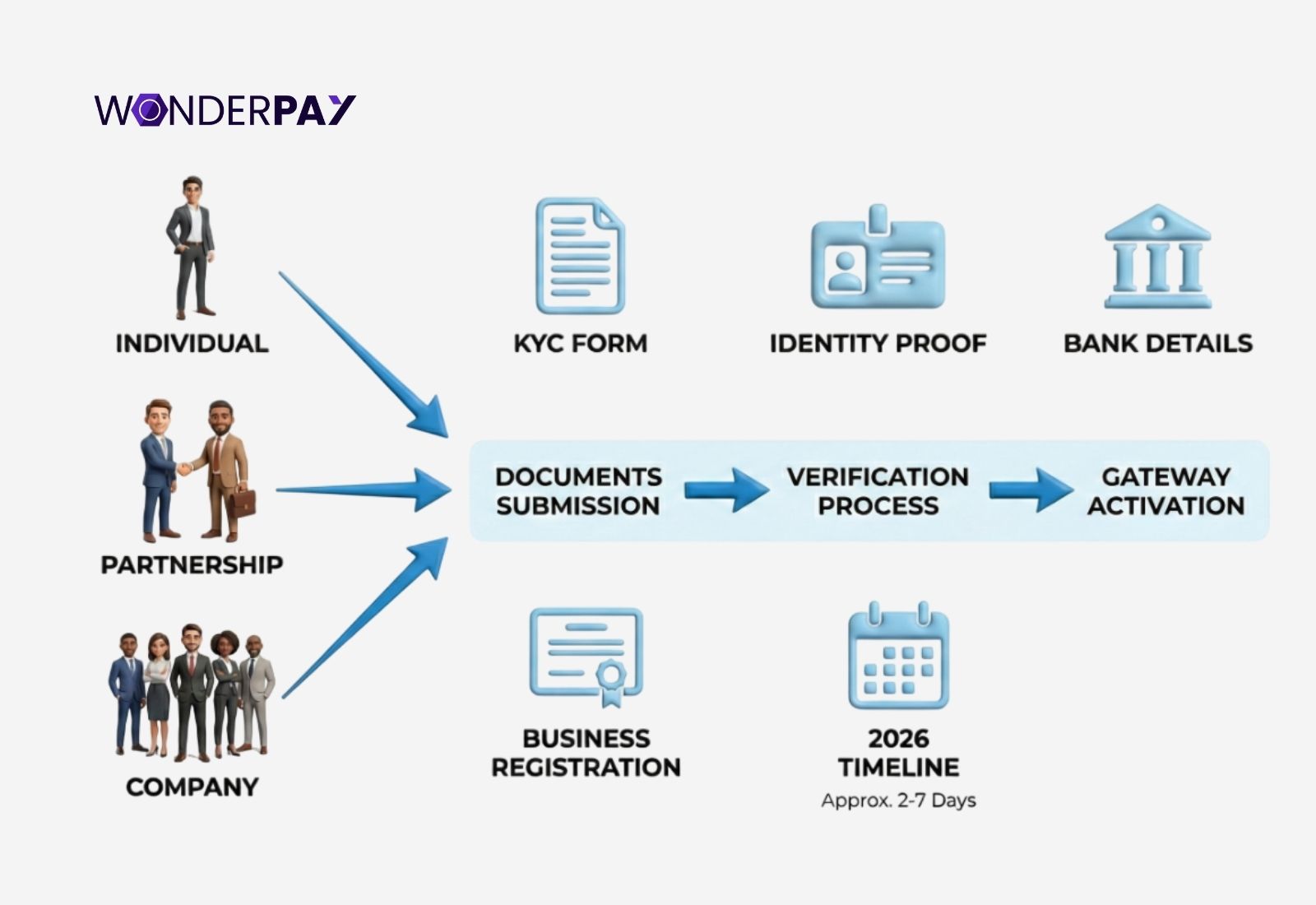

Everything you need to start accepting online payments with a reliable payment gateway in India.

