Business savvies are usually confused about payment processors and do not get clarification, especially when it comes to making an informed decision. In order to choose between a payment gateway vs payment processor.

This confusion causes companies higher transaction costs, poor payment experiences, compliance risks, and delayed payment settlement.

This guide helps you make an insightful decision to know what the payment process is, how it works, & differ from payment gateways in India, and how to choose one of the top payment processors in India for your business’s seamless online payments.

What Is a Payment Processor?

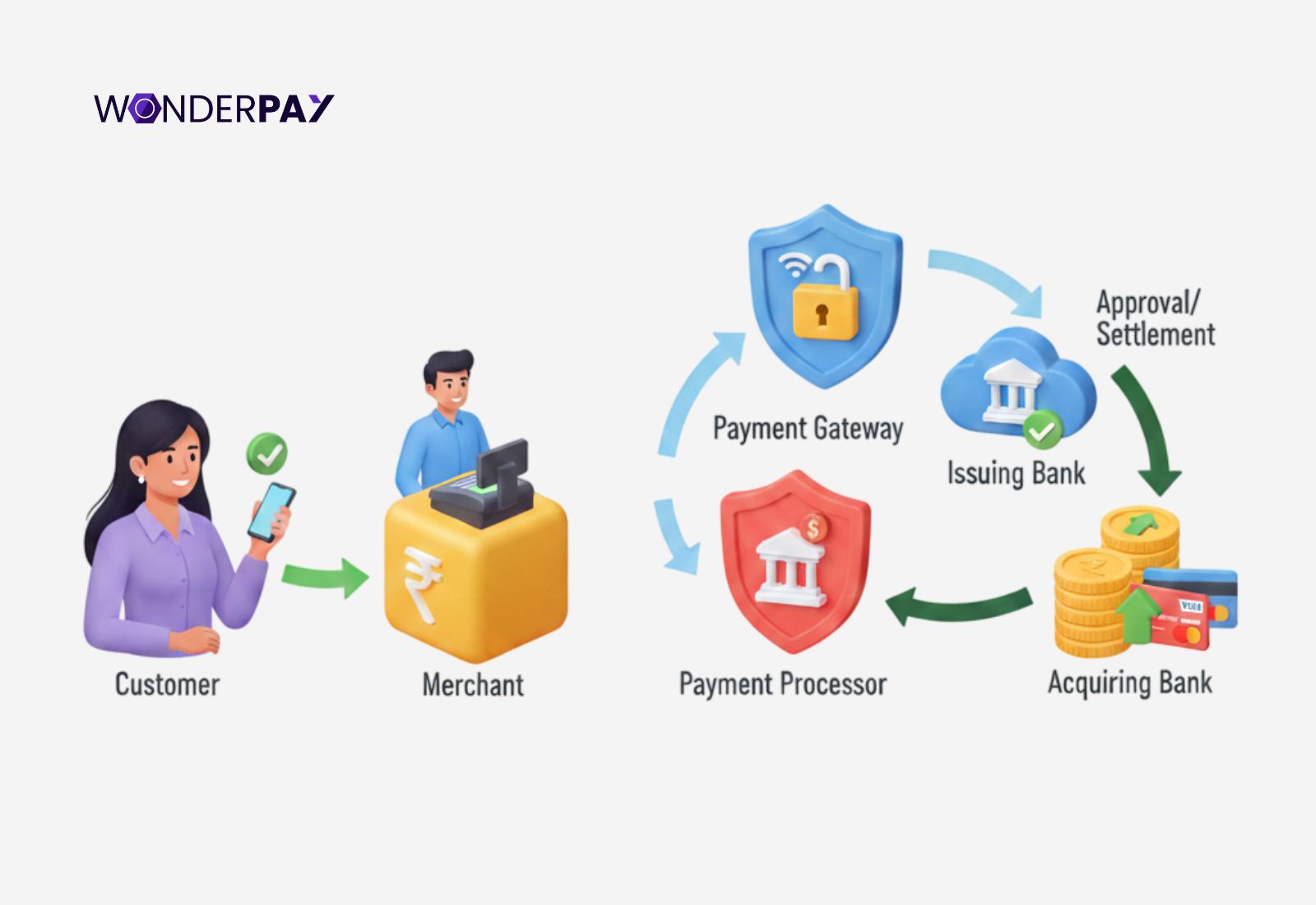

A payment processor is a financial institution authorised by the RBI in India. It plays a significant role in merchants’ digital payments, from accepting or disbursing online transactions via all available payment methods. This includes credit/debit cards, direct bank transfers, UPI, e-wallets, etc.

