The MDR impact on MSMEs can make or break their profit margins. It could be a little technical term for most CFOs or any other decision makers, if they have not studied or have no previous knowledge about how the online payment ecosystem works.

Merchant Discount Rate (MDR) for any business should align with its goals. In order to meet their considerations and the turnover strategies. Either it could affect a company’s earning potential, which then directly impacts the operations.

This blog post will help you make an informed decision for the MDR charges. You should consider, discuss in detail, and connect with the right payment service provider.

What is MDR in Banks?

MDR stands for “Merchant Discount Rate”. It is the transaction fees a merchant pays to a payment service provider company. Further, the charged fee is divided into parts between different entities involved in providing a payment infrastructure, both to the merchants and their customers, including the issuer bank, the card network, the enquirer bank, and the payment gateway/processors.

The methodology endorses a secure, simple, compliant, and regulated backed digital payment system for a better experience. As a result, online money transfer has grown, developed, changed the buying behaviour of consumers, improved productivity, and created transparency between businesses and governments, especially in developing countries.

How Does MDR Impact on MSMEs?

The impact of MDR on MSMEs has both negative and positive sides. It depends on you, how you handle it. In this section, we will discuss both sides. This way, you will be able to make a better decision at the time of payment gateway or processor service provider’s cost per transaction to your company.

1. Affect Your Profit Margin

If the MDR charges are high, it may directly affect your customer experience, even though a business pays MDR charges. It means that for every transaction of a product or service you sell. You pay a small part as the transaction charge to the provider.

Here, you have to strike a balance between the product/service price and paying charges for MDR. It may force you to change your product or service price to fulfill the specific necessary requirements, like your earnings on that particular product, so that users feel and purchase it at a fair price.

Note: It also depends on the payment method a customer chooses at the time of checkout.