Why Digital Wallets Matter?

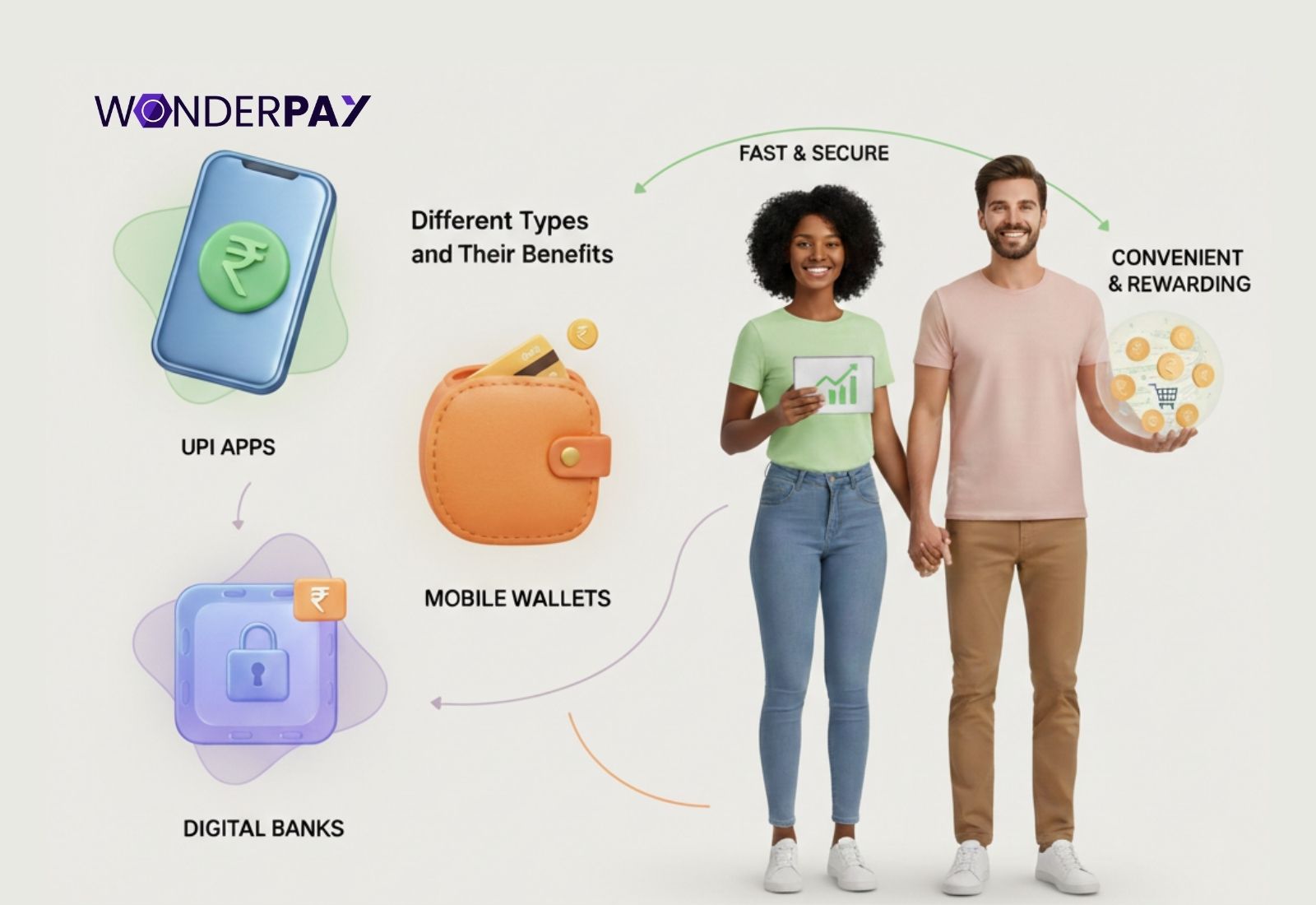

Different types of digital wallets available in the market offer various advantages to business customers as well as businesses. In this section, we will discuss why online wallets matter.