Additionally, a processor communicates with the issuing bank (customers) and card networks on behalf of the acquiring bank (merchants). In order to authorize the payments, check the available balance in the customer’s bank account. After going through every step, either the payments are settled in the merchant account or declined if they fail to pass any of the steps while authorization and verification.

Now, a payment gateway technology comes into the picture. It transmits the data from the business website/application to the processor with its encryption. Gateways are compliant as they need to implement Payment Card Industry Data Security Standards (PCI DSS).

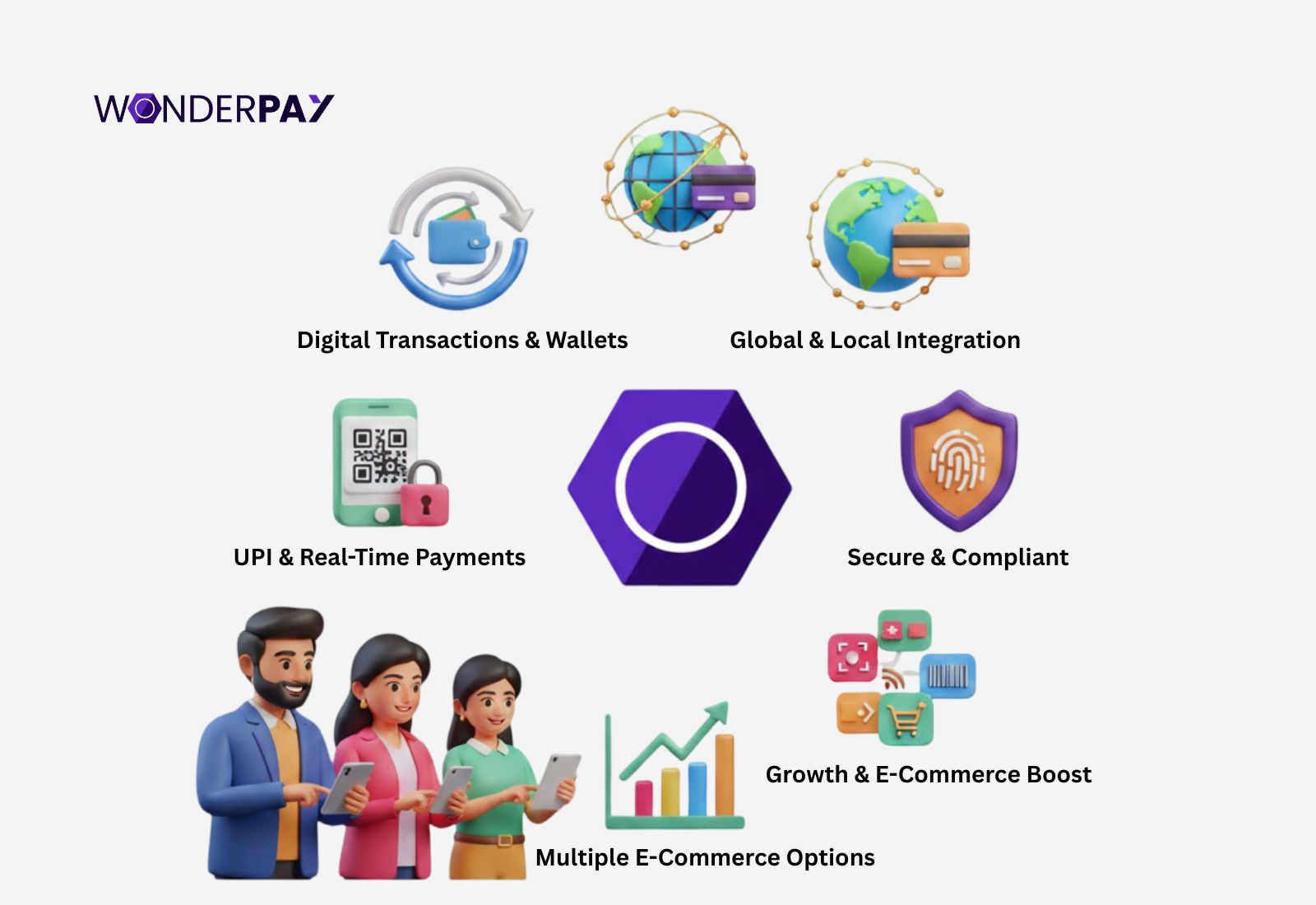

Payment processor (payment gateway) assists businesses in improving their business cash flow, builds customer trust, helps with rapid conversion, and doubles productivity with its advanced technology to have helpful insights with the advanced analysis, automation for subscription based businesses (SaaS).

While a payment processor handles transaction processing, platforms like Wonderpay combine processing with secure payment solutions for businesses.

