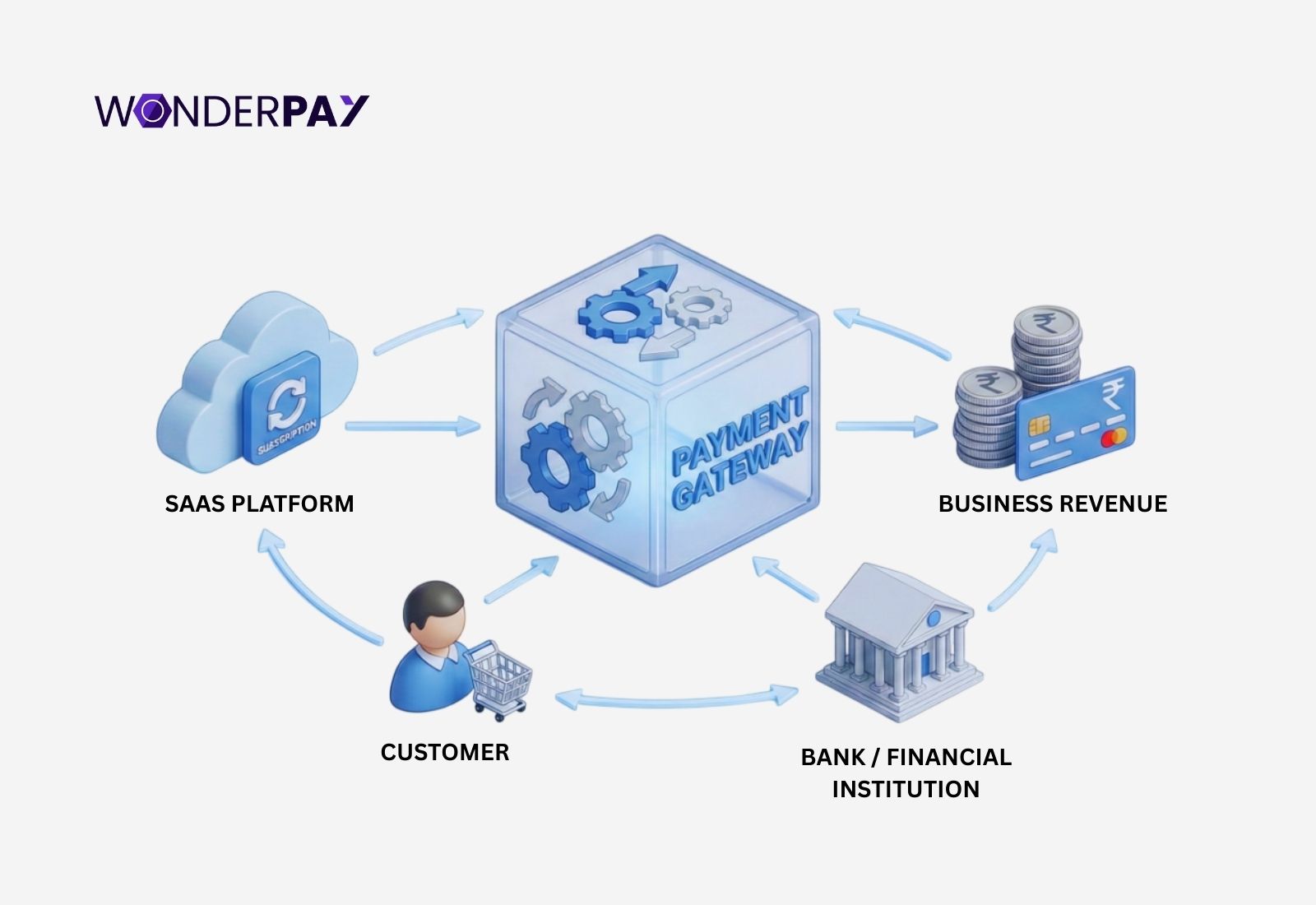

- 1. What is SaaS Business Payment Gateway

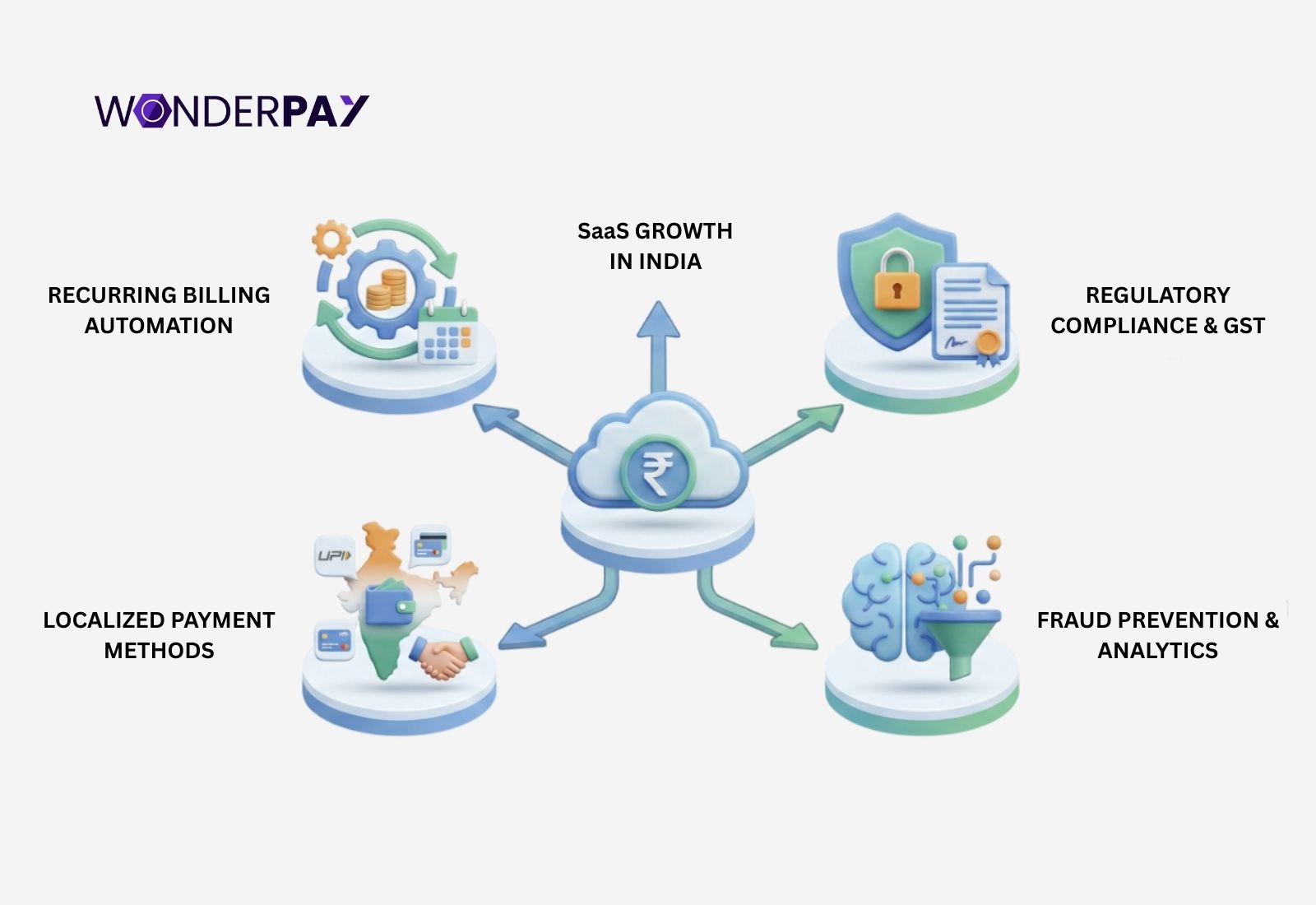

- 2. Reasons: Why Saas Companies Require a Specialized Online Payment Gateway in India Solutions