Different types of digital wallets available in the market offer various advantages to business customers as well as businesses. In this section, we will discuss why online wallets matter.

How Many Key Types of Digital Wallets Are in India

In India’s rapidly growing payments scene, understanding the different types of digital wallets is essential if you want to make informed decisions about how and where to use the funds you have stored digitally. The Reserve Bank of India (RBI) classifies prepaid payment instruments and that includes digital wallets into clear categories based on where and how you can use them.

In India’s rapidly growing payments scene, understanding the different types of digital wallets is essential if you want to make informed decisions about how and where to use the funds you have stored digitally. The Reserve Bank of India (RBI) classifies prepaid payment instruments and that includes digital wallets into clear categories based on where and how you can use them.

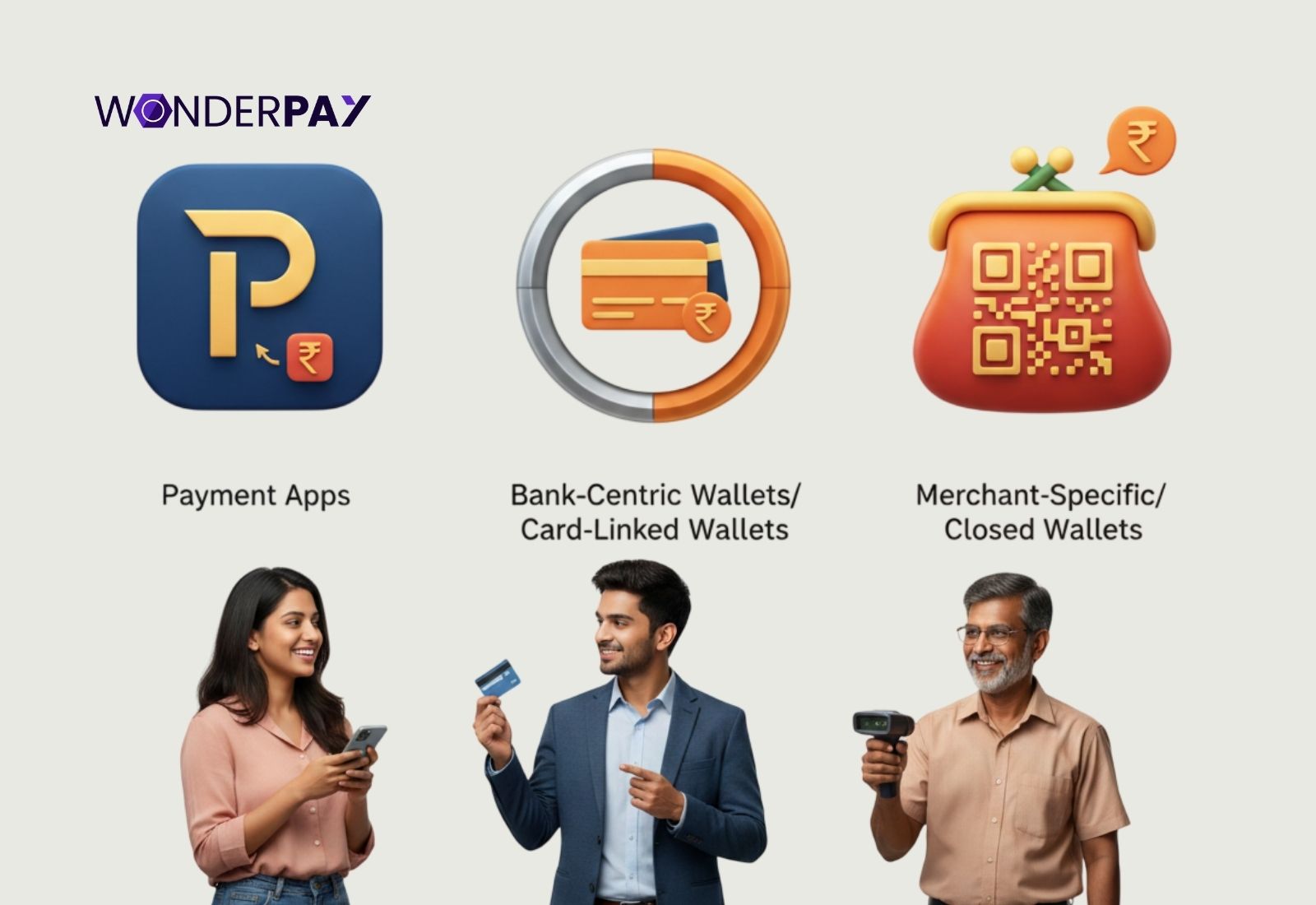

1. Closed Wallets

Closed wallet is a digital payment tool, with a restriction to use it within a company, the platform that issued it. They are typically issued by a company like Amazon and can be used to shop or get services from within that particular ecosystem such as supermarkets or partner websites, for instance. They are super simple to use but you would not be able to transfer the funds to your bank account or get any cash with the wallet.

Example:

Take Amazon Pay Wallet. You can only use that if you are shopping on Amazon or one of a handful of partner websites.

The Perks of Closed Wallets

- Easy refunds and reconciliations for purchases.

- Loyalty points and special deals from the brand.

- No need to enter card or bank details every time you make a purchase.

2. Semi-Closed Wallets

Semi-closed wallets are probably the most common kind of digital wallet you will come across in India today. They let you pay at loads of online and offline merchants that have partnered with the wallet provider. You can not get cash back out with them, but they are otherwise pretty useful.

Examples:

Take a look at Paytm Wallet, MobiKwik Wallet or PhonePe Wallet.

What do Semi-Closed Wallets have to offer?

-

You can use them at loads of different outlets.

-