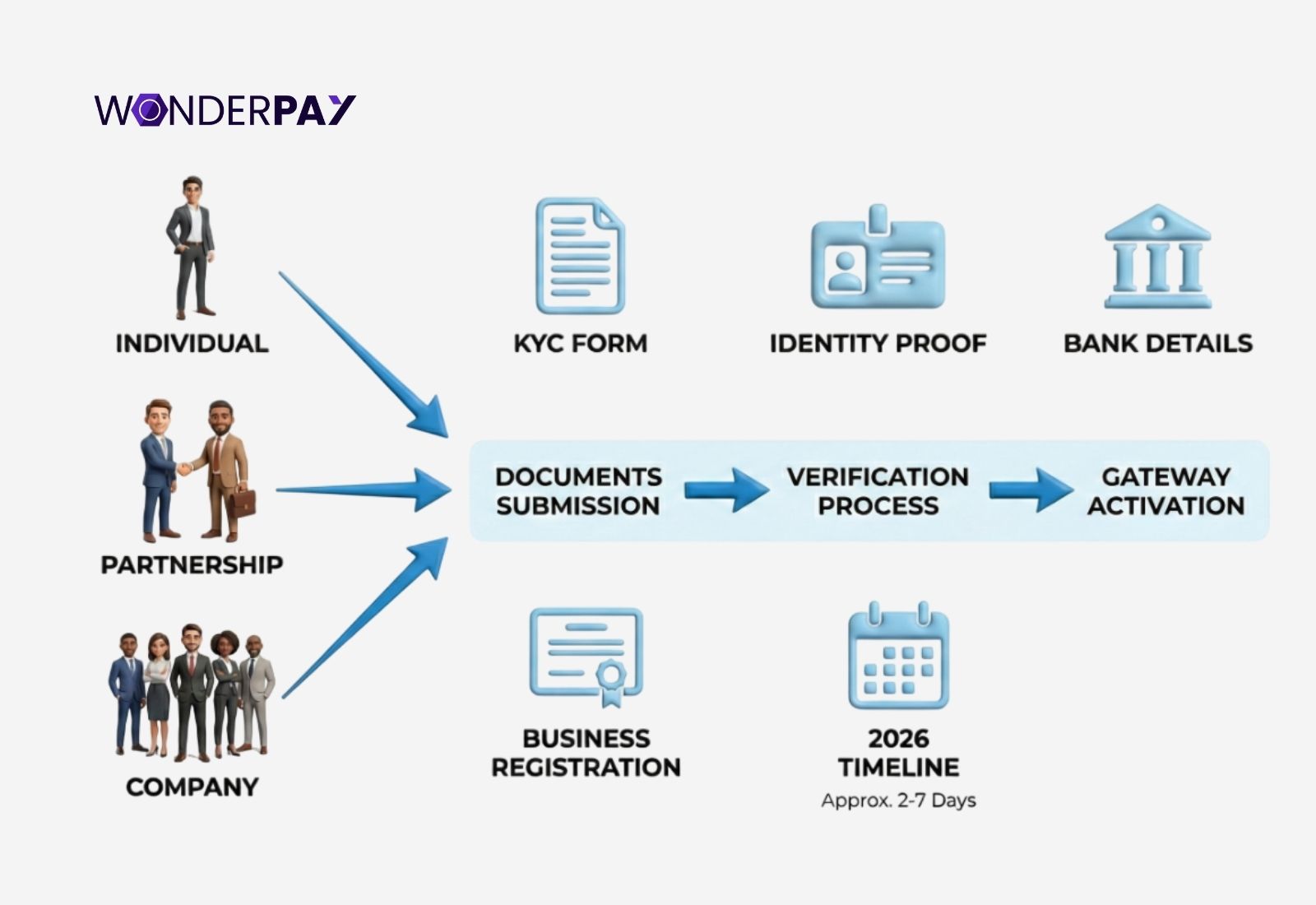

Suggested read: Documents Required for Payment Gateway Onboarding in India

Payment Processor vs Payment Gateway: Know The Key Differences

This comprehensive table clears your doubts about payment processor vs payment gateways. In all aspects, both play a crucial role in a business: seamless transactions.

| Aspect | Payment Processor | Payment Gateway |

|---|---|---|

| What it does | Processes the transaction by communicating with banks and card networks to approve or decline payments. | Collects and securely transmits payment details from the customer to the processor. |

| Primary role | Moves the money and handles authorization, clearing, and settlement. | Acts as the digital front door where customers enter payment details. |

| Where money flows | From the customer’s bank to the acquiring bank, and then to the merchant account. | No money is held; it only passes payment data securely. |

| Who interacts with it | Banks, card networks (Visa, Mastercard), and UPI systems. | Customers and merchants. |

| Security responsibility | Ensures transaction approval and fraud checks with banks. | Encrypts payment data and ensures secure transmission. |

| Compliance focus | Bank-level compliance, settlement rules, RBI guidelines (India). | PCI DSS compliance, data encryption, and tokenization. |

| Visible to customers | No (works in the background) | Yes (checkout page, payment screen) |

| Example in practice | Handles authorization and settlement after “Pay Now” is clicked. | Displays UPI, cards, and e-wallets, and captures payment details. |

Similar Reads: Payment Gateway vs Merchant Account: What’s the Difference?

How Payment Processing Works

A payment processor completes its work within 4 simple steps. This section delivers a clear picture with a scenario example, step by step.