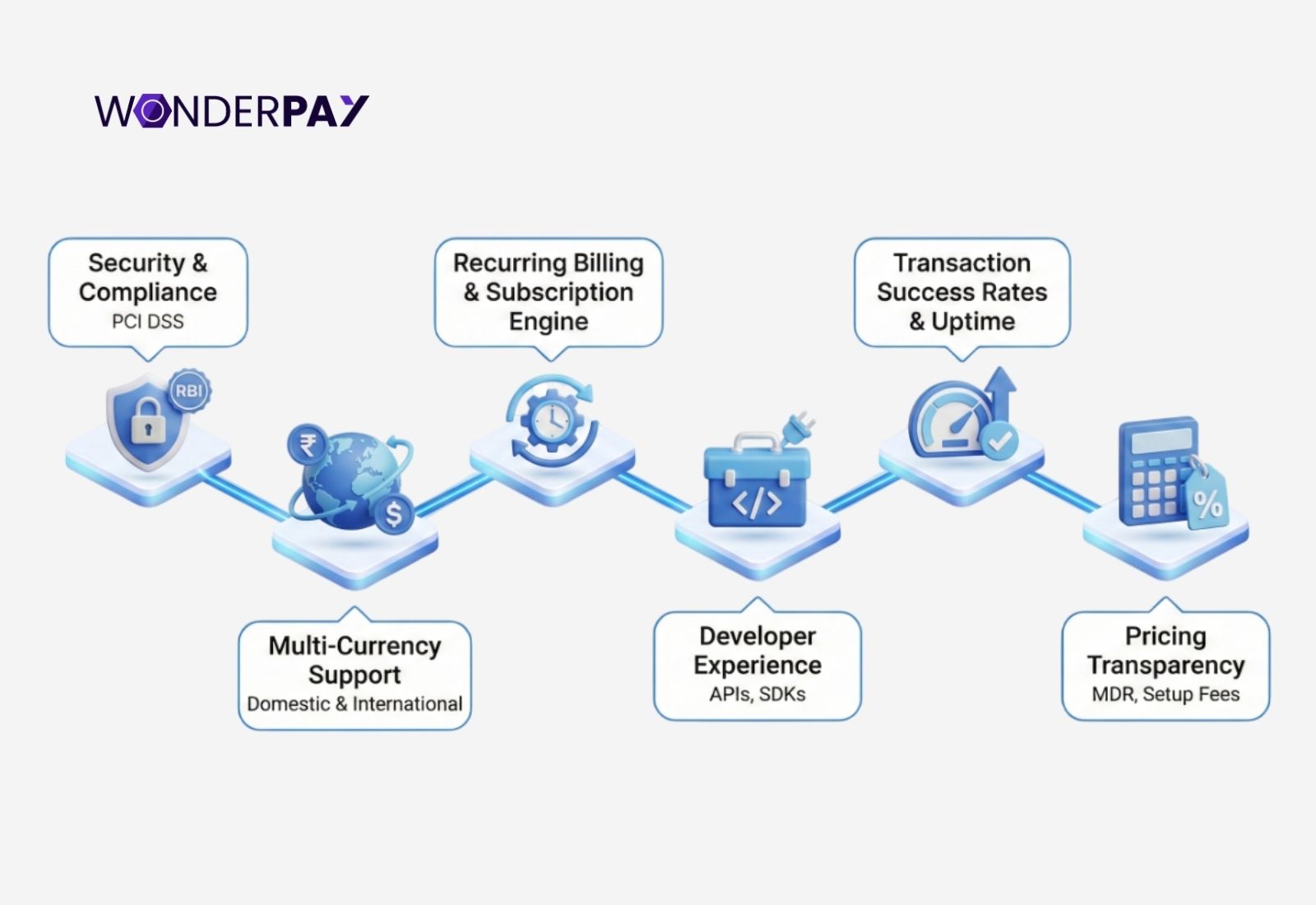

- 3. Must-Have Features of an Online Payment Gateway in India for Saas

- 4. Choose the Best Digital Payment Solution Among the Top 10 Payment Gateways in India

