- 1. What Are the Payment Methods?

- 2. What Are the 4 Types of Payment?

- 3. What Are The 5 Modes of Payment?

- 4. How Payment Methods Affect Customers and Merchants?

- 5. How Does Payment Method Impact Merchants?

- 6. How Do I Choose the Right Payment Methods?

- 7. What Are Net 7 Payment Terms?

- 8. Final Thoughts

- 9. FAQs

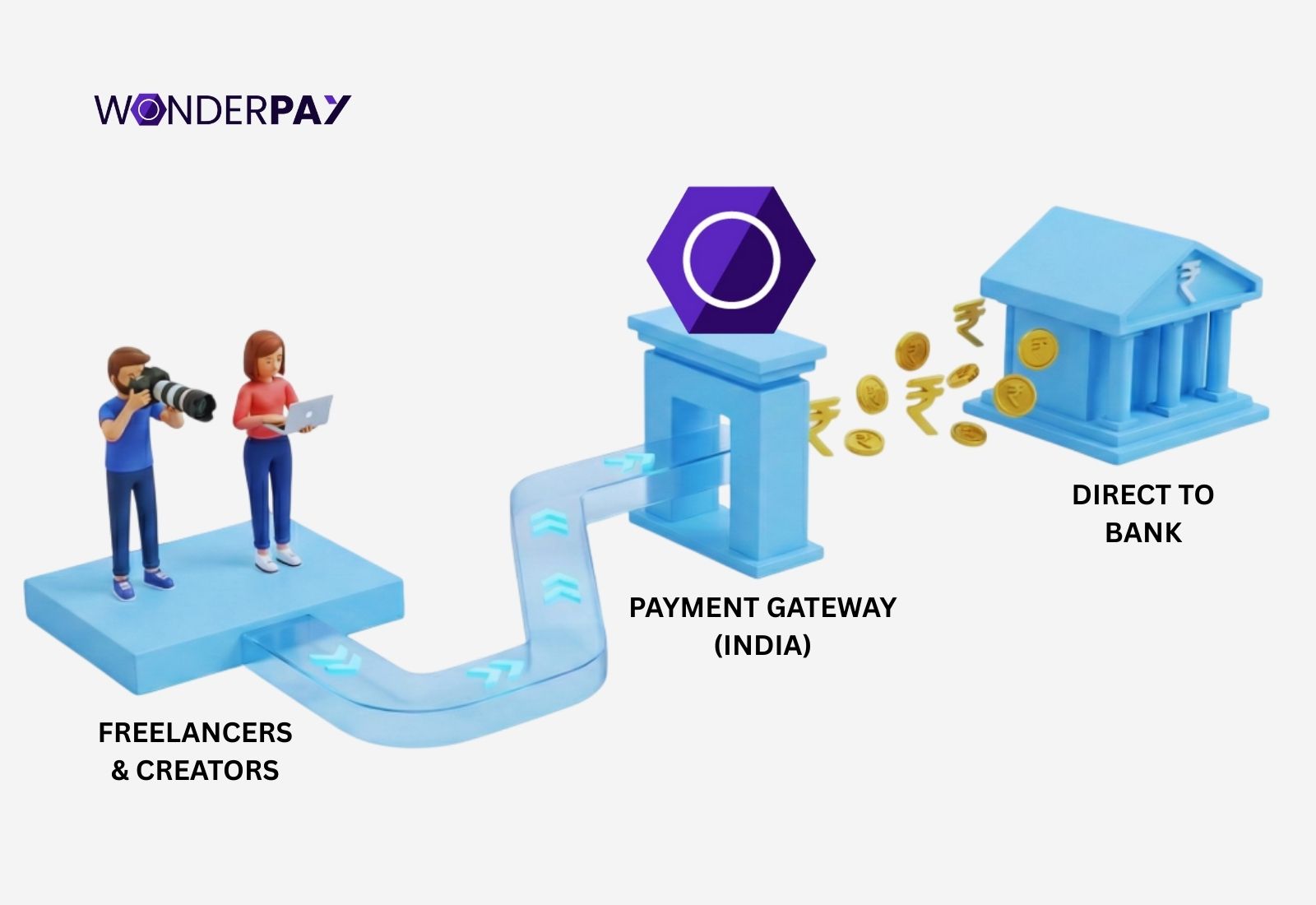

Online payment service provider tools the payment gateways offer various payment methods, including credit, debit cards, UPI, RTGS, NEFT, e-wallets, etc. It can affect a business’s decisions in terms of overall cost to them, predictive cash flow, and working capital for smooth business operations.

Whether you want to accept or disburse funds, you need a payment method. In order to get payments settled in your bank account. This could be a critical decision to choose the right method as required per the situation, business type, and its customers’ payment behaviour. A right pay option that aligns with your customer base and operational model will help you reduce card abandonment, improve security, and lower costs.

This comprehensive guide will clear your doubts about payment methods, their types, benefits, pros & cons, and limitations.

Let’s get started.

What Are the Payment Methods?

It is a mode a payee chooses to transfer funds between B2B entities, individuals like freelancers, suppliers, or B2C, such as merchant payments in exchange for goods or services. Payment methods include both traditional payments, such as cash and cheques, as well as the modern electronic payment solutions like credit, debit cards, UPI, netbanking, RTGS, and more.

A mode of payment plays a significant role. It improves business cash flow, converts buyers, and enhances customer experience by getting rid of card abandonment.

Each and every option for payment modes comes with different characteristics that distinguish them for businesses and customers in terms of their use cases and benefits.

Businesses looking for reliable digital payments can explore Wonderpay’s payment solutions for secure and scalable transactions.