2. Payment Type

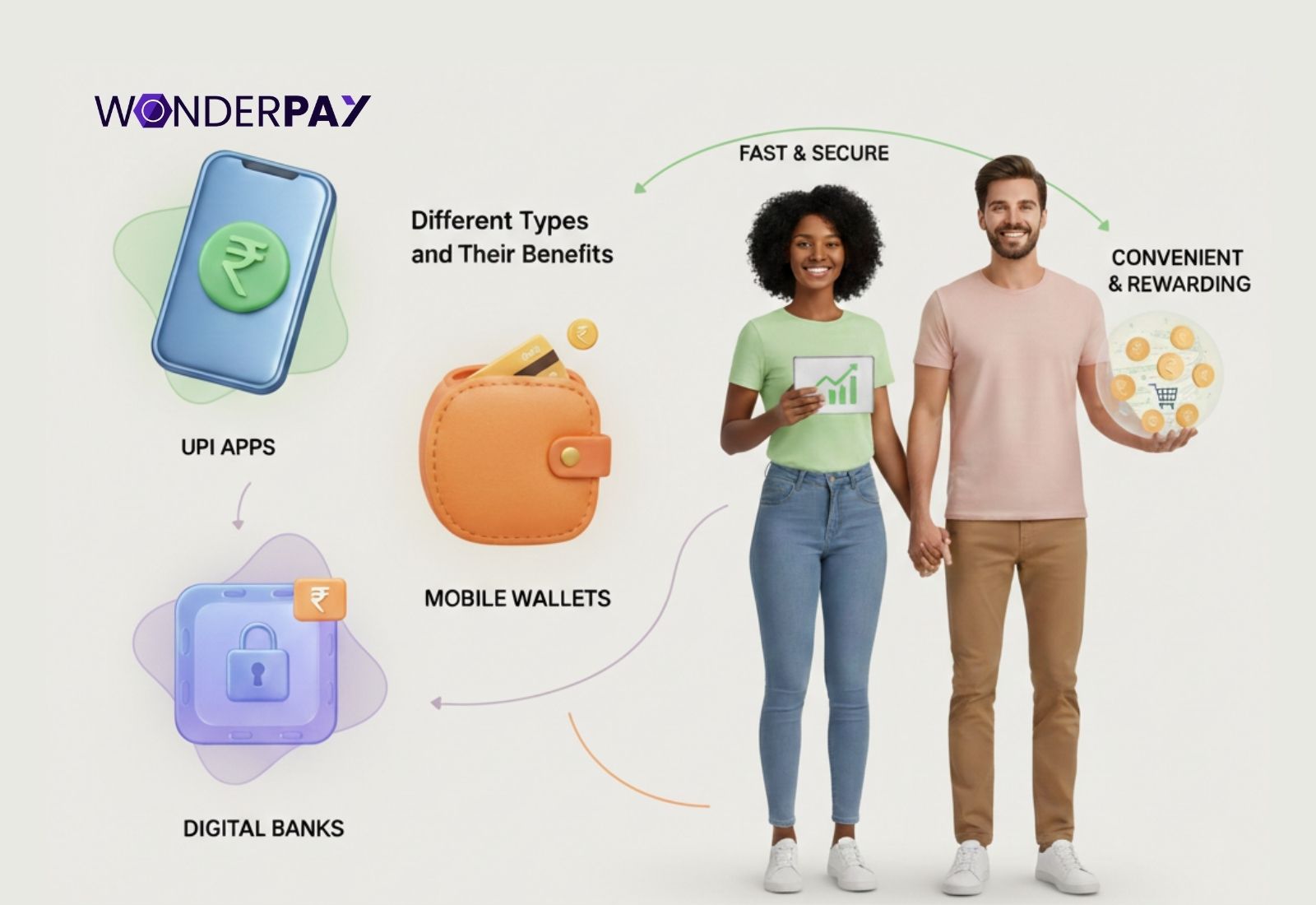

The Merchant Discount Rate for each payment method differs. The payment methods include:

-

Credit cards typically range from 1% to 3%

. -

For debit cards, it may range from 0.4% to 0.9%.

-

Digital wallet may incur an intercharge fee of 0.5% to 1.1%.

Businesses need to consider the payment methods their customers use to pay. It is going to affect their profit margin.

3. Customer Experience

In developing countries like India, a product or service with higher prices than expected may affect customer experience. It could be because of the MDR fee passed on to customers.

However, the Reserve Bank of India (RBI) law strictly says that the merchant MDR fee can not be extended to customers. It becomes a challenge for businesses to balance the product or service price while considering the Merchant Discount Rate fee for each transaction.

4. Cash Flow Issues

The digital payments are increasing at a rapid rate, business customers are more willing to pay online instead of just carrying cash with them, especially the Gen-Z, including the millennials.

This is why accepting payments with digital payment solutions is no longer a choice at all. It does not matter what payment method the customer uses at your store, whether online or offline.

Result: When you do not have a choice between offline and online payments, especially for in-store businesses. If you do not accept digital payments, you may face a cash flow problem.

5. Increase Operation Cost

Since the online merchant payments are settled after deductions, the rest earning amount is credited later. This pay affect your operational experience as a company needs to look for utilities, rent, and other expenses.

These reason of MDR impact on MSME could lead them towards a poor experience both for them as well as customers.

Learn more about for Payment Gateway Charges

What Merchants Should Consider for Their Payment Service Provider’s MDR Rates?

MDR impact on MSME, such as having higher rates, may put a business to loose various opportunities if the strategies are not prepared well.

This section highlights some of the considerations a business must consider before finalizing a payment service provider for a better cash flow and frictionless digital money transfers, while considering business margins.

Things to consider:

-

Determine what the cost per transaction will be to your company.

-

What payment method does the system support?

-

The security patches.

-

The compliance (PCI DSS) and regulations (RBI) practices.