Handy for everyday things like mobile recharges, bill payments, buying train or bus tickets and shopping.

-

You can top up with UPI, debit card or net banking

Semi-closed wallets are really where the balance between ease of use and lots of different merchants taking them comes in. And, they are regulated by RBI’s PPI rules.

3. Open Wallets

Open wallets offer the full package when it comes to digital wallets in India. They are issued by banks, so you can use them to pay for goods and services, transfer funds to your bank account and even pull out cash from an ATM or linked banking system.

Examples:

Have a look at bank-linked wallets like ICICI Pockets or SBI YONO Wallet.

Benefits of Open Wallets

-

Full payment capabilities, including being able to transfer and withdraw cash.

-

You can use them all over the place, online and offline as well.

-

They offer really strong banking-grade security and regulatory compliance

Payment Apps Do not Count as Wallets (Sometimes)

Now, apps like Google Pay, PhonePe and Paytm often act a lot like wallets in practice, but they are fundamentally UPI payment interfaces that work by linking directly to your bank rather than storing the cash in a separate wallet balance.

Additional Modern Wallet Formats

India’s digital scene has also spawned newer wallet types that are designed for specific kinds of transactions over here.

4. UPI Lite & Micro Wallets

UPI Lite is a low-value in-device wallet that makes use of the Unified Payments Interface to let you make quick payments without having to repeat the bank authentication process every time. That is especially useful for small daily expenses.

Who would find UPI Lite useful?

-

People with modest daily expenses (typically under ₹2,000 per day)

-

If you need to make quick payments without having to worry about PIN or network delays.

These kinds of micro wallets really help to speed up the adoption of digital payments at local shops and small merchants, where speed is what matters most.

5. Transit & Gift Wallets

Transit and gift wallets are sort of special purpose wallets that are built for specific use cases. They store value for particular services rather than general payments.

Example:

-

It can include transit cards such as FASTag and metro travel wallets.

-

The brand gift wallets are redeemable for selected products.