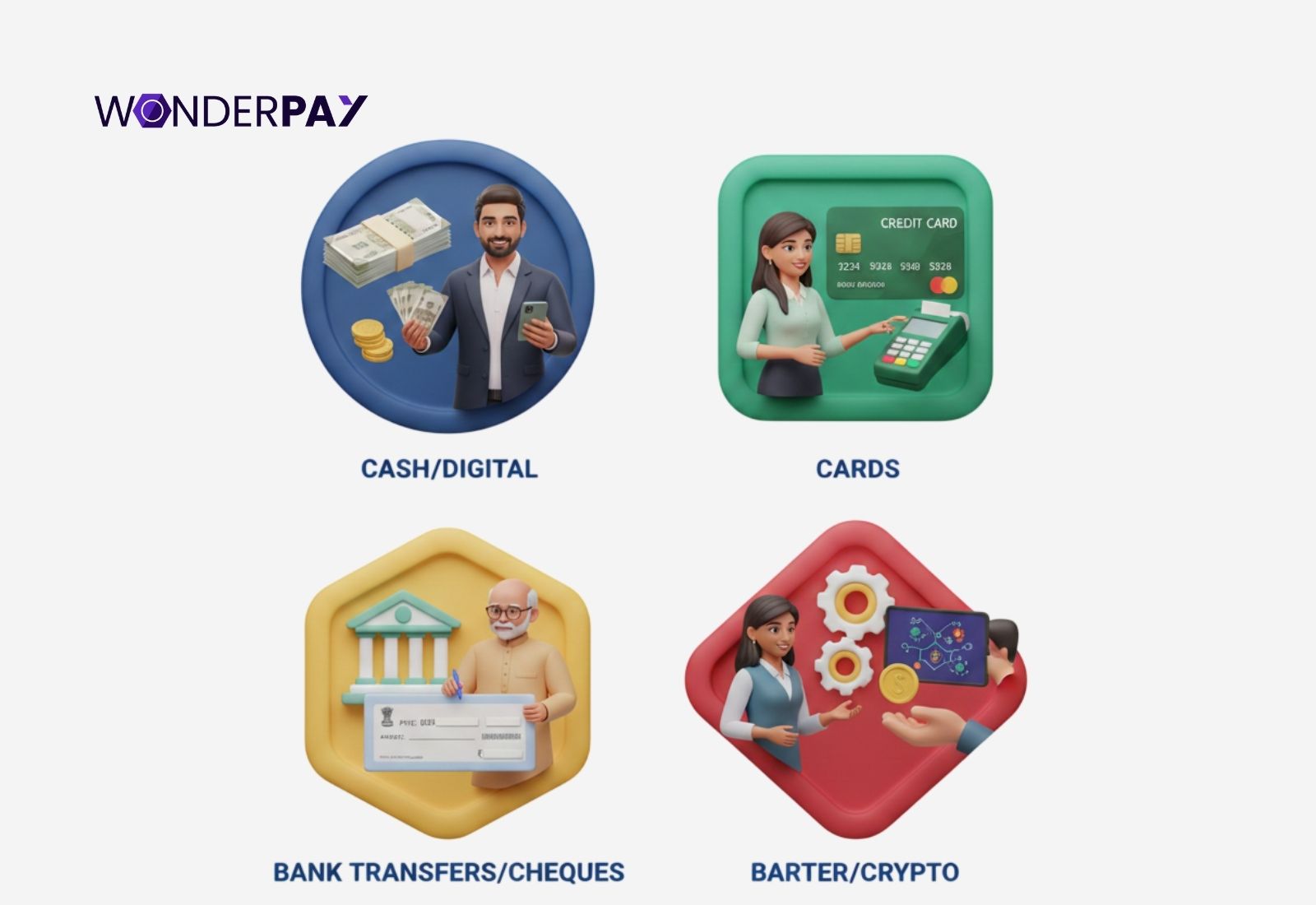

What Are the 4 Types of Payment?

The four main payment types are as follows:

- Cash

- Digital

- Direct bank transfer

- Cards

Each payment type serves its own benefits and use cases. It means it does not affect anyone’s experience directly unless they are used without any proper strategies. This section will discuss all of them with brief details.

-

Cash payments: It is a traditional payment method that uses physical currency for immediate transactions. However, it is still in circulation and matters most in the evolving economies. To let anyone accept payments in areas where people still lack active internet connectivity or are anxious to adopt digital solutions.

Cons: Often, it does not have accurate payment records. In case the record is created, there are higher chances of losing the record due to unauthorized access.

-

Digital payments: Mobile device-enabled payments, Unified Payment Interface (UPI), contactless NFC payments, and QR-based payments in developing countries like India revolutionized online payments. The UPI alone recorded 27,96,712.73 Crore value last month, in December 2025.

Cons: UPI is one of the payment methods, not a type that limits merchants to accept other online payments. In case a vendor is seeking a multi payment acceptance option for their business, which will increase business cash flow. A merchant has to subscribe to a payment service provider, such as a payment gateway.

-

Card Payments: The credit card payments in India are growing at a rapid speed. This payment method enables buyers with various perks, like cashback and points, and is ideal for large purchases for users. Its transaction value is expected to rise at 14% in the recent year 2025 to Rs. 25,40,000 crore. On the other hand, debit card payments allow buyers to make payments directly from their bank accounts. The best part of these payments is to these accept both online and offline purchases.

Cons: Businesses can face card payment method limitations, such as high costs and risk issues with card payments, such as higher transaction fees, Merchant Discount Rate (MDR), delayed settlements, and the risk of chargebacks, including Payment Card Industry Data Security Standards (PCI DSS) compliance requirements to handle customer payment card data.

-

Bank Transfer: The direct bank transfer payment method enables a user to make larger purchase transactions at a time. It includes bank transfer options like National Electronic Fund Transfer (NEFC), Immediate Payment Services (IMPS), and Real Time Gross Settlement (RTGS). These multiple bank payment options can be used for various purposes with seamless payments both for businesses and customers, as they are secure and cost-effective.