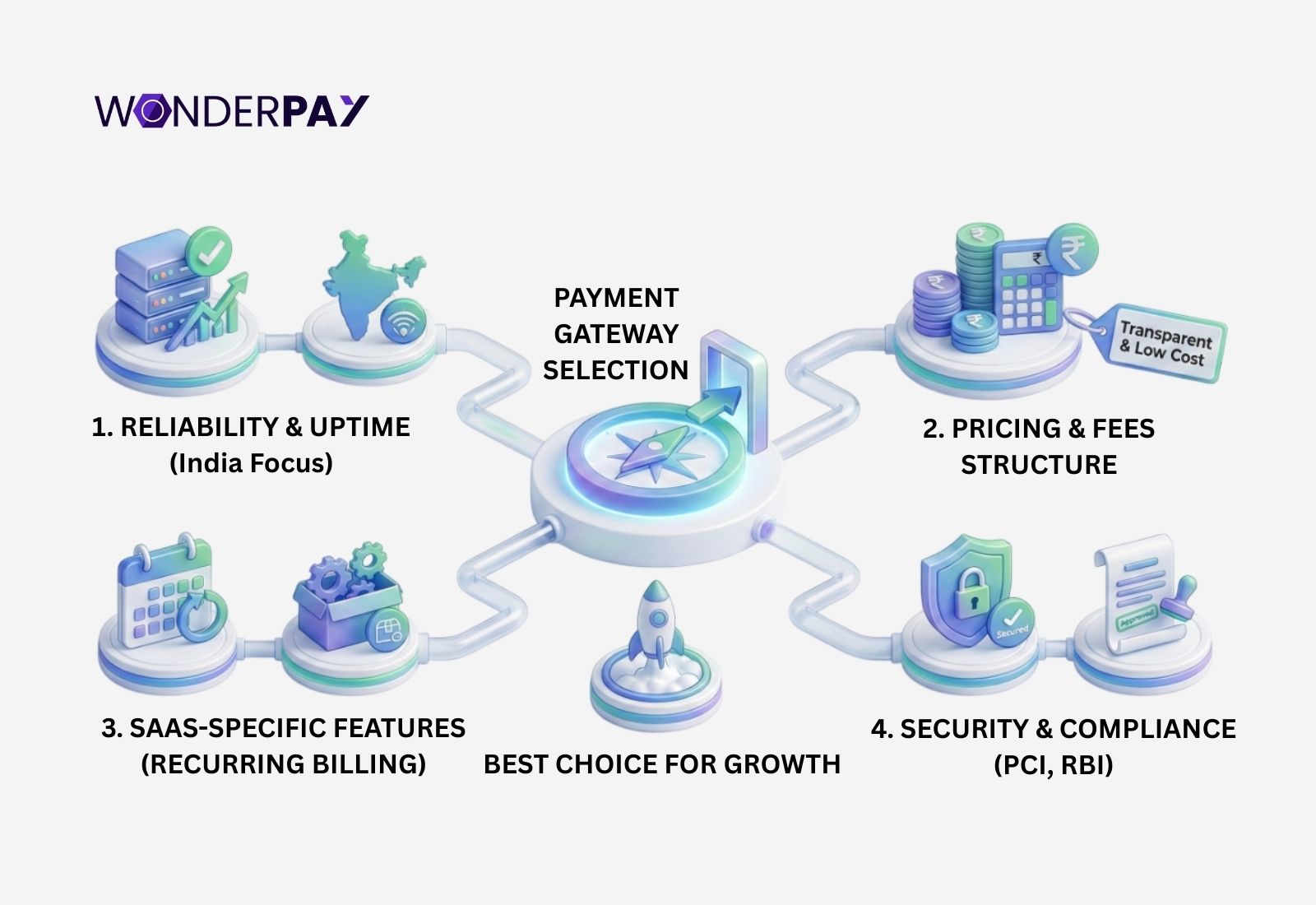

- 5. Significant Facts to Consider Before Selecting a Payment Gateway in India for SaaS

- 6. How Can SaaS Companies Implement Embedded Payments

- 7. Why Choose Wonderpay, Your Top Payment Gateway in India for Subscription Businesses like SaaS

- 8. Final Thoughts

- 9. FAQs

Getting started with the right payment gateway in India can directly impact a SaaS company’s revenue, customer retention, and growth.

Subscription based businesses do not just need an online payment gateway, but they need a system that supports recurring billing, UPI AutoPay, international payments, RBI compliance, and seamless user experience.

With a dozen options claiming to be the best payment gateway in India, SaaS founders often struggle to identify what truly matters: success rates, settlement speed, compliance, pricing transparency, and scalability.

This guide breaks down how Software as a Service organizations can choose the best payment gateway in India, what features to prioritize, and how to evaluate the top payment gateway in India for subscriptions, domestic, and international transactions.

What is SaaS Business Payment Gateway

A payment gateway for SaaS is a digital payment system. It offers Software as a Service businesses with specific payin features. This could include collecting payments in subscriptions for different plans, such as monthly, quarterly, annually, or weekly.

The best payment gateway for SaaS in India will enable your business to collect all its online payments via every payment channel, including Unified Payment Interface (UPI), netbanking, debit or credit cards, contactless transactions with Near Field Communication (NFC), e-wallets, and more.

Moreover, a PG for subscription business offers advanced features like reconciliation, analytics with complete report generation, sending automated follow-up messages for due payments in advance before the subscription ends, and encrypts all your payments while implementing rules and regulations of the Reserve Bank of India (RBI) and Payment Card Industry Data Security Standards (PCI DSS).

Reasons: Why Saas Companies Require a Specialized Online Payment Gateway in India Solutions

The SaaS organizations are heavily dependent on subscription and recurring payments. Therefore, they require a trusted and best online payment gateway in India - one that can align with their business needs.

In this section, we will discuss our technical experts’ top-picked reasons that could help your organization choose the best option of gateway provider for your software company.

Provides Reliable Fintech Infrastructure

The top payment gateway companies in India, such as Wonderpay, offer a reliable fintech infrastructure. It helps SaaS organizations in many ways, from collecting all their payments seamlessly via any payment method to eliminating the need to maintain crucial practices like PCI DSS and obeying RBI guidelines for secure payments and Anti Money Laundering (AML) standards.

UPI was observed as the most significant expansion, which recorded more than 50% growth, and credit cards grew by approximately 20% because of high demand from Gen Z and with the population in Tier 2nd and below cities. Additionally, the Bharat Bill Payment System (BBPS) witnessed a growth of 25%.

The payment methods from UPI to cards are the simplest and easiest solutions to make any payments from subscription to one time. At the same time, options like UPI also provide auto debit features along with linking of credit cards, which makes payment circulation simpler today.

Experiencing the rapid growth of digital payments, you need a strong, trusted, and compliant payment gateway that can help your company generate good revenue with its seamless online payment solution.