The listed wallets will enhance convenience for targeted spending scenarios, which include travel or gifting through their utility that is limited outside those contexts.

Learn more about choosing the right payment methods in our detailed guide

What Are the Practical Benefits of E-Wallets?

The different types of e-wallets deliver different benefits. In this section, we will discuss them all step by step.

The different types of e-wallets deliver different benefits. In this section, we will discuss them all step by step.

Digital Wallet Meaning: Convenient. Secure. Quick.

The ease of payment delivers an improved experience to the buyers. The days are gone when users used to enter all the details for payments manually, which was prone to payment errors due to wrong payment details, and businesses faced failed transactions. It was one of the cones that could not convert users quickly.

Thanks to various types of digital wallets that speed up payments, making them quick to pay using a number of payment modes like Quick Response (RQ) codes, IDs using technologies such as Near Field Communication to make payments over payment terminals like POS (Point of Sale) while being secured.

-

Convenience & Speed: They deliver you with faster checkout and peer-to-peer transfers of funds as well.

-

Enhanced Security: Its improved solution helps you get encrypted and tokenized, and features for higher security, like biometrics, which assist in reducing fraud risk.

-

Financial Management Tools: You get to have the rich functionality in some wallets, which include transaction history and budgeting tools as well, for a better, controlled system for users.

-

Rewards & Offers: The rewards, such as cashback, loyalty points, and special deals, are one of the magnetic tools that will help you keep the users engaged and continuously use the platform.