Cons: Businesses can face a number of payment method limitations with the direct bank transfer. This may put you to face challenges like manual reconciliation, customer-initiated processes, and data entry errors. Moreover, the NEFT batch payments may be delayed in case it misses one, and options like RTGS are for higher transactions (above 2 lakh), and IMPS comes with a maximum daily transaction capacity of often (5 lakh).

Must read: Best Payment Gateway in India for Freelancers & Creators

What Are The 5 Modes of Payment?

The payment mode and payment method are used interchangeably, but distinguish. Before we start with the 5 modes of payment, let us get clarification on the difference between payment modes and payment methods that are used.

Payment Mode vs Payment Method with Examples

A customer paid using UPI to a vendor.

-

UPI ( at the Wonderpay platform) is a mode of payment.

-

The method the customer chooses, like OR code (scanned at the shop) and UPI ID (Dineshjoshiexample@oksbi). It is a payment method that the user usually chooses to make a payment.

Now, the myth about payment methods and in-person or online payment modes is clear, as it is said that both are the same with synonyms. But they distinguish themselves on the ground with their different work.

The 5 Modes of Payments

The main 5 modes of payment in India are:

- UPI

- Card payments

- Cash

- Netbanking / bank transfer

- Digital wallets

Also Read: Instant Settlement Payment Gateway In India: Complete Guide

How Payment Methods Affect Customers and Merchants?

Electronic payments are no longer optional for any business. It is because more and more business customers want to pay using their preferred online payment methods. This includes credit or debit cards, UPI, e-wallets, etc.

This section will help you make an informed decision on why payment methods are crucial for business.

1. Online Payment Options for Customers

Business customers expect effortless and familiar payment options. One that does not require to fill the heavy details, as traditionally business customers used to do when sending funds to family or friends. No one wants to do that at all!

Now they need just a click and pay solution that is easily available with financial institutions like payment gateway service providers. They can assist with all the trending and simple payment methods, like:

-

UPI: The Unified Payment Interface is the king for digital payments in India. It alone contributes to the economy with its billions of transactions across the country.

UPI lets merchant customers pay instantly with its PIN less or secured PIN transactions in just a click by using payment modes like QR codes or UPI ID.

-

Card Payments: Both credit and debit card payments offer secured card details saved within the service/product provider’s database that follows PCI DSS compliance. This process allows business customers to make a payment with just a click while secured with two-factor authentication (2FA).

2. The Trust Factor & Security Perception

-

The payment methods you provide send a clear signal for better customer security.

-

Well known UPI apps and card networks do more to build confidence in people.

-

While unknown or limited opt ions do the opposite, causing people to hesitate.

Result: The more trusted payment methods you offer, the higher the customers’ checkout confidence will be.

3. Payment Flexibility - Because One Size Does not Fit All

Different customers have different needs.

-

Some credit cards provide the flexibility to pay in installments or put off their payment.

-

For others, UPI means instant debit.

-

And for those who want to keep spending under control, wallets are the way to go.

Result: The more you can offer, the happier your customers will be and the more they will come back and shop with you.

4. Accessibility & Inclusion - Everyone’s Got Something Different

-

Not everyone has access to the same financial tools.

-

Some people do not use cards at all

-

Some only have UPI to fall back on

-

Others still prefer to use wallets

Result: The more payment options you offer = the wider your customer base will be.

Learn more about: Types Of Payment Gateways In India & How To Choose Right One

How Does Payment Method Impact Merchants?

1. Conversion Rates - Do not miss out

-

For every payment method you don’t support, you are losing sales.

-

Having UPI available gives a big boost to mobile conversions.

-

And cards can increase average order values.

-

But having limited options just makes people less likely to finish their order and abandon their cart.

Result: The more ways you can take payment, the better your revenue will be.

2. Cost & Margins - Every Little Bit Counts

-

Each payment method comes with different MDR and operational costs.

-

In our experience, UPI is the cheapest option

-

Cards are more expensive, with higher MDR costs

-

And wallets have their own set of variable fees

Result: The way you mix and match payment methods can have a big impact on your profitability.

