- 1. What Is an Online Payment Gateway & Why It Matters?

- 2. How We Evaluated the Top Payment Gateways for Freelancers India?

- 3. Best Payment Gateway for Freelancers in India by Business Type

- 4. Best Payment Gateway for Freelancers and Creators

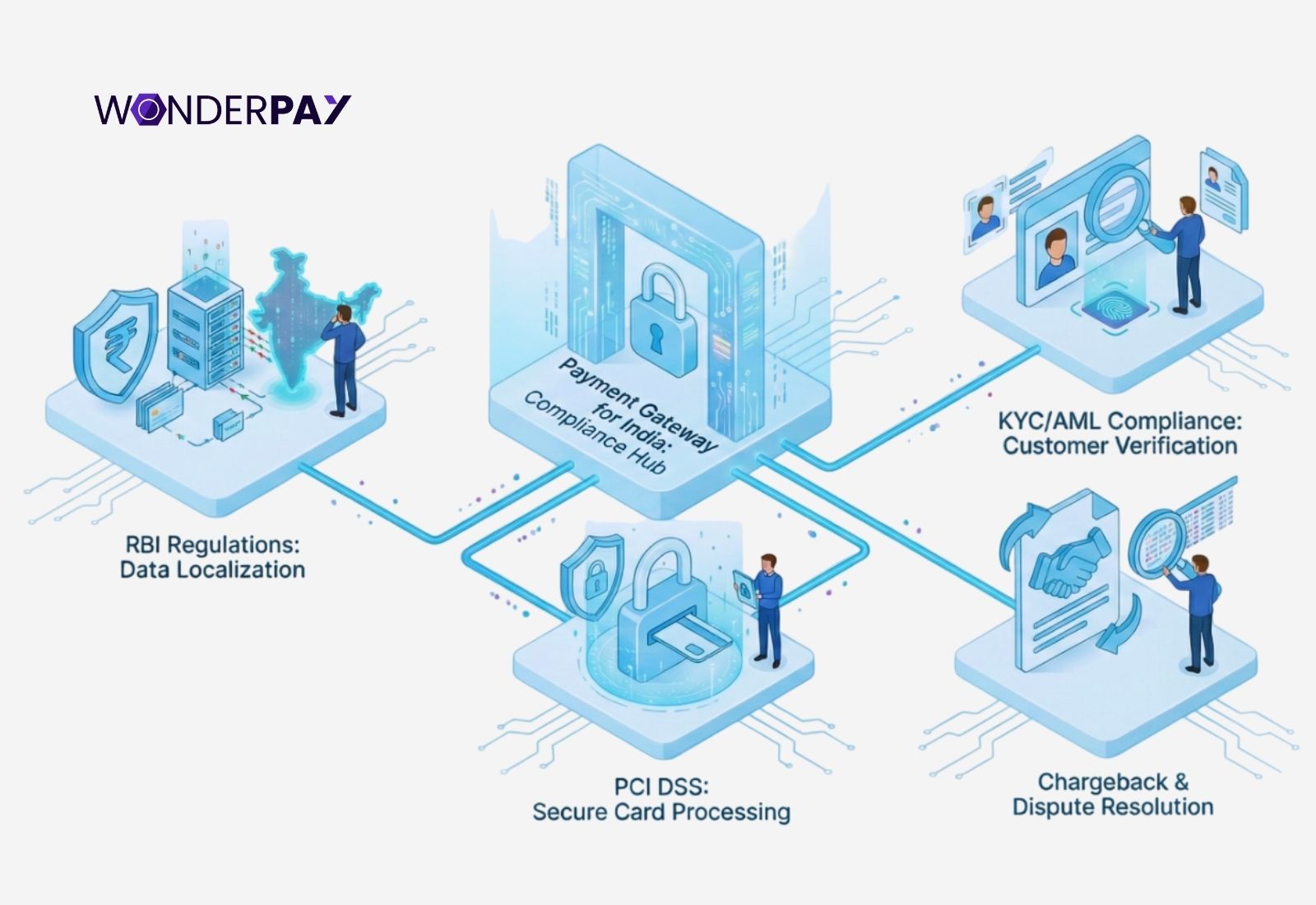

- 5. Payment Gateway for Freelancers: Compliance and Regulatory Factors

- 6. Comparison Table: Top Payment Gateways for Freelancers at a Glance

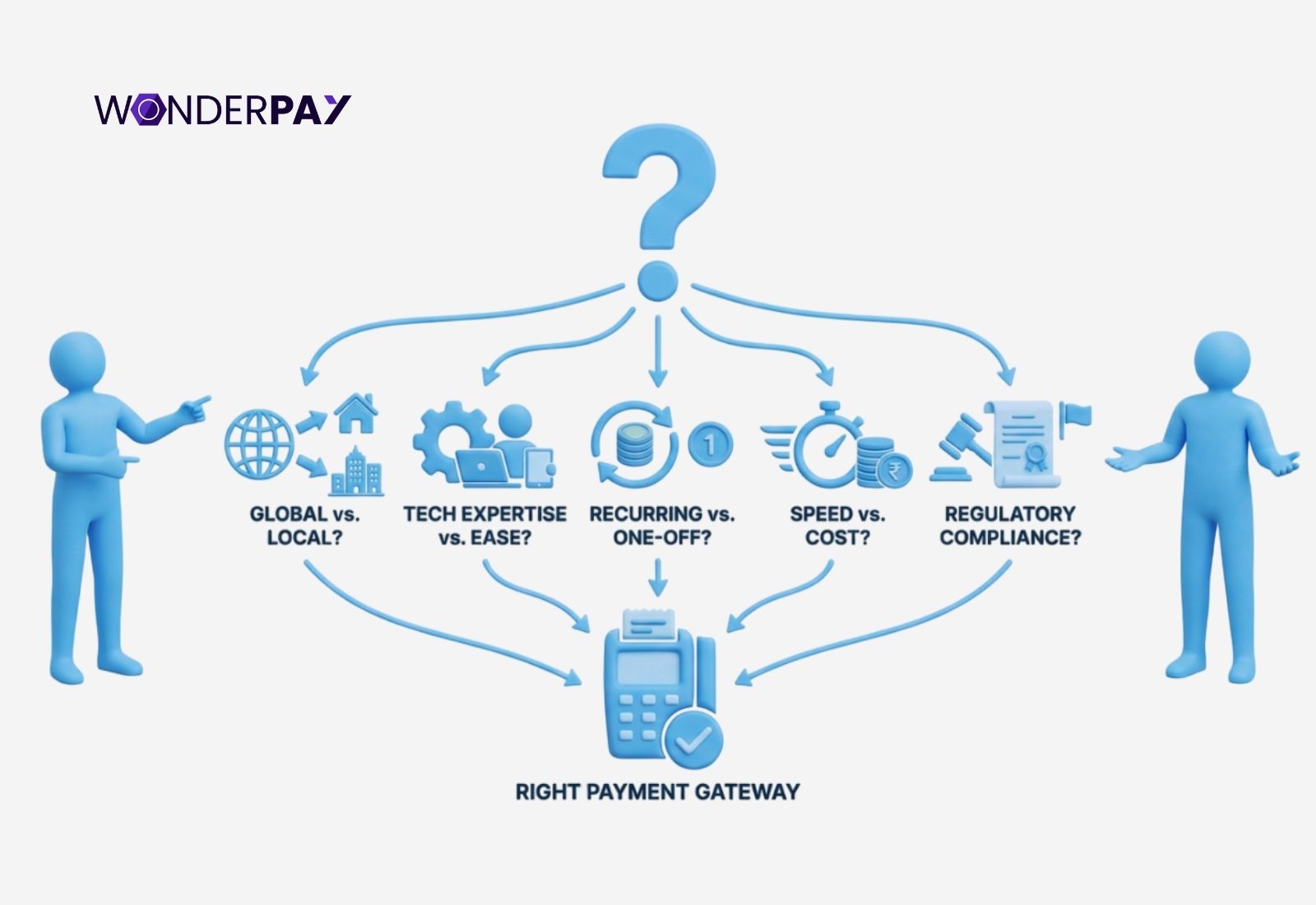

- 7. How to Choose the Right Payment Gateway for Your Business?