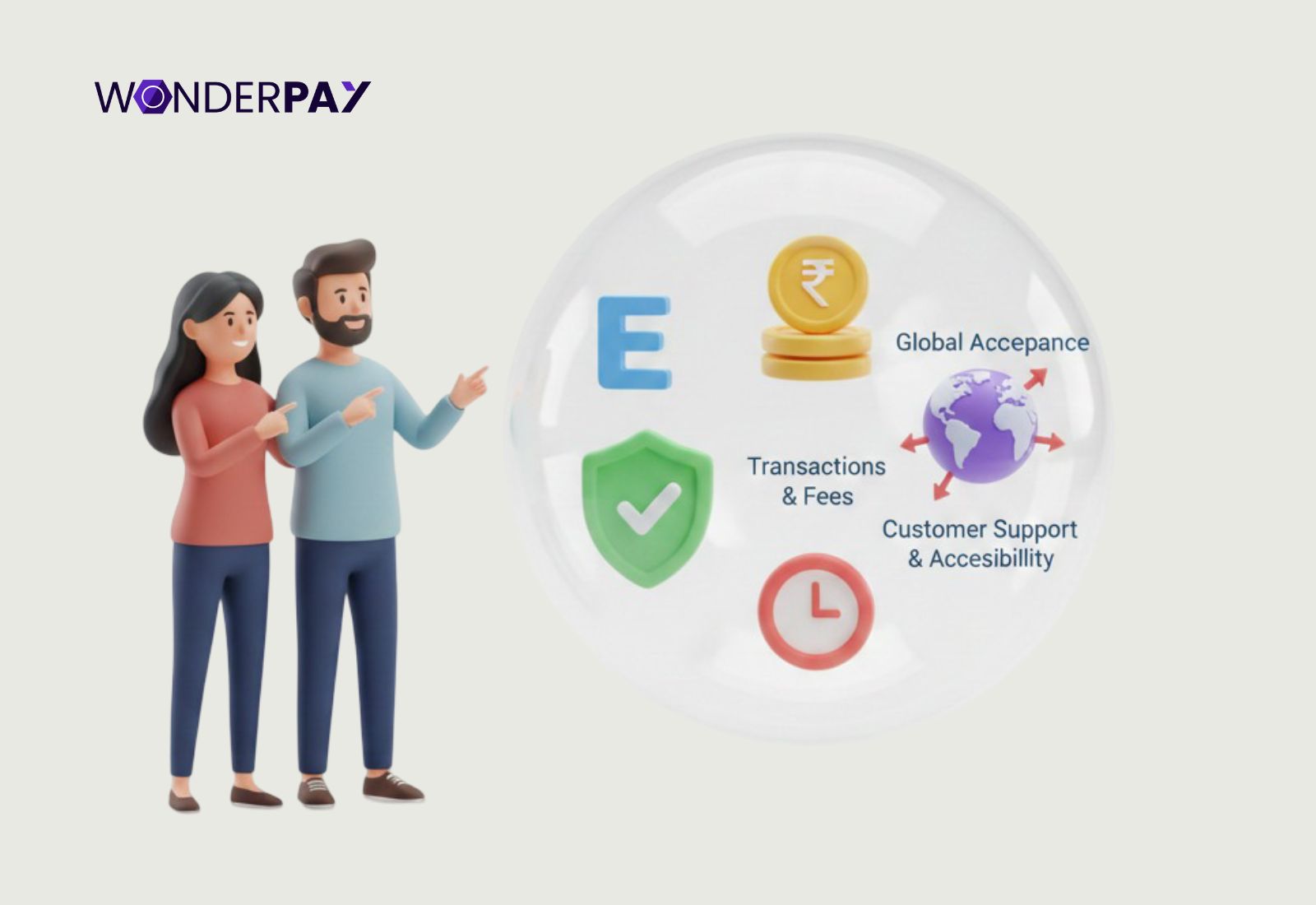

How to Choose the Right E-Wallet

Getting started with online wallet service provider companies. You should consider the following considerations, which will help you make an informed decision.

-

Determine your purpose for using a wallet. Whether you need everyday payments, cross merchant use, or you want to use it for withdrawal purposes.

-

Get to know the security features. You can get to know whether they have strong authentication and clear privacy policies.

-

The merchant acceptance. Do they have wider networks equal broader utility or not?

-

The perks are the ones that attract users more. Even though you are a user or a small business, you need to distinguish how the reward program is going to help you, one that aligns with your spending habits.

Conclusion

Now it is clear to you how many types of e-wallets there are. Each of them delivers different advantages and distinguishes them from the others. If you are getting started with a wallet digitally, then you can navigate through one of the types that aligns with your needs and requirements.

FAQs

1. What is the difference between an e-wallet & digital e-rupee wallet?

E-wallets are a service with a digital container that holds a user’s electronic money, reloaded funds. It is processed by a private intermediary. On the other hand, a digital e-rupee wallet like the Central Bank Digital Currency (CBDC) holds direct RBI issued legal tender in digital form, which acts like physical cash. It offers direct central bank liability, anonymity, and offline use, which is unlike an e-wallet.

2. What is an e-wallet?

An e-wallet is a service of a third party application/software. It offers numerous benefits like fund management (in some applications), reduces the dependency on a poor network when needing quick, speed payments daily for frequent uses. Additionally, the wallet payment digitally eliminates the need to add payment details manually each time, carrying physical cards as a payment method when paying online, and more.

3. What are the different types of digital wallets in India?

In India, the different types of digital wallets, it include:

- Open digital wallets

- Semi Closed.

- Closed.

The specialized wallet types include:

- UPI Lite.

- Transit.

- Crypto.

- Wallets.

4. What are the 3 main regulatory types of wallets?

The main regulatory types of wallets include are:

- Custodial wallets.

- Non custodial.

- Smart contract or hybrid wallets.

5. Are digital wallets safer than physical cards?

Yes, because they use tokenization by replacing real card numbers with one time codes, encrypted, and have functionalities like biometric authentications, such as fingerprint or face ID, to unlock the application. Additionally, they prevent exposing actual card details while the transaction is digitally processed, mitigating fraud risks, and allow for remote locking if accessed by an unauthorised person.

6. Does Wonderpay support e-Wallet payments?

Yes, Wonderpay offers wallet payment service acceptance as a payment method. It means businesses can accept all the payments with a digital wallet, too.