3. Cash Flow & Settlements - Faster is Better

-

Settlement speed varies from one payment method to another.

-

With UPI, you can get your money faster, with faster settlement cycles.

-

With cards, it is one to two business days.

-

Net banking is a bit of a mixed bag, depending on the bank you work with.

Result: The faster you can get your money, the better your working capital will be.

4. Risk, Refunds & Chargebacks - There is No Such Thing as a Free Lunch

-

Some payment methods carry higher risks than others.

-

With cards, you can expect chargebacks and disputes.

-

With UPI, the window for disputing a transaction is much smaller.

-

And net banking tends to have fewer reversals.

Result: You have to balance the potential for growth with the potential for risk.

5. Backend Operations - It is Not Just About Checkout

-

Different methods need different levels of processing.

-

Cards need you to comply with PCI DSS.

-

Wallets have their own set of KYC requirements.

-

And bank transfers require you to do a lot of complicated reconciliation.

Result: Payment methods impact the way you operate and comply, not just at checkout.

Customer vs Merchant View

Aspect Customer Impact as well as the Merchant Impact.

| Aspect | Customer Impact | Merchant Impact |

|---|---|---|

| The choice | Easy and flexible | Higher conversion rate |

| Speed | Helps with faster checkout | Assists with better cash flow |

| Cost | Often invisible | Directly affects margins |