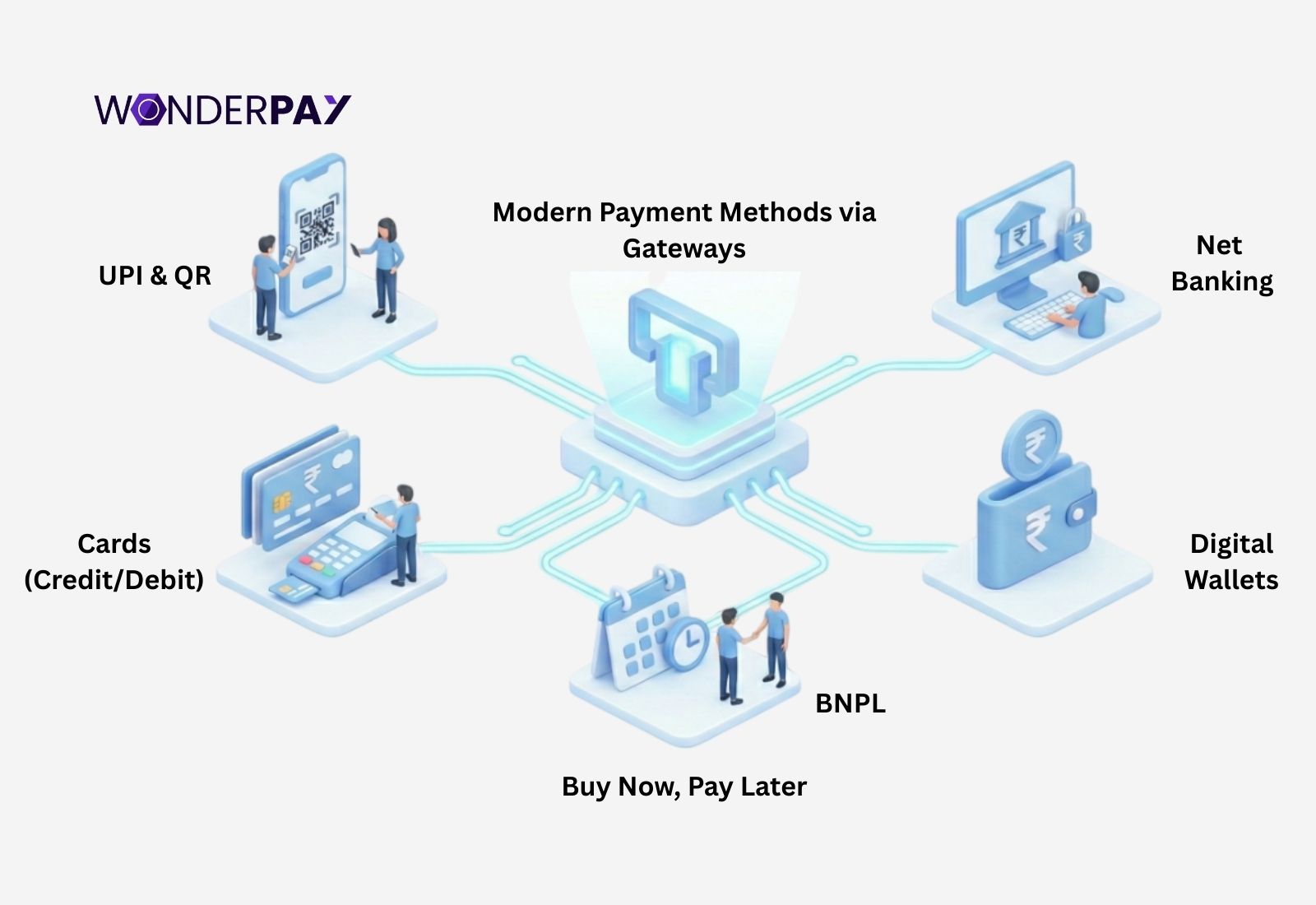

- 8. Payment Methods Supported by Modern Payment Gateways in India

- 9. FAQs

- 10. Conclusion

Choosing the best online payment gateway in India is becoming confusing for businesses, freelancers, or content creators. With several platforms promising to be the best payment gateway service provider for freelancers, with similar features. It is difficult to tell which payment gateway fits well for individuals like you.

India’s digital payment ecosystem is the most advanced in the world, with the UPI adoption, regulatory oversight from RBI, and a rapidly growing online-first ecosystem. As a result, payment gateways are not just transaction tools. They impact your business cash flow, your customers’ trust, and operational efficiency.

This guide is created to help you decide on a PG solution and compare them objectively. Understand which platform fits best for your business, whether you are an individual, a startup, or an enterprise that requires an international payment gateway for freelancers or domestic purposes.