Let us get into the process for payment processors in India for a better understanding of it.

-

Step 1- Customer Makes Payment: Customer enters payment details after choosing a payment method. The customer enters the details of their card (debit or credit), UPI, or other familiar method they want.

-

Step 2- PG Carries Data: Do not forget payment gateway and the payment processor both work together. The gateway technology forwards the payment details (data) to the processor.

-

Step 3- Processor Communicates: Now the processor talks to the customer bank (issuing). In order to check whether card details are genuine or not, sufficient account balance.

-

Step 4- Authorization & Moving Funds: In this last process Payment Service Provider (PSP) authorizes the fund, moves it, make settlement in the merchant account, and lastly, it makes the payout in the business’s regular account within T+1 or T+2 days as mandated by the RBI.

Also Read: How To Choose Best Payment Gateway In India For SaaS

Why Your Business Needs a Good Payment Processor

There are various payment processor companies as well as types of payment processors. It becomes crucial to decide on the right PSP organization that meets all your business’s requirements for digital payment needs.

This section will provide you with a complete list of reasons to know why your business needs a good payment processor.

- Security & fraud protection: You can not rely on any of the financial institutions over the internet. The reason is compliances like PCI DSS, and the Reserve Bank of India’s strict regulations for payment gateways (PG) or Payment Aggregators (PA) in India.

In case you connect with the wrong payment service provider. It may put you to face liabilities, such as:

-

Leakage of customers’ sensitive payment data.