| Trust | Confidence to pay | Brand credibility |

| The risk within it | Assists with protected payments | Dispute management |

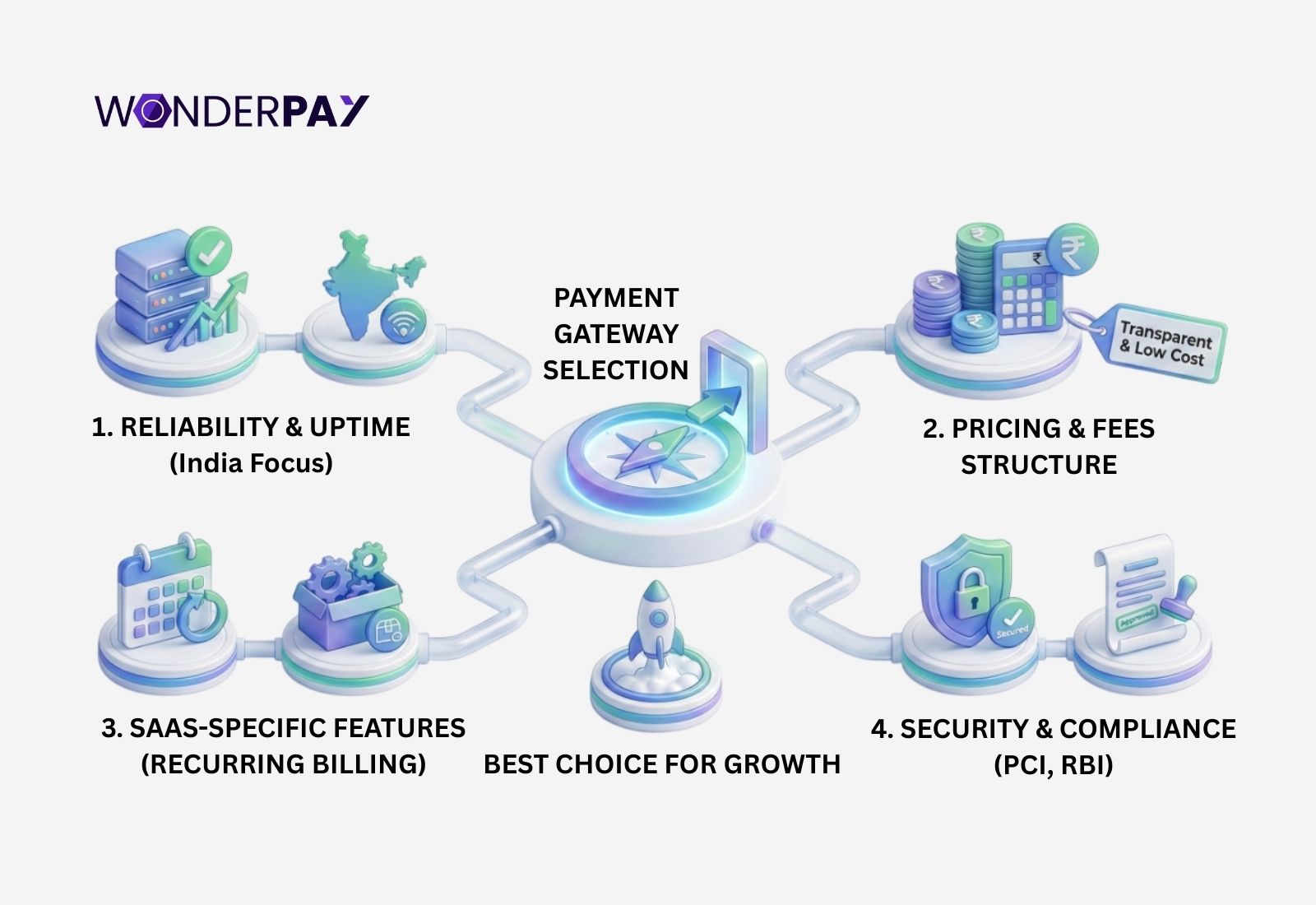

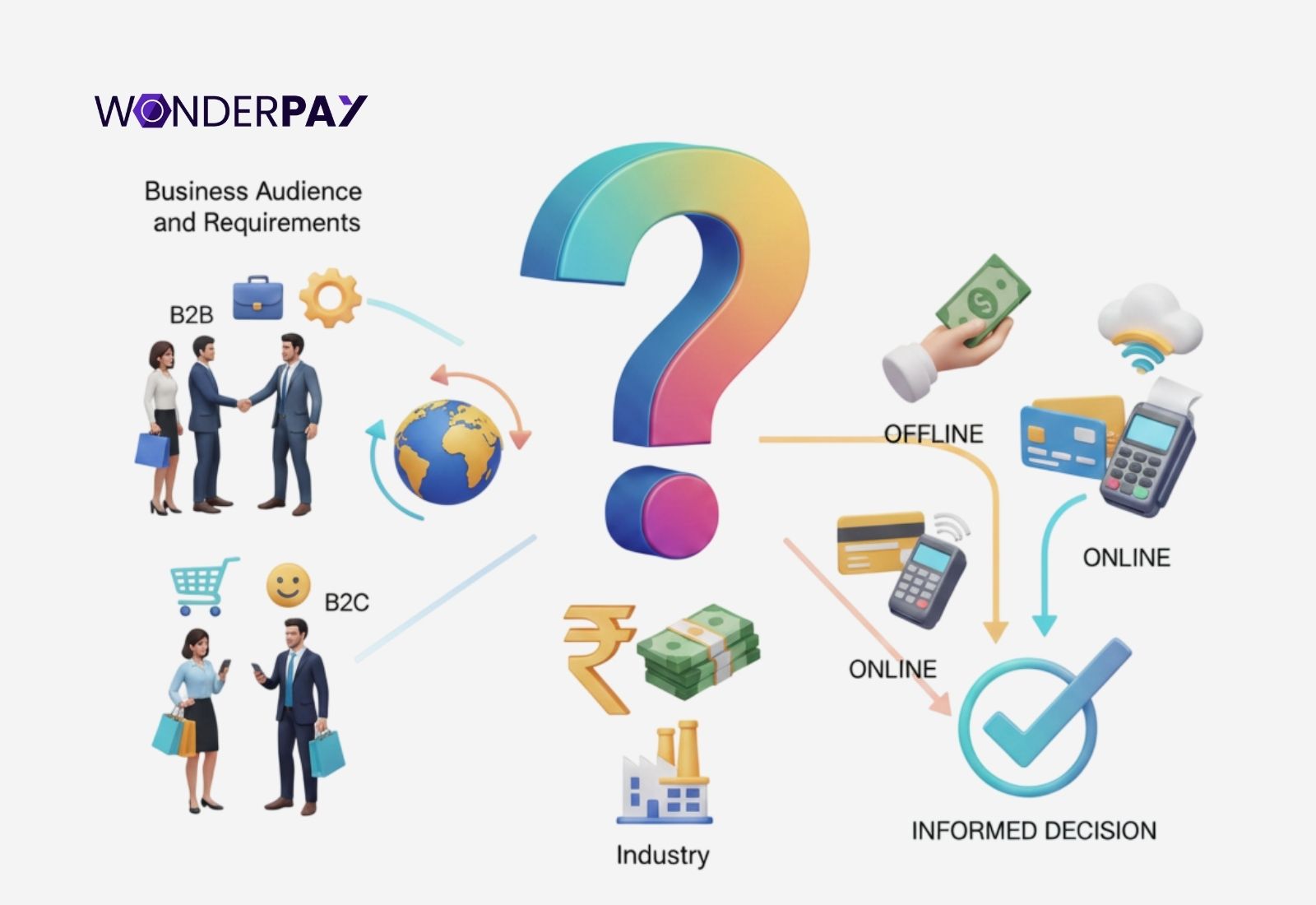

How Do I Choose the Right Payment Methods?

It depends on your business audience and requirements. Whether you serve B2B or B2C, domestically or internationally, as well as the industry you belong to. Once you are clear about your exact requirement. You can make an informed decision to choose between offline and online payment methods.

| Decision Factor | What You Should Evaluate | Why It Matters | Outcome / Direction |

|---|---|---|---|

| Business Audience | Are your customers B2B or B2C? | B2B buyers prefer structured, invoice-based and account-to-account payments. B2C users expect speed and convenience. | B2B > Bank transfer, invoicing, net terms B2C > Cards, UPI, wallets |

| Geographic Reach | Do you operate domestically or internationally? | Payment preferences and regulations vary by country. Local methods increase trust and success rates. | Domestic > Local bank & real-time payments International > Cards, cross-border transfers |

| Industry Type | What industry do you operate in (e-commerce, SaaS, retail, services, manufacturing)? | Each industry has unique transaction sizes, frequency, and compliance needs. | High-volume > Instant digital methods High-value > Secure bank-led methods |