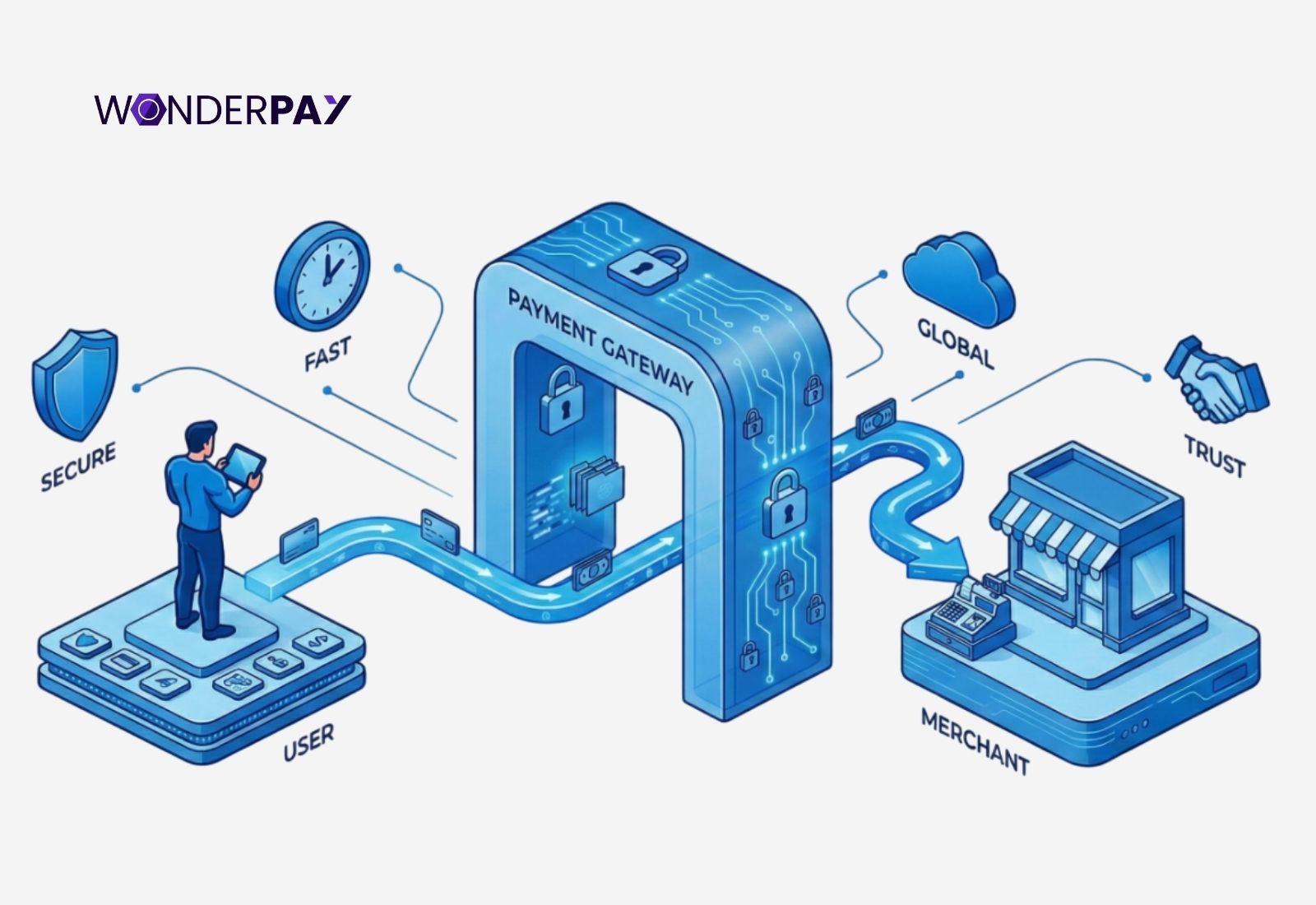

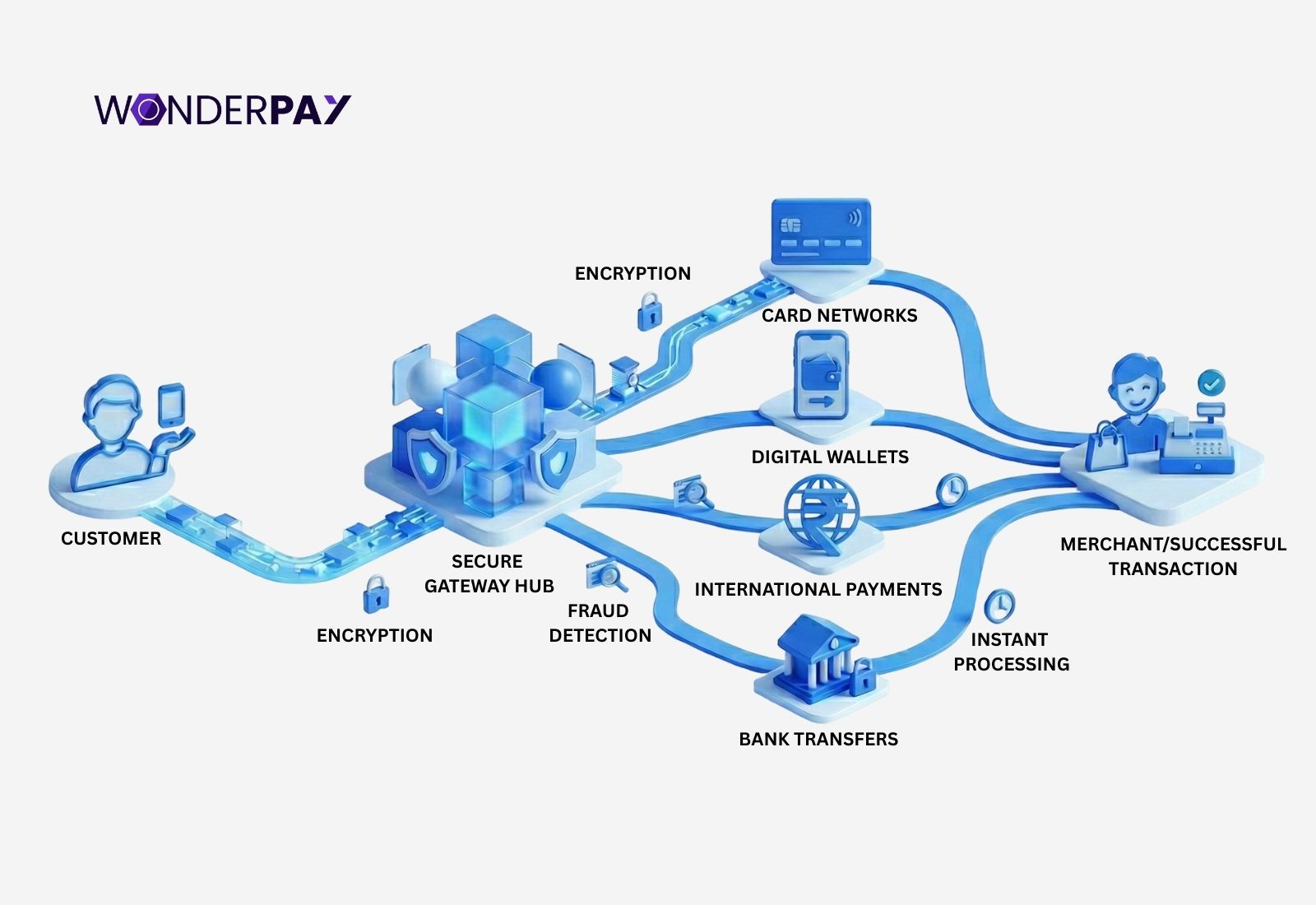

What Is an Online Payment Gateway & Why It Matters?

An online payment gateway for freelancers is a technology layer that securely authorizes, transmits, and settles digital payments between customers, merchants, banks, and payment networks. Consider it as a bridge that ensures effortless and secure money moves from one account to another.

An online payment gateway for freelancers is a technology layer that securely authorizes, transmits, and settles digital payments between customers, merchants, banks, and payment networks. Consider it as a bridge that ensures effortless and secure money moves from one account to another.

While banks hold funds, the payment processor handles transaction execution, and the payment gateway manages encryption, authentication, and communication across the entire payment flow. It is a crucial process; choosing the wrong gateway may lead you to face liabilities, failed transitions, delayed payments, and compliance risks.

In India, where Unified Payment Interface(UPI) volumes are high and regulatory standards are strict, the reliability, compliance, and settlement speeds matter as much as pricing. A digital payment service provider that struggles in peak traffic or experiences delayed payments can disrupt both the client and business experience.

How We Evaluated the Top Payment Gateways for Freelancers India?

In order to identify what truly qualifies as a top payment gateway for freelancers in India, we evaluated each platform by utilizing consistent, business-relevant criteria instead of just marketing claims or popularity alone. This approach ensures the comparison remains practical and unbiased.

This evaluation focuses on the following:

-

Support payment methods such as UPI, cards, wallets, net banking, etc.

-

The settlement speed and payout reliability.

-

Their pricing transparency and hidden charges.

-

API quality and how easy it is to integrate.

-

Is PG compliant with RBI guidelines and PCI DSS standards?

-

Quality of customer and technical support.

By applying the same backmark across all platforms, this guide will avoid surface-level comparison and assist you in assessing the gateway based on long-term usability and operational fit.

