How do you accept your business payments? Is it manual or unorganized? If you are in search of a comprehensive payin solution for your organization. Payment gateway India services, such as WPay, can help you in several ways. In order to accept your payments securely for any product or service you sell.

Payment gateway comes with advantages such as multi-pay-in option, and pay-in features like payment link, recurring, subscription, and much more. In this piece of information, we will discuss all the significant options you must explore.

It will assist you with your company’s revenue generation. To accept all your payments for any purpose, at any time, anywhere, via all payment methods that your customers prefer or are familiar with.

Let’s take a deep dive and find out all the crucial benefits you can leverage for your brand.

What is Wonderpay Payment Gateway in India?

Payment gateway payin is a service. It enables organizations to accept all their payments, using any of the payment methods securely and efficiently. The service comes with various benefits such as reconciliation, autopay, improved cash flow, quick access to funds, and more.

Payment gateway payin is a service. It enables organizations to accept all their payments, using any of the payment methods securely and efficiently. The service comes with various benefits such as reconciliation, autopay, improved cash flow, quick access to funds, and more.

Gateway will help an organization enhance its daily work and assist in reducing churn rate, which is more important for a business to drive its business growth.

How Can Wonderpay PayIn Service Help Businesses?

Wonderpay, a trusted payment gateway in India, delivers several advantages to enhance your business payin system. This section will help you find out the significant advantages. With the same benefits, you can get started with the same for better results.

Valuable Insights: WPay’s PayIn solution drives you with valuable insights. It helps you make informed decisions for your company, as the dashboard allows you to know your customers’ behavior, such as which payment option customers use frequently, and you can get help with other things.

It Scales as You Grow: The time your company grows, the WPay Payment Gateway scales at the same time. It means no issues, such as downtime, failed transactions, or major problems like security threats. This will allow you to continue with the services for easy and effective payment management within your organization.

Customization: Customization for a payment gateway is a basic requirement for a company that really thinks about its branding. So, if you are the one who wants the freedom of customization. Therefore, Wonderpay’s platform assists your organization in bringing your brand identity to your customers.

In order to have your company’s theme color, fonts, and other crucial elements of your branding. This will help you to let your business customers remember your brand throughout their entire journey from selecting a product or service to the checkout page.

Security First: The important practices like the Payment Card Industry Data Security Standards (PCI DSS) and the Reserve Bank of India (RBI) guidelines. These all comply with high security standards. Moreover, the system will assist your company and the customers in preventing any security threat, come what may.

Accept Payment Effortlessly with Payment Link

The well-known online payment gateway service providers, like Wonderpay, offer you a seamless solution for payments with a link. This will help you in a number of ways that we will discuss in this section.

-

Wonderpay’s Payment Link Service enables you to accept each of your payments via all payment methods. You can receive your funds quickly with no effort, whether your customers pay you via unified payment interface (UPI), netbanking, a card, or more.

-

Payment with a link does not require any specific website or complete store to accept your payments. If you sell via social media channels, this option will best fit you in order to increase cash flow.

Advantages of WPay Payment Link

- No need to pay any maintenance costs.

- More chances to increase conversion rates.

- You can improve your income as you will have the easiest payment option.

- You get to have more sales channels, as you will get the freedom to sell your products on any platform and get your payments with no restrictions.

Use Cases of Payment Gateway PayIn

Payment gateway service providers like Wonderpay assist businesses in several ways. This section will discuss some of the important uses. So, continue with the section for clear information for users.

Subscription Payments: Are you a subscription-based business model? If so, getting to have an organized system for your company will help you a lot. PG allows you to collect all your recurring payments.

It does not matter whether you need to use it for monthly, quarterly, or annual. You can accept all your payments on time without any restrictions at all.

One of the top benefits you will get is to have its auto reconciliation option. This will enable you to have a clear picture, who paid you, how much, and when. It will increase your team’s productivity and let you focus on other valuable tasks.

E-commerce: You may have heard the term or a common question, “What is payment gateway in e-commerce?” Gateway is a system to collect all online payments securely with no restrictions or limitations on payment methods. It allows your organization to collect all payments from any digital payment method preferred by your business customers.

Travel and Tourism: If you are in the travel and tourism business. Getting started with the PG solution for your organization will help you in several ways. It is a comprehensive solution that offers your customers a number of payment methods to make payments, pay instantly, without any effort, and most importantly, you build your brand image in the market, as you are providing your business customers with an improved solution for quick payout.

It does not matter what platform you used to build a website for travel or e-commerce. You get the options like a payment gateway for Shopify, a WordPress website, and more.

Retail Businesses: A payment gateway for businesses like retail, whether they operate online or offline. They all can leverage a gateway solution for their company. It offers you solutions like point of sale (POS) for your offline store to accept all payments.