When it comes to India’s digital payment statistics, PwC released its Indian Payments Handbook, which mentions that the popularity of Indian payment products is escalating considerably. This growth is driven by the new industry use cases, which include the increasing participation from banks, non-banking financial companies (NBFCs), as well as fintech companies, and more, with their seamless integration with digital ecosystems and marketplaces, and the advanced security features they offer.

Recurring Payments

A payment gateway in India with rich features, like recurring payments, allows you to collect payments easily. Along with periodic transactions, you get other features as well, which include sending in-app notifications for due month payments, reconciliation, and generating reports with just a click.

Gateway platforms may ease your work with their well-developed dashboards, which also provide you with different functionalities. It may help you with a specific month’s turnover that you want to know about, abandonment rates, and more.

Must Read: What is a Payment Gateway? Meaning, Features, Benefits, and working?

Enhance Customer Experience with AI and ML

The rise of Artificial Intelligence (AI) and Machine Learning (ML) both these technologies transforming customer interactions together. These technologies facilitate:

Quick Fraud Detection: The AI identifies suspicious activities such as unauthorized access patterns. The ML, on the other hand, learns from the same activity and makes the system more secure.

Personalization: Its ability to personalize recommendations suggests relevant content or services tailored to user preferences.

Behavioural Insights: Know your customer behaviour towards a service or the content they engage with more. Its deep understanding of a customer’s behaviour drives your engagement and loyalty.

Thanks to advanced technologies of AI and ML that simplify complex operations, provide advanced security, and personalization with their seamless working.

UPI Payment Support

The Unified Payment Interface (UPI) is the undisputed king in India. It captures most digital transactions, reaching 85%. This online digital payment method is transforming the landscape for consumers as well as for small businesses.

-

Its simplicity and affordability make online payments incredibly easy for any user, whether it is a street vendor, a large retailer, or a customer.

-

UPI payments support financial inclusion by bringing small businesses to individuals into the formal digital economy.

-

This simplest solution for online payments has become RBI’s backbone to be a revolutionary force in India’s less-cash future.

Compliant Payment Gateway in India

The top payment gateway in India, for SaaS, is compliant and RBI-approved. A PG solution will involve the RBI or the Foreign Exchange Management Act (FEMA) rules - this makes it the best payment gateway in India for international transactions, further the GST on domestic or export, and PCI DSS for card security.

With the proper documentation, such as Permanent Account Number (PAN), GST, and bank details for setup, and secure recurring billing while having clear customer consent. These key components make a gateway a top solution for any Software as a Service Business to get a payment gateway that aligns with their exact requirements.

All these reasons make a PG solution in India stand out of the box for any software service provider. In order to deliver a connected experience, with seamless payments and high security.

Must-Have Features of an Online Payment Gateway in India for Saas

Payment gateway for saas in India requires business owners to ensure RBI regulations, mandating Two Factor Authentication (2FA) such as One Time Password (OTP), and data localization, with the industry standards like PCI DSS, plus the tech like card tokenization encryption, and secure platforms like UPI. All these factors aim to verify a user’s identity and protect selective data from breaches.

Complete List of Features Best Payment Gateway in India Should Offer You:

RBI Regulatory Framework

-

Two Factor Authentication: The 2FA is RBI’s regulatory framework. It mandates the online payments (Card Not Present), requiring something the user knows, such as their PIN or password, and something you have, which could be OTB/phone.

-

Data Localization: It is compulsory to store payment data within the country, which provides RBI with better oversight and security as well.

-

PA/PG Guidelines: The rules and regulations for payment aggregators or gateways cover security, settlement, as well as operations.

Suggested Reads: 10 Security Standards for Businesses | Payment Gateway in India

The Technological Safeguards You Should Consider are as follows:

-

Tokenization: All payments by any customer are secure and shielded in a unique way. Once the user enters card information like card number, expiry date, and CVV. They are all saved not in actual numbers but in a tokenized form. It avoids the data breach of user-sensitive payment data.

-

Encryption: The PG must scramble data using technologies such as SSL, TLS, and 256-bit encryption, which should be done during transmission to prevent interception.

-

3D Secure: It is an extra verification step that is verified by Visa, Mastercard SecureCode for eCommerce.

A Secure Payment System

-

UPI Payments: It uses a real-time system with device binding and a PIN for secure and instant fund transfers.

-

Payment Gateways: It should implement the technologies that comply with the PCI DSS, which is a global standard for card data security, and also the RBI mandates.

What Other Measures a SaaS Business Should Consider

-

Information Security Policies: Entities using a payment gateway for SaaS must have board-approved policies, security frameworks, as well as incident response systems.

-

Cyber Insurance: Available for individuals and businesses to cover losses from digital fraud, phishing, and frauds with data breaches.

-

Digital Ombudsman: They should provide a channel for grievance redressal for digital payment issues.

Also Read: Wonderpay Payout: Meaning, Process & Benefits

Choose the Best Digital Payment Solution Among the Top 10 Payment Gateways in India

Choosing the right digital fund transfer service provider among the top 10 payment gateways in India is easy. In this section, we will discuss a comprehensive list you must consider before you finalize one for your business’s digital payment needs.

Choosing the right digital fund transfer service provider among the top 10 payment gateways in India is easy. In this section, we will discuss a comprehensive list you must consider before you finalize one for your business’s digital payment needs.

- What is your business model and scale?