Also read: How To Choose Best Payment Gateway In India For SaaS

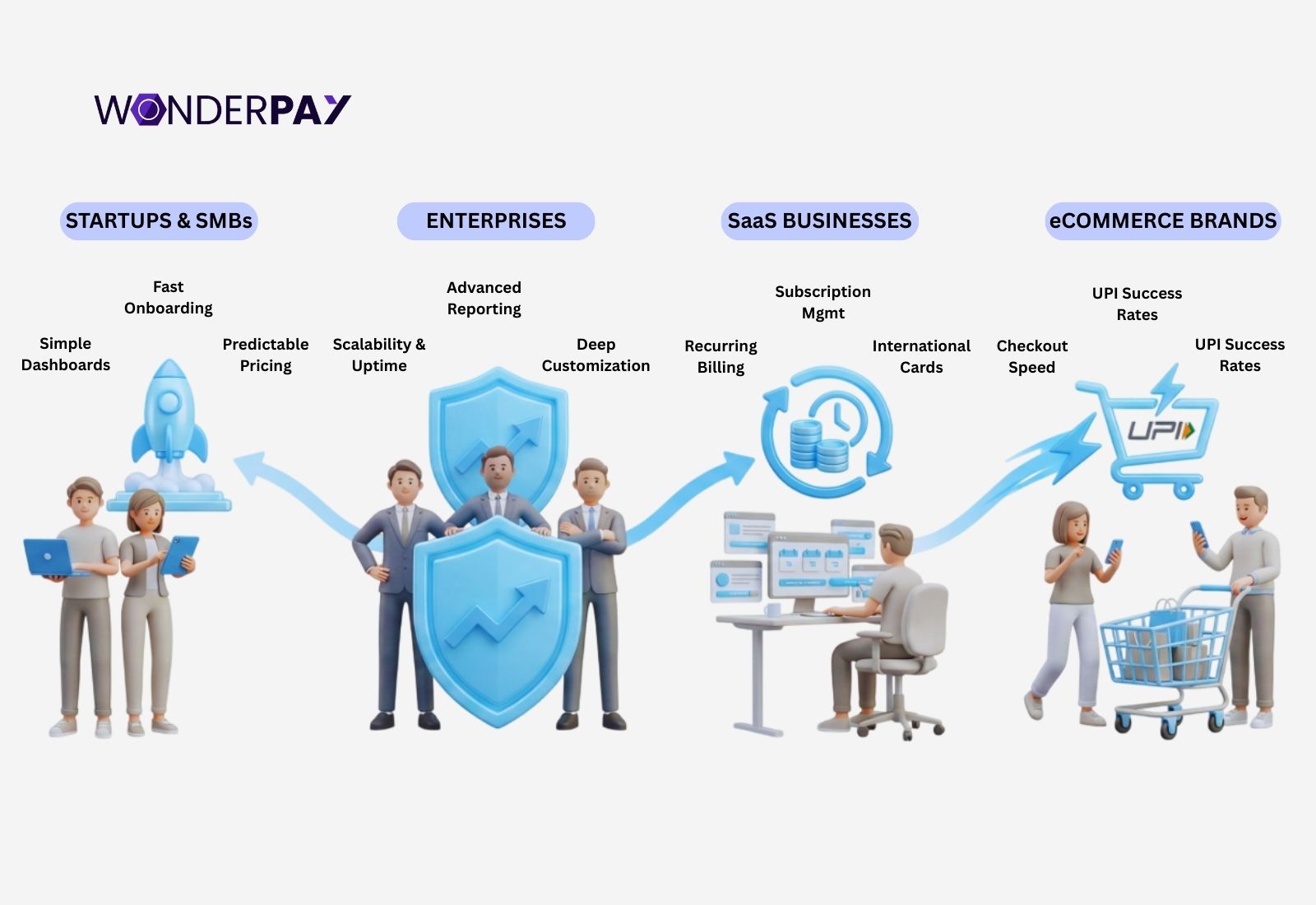

Best Payment Gateway for Freelancers in India by Business Type

You will not find a single platform that works equally well for every business. The best online payment gateway for freelancers will always depend heavily on your transaction volume, customer geography, technical capabilities, and compliance readiness. Instead of choosing one based on popularity, businesses should align gateway strengths with operational needs.

You will not find a single platform that works equally well for every business. The best online payment gateway for freelancers will always depend heavily on your transaction volume, customer geography, technical capabilities, and compliance readiness. Instead of choosing one based on popularity, businesses should align gateway strengths with operational needs.

Startups and the SMBs

The early-stage companies get benefits from gateways that offer fast onboarding, minimal documentation, and predictable pricing. On the other side, the simple dashboards, responsive support, and quick settlements matter more than advanced enterprise features. If you look for most startups, the best online payment gateway in India is the one that removes friction rather than adding complexity for businesses.

For Enterprises

Every large organization always prioritizes scalability, uptime guarantees, advanced reporting, and, most importantly, deep customization. Enterprises often require dedicated account managers, SLA-backed support, and robust fraud detection systems. With that, they can integrate with internal risk workflows.

Software as a Service Businesses (SaaS)

The business models that usually depend upon subscription management, recurring billing, tokenization, and webhook reliability. All of them are critical for any SaaS platform. A gateway must handle automated retries, proration, as well as the international cards without breaking the customer experience.

eCommerce Brands

When discussing the rapidly growing industry, e-commerce, its success depends on checkout speed, Unified Payment Interface (UPI) success rates, and failure recovery mechanisms. A gateway service provider that optimizes payment routing and reduces drop-offs directly impacts conversion rates and revenue, which is one of the most considerable facts for every business accepting or disbursing payments.

Must Read: What is a Payment Gateway? Meaning, Features, Benefits & working.