If you operate online and are looking for a reliable solution for your company, then an electronic point of sale (ePOS) will make your work more effective. You will be able to deliver your customers with a smoother experience to buy easily and pay for the services.

This integrated solution for your company makes accepting all your payments easy and increases your cash flow. As your customer pays you online with just a few clicks, while they are in their comfort zone.

This is one of the top things your company will benefit from to have an improved solution to boost your company’s revenue.

PayIn and PayOut in Payment Gateway

In this section, we will discuss the pay in and pay out system of a gateway. It will assist you in understanding both terms clearly. You will know what best fits for your company for better payment management.

PayIn: This service allows you to accept your payments in exchange for a product or service you sell to your customers. The gateway’s role in payin is to act as a bridge between you and your customers’ bank for a secure payment.

Moreover, the gateway system offers several options. It will help your organization collect payments, such as fees for your education institution, your online and even offline store, with the help of a point of sale (POS).

PayOut: The payout service by a payment gateway allows you to disburse funds for any purpose. Its bulk payout allows you to disburse salaries within your company, manage the payouts, including expenses for daily needs, and more.

The best part you will like a lot for both services via the payment gateway is to have the reconciliation solution. It means who paid you, what the amount was, and the exact time of payment. This will give you a clear image with all the details, and you do not have to match each entry one by one at all.

The uses of both the payin and pay-out distinguish each other. You must first know your business needs, so you can get the best solution for your company’s use.

Must Read: What is Bulk Payment? Process, Benefits & Its Working?