-

Your fund may get stuck due to Anti Money Laundering (AML) and Prevention of Money Laundering Act (PMLA) obligations for fintechs.

-

Customers lose trust in your platform because of a poor and insecure checkout experience.

- Speed of settlements: There is no doubt, your company too expects secure and on time fund settlement, right? Why would you choose a processor that does not align with your business values? The delayed payments let you face cash flow issues and affect the working capital also.

Here is how you should evaluate connecting with the right payment service provider in India.

-

Check if the processor is RBI authorized.

-

PCI DSS compliant.

-

Secure and provides you with a better UI/UX experience.

-

No, learning curves.

-

Settlements happen in mandated timelines by the RBI.

- Multiple payment methods: Does your payment provider support all payment methods? If not, you will face limitations related to cash flow, difficulty in aligning with your targeted audience, familiar payment options like UPI in India, which is one of the top methods, and other options like cards and wallets.

-

Choose a PG or PA that aligns with your business customer needs, especially for payment methods supported.

-

Simple checkout experience.

- Scalability & analytics: Can a payment service provider grow with your company? If not, you may lose a large number of sales. In most cases, it is seen that the payment provider cannot scale with your business’s payment requirements. Let businesses face problems accepting payments, including during peak time, also.

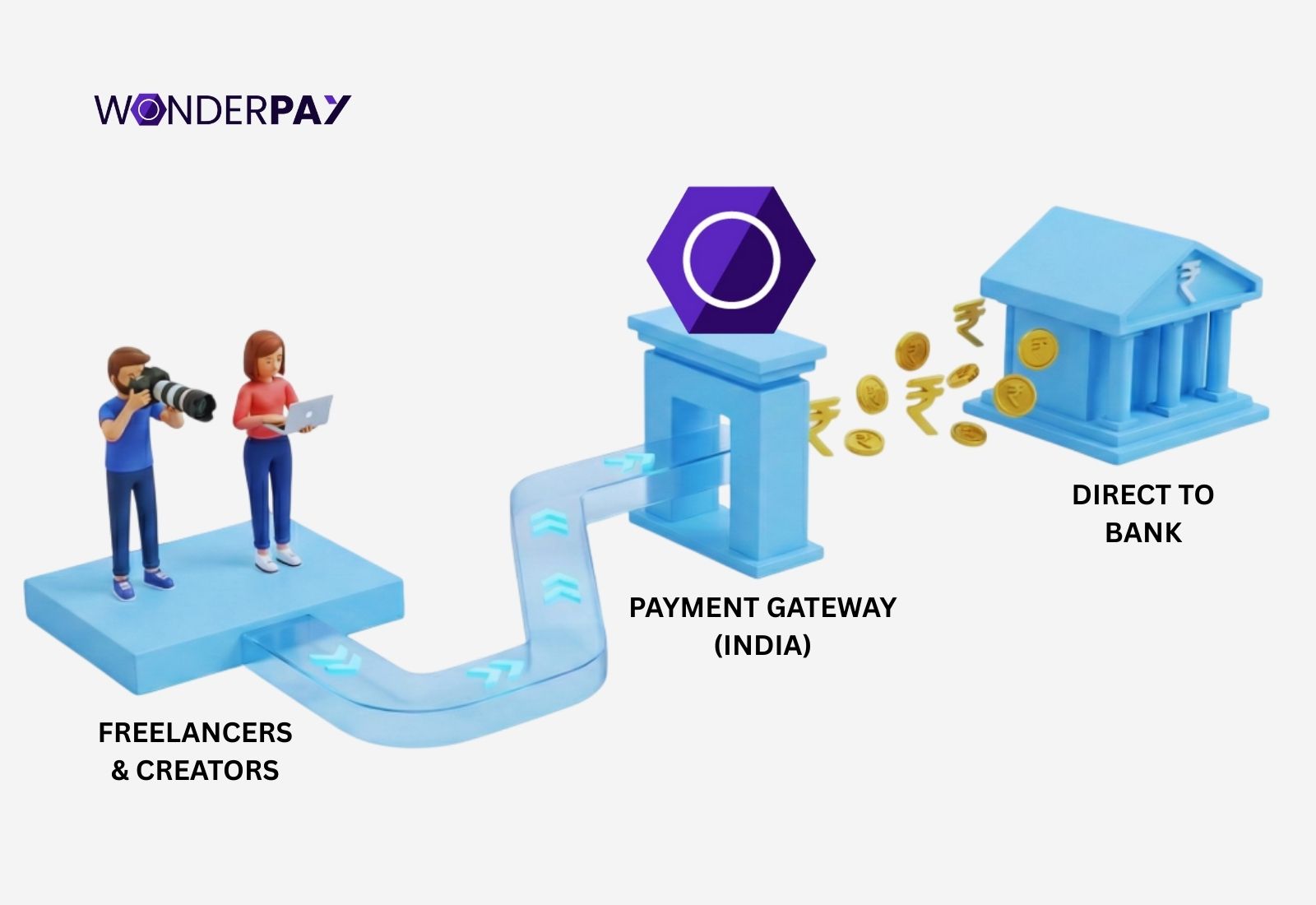

Must read: Best Payment Gateway in India for Freelancers & Creators

Payment Processors in India: Know What Makes It Unique in the Market

India’s payment ecosystem stands out due to the strong RBI regulations, and the Unified Payment Interface (UPI) allows innovations as well as rapid digital payment adoption.

The Reserve Bank of India regulates payment systems, which is done under the Payment and Settlement Systems Act 2007. This authorized body also issues the guidelines for the Payment Aggregators (PAs), as well as for the Payment Gateways (PGs). It includes the following:

-

The mandatory RBI authorization for organizations like non-bank payment aggregators.

-

It includes the strict Know Your Customer (KYC), Anti Money Laundering (AML), cybersecurity, as well as the risk management norms also.

-

Safe guarding merchant funds with a nodal or escrow account.

-

The clear timeline for settlement and the dispute resolution standards.

Suggested reads: Why Choose Wonderpay Payment Gateway In India for Businesses