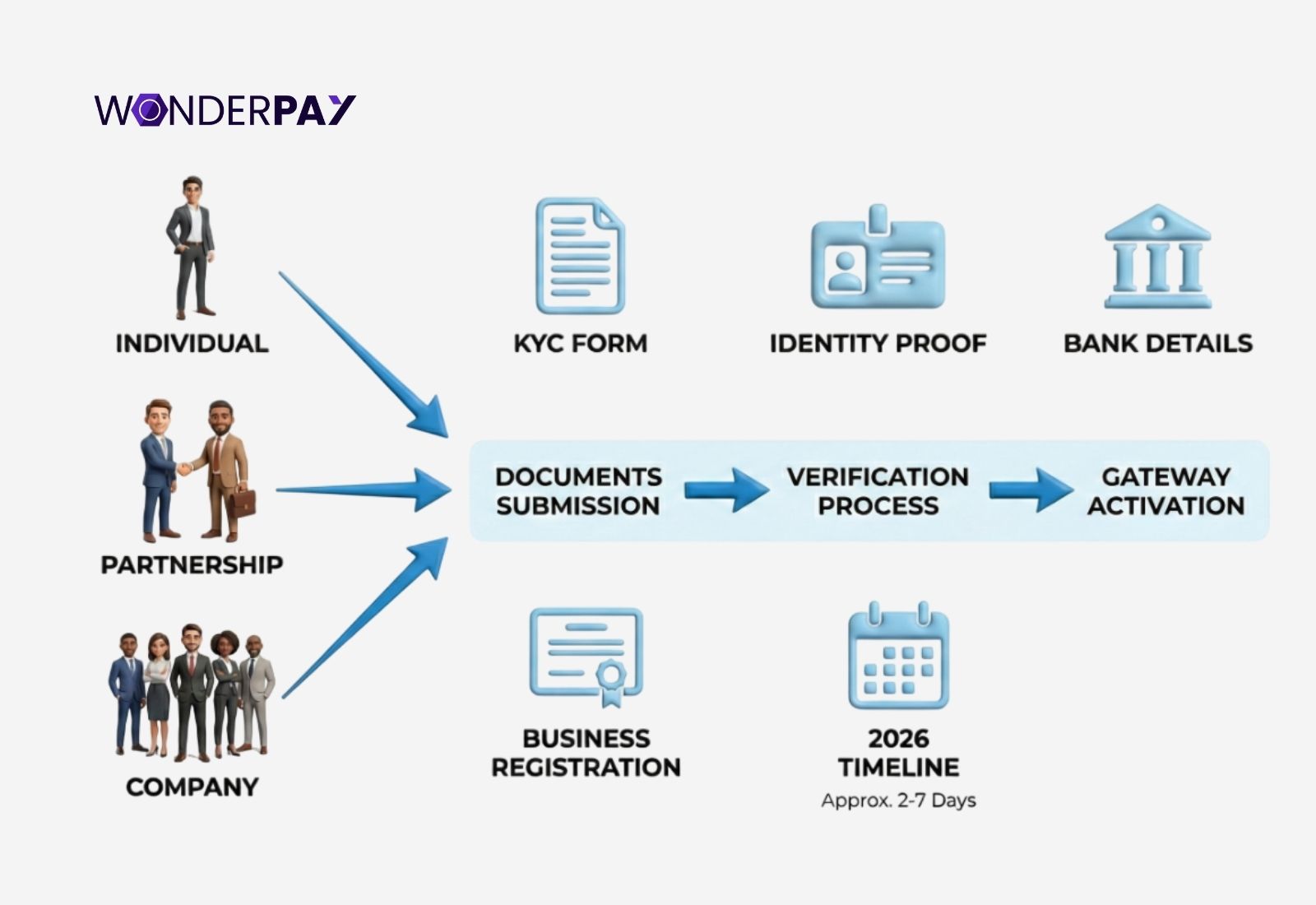

Merchant Discount Rates: Every online payment service provider’s rates may differe which are sometimes customizable also. You need to consider it and discuss or study every transaction fee before you finalize it.

Things you should bear in mind: Payment Method Charges: All payment methods come with different payment charges. You need to think of each.

Know: What your business requirement is: In most of the cases, it is seen that business customers for a specific business are familiar with their preferred payment method. It could be anything from Unified Payment Interface (UPI), card payments, netbanking, and more.

The payment solution should align with your business’s exact payment requirements. In case the provider does support a specific payment method. It may result yin ou to face increasing bounce rate, which is critical for any business.

Conclusion

Now you are clear about how MDR impact on MSME. Therefore, it becomes critical for any business choose a payment provider based on the facts like its payment methods that your company’s customers are familiar with, cost per transaction, and the business margins. It is so crucial to finalize everything with a comprehensive list that aligns with your exact requirements.

If you are searching for a cost effective solution for your company, feel free to connect with one of our representatives and get the free quote right now!