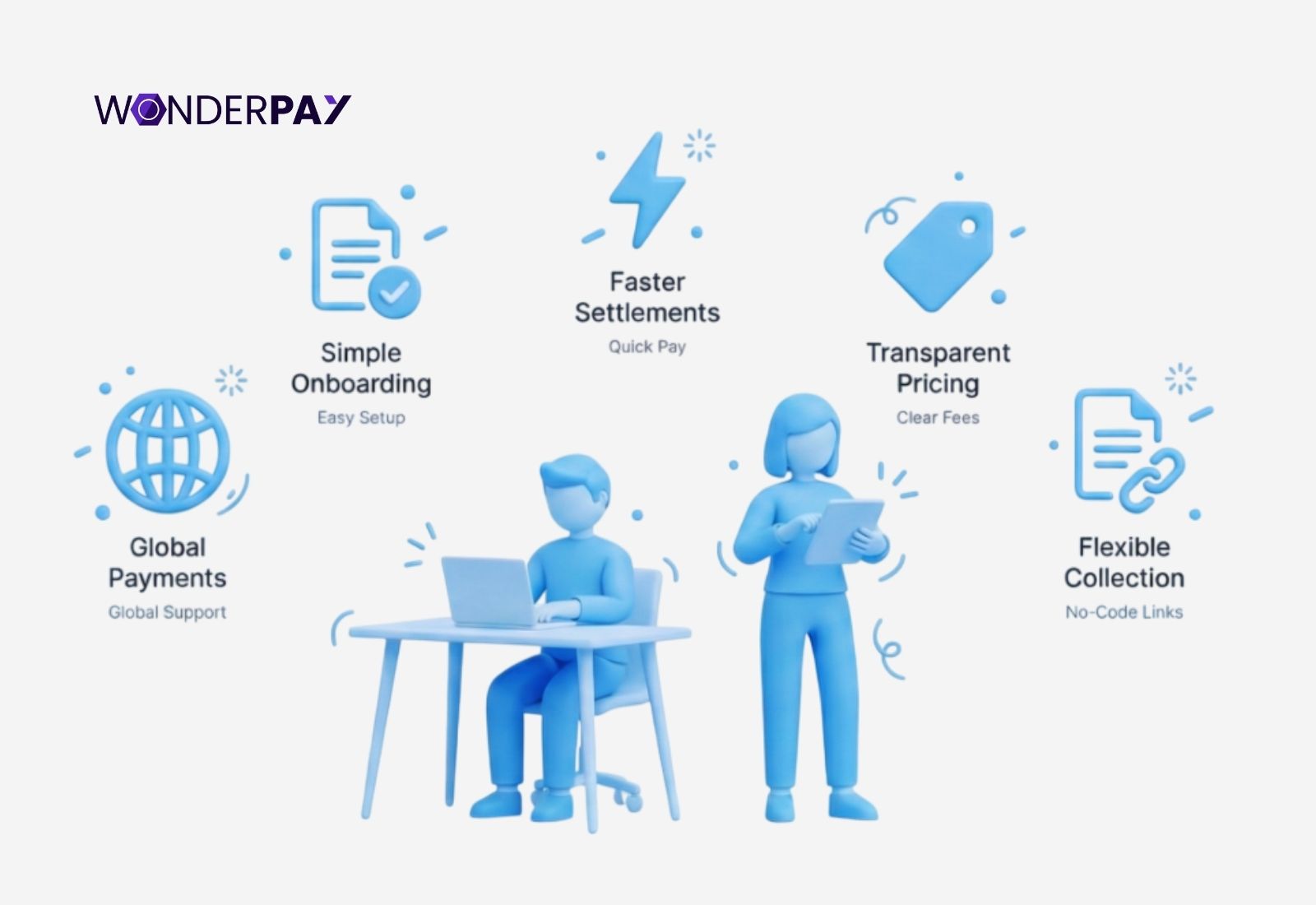

Best Payment Gateway for Freelancers and Creators

Being a freelancer, creator, or any individual, you may have experience or may face very different challenges if you compare them to a registered business. The ideal solution of an international payment gateway for freelancers must support multiple currencies, require minimal compliance, and at the same time ensure fast access to earnings. For this segment, ease of use often matters more than advanced enterprise controls.

The key factors freelancers and any creator should evaluate are as follows:

-

It should allow you to accept all your payments globally.

-

The PG must have simple onboarding with low documentation friction.

-

Know that the payment gateway supports faster settlements to personal or business accounts.

-

Ask for transparent pricing without complex slabs.

-

Does it support links, invoices, and no-code payment collection, which is needed the most?

Unlike traditional businesses, freelancers or individuals working in any field need flexibility. So, getting started with the right gateway will empower creators or freelancers to focus on their work while handling payments quietly in the background.

Payment Gateway for Freelancers: Compliance and Regulatory Factors

Choosing a payment gateway for freelancers in India for individual or business purposes. It is not just a technical decision but also a regulatory one. In India, the payment ecosystem is governed by strict guidelines issued by the Reserve Bank of India (RBI). This directly influences how a payment gateway for freelancers operates.

-

RBI regulations: Payment gateway for freelancers must be compliant with RBI regulations. In order to store data, monitor transactions, and ensure customer protection. It includes the data localization requirements, as the Reserve Bank of India says, “the sensitive payment data information must be stored within the country.”

-

PCI DSS importance: The Payment Card Industry Data Security Standards (PCI DSS), is another critical compliance requirement for gateways in India. It ensures cardholder data is processed and stored securely to avoid unauthorized access.

A digital payment gateway that lacks strong compliance control will increase the risk of breaches, penalties, and chargeback disputes. -

Chargeback handling: The major role of chargeback handling and dispute resolution framework is to protect merchants. Therefore, connecting with one of the reliable payment gateways for freelancers India should provide you with a clear workflow, timely notifications, and evidence management support. This will assist in reducing financial and operational risk.