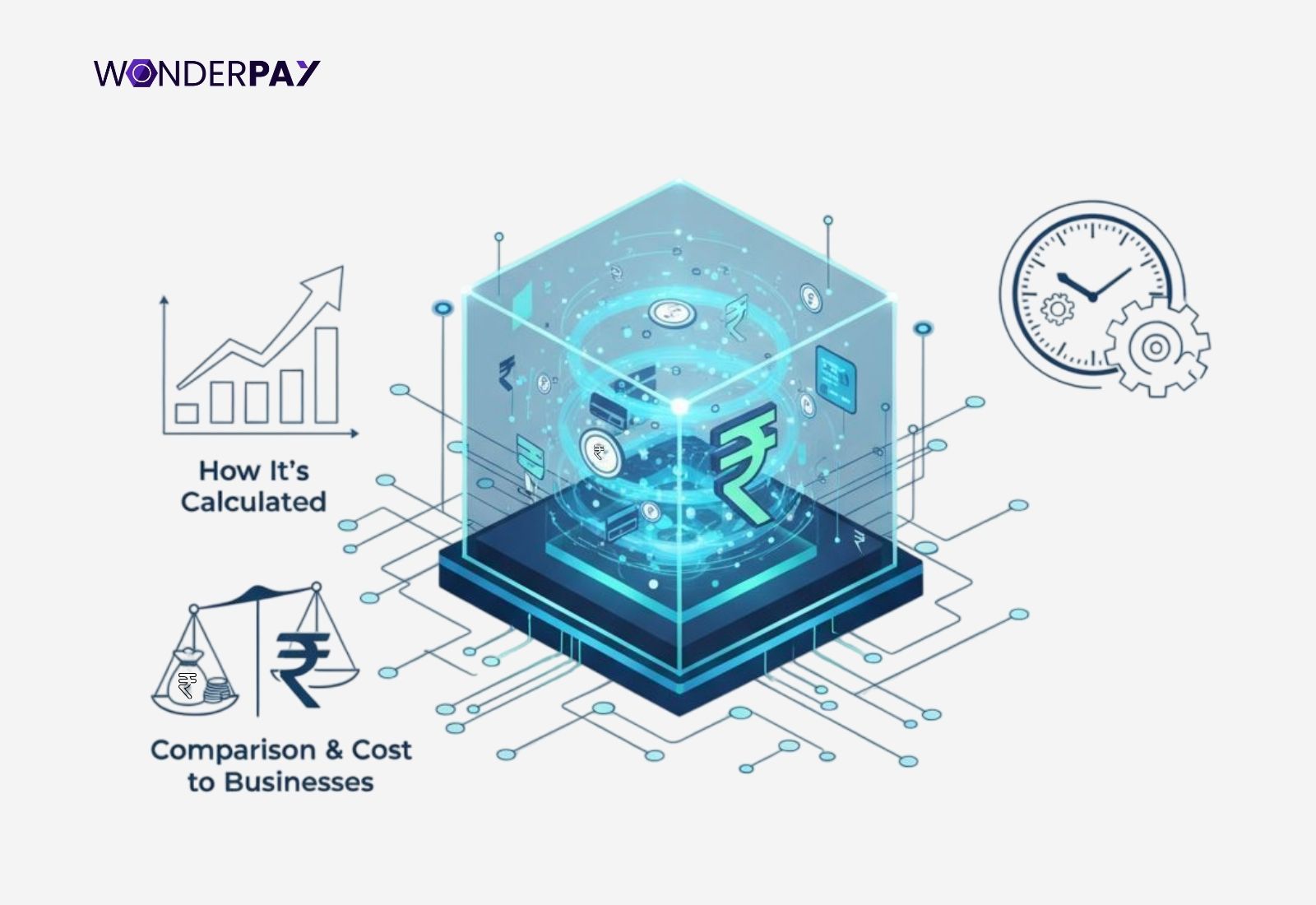

- Fees and pricing.

- What payment methods do they support?

- Security and compliance.

- Their integration system and previous user experience.

- Settlements and payouts.

- Product and service eligibility.

Getting started with a payment service provider. You can also consider the following things, which are crucial for all sizes of businesses.

Learn: How Can You Choose a PG Solution

- You can list all your needs you want within a payment gateway.

- Now check and shortlist the best payment gateway for SaaS.

- Compare key metrics.

- You may test them as well, if possible, first.

- Read the older users’ experience within reviews on Google My Business profile (GMB) or other platforms that provide you with genuine reviews.