Conclusion

Now, it is clear to you how critical it is to have a payment processor for your company. One single mistake can affect your business in many ways; losing customer trust in your brand, delayed payment settlement, facing liabilities to pay heavy penalties impose by authorities in case of leakable sensitive customer payment data, money laundering under the Act (PMLA), and more.

Therefore, you need a compliant, trusted, and the best online payment processor for your organization. One that meets your company’s exact requirements and delivers you a seamless experience.

Are you in search of a trusted and compliant payment gateway? You may connect with Wonderpay right now and get the free consultations.

Businesses comparing digital payment solutions often evaluate costs and features, you can explore Wonderpay’s pricing plans to understand fees and available payment options.

Similar read: Payment Gateway Charges Guide for Businesses

FAQs

1. What do payment processors do?

A payment processor routes transaction data between banks as discussed:

-

The customer’s bank is known as the issuing bank.

-

Merchant’s Bank is known as the acquiring bank.

-

The card networks like Visa, Mastercard, RuPay, etc.

-

It also handles authorization, clearing, and settlements.

-

Focuses on transaction execution.

2. How to become a payment processor?

The first thing you would do is to secure a bank partnership (acquiring bank), get the certifications for PCI DSS compliance, develop or license secure gateway software, and register with a card network (Visa or Mastercard).

In order to be one of the top payment processors, you would need a heavy legal, technical, and security infrastructure to handle transactions, KYC, and AML risks as well.

3. How does a payment processor make money?

The earnings of each payment processor differ because some charge monthly subscriptions, setup charges, hardware sales, and fees for value added services such as fraud protection and chargebacks. Typically, a processor charges transaction fees which include a small percentage plus, or sometimes a fixed cost per sale; Ex. 1.5% on UPI payment, cards, etc.

4. What is the difference between a payment gateway and a payment processor?

Payment gateway vs payment processor, they both work together, but differ when it comes to comparing them. A gateway is a secure, front end software that captures and encrypts customer payment data on a business website or mobile application. On the other side, a payment processor is the backend service, something like an engine that moves payment data, authorizes, settle funds between banks.