Also Read: 10 Security Standards for Businesses

Comparison Table: Top Payment Gateways for Freelancers at a Glance

This comparison table will help you choose the best payment gateway in India and make a quick decision to embark on one that fits you right.

| Gateway | Best Suited For | Supported Payment Methods | Average Settlement Time | Pricing Structure | Ease of Integration |

|---|---|---|---|---|---|

| Modern API-First Platform | Startups, SaaS, e-commerce | UPI, cards, wallets, netbanking, international | T+0 to T+1 | % per txn + optional add-ons | Easy (APIs + plugins) |

| Large Merchant Network Gateway | Retail & multi-channel merchants | UPI, cards, netbanking, wallets | T+1 | % per txn with volume tiers | |

| Rapid Settlement Gateway | High-volume online sellers | 120+ payment modes incl. international | Instant & T+0 options | % per txn + cross-border fees | Moderate with plugins |

| Developer-Friendly Payment System | Tech products & platforms | UPI, cards, wallets, subscriptions | T+0 to T+1 | % per txn, no setup | Very easy (SDKs/APIs) |

| All-in-One Merchant Gateway | Mobile and web businesses | UPI, netbanking, cards | T+1 | Free setup, variable % | Easy (plug-and-play) |

| Enterprise-Grade Solution | Large enterprises & global sellers | UPI, cards, netbanking, multi-currency | T+1 to T+2 | % + enterprise pricing | Moderate (custom) |

| Simple Small Business Gateway | Small online sellers & freelancers | UPI, cards, wallets | T+1 | Low % + minimal fees | Very easy |

| Lightweight Payment System | Micro-SMEs & solopreneurs | UPI, cards | T+1 | Very low % + optional features | Easy |

How to Choose the Right Payment Gateway for Your Business?

Choosing the top payment gateway for freelancers India comes down to asking the right questions before making a decision. Rather than getting caught up in a list of features, businesses need to think about what really matters in a payment system.

In this section, we will discuss all about selecting the payment system for your organization. One that aligns with your company and its exact requirements. Let’s get started and find out what fits you the best with just a few important questions.

Take some time to ask yourself:

-

Are your customers mostly in India, or dealing with global customers?

-

Do you need to handle recurring payments or just the odd one-off transaction?

-

Is getting paid in a hurry more important to you than what it is going to cost?

-

Have you got a team of tech experts who can sort out the behind-the-scenes stuff, or would you rather have a payment system that does not require a university degree to use?

-

How much does having a payment system that is fully compliant with Indian regulations matter to your business?

Ask yourself these questions, and the right payment gateway for your business should become pretty clear. And that makes life a lot easier in the long run.

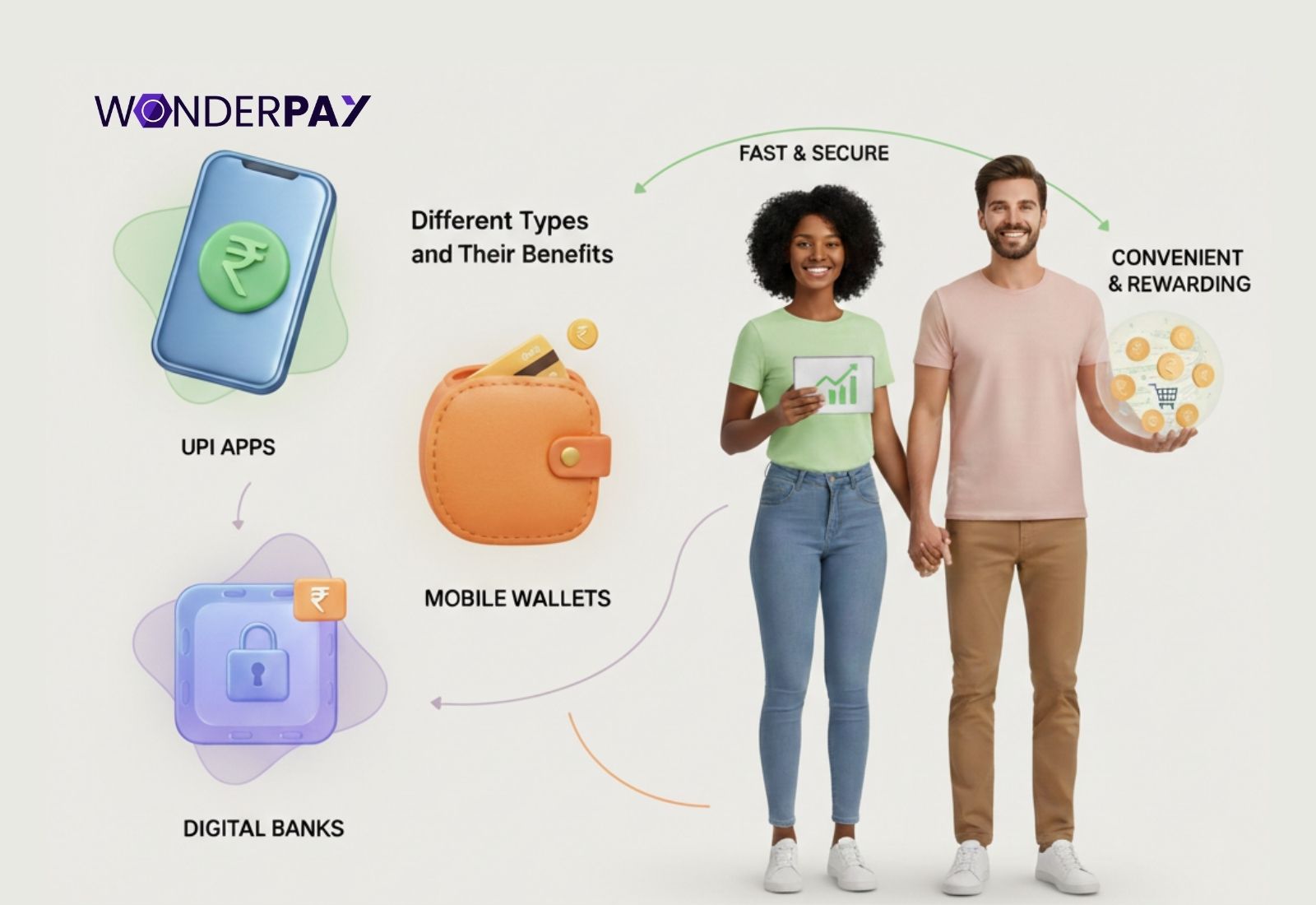

Payment Methods Supported by Modern Payment Gateways in India

When weighing up the options from any of the top categories above, the payment methods a gateway supports can make all the difference when it comes to conversion rates, customer trust and getting paid on time. India’s a country with a big variation in payment preferences, dependent on the region, the device people use and what kind of business they are running - which makes choosing the right gateway an absolutely crucial decision.