Suggested Read: Payment Gateway Charges Guide for Businesses

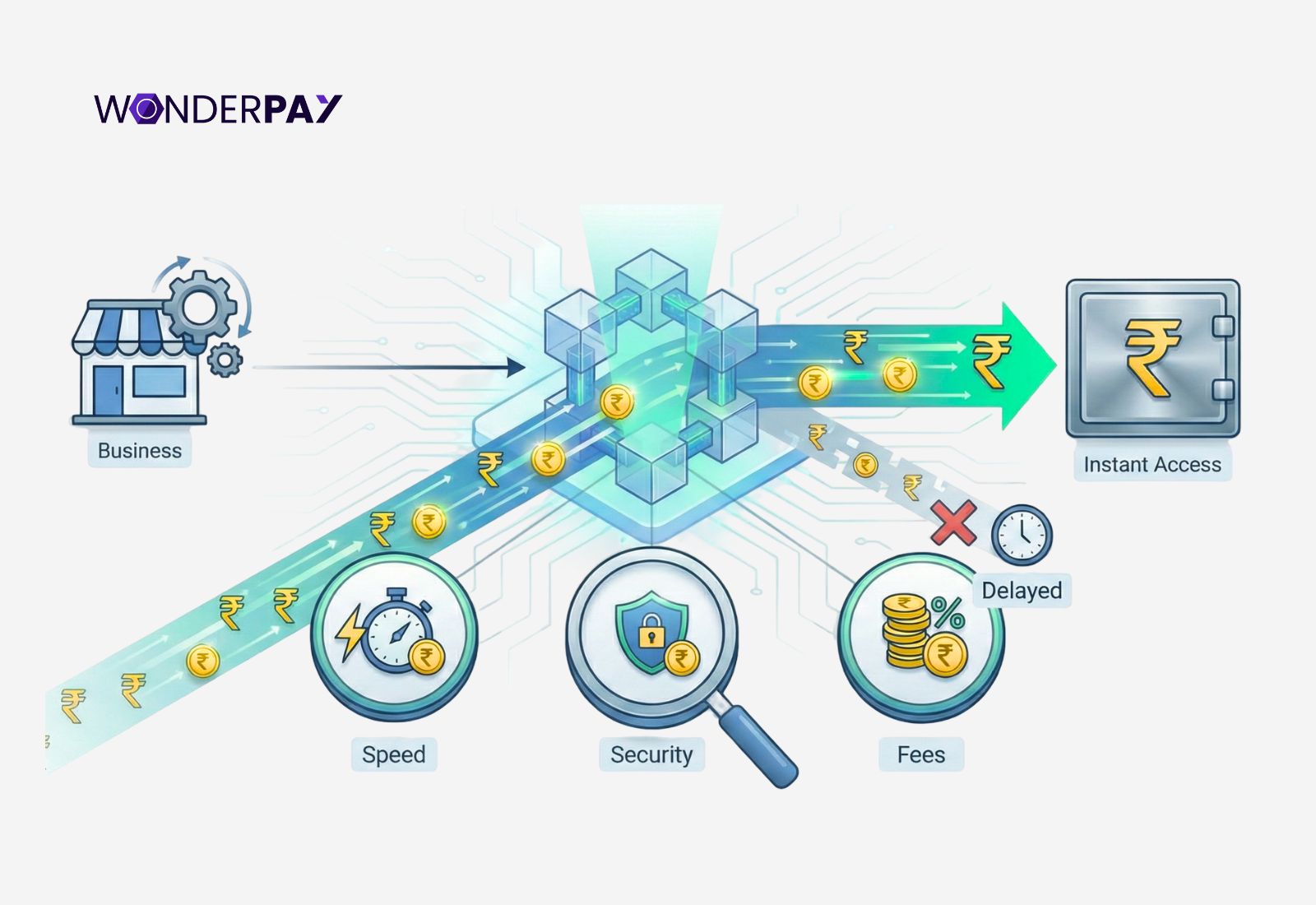

Significant Facts to Consider Before Selecting a Payment Gateway in India for SaaS

Choosing an online payment gateway for SaaS in India can be tricky due to the many options. It could be due to complex fee structures, varying support, and specific business needs such as high-value transactions or international reach.

Choosing an online payment gateway for SaaS in India can be tricky due to the many options. It could be due to complex fee structures, varying support, and specific business needs such as high-value transactions or international reach.

One that requires a deep dive beyond simple pricing, making it less about finding one perfect fit and more about aligning features like robust security, seamless mobile integration, support for local methods such as UPI, wallets, including the transaction limits with your unique business model.

Frictionless Payments

Since you are a SaaS company, your customers aim for a streamlined checkout process, with fewer steps and simpler interactions. A reliable online payment gateway will always help you eliminate obstacles and potential barriers that may prevent a consumer from completing a transaction, drive you to a higher conversion, and ultimately generate more revenue for your organization.

Look for India’s Highest success rate

To get payment gateway in India, you should aim for an intelligent payment infrastructure of a PG. It helps you deliver the unmatched success rates among all payment methods your customers are familiar with, from UPI, netbanking, to cards.

All Payin Options

Software as a Service brands are subscription-based businesses. Take an example of a video streaming platform like Netflix. Your business customer comes from a different background, right? There, they expect a simple, quick, and effortless pay option. It is a fact reported by

Developer-friendly APIs

Software service provider businesses like yours need a reliable subscription payment gateway in India. It is only because of the complicated market of PG service providers, which you may find committing the best payment gateway.

In order to connect with the trust payment solution, you may consider a PG company only after knowing whether they could help you with a developer-friendly API along with clean, well-documented code. One that lets you integrate payments effortlessly on any platform, from your business website to a mobile application.

Enterprise-grade Security

A payment gateway service provider implements the best practices to provide rich security. The provider must comply with PCI DSS Level 1 compliance, offer continuous monitoring as well, and use advanced encryption. This helps you shield both your customer data as well as the transitions compromised.

Visualized Everything from a Dashboard

An online payment gateway in India should assist you with everything while providing you with complete control over all your activities that you initiate. It should let you track payments, refunds, settlements, and analytics. This will be done with a single, intuitive dashboard. On the other hand, the dashboard should allow you to get real-time insights so your business can make smarter business decisions.

Consider for Conversion-Optimized Checkout PG

A better checkout experience will lead you to increase sales, which is a must for a subscription-based business. Getting started with a high-performance checkout built to minimize your business customer friction and will support you with an optimized conversion success across every transaction.

Hidden Costs

Per transaction fees are one part, but you should go beyond them, such as setup fees, maintenance, chargeback, and failure charges, also.

Integration Complexity

You must review and research well for your provider’s API solution, plugins for platforms like WooCommerce, or Shopify. In case of poor API or plugins, you have to face unnecessary headaches.

Also Read: What is Instant Settlement?