| Transaction Value | Are payments low-value, high-frequency or high-value, low-frequency? | Transaction size impacts fees, fraud risk, and customer willingness to pay instantly. | Low-value > Fast, frictionless payments High-value > Verified, traceable payments |

| Payment Frequency | One-time, recurring, or milestone-based? | Recurring and scheduled payments need automation and predictability. | One-time > Manual or instant methods Recurring > Automated debit systems |

| Customer Payment Behavior | How comfortable is your audience with digital payments? | Adoption level affects conversion rates and payment success. | Digital-first > Online payments Cash- heavy > Offline or assisted payments |

| Where Payments Happen | Online, offline, or both? | The payment environment defines the required infrastructure and user experience. | Online > Digital payment methods Offline > Cash, POS-based payments |

| Operational Readiness | Do you have systems for reconciliation, settlement, and reporting? | Some payment methods demand stronger backend systems. | Limited options > Simple methods Advanced ops > Multiple payment options |

| Compliance & Risk | Are there regulatory or security constraints? | Certain industries and regions require stricter controls. | Regulated > Bank-backed methods Low-risk > Flexible options |

| Growth & Scalability | Do you plan to scale or expand markets? | Payment choices should support future growth without re-integration. | Growing business > Scalable, multi-method setup |

What Are Net 7 Payment Terms?