Below is a rundown of the core payment methods every modern gateway needs to support, along with when and why each one counts.

1. UPI (Unified Payments Interface)

Why is it so important

India’s digital payments scene is dominated by UPI because of its speed, the fact that it requires almost no hassle and the fact that it’s widely adopted across all user segments.

What to look out for

- Can the gateway collect money via UPI ID and QR codes

- Does it allow UPI Intent flows for mobile apps

- Does it support AutoPay for recurring payments

Best for

- Freelancers who need to get paid on time

- Small and Medium sized businesses

- Subscription services

- Mobile-first platforms

2. Debit & Credit Cards

Why they still matter

Card payments are still super important for bigger value transactions and international payments.

What to look out for

- Do the cards operate in India and internationally

- Is the gateway compliant with tokenization rules

- Does it support 3D secure or OTP based authentication

Best for

- E-commerce sites

- SaaS platforms

- Businesses that export goods or services abroad

3. Net Banking

Why it still counts

Net banking is still the preferred option for people making bigger ticket payments or business transfers.

What to look for

- Does the gateway support major Indian banks

- Can it handle stable redirects and callbacks nicely

- How good is its payment failure rate

Best for

- Big businesses

- B2B platforms

- Invoice-based payments

4. Wallets

Why they matter

Wallets make repeat purchasing and impulse buying a whole lot easier, especially on mobile.

What to look out for

- Does the gateway support all the main Indian wallets

- Does it authorise payments quickly

- Does it validate wallet balances?

Best for

- Consumer apps

- Gaming platforms

- Products aimed at younger people

5. EMI & Buy Now, Pay Later (BNPL)

Why flexible payments matter

Flexible payment options can boost average order value and stop people from abandoning their shopping carts.

What to look out for

- Can the gateway offer card-based EMI

- Does it approve BNPL instantly

- Does it clearly show fees

Best for

- E-commerce sites

- Edtech

- High-value services

6. International Payments & Multi-Currency Support

Why compliance matters

Businesses that serve global customers need a gateway that can handle cross-border payments properly.

What to look out for

- Does the gateway support multiple currencies

- Does it automatically convert foreign exchange

- Is it compliant with FEMA

Best for

- Freelancers working with international clients

- SaaS businesses

- Exporters

7. Recurring & Subscription Payments

Why predictable payments count

Recurring billing is essential for businesses with a predictable revenue stream.

What to look for

- Can the gateway handle UPI AutoPay mandates

- Can it manage card mandates

- Does it have good retry logic and dunning procedures

Best for

- SaaS platforms

- Membership platforms

- Content subscriptions

8. Payment Links & Invoices

Why a full checkout isn’t always needed

Not every business needs a full checkout flow.

What to look out for

- Can the gateway generate shareable payment links

- Can it auto-generate invoices

- Does it support partial payments

Best for

- Freelancers

- Consultants

- Service providers

Above all, the payment methods are offered by every top 10 payment gateways in India. It does not mean they will align with the exact requirement that you are seeking. Therefore, you must conduct in-depth research before you choose a PG for your freelancing use cases. It also applies to an organization when seeking a payment gateway service provider.

FAQs

Which is the safest payment gateway in India for freelancers?

Safety is dependent on a combination of things. Whether the gateway is PCI DSS compliant, it is playing ball with the RBI, how good its fraud prevention tools are, and how it handles its data security, rather than being a measure of the brand’s size.

What is the ACH freelancer payments system?

ACH stands for “Automated Clearing House” and refers to a bank transfer. It is an electronic payment method for moving funds between USA bank accounts. This option is known for its low cost and efficiency, though it is generally slower, which requires USA bank accounts for both parties, making it the best option for domestic clients while paying freelancers.

How do I choose the best PG among the top 10 payment gateways in India?

Conduct in-depth research and shortlist a few that meet your needs. Once you have shortlisted some of the PGs for your regional country-based (India) use cases. Make a checklist, adding options like what payment options they offer, the cost of each, support system, uptime, security, and settlement cycle. This will help you make an informed decision before you finalize one among the top 10 payment gateways that you researched.

Is an automated clearing house available in India?

The Automated Clearing House, abbreviated as “ACH”. It is a USA-exclusive concept, and its alternative in India is ECS (Electronic Clearing System). Using this digital payment option, users can initiate bulk payments or repetitive bills, also.

Can freelancers use payment gateways without paying GST?

Yes, there are plenty of gateways that will let freelancers get set up without worrying about GST. But there is often some catch, such as limitations on what kind of transactions you can make and how many you can do.

What is the cheapest payment gateway in India?

The cheapest option to go with will depend on a bunch of things, including the size of the transactions you are making, the payment methods you use and when you get paid. So be sure to factor in the total cost of using a particular gateway - do not just look at the headline fees.

Are UPI payment gateways reliable?

UPI payment gateways are generally reliable for making domestic payments but they might not be the best bet for businesses that need to handle cards or international transactions. It is because it limits their ability to grow and expand.

Conclusion

It is super easy to get started with the best payment gateway for freelancers, but when you are clear about your goals, exact requirements, and compliances you need to implement. It becomes an enabler of growth rather than a bottleneck. Therefore, it does not matter whether you are an individual, a business, or a creator; you can choose the best PG service provider in India.

If you are looking for a reliable digital payment service provider for your organization, freelancers, etc., feel free to contact us to get started with the top gateway.