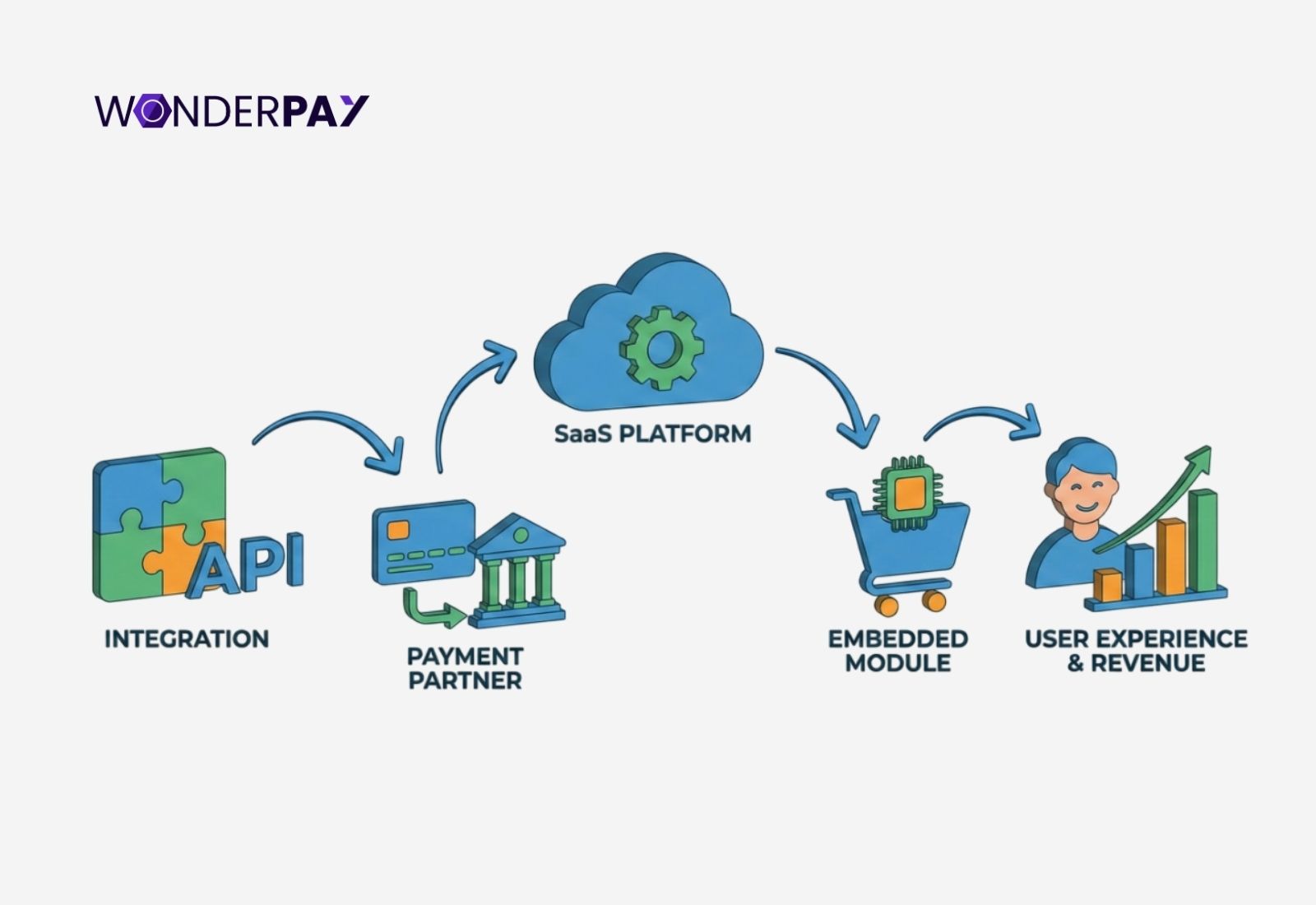

How Can SaaS Companies Implement Embedded Payments

Software companies selling their services online can control their customer journey, and they can also offer their customers financial services natively. Its direct integration within your SaaS platform lets your users pay without leaving your mobile application or website.

It provides your business customers with a seamless checkout experience. Customers sitting anywhere at any time can make a payment to you directly into your account. It can be completed using any of the payment methods customers are familiar with. It will help get a frictionless experience and reduce cart abandonment.

Easiest Ways to Implement an Embedded Payment Gateway for SaaS Businesses in India

The first thing you can initiate to implement an embedded payment gateway in India for your company is to partner with a payment facilitator (PayFac) or PayFac as a Service (PFaaS) provider. Within this, it will assist you with Application Programming Interface (API), Software Development Kit (SDKs), in order to have a native payment experience like card fields, e-money accounts, or branded cards.

Steps:

- Choose your model among PayFac (Payment Facilitator), PayFac as a Service.

- Select a payment partner such as Wonderpay.

- Integrate with APIs or SDKs.

- Handles data and compliance.