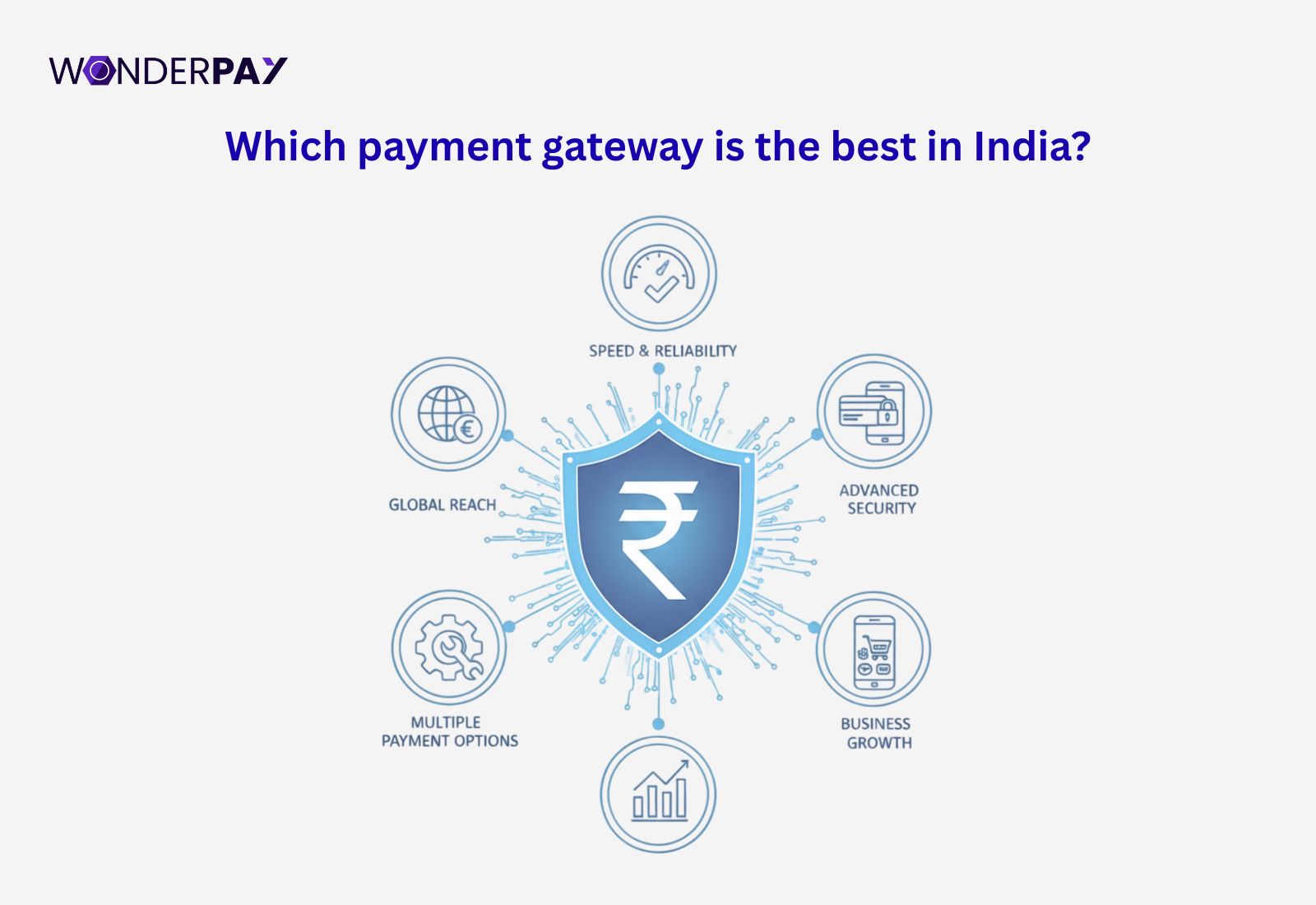

Which payment gateway is the best in India?

It depends upon your business needs and requirements. Therefore, you must make a list and get started with one that fits right for your company. In this section, we will discuss some of the crucial facts you must consider.

Know Your Business Needs

- How are you going to use a PG for your organization?

- Whether you will be using it for pay in service or pay out.

- Do you need an international payment gateway for website?

- Will you need a gateway integration solution or plugin?

You may have other such questions that you may include. It will help select the right PG for your company.

Consider Your Budget

All payment service providers have different charges, integration processes such as software development kit (SDK), plug & play solution, or application programming interface (API). This requires some time and technical expertise, which may require you to hire a technical person, a different transaction fee, and more.

It will help you connect with the online payment provider that meets your business’s set budget.

Know Your Target Audience

Who is your target audience? Once you are clear about your target audience. It will be easy for you to deliver a personalized experience to your customers. Suppose you are more in utility bill payments, and most of your customers use the UPI payment model or net banking. Therefore, you can go with the UPI Payment gateway for your company.

It will help you connect with the payment service provider that meets your company’s requirements.

Final Thoughts

Wonderpay payment gateway is a complete solution. It aims to fulfill the gap in businesses face in digital payments. It offers solutions including payin, payout, and tax payments with the help of its payment gateway for sole proprietorship, and a payment gateway without GST, as well as with GST calculation.

It helps make your payments simple, whether it is payin or payout for any purpose at any time you need for your company. If you are in search of a trusted digital payment service provider for your organization. We at Wonderpay can help you with a modern payment gateway for a website and mobile application, or for individual use. Get connected with us right now and get the solution your organization needs.

FAQs:

1. What are instant payments?

Instant payment means quick settlements of a fund, which can be between a business and to customer (B2C), a customer and to business (C2B), or any other purpose. A payment gateway for businesses also assists in instant payments for their sold products or services.

2. What are payment gateway charges?

Payment gateway charges are based on transactions or the payment methods your customers will use to pay you. It does not matter for what purpose you will use the payment solution for. Let us understand it with an example: a customer selected a product from your store and came to the checkout page for payment.

Now choose the payment method, credit card, so the charges could be 1.1%, for UPI, it could be less. The charges for all PG service providers are different, and have different conditions as well.

3. How do I get a payment gateway service for payin?

You can get a payment gateway payin service by connecting with one of the trusted online payment gateway service providers like Wonderpay. They will help you with the best solution in order to help you accept all your online payments securely and easily.

They also provide you with multi-functionality also including getting payments via any method your customers prefer, reconciliation, and more.

4. Can I customize the payment gateway?

Yes, it is easy to customize a Payment gateway like WPay to align with your company’s unique requirements. This gives you the freedom to create a connected experience when your customers come to the checkout page and make a payment, and there they see your company branding on the checkout page.

5. What are the UPI payment gateway charges?

The UPI payment gateway charges are different for all gateways. Some of the payment gateway in India may charge typically 0% or 0.25% or more. So, whenever you choose a payment service provider, you should determine what your business uses would be. This will help you make better decisions to choose the right choice for your company.

6. Can I use the payment gateway payin within my website or app?

Yes, the integration of a payment gateway within your business website or mobile application is simple. WPay offers you a plug & play solution for platforms like WordPress, an application programming interface (API) for custom websites. This will allow your business to accept all your payin quickly while letting your customers be on your platform, whether they are using your site or application.

7. What are the conditions for real-time payin?

Within a payment gateway, if you need real-time payin for your business. You have to pay a small fee, which is different for all payment gateways. The fee may depend on the amount you want to settle in your account at the same time, which usually takes T+1 or more in most cases. So, this is upon your requirement for the real-time fund settlement for businesses.

8. Which payment gateway is free in India?

Payment gateway services are not free for anyone. Since it is a technology service provided by a third party. They charge you a small fee on all transactions, or it could be a law or a higher fee. As all payment providers have different fee structures.