In simple language, 7 means the number of days a business has to make a payment from the day the invoice is created. It is a Business to Business (B2B) transaction. If the invoice is due by day 8, the late fees may apply.

Example: If an invoice is issued on 1 January, and the payment is due by 8 January. The company has to pay a late fee.

The net 7 payment terms assist both the buyers and the businesses. It allows sellers to improve cash flow, lower credit risk, and better control over receivables. On the other hand, the buyer in this term is more flexible than with advanced payments, and builds trust in early stage relationships.

Related reads: What is a Payment Gateway? Features & Working.

Final Thoughts

Choosing payment methods can make or break a business. With the right strategy and considerations of your company’s targeted audience, geography, exact requirements, and latest payment trends in the market. It will let your company stand out and operate properly.

In short, solve your business’s target audience’s problems, and the rest follows you back. Your targeted audience expects a familiar, effortless, and easy to use payment solution. Once you provide. It will solve the problem your customers are facing for seamless transactions.

Are you in search of reliable, multi payment methods financial services? Look no further, and connect with Wonderpay now, and get it right away.

Suggested read: Why Choose Wonderpay Payment Gateway In India for Businesses

FAQs

1. What are the different payment methods?

There are a number of payment methods that a financial institution, such as a payment gateway, can offer to a merchant (businesses). The different payment methods include card, digital mobile wallets, bank transfers, cash, as well as the newer, faster options like Buy Now Pay Later (BNPL). Additionally, it includes cryptocurrency as a payment method.

2. What are the main categories of payment methods?

The main categories of payment are:

- Cash, the traditional way.

- Card payments.

- Digital mobile e-wallets.

- Direct bank transfer.

- Buy Now Pay Later (BNPL).

3. What is the most secure & safe payment mode in India for online shopping?

All payment modes in India are secure and safe due to the RBI’s regulations and PCI DSS compliance. Every customer payment over any merchant platform, either on the website or the mobile app, is safe because a business can not see the saved customer payment data because of its tokenization policy for card payments, payment encryption, two factor authentication (2FA), which makes every digital payment secure.

4. What are the most essential payment options for a small business?

A small business can use Unified Payment Interface (UPI), which is king in online payments in India. Card payments, mostly credit cards, are another option that you can utilize, one of the most attractive options after UPI, as this offers customers various perks when purchasing with them. These options can deliver the best experience to any small business looking to improve its cash flow and offer the relevant payment methods trending in India.

5. What are the different payment options offered by e-commerce platforms?

E-commerce platforms offer various payment options that are familiar to users. It includes both cash on delivery and online payments. The online payments are revolutionizing the online buying behaviour with the top payment methods like UPI to convert users easily, card payments let customers make high-value transactions while getting benefits like discounts on future purchases with points, and get cashback.

The other payment options, like BNPL, make online purchase more easy to let users pay later in installments. Moreover, the other payment options like bank transfer are other options which are also offered.

6. Which is the best payment method for e-commerce companies?

The top payment options offered by e-commerce are UPI, card payments, and Buy Now Pay Later (BNPL). UPI offers one of the easiest, one-click, secure, and cost-effective solutions for both businesses and their customers. It does not require customers to fill in any payment details, which assists businesses convert the user faster while eliminating the abandonment rate.

On the other hand, card payments, especially credit cards with top benefits like cashback, point collection, and other benefits, make it a magnetic strategy to let customers buy their valuable/needed products while leveraging the benefits on every transaction. BNPL allows customers to purchase their interest products, which are newly launched, and buy early to be an early adopter on easy EMIs and pay the rest amount in parts, quarterly, monthly, or weekly.

7. Are QR code payments online payment modes?

Yes, it is an online payment mode; a customer pays a merchant in-person at the store/shop. Scanning the OR code and making a payment eliminates the need for customers to add payment receiver payments manually, and eliminates the need for merchants to tell every customer their payment details, like payment ID (UPI ID or phone), to receive the payments. It saves time and effort for both customers and businesses while making or receiving payments.