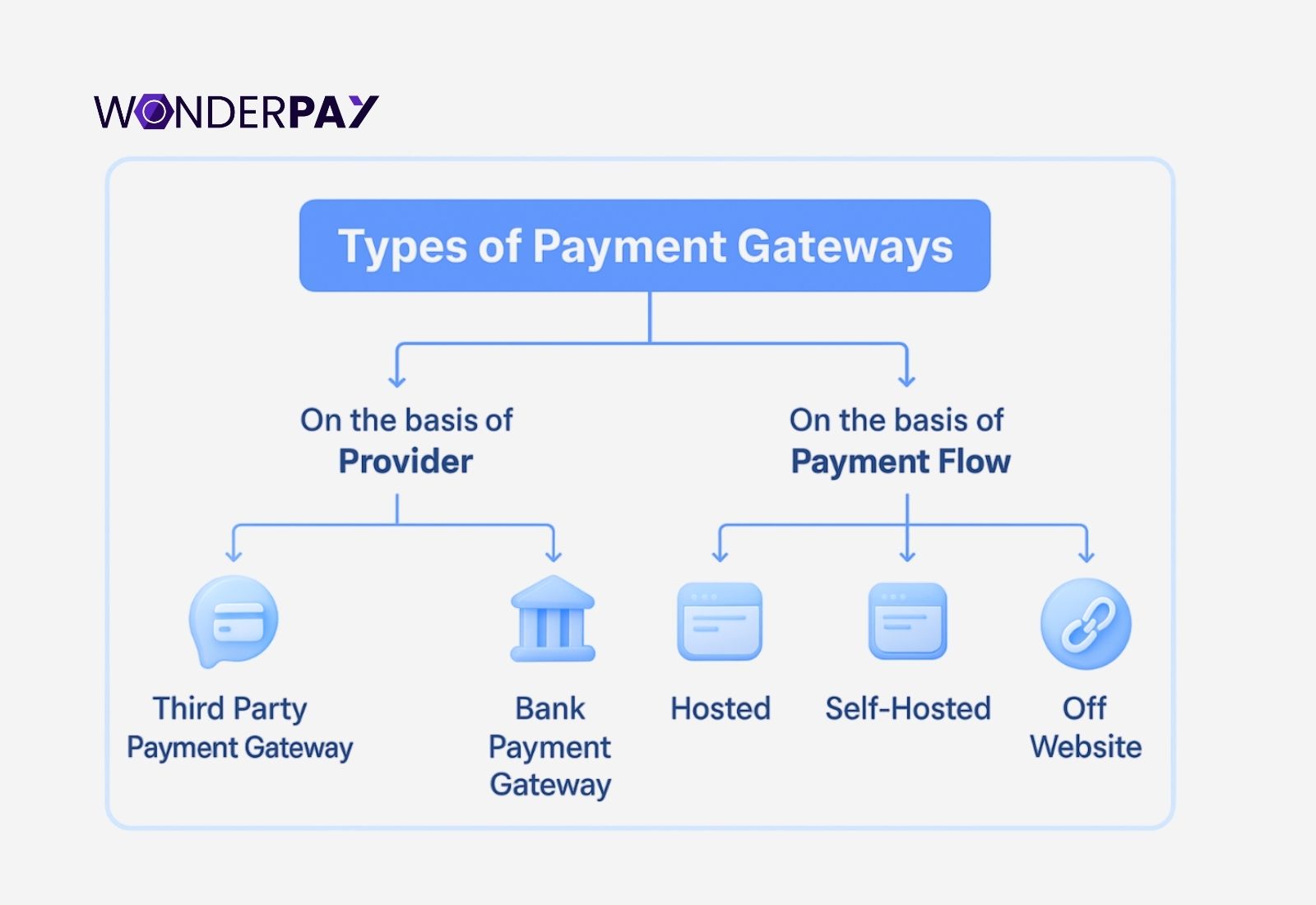

Suggested Read: Types Of Payment Gateways In India & How To Choose Right One

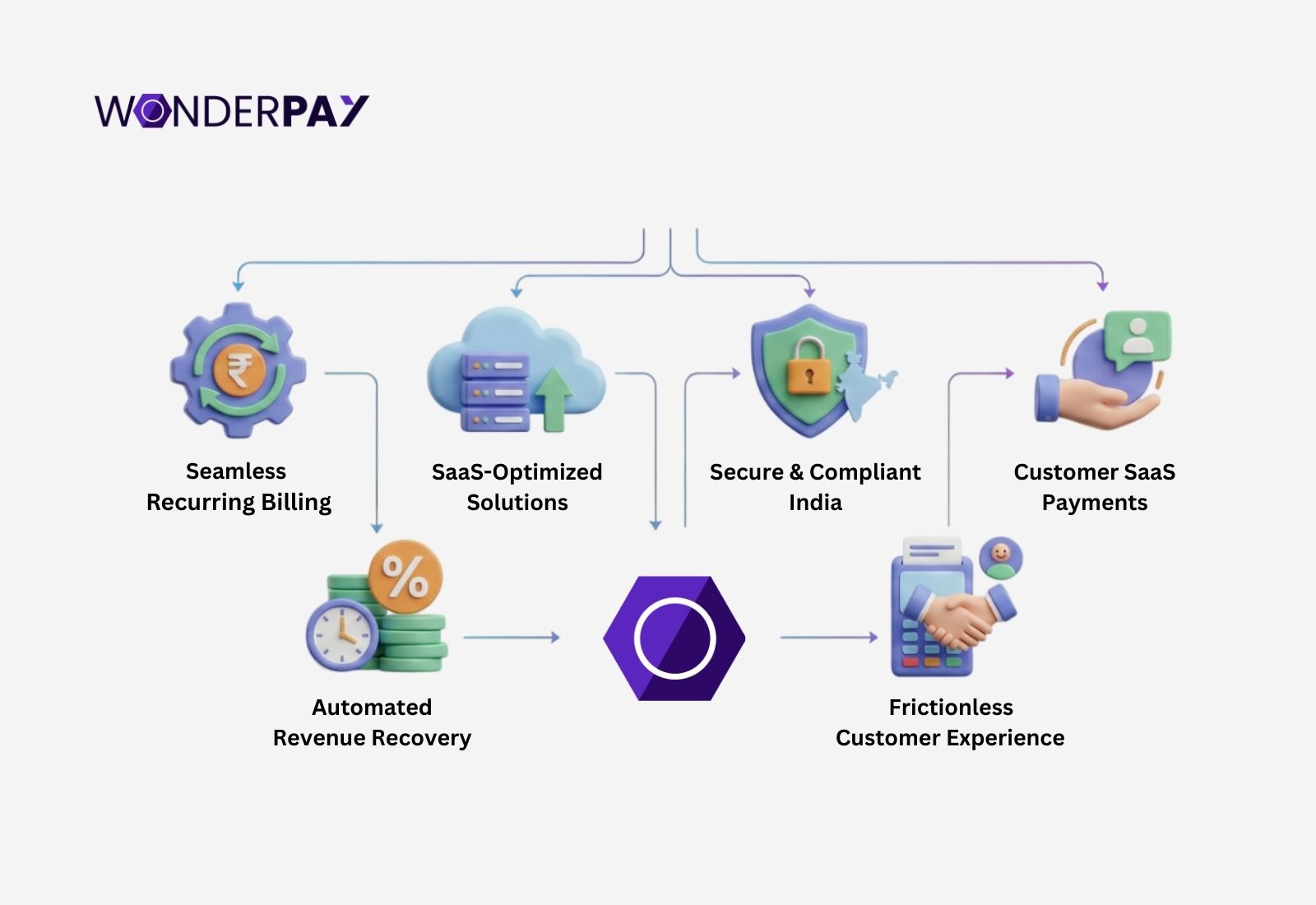

Why Choose Wonderpay, Your Top Payment Gateway in India for Subscription Businesses like SaaS

The top payment gateway of India, Wonderpay, offers all sizes of SaaS organizations with a fully customized payment solution. Its modern technology with rich features with a comprehensive dashboard drives you with an improved experience. So, you can deliver your business customers with a seamless checkout experience, reduce churn rate, and eliminate card abandonment with an easy to use platform.

Collect all your recurring payments for your subscription company with its advanced technologies, like in-app notifications for due payments, push notifications, scheduled payments, get customer insights by knowing their behaviour, and much more.

WPay serves several software as a service merchants that collect all their online payments using all payment options. Moreover, with our embedded payment solution, your customers pay you directly on your platform, whether it is your app or website. It means, check out on your platform with your branding, within just a few clicks that are encrypted, tokenized, and fully compliant with PCI DSS, RBI, GST, and NPCI, and this makes it a top payment gateway for India.

You Might Also Like: Why Choose Wonderpay Payment Gateway In India for Businesses

Final Thoughts

Choosing the right payment gateway is a strategic decision for SaaS businesses. Beyond transaction processing, it affects cash flow, customer experience, compliance, and scalability.

By evaluating payment gateways based on subscription support, success rates, security, and developer experience, Software as a Service organizations can build a reliable payment foundation that supports long-term growth.

India’s digital payments ecosystem continues to grow; choosing a future-ready online payment gateway in India will be critical for sustainable SaaS success.

FAQs

What is the best payment gateway for SaaS in India?

The best payment gateway for SaaS in India assists with recurring billing, UPI AutoPay, subscription analytics, and RBI and PCI DSS compliance. It does not matter whether it is a domestic payment or an international one.

Can SaaS businesses accept international payments?

Yes, many payment gateways in India support international cards and cross-border transactions, which are subject to FEMA regulations.

Is UPI suitable for subscription payments?

Yes, UPI is one of the best options that AutoPay allows a customer to make recurring collections with customer consent, making the same ideal for SaaS subscriptions.

Are payment gateways free for SaaS businesses?

There are no free payment gateways for SaaS, but some providers of PG services waive setup or maintenance fees, which are completed on